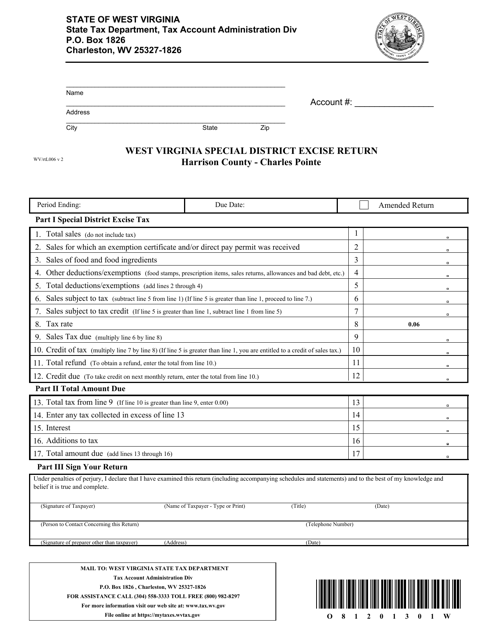

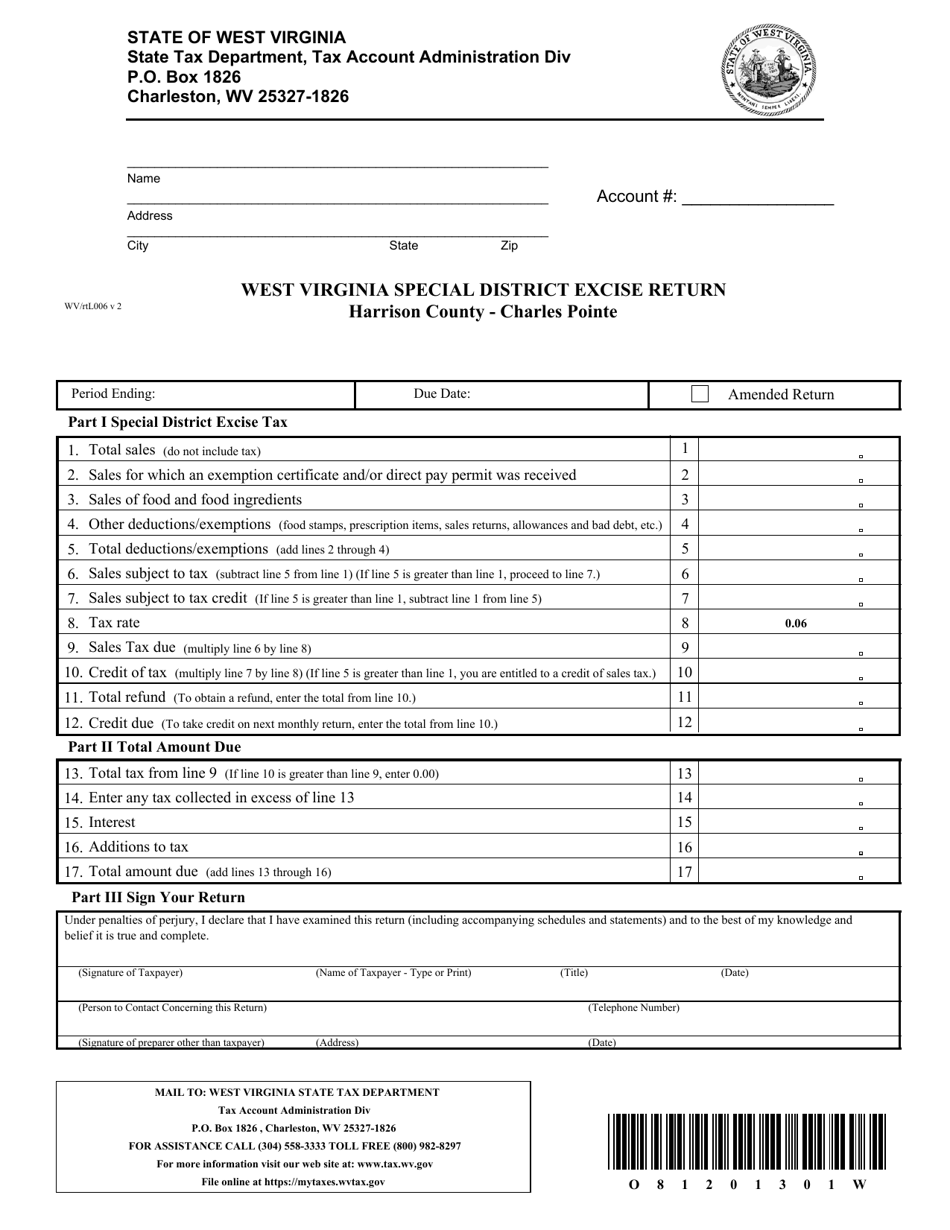

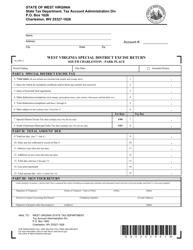

Form WV / RTL006 West Virginia Special District Excise Return - Harrison County - Charles Pointe, West Virginia

What Is Form WV/RTL006?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. The form may be used strictly within Harrison County - Charles Pointe. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/RTL006?

A: WV/RTL006 is a special district excise return form.

Q: Who is required to file WV/RTL006?

A: Harrison County - Charles Pointe, West Virginia is required to file WV/RTL006.

Q: What is the purpose of WV/RTL006?

A: The purpose of WV/RTL006 is to report and pay special district excise taxes.

Q: What is a special district?

A: A special district is a designated area that has an additional excise tax imposed on certain goods or services.

Q: What is an excise tax?

A: An excise tax is a tax on the sale or use of specific goods or services.

Q: Are there any specific instructions for filling out WV/RTL006?

A: Yes, specific instructions for filling out WV/RTL006 are provided on the form.

Q: Is WV/RTL006 only applicable to Harrison County - Charles Pointe, West Virginia?

A: Yes, WV/RTL006 is specifically for businesses located in Harrison County - Charles Pointe, West Virginia.

Q: What happens if I don't file WV/RTL006?

A: Failure to file WV/RTL006 may result in penalties and interest charges.

Q: Is WV/RTL006 used for any other purposes?

A: No, WV/RTL006 is solely used for reporting and paying special district excise taxes in Harrison County - Charles Pointe, West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/RTL006 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.