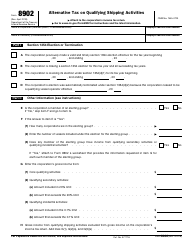

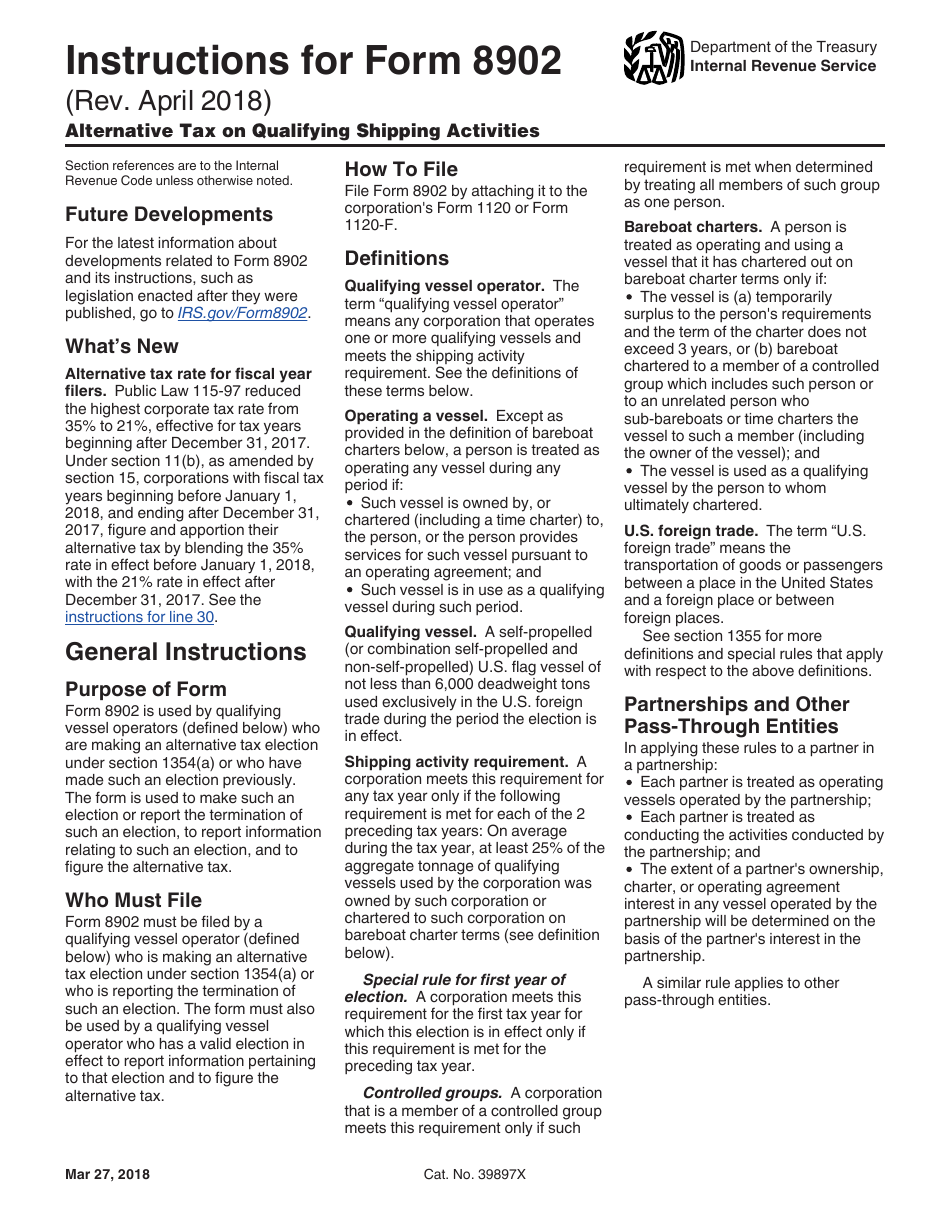

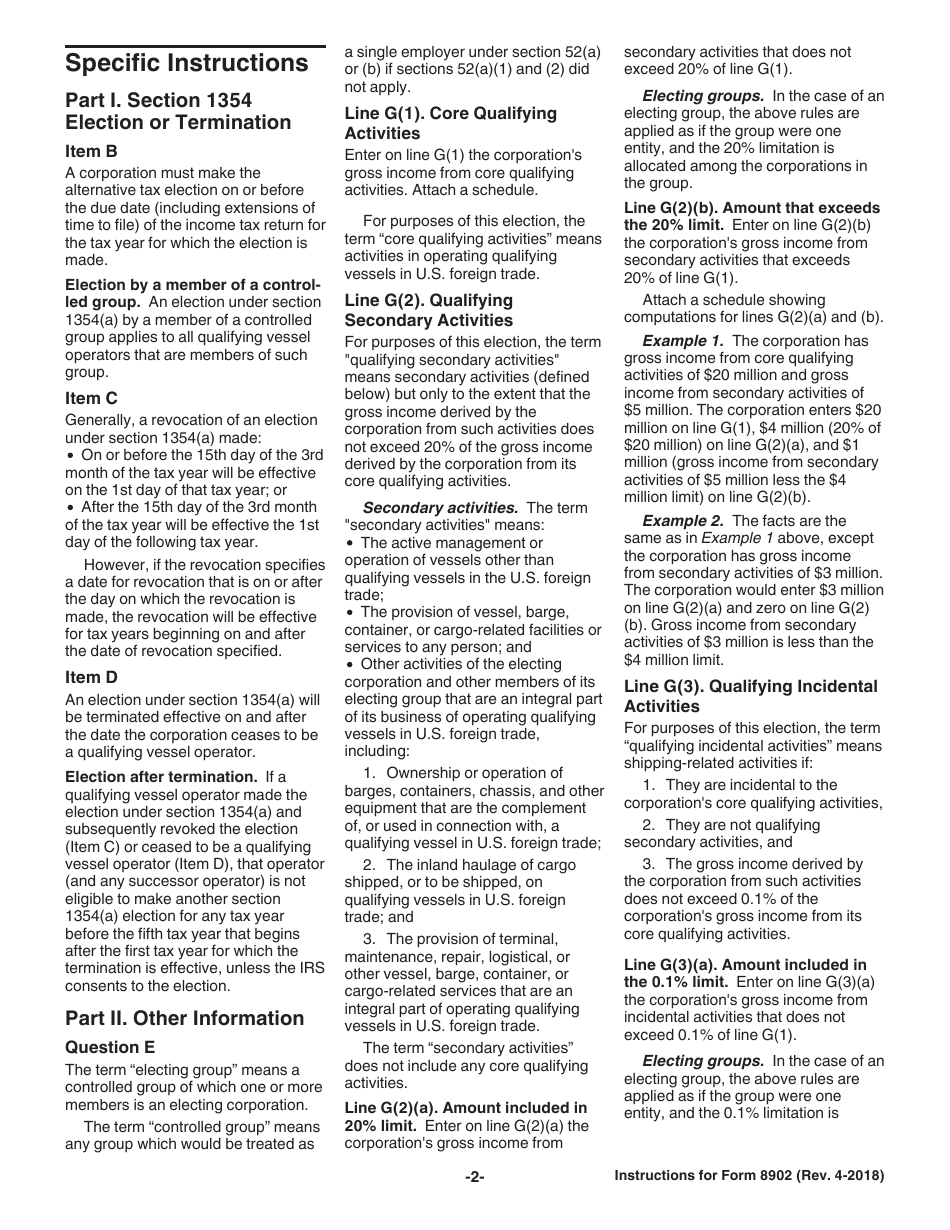

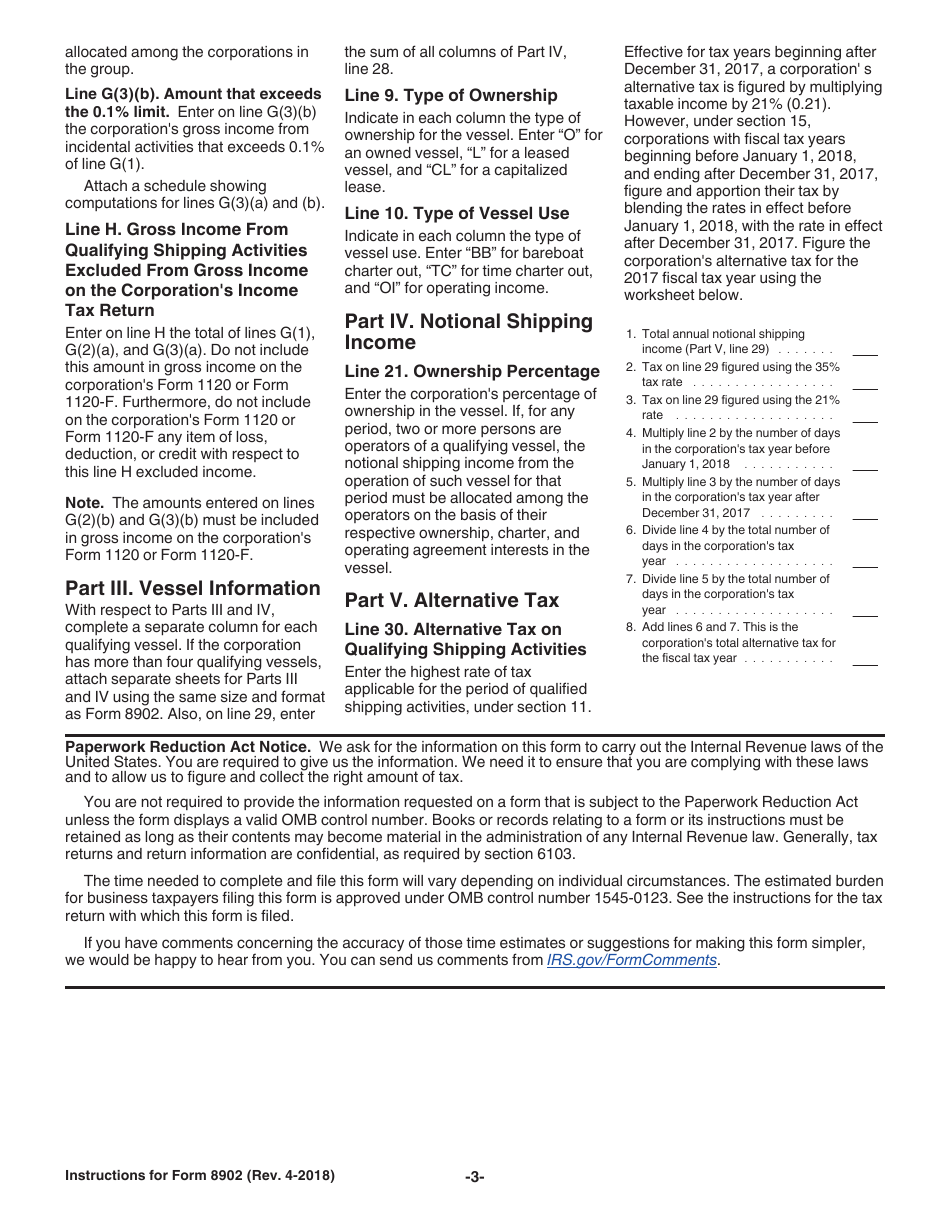

Instructions for IRS Form 8902 Alternative Tax on Qualifying Shipping Activities

This document contains official instructions for IRS Form 8902 , Alternative Tax on Qualifying Shipping Activities - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8902 is available for download through this link.

FAQ

Q: What is IRS Form 8902?

A: IRS Form 8902 is a form used to calculate and report the Alternative Tax on Qualifying Shipping Activities.

Q: What is the Alternative Tax on Qualifying Shipping Activities?

A: The Alternative Tax on Qualifying Shipping Activities is an additional tax imposed on certain shipping income.

Q: Who needs to file IRS Form 8902?

A: Businesses engaged in qualified shipping activities need to file IRS Form 8902.

Q: What are qualified shipping activities?

A: Qualified shipping activities include the transportation of goods by water.

Q: How do I calculate the Alternative Tax on Qualifying Shipping Activities?

A: The Alternative Tax on Qualifying Shipping Activities is calculated using a specific formula outlined in the instructions for IRS Form 8902.

Q: When is the deadline for filing IRS Form 8902?

A: The deadline for filing IRS Form 8902 depends on the specific tax year. It is generally due with the business's annual tax return.

Q: Is there a penalty for not filing IRS Form 8902?

A: Yes, there may be penalties for not filing IRS Form 8902 or for filing it late.

Q: Can I e-file IRS Form 8902?

A: Yes, IRS Form 8902 can be e-filed through approved tax software or a tax professional.

Q: Do I need to attach any supporting documents with IRS Form 8902?

A: It is recommended to keep all necessary records and supporting documents for IRS Form 8902, but they do not need to be attached to the form when filing.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.