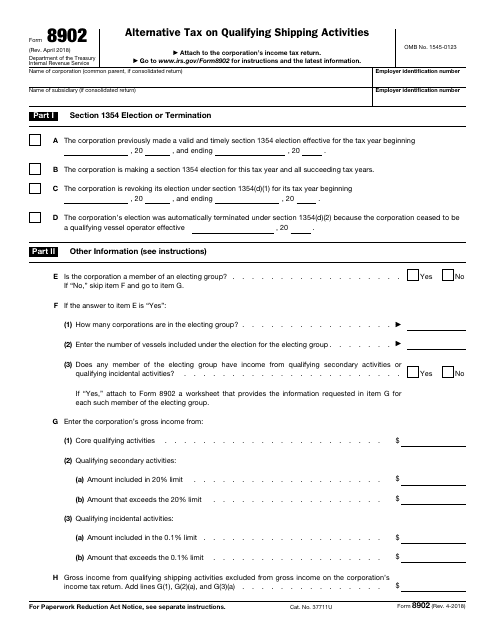

IRS Form 8902 Alternative Tax on Qualifying Shipping Activities

What Is IRS Form 8902?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8902?

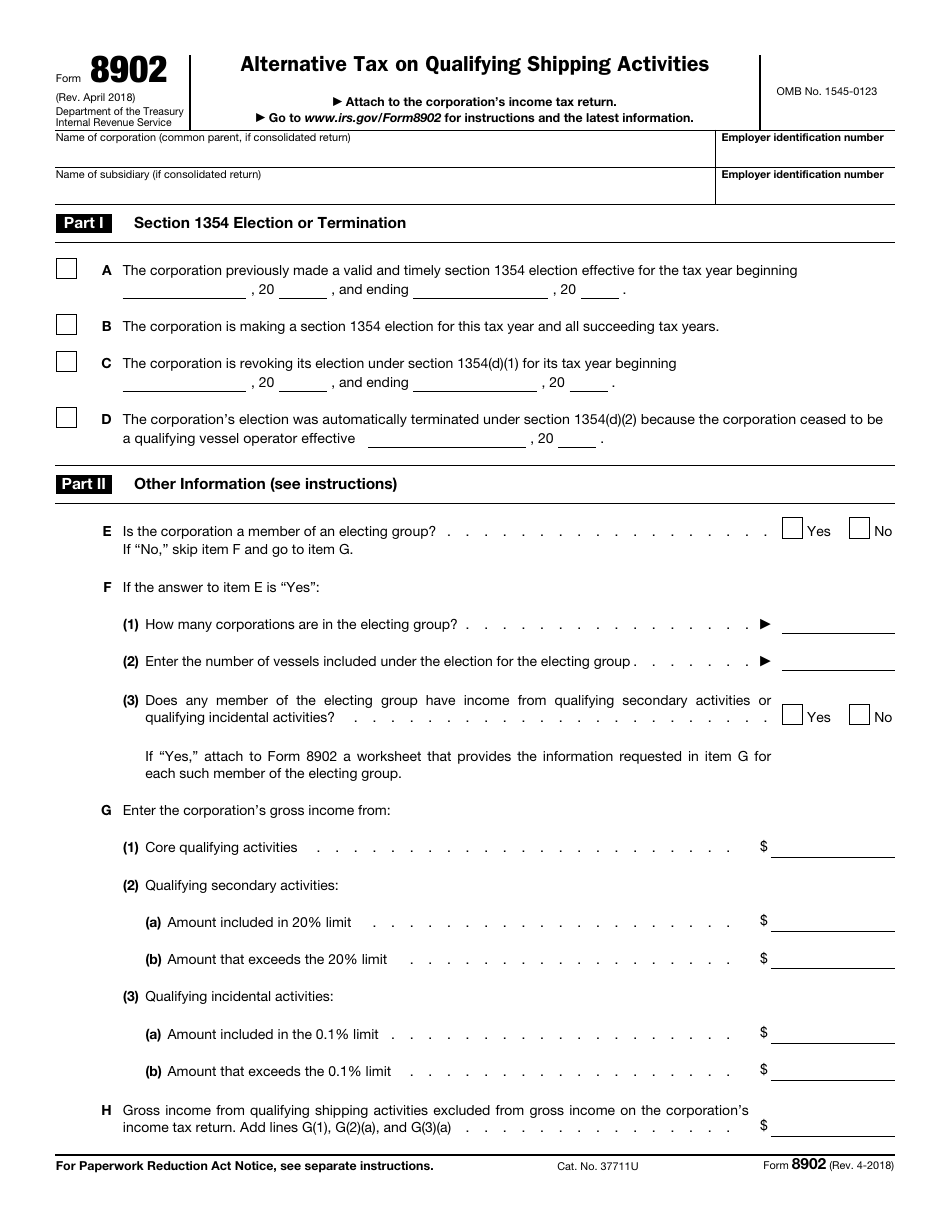

A: IRS Form 8902 is a form used to calculate and report the Alternative Tax on Qualifying Shipping Activities.

Q: Who needs to file IRS Form 8902?

A: Individuals or companies engaged in qualifying shipping activities may need to file IRS Form 8902 if they are claiming a tax credit or deduction related to these activities.

Q: What are qualifying shipping activities?

A: Qualifying shipping activities include the transportation of property and passengers by water, as well as certain related services.

Q: What is the Alternative Tax on Qualifying Shipping Activities?

A: The Alternative Tax on Qualifying Shipping Activities is a tax imposed on certain income derived from qualifying shipping activities.

Q: How do I calculate the Alternative Tax on Qualifying Shipping Activities?

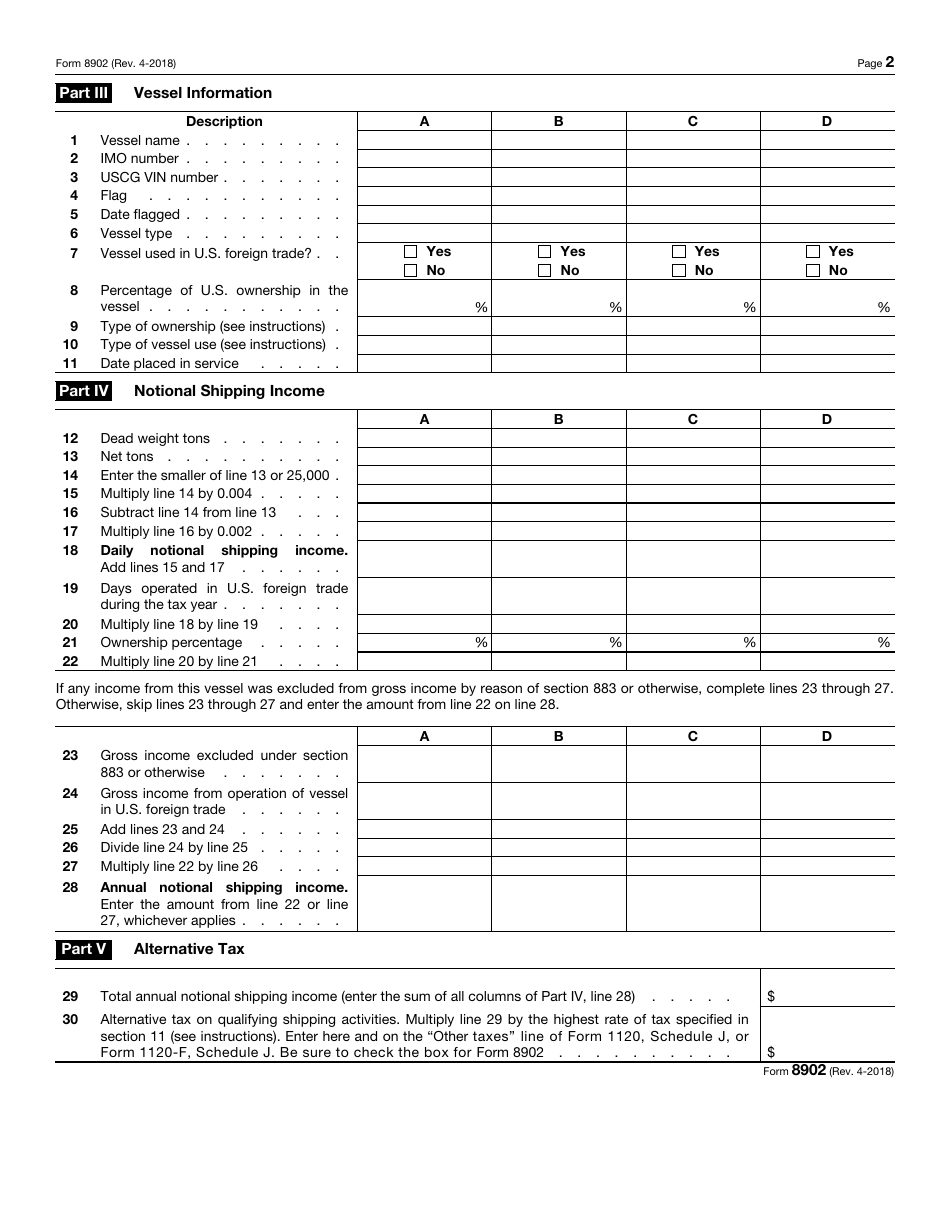

A: To calculate the Alternative Tax on Qualifying Shipping Activities, you will need to complete the appropriate sections of IRS Form 8902 and follow the instructions provided.

Q: Are there any deadlines for filing IRS Form 8902?

A: Yes, IRS Form 8902 must generally be filed by the due date of your tax return, including any extensions.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8902 through the link below or browse more documents in our library of IRS Forms.