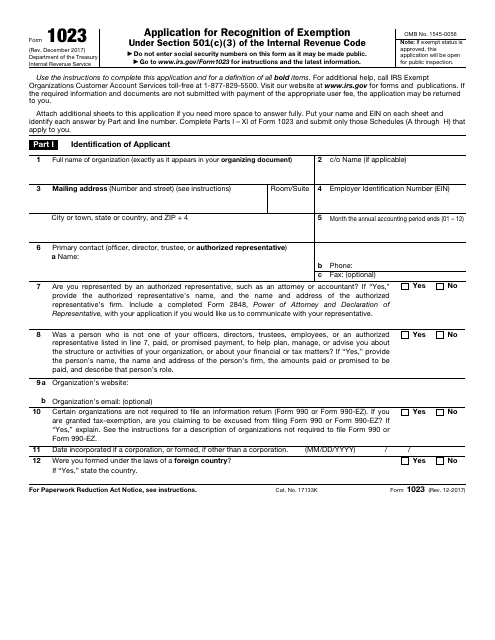

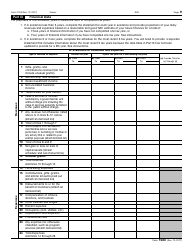

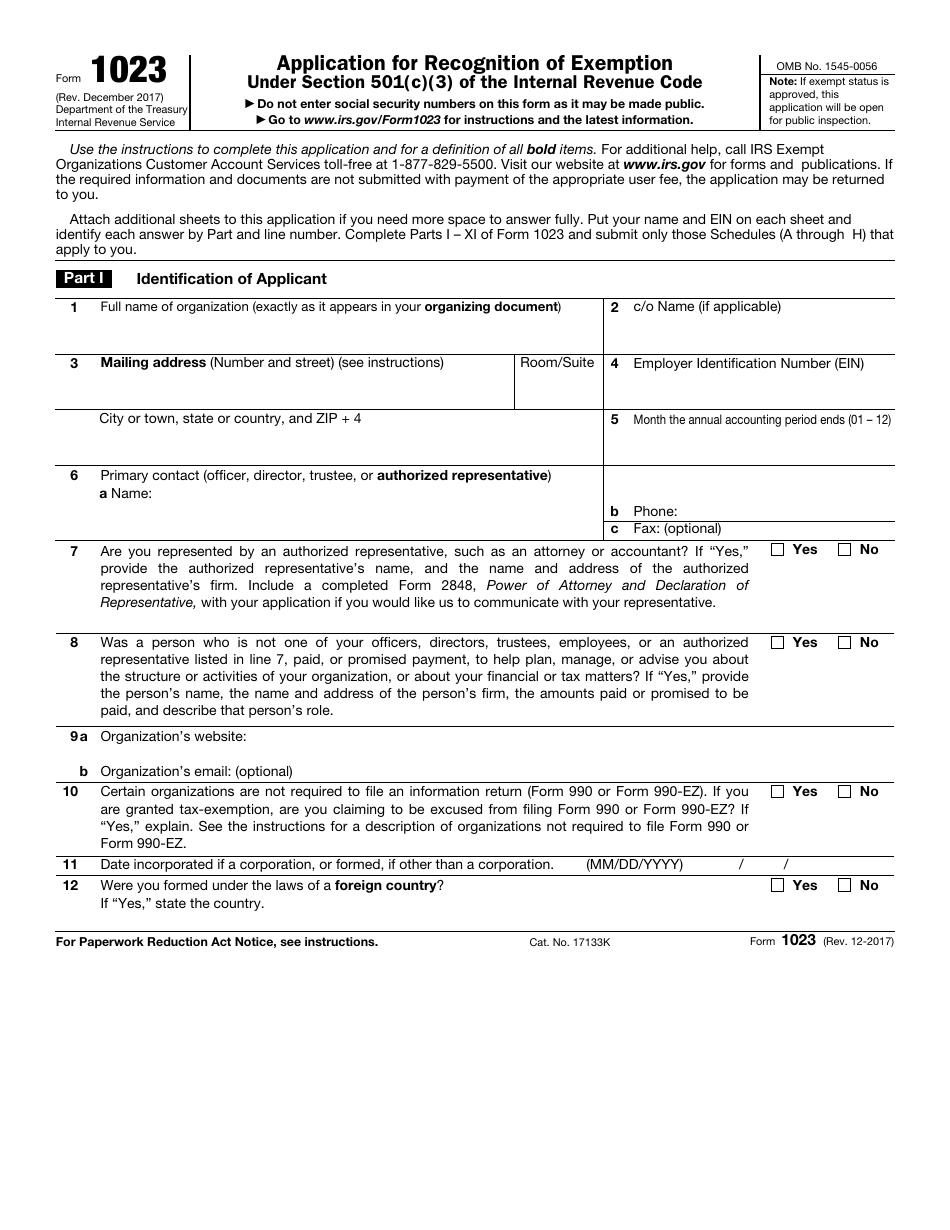

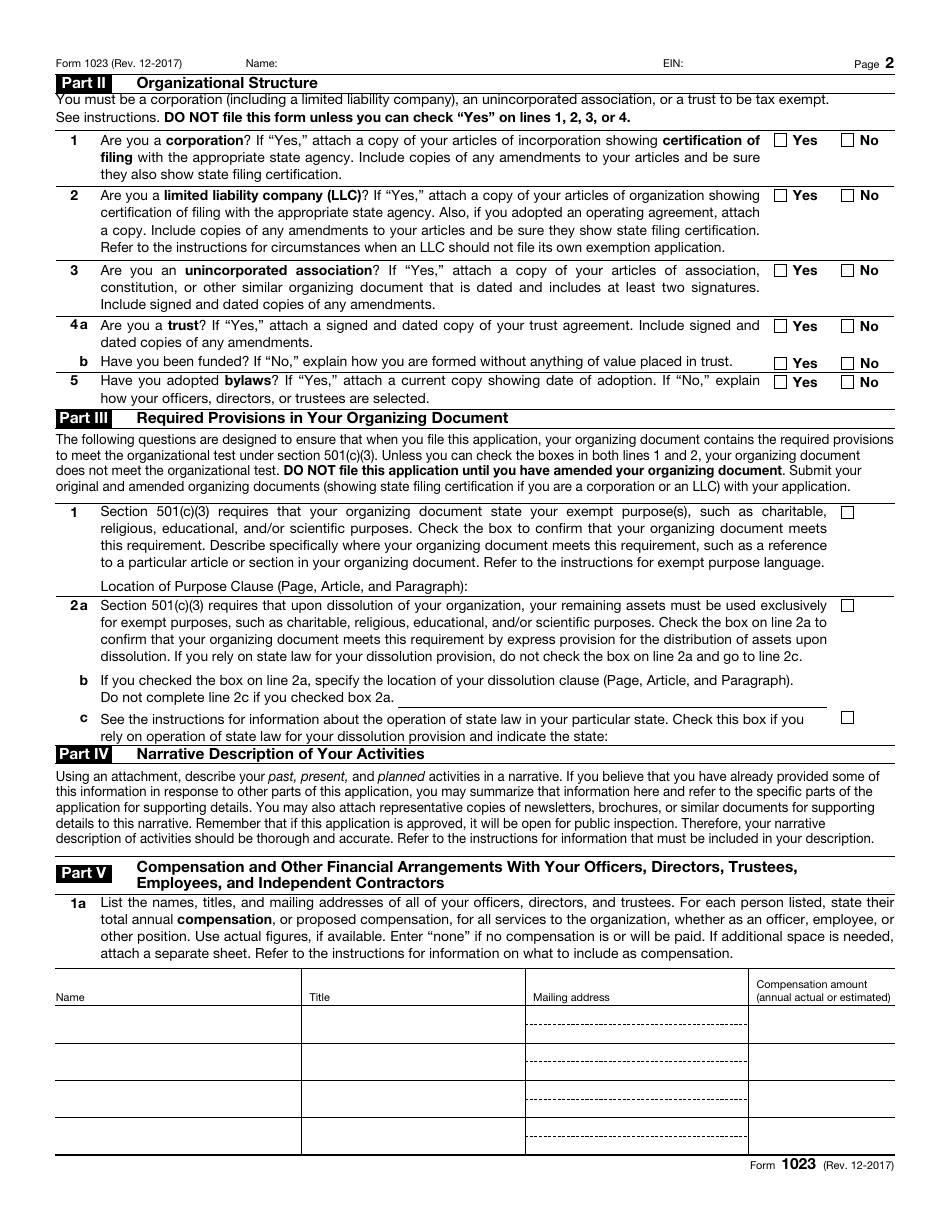

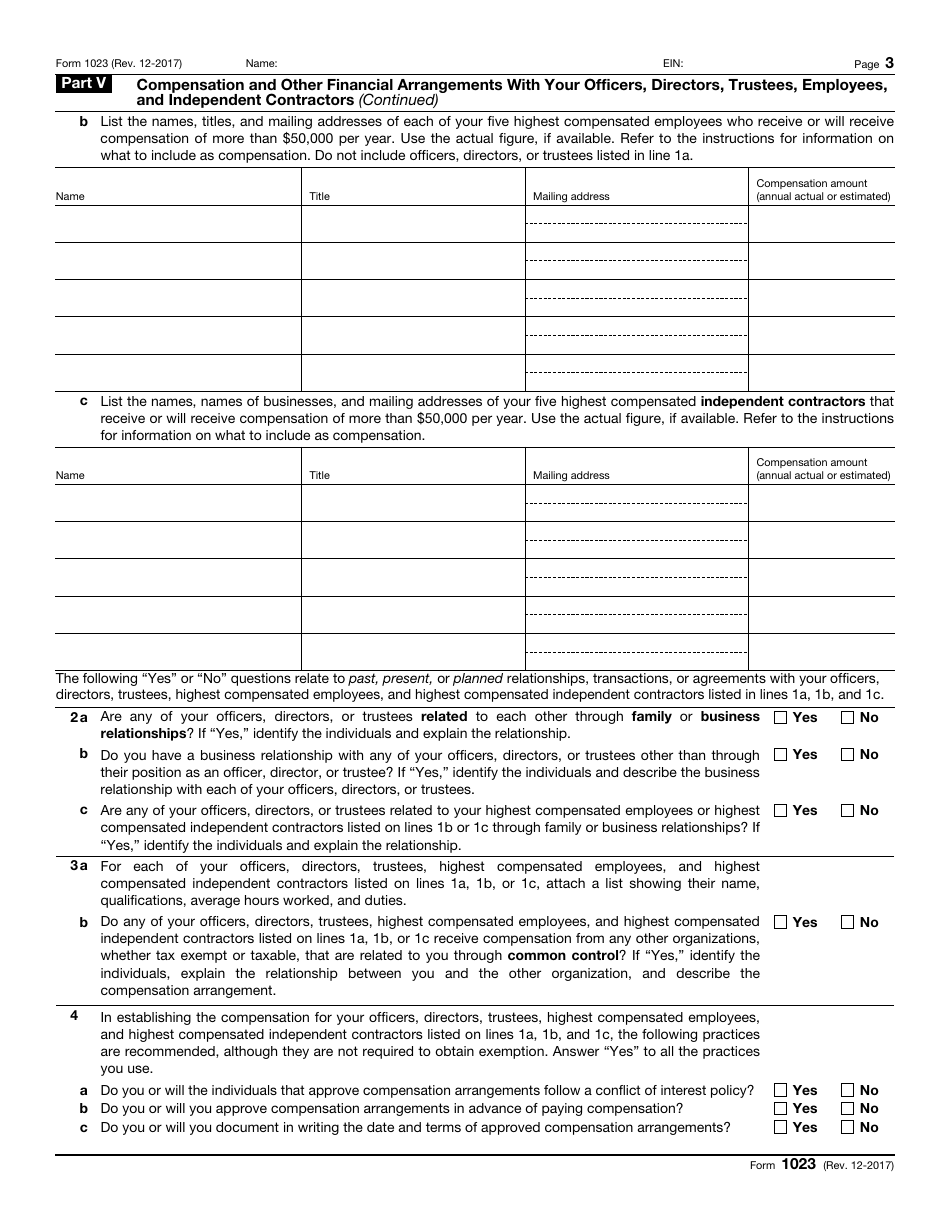

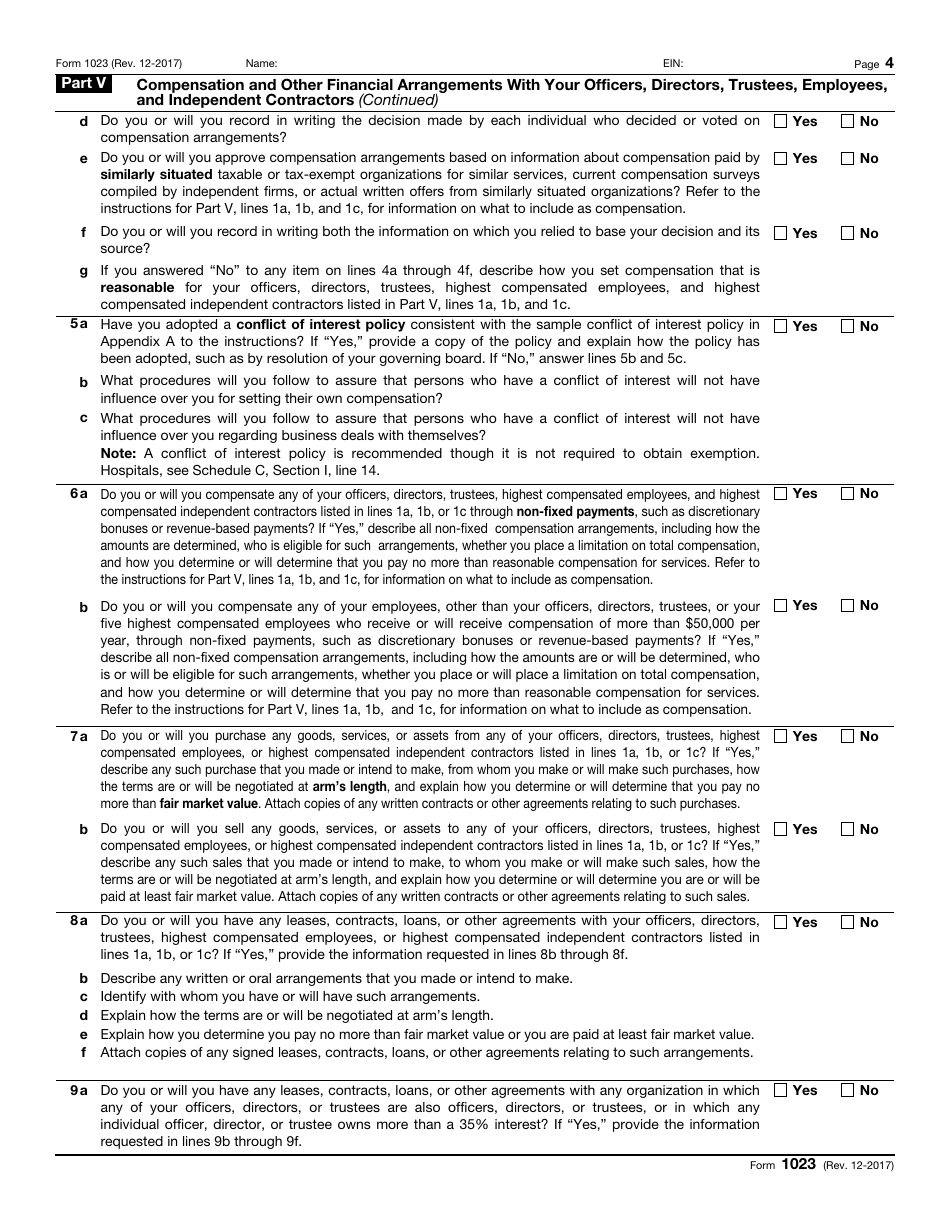

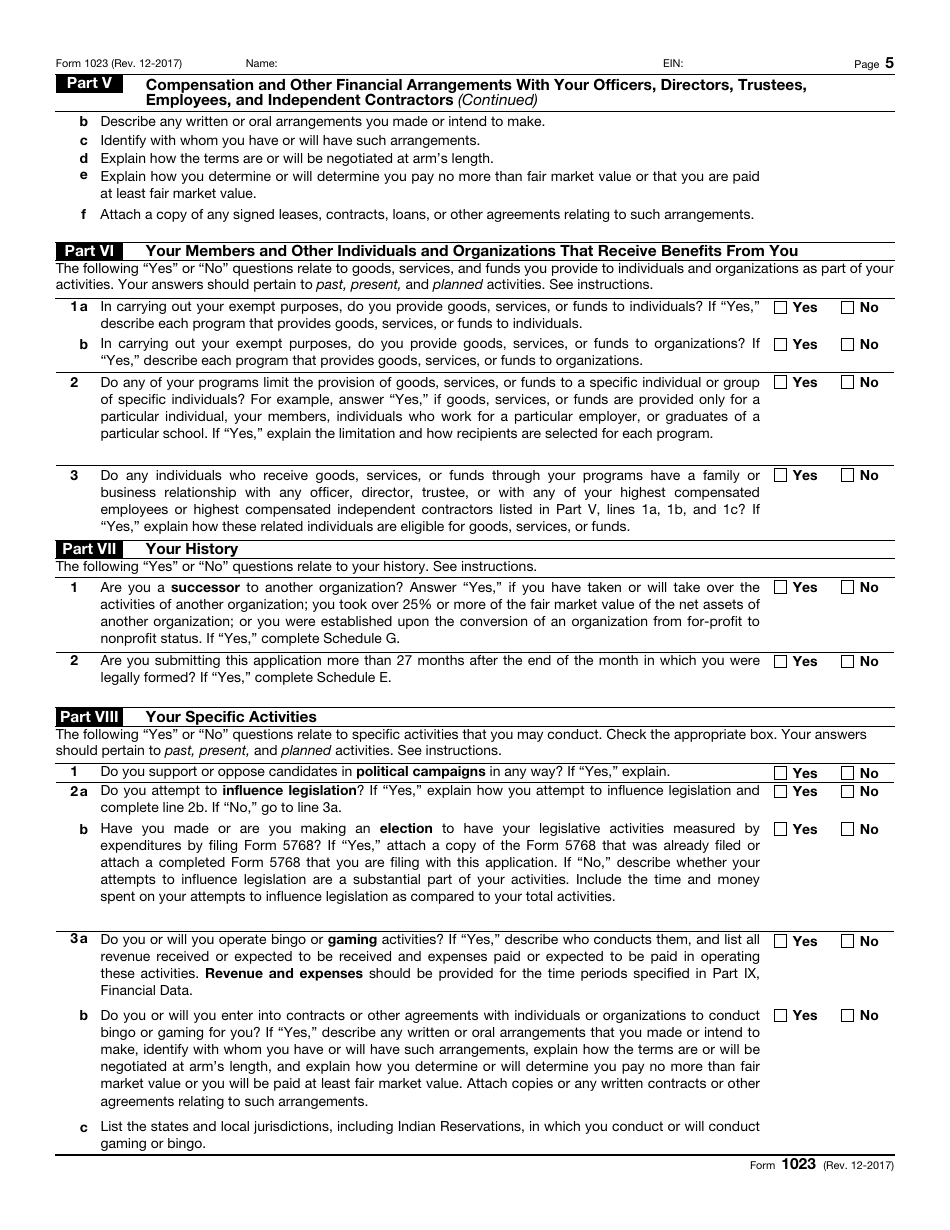

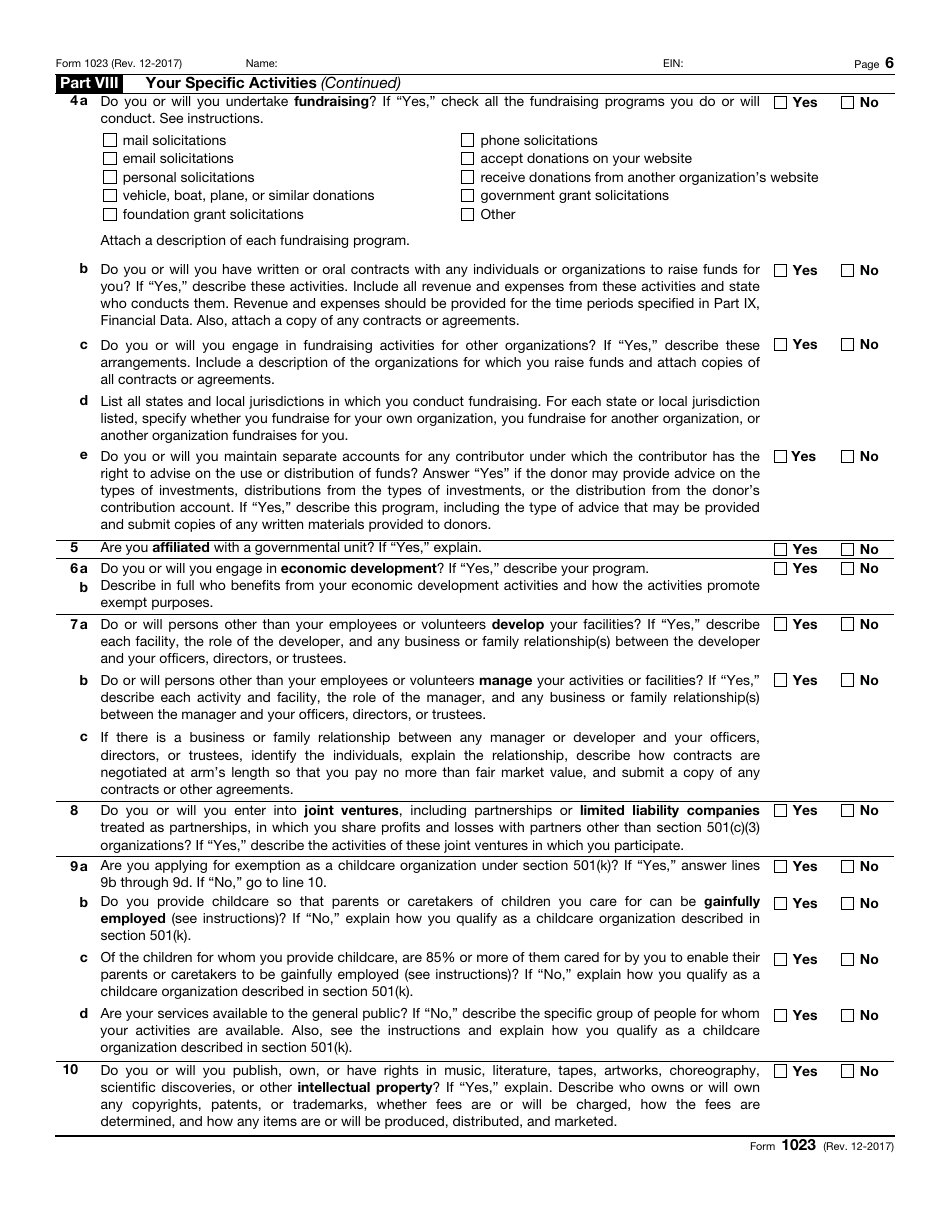

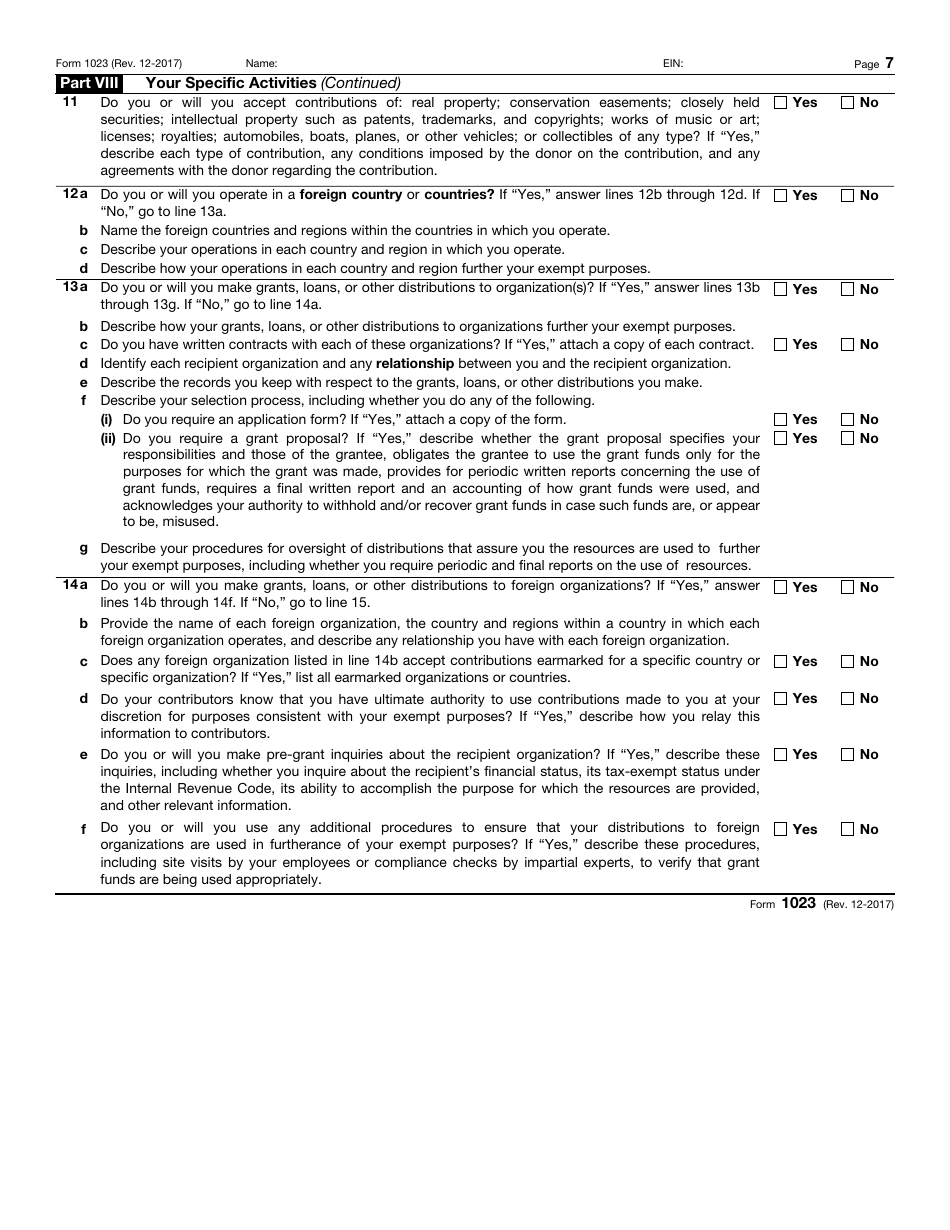

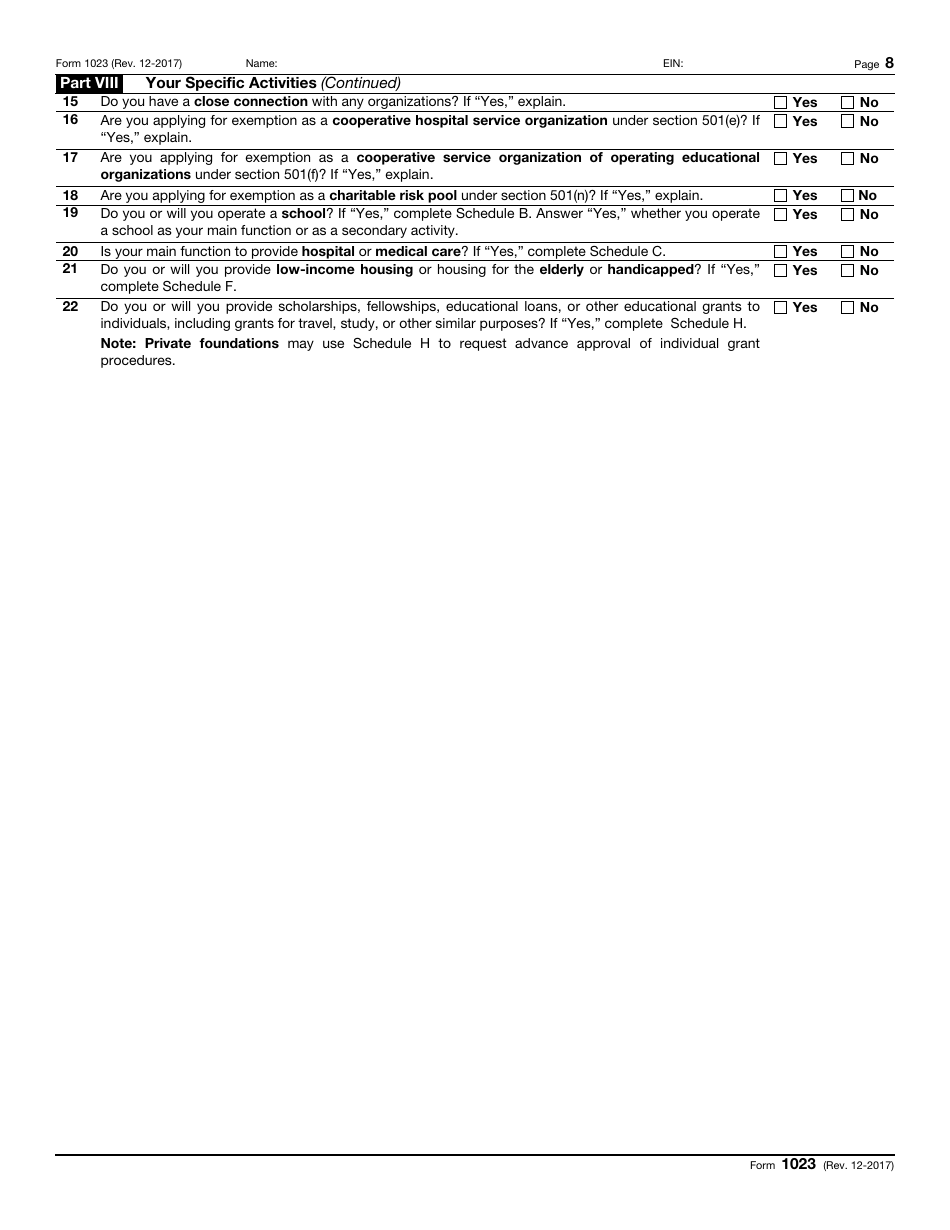

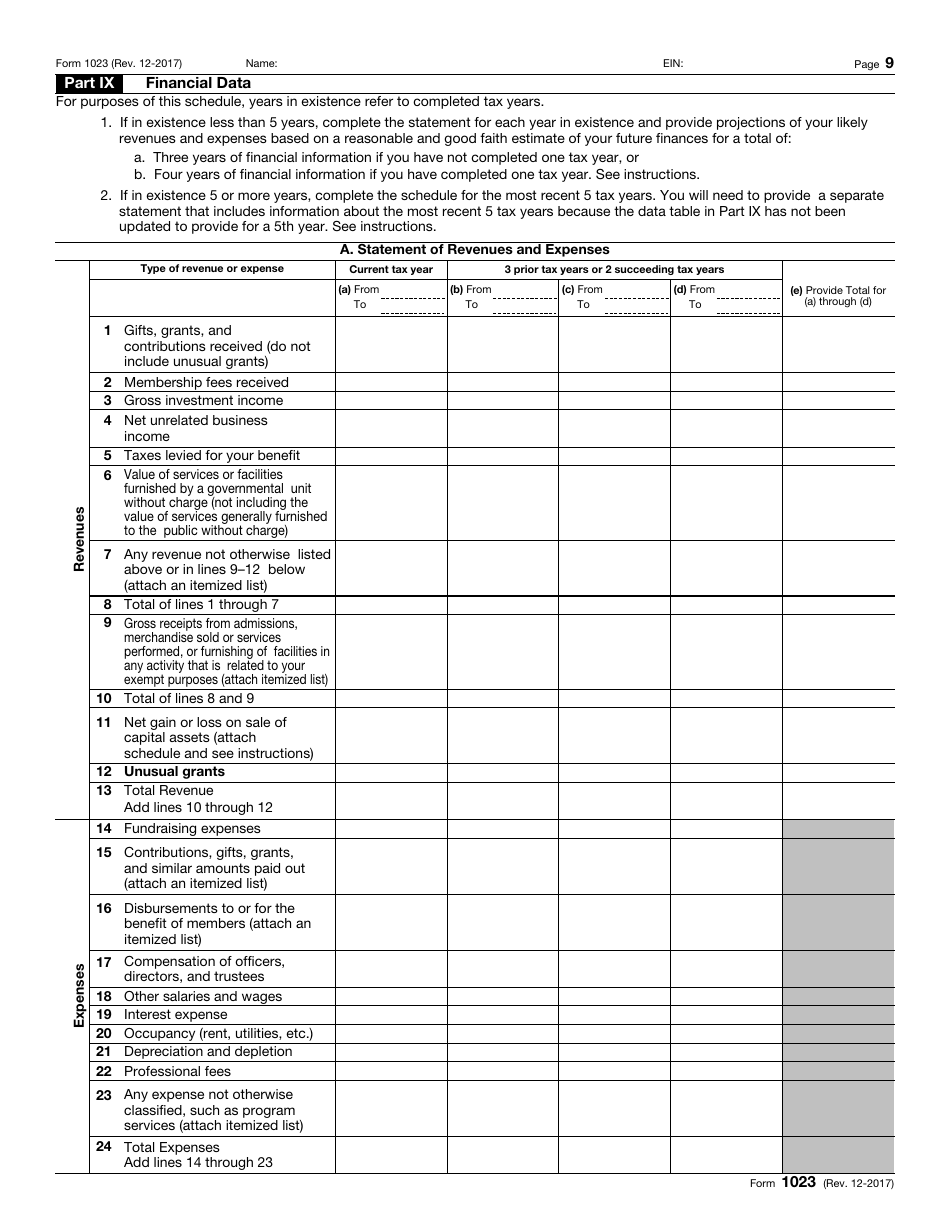

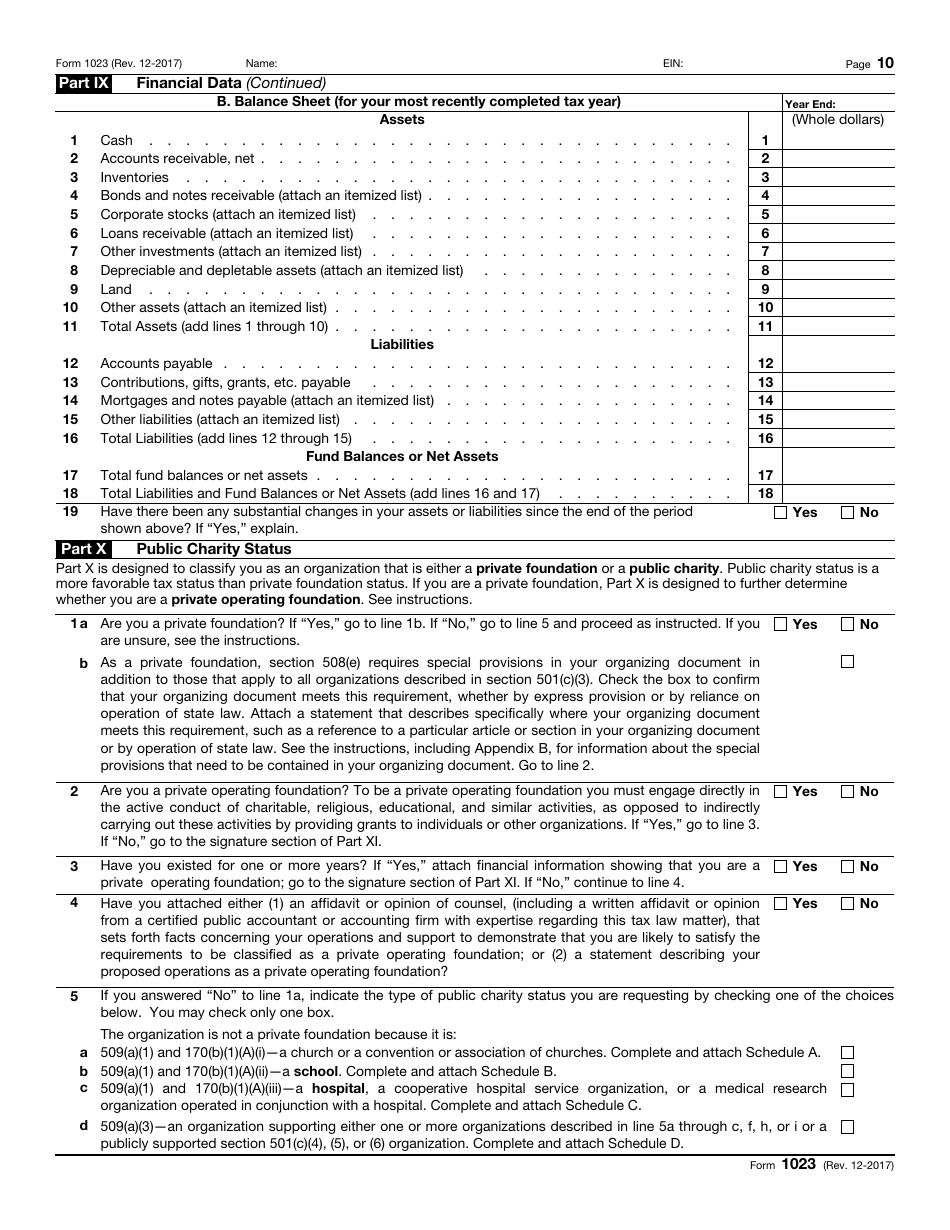

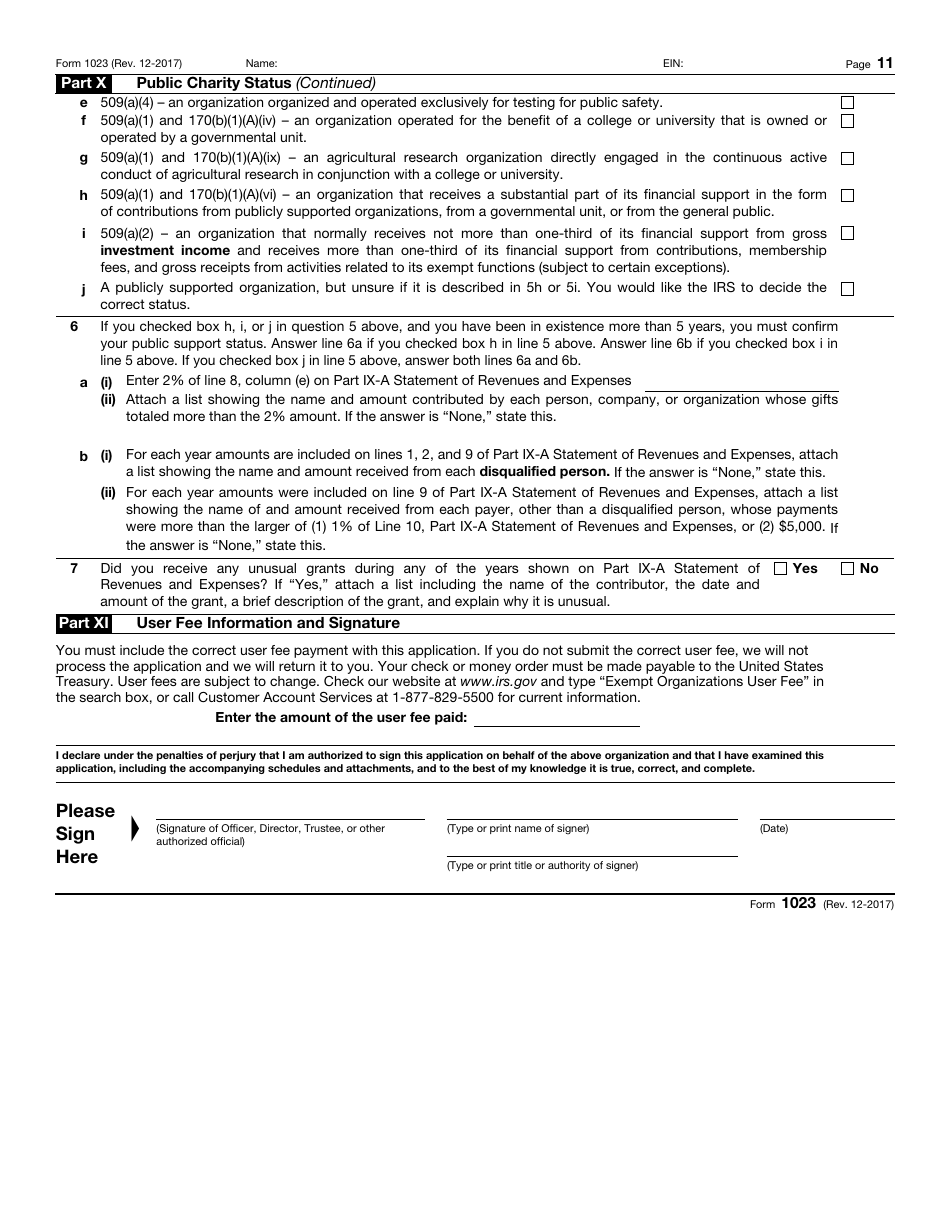

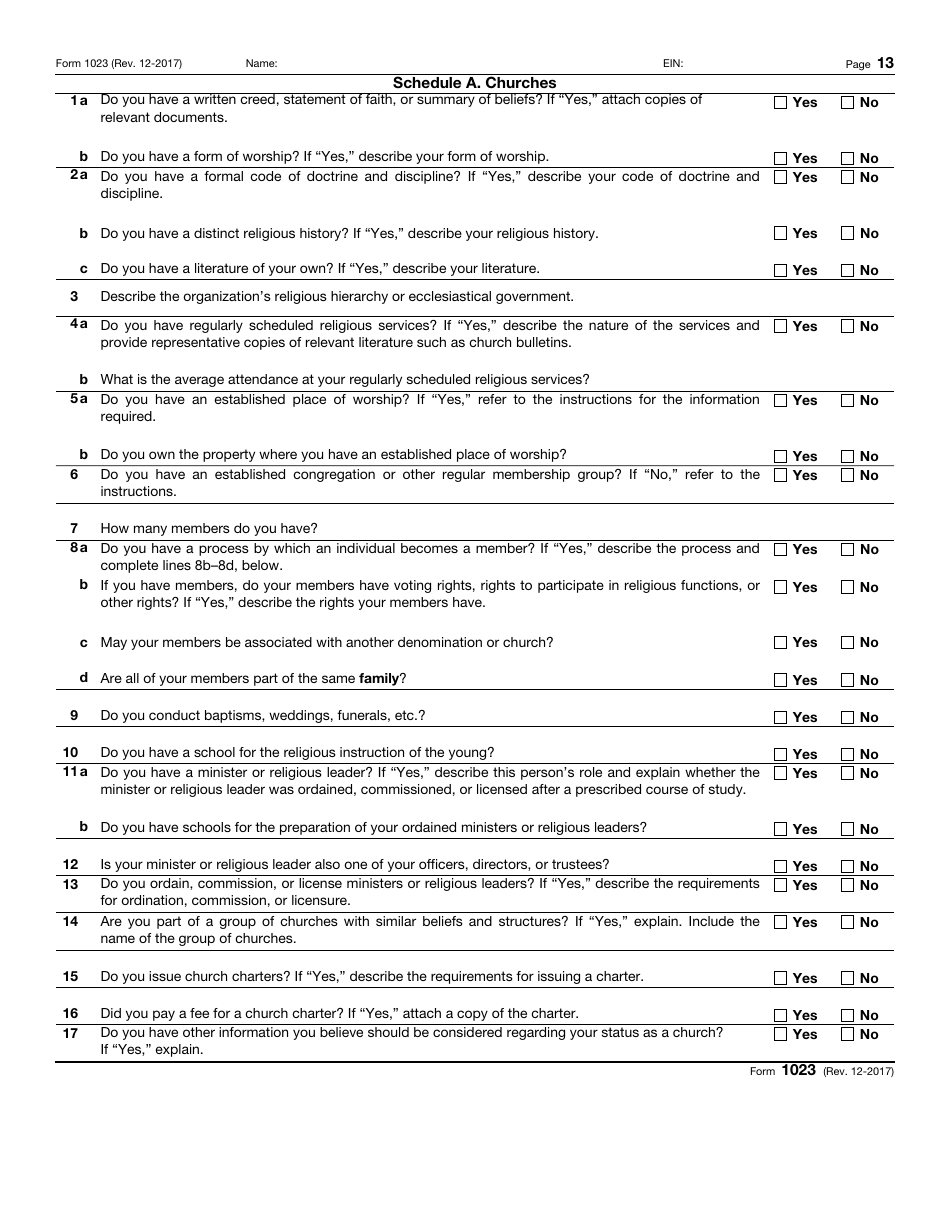

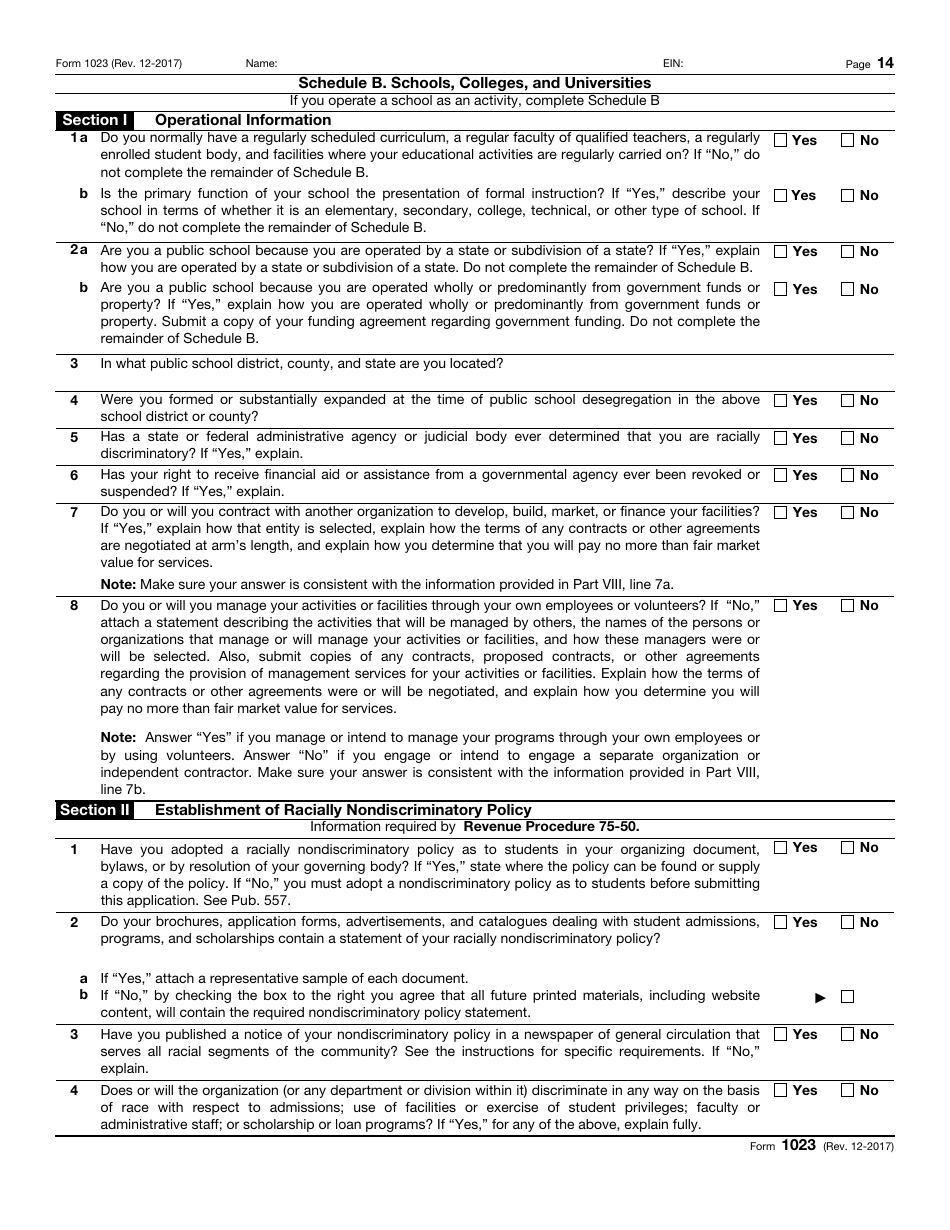

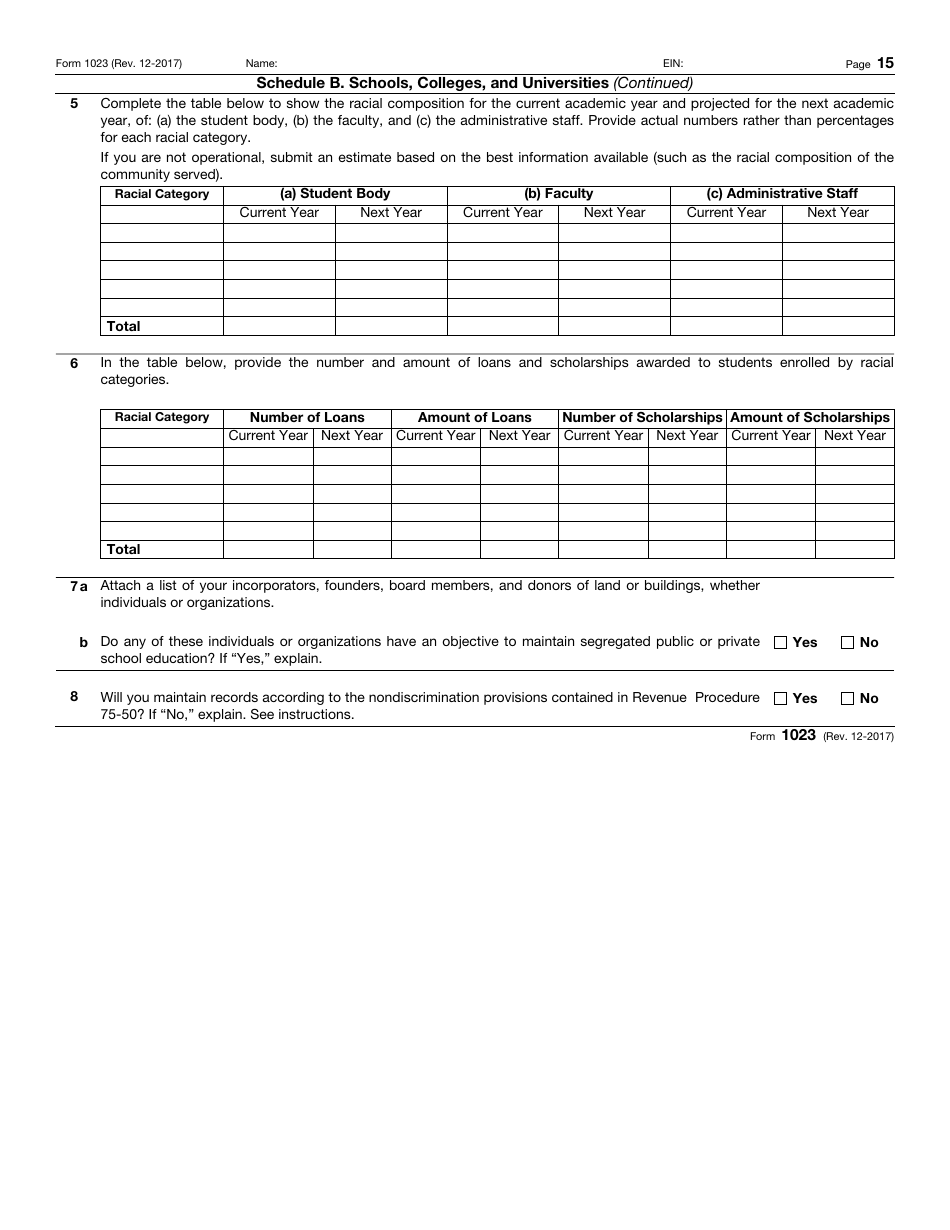

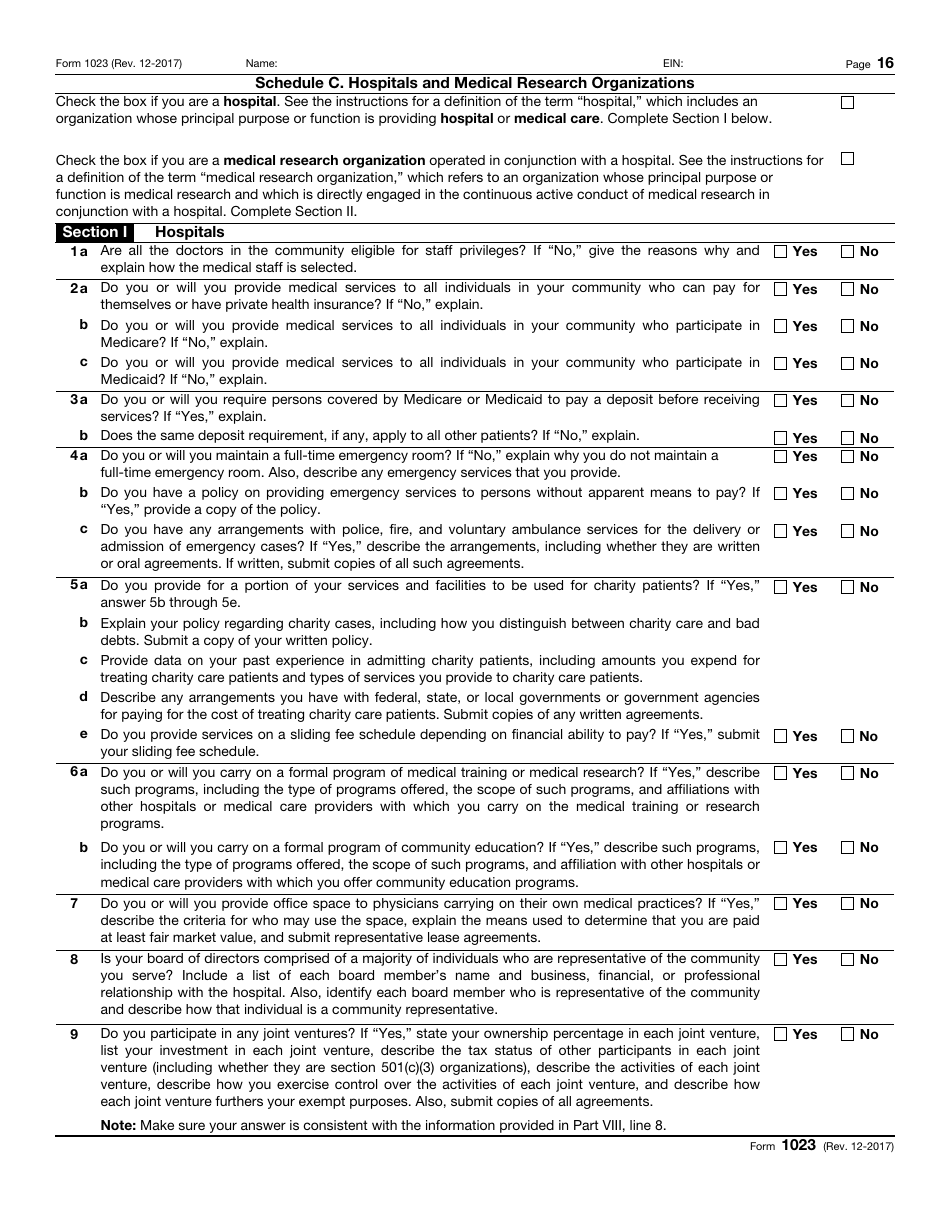

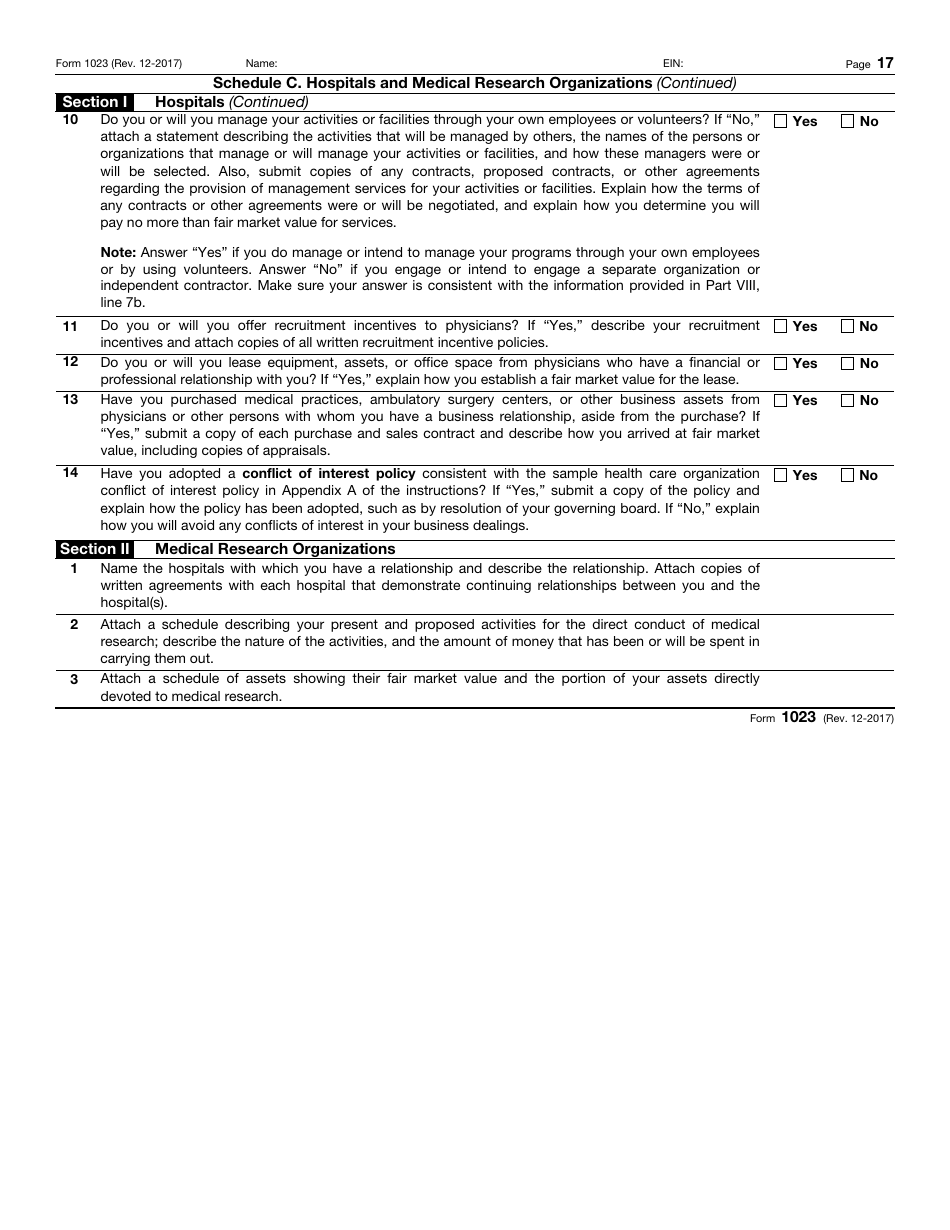

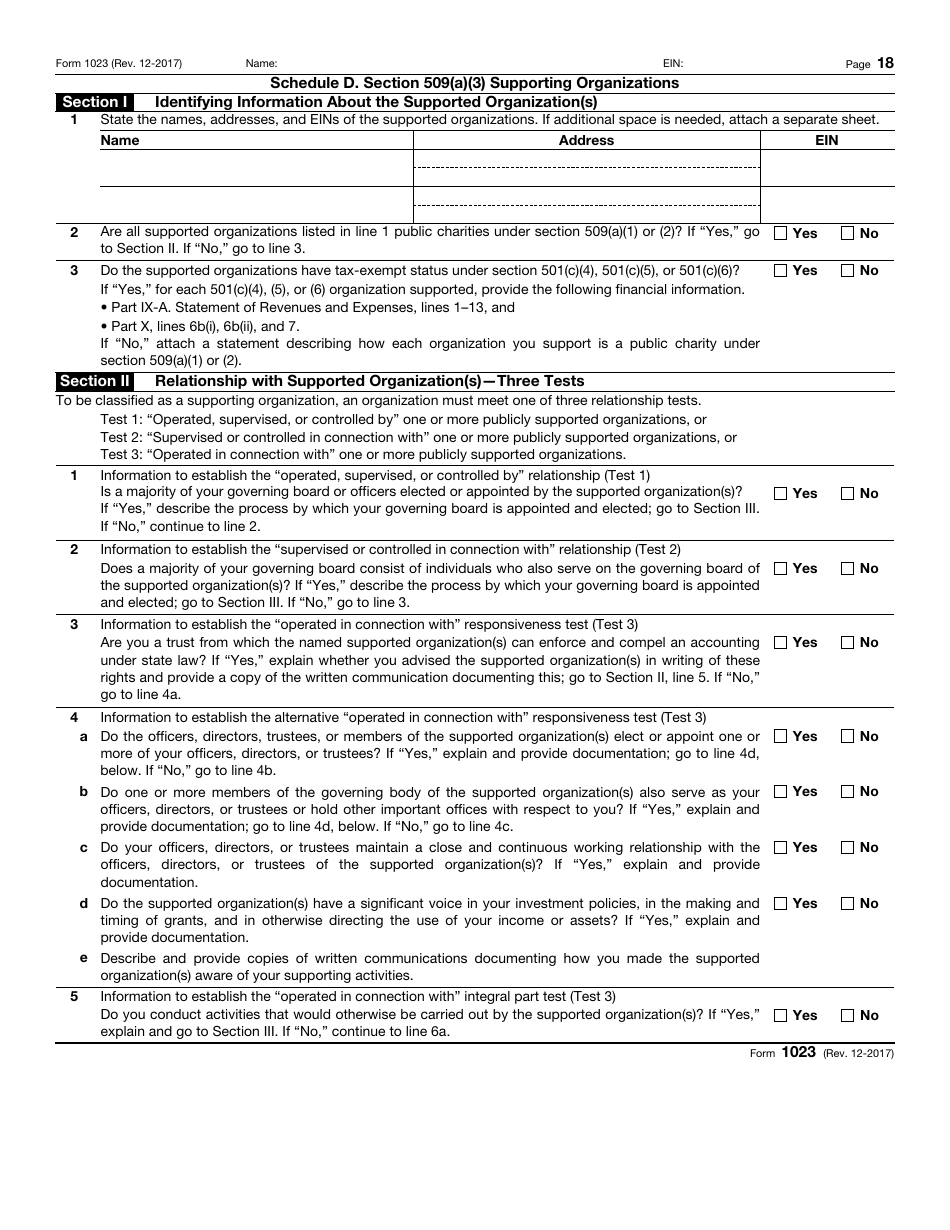

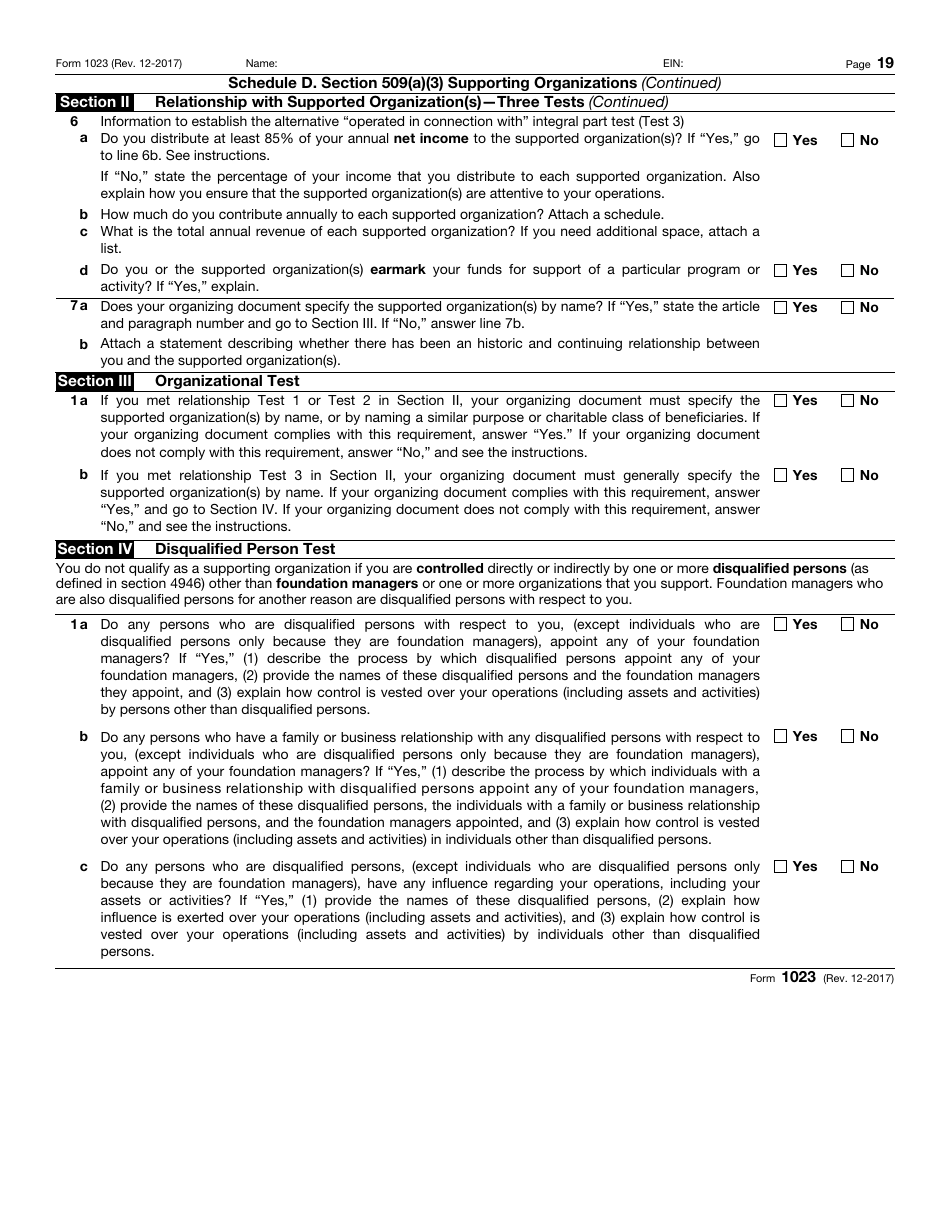

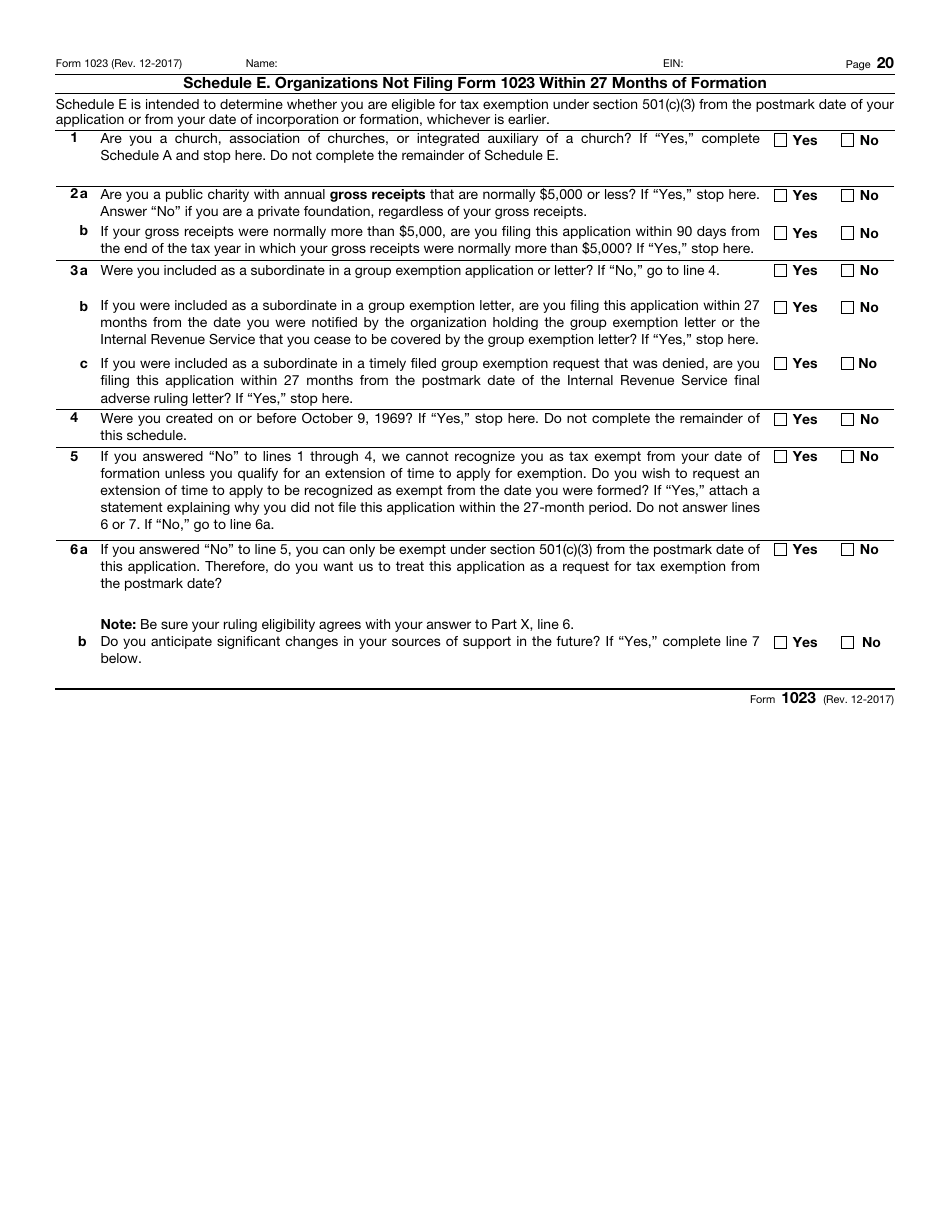

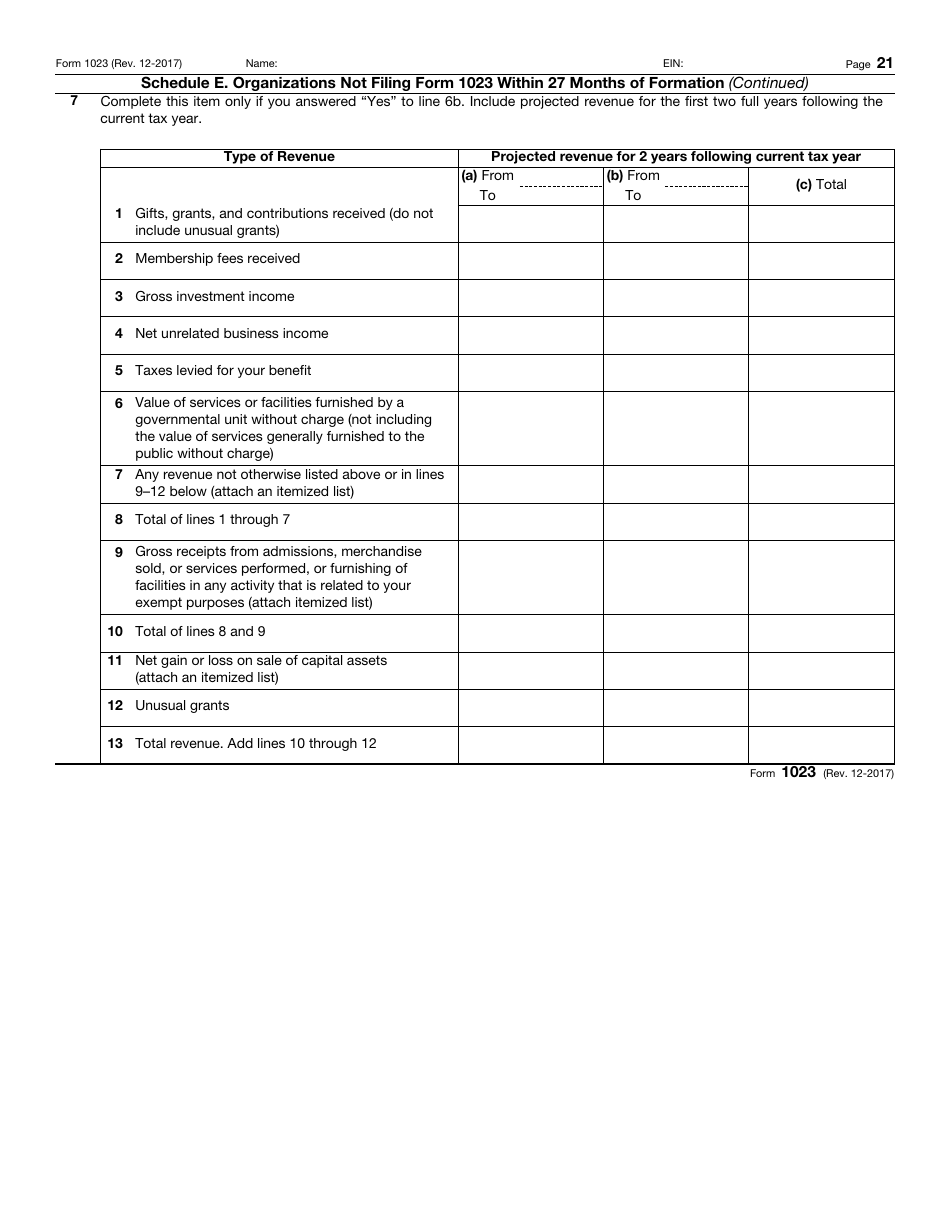

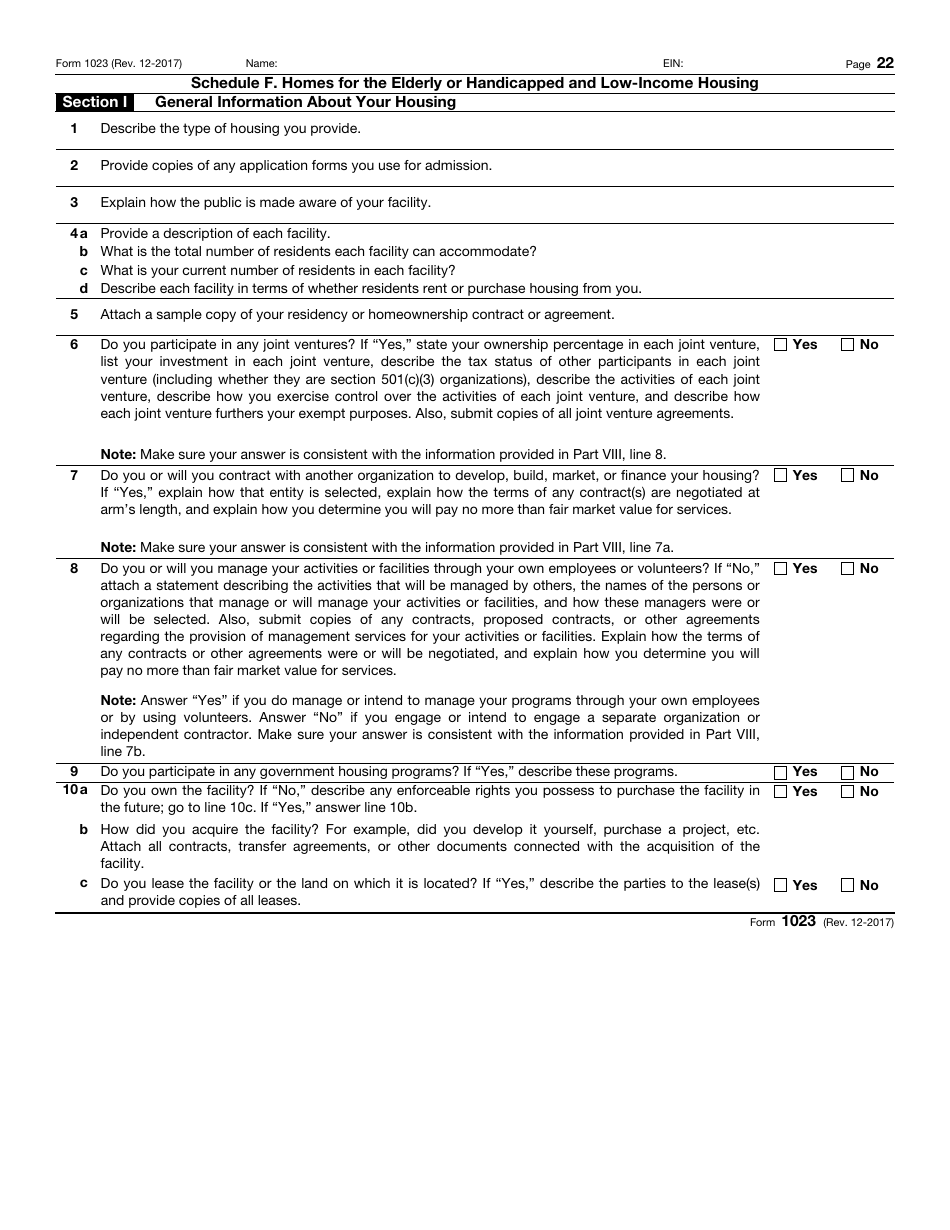

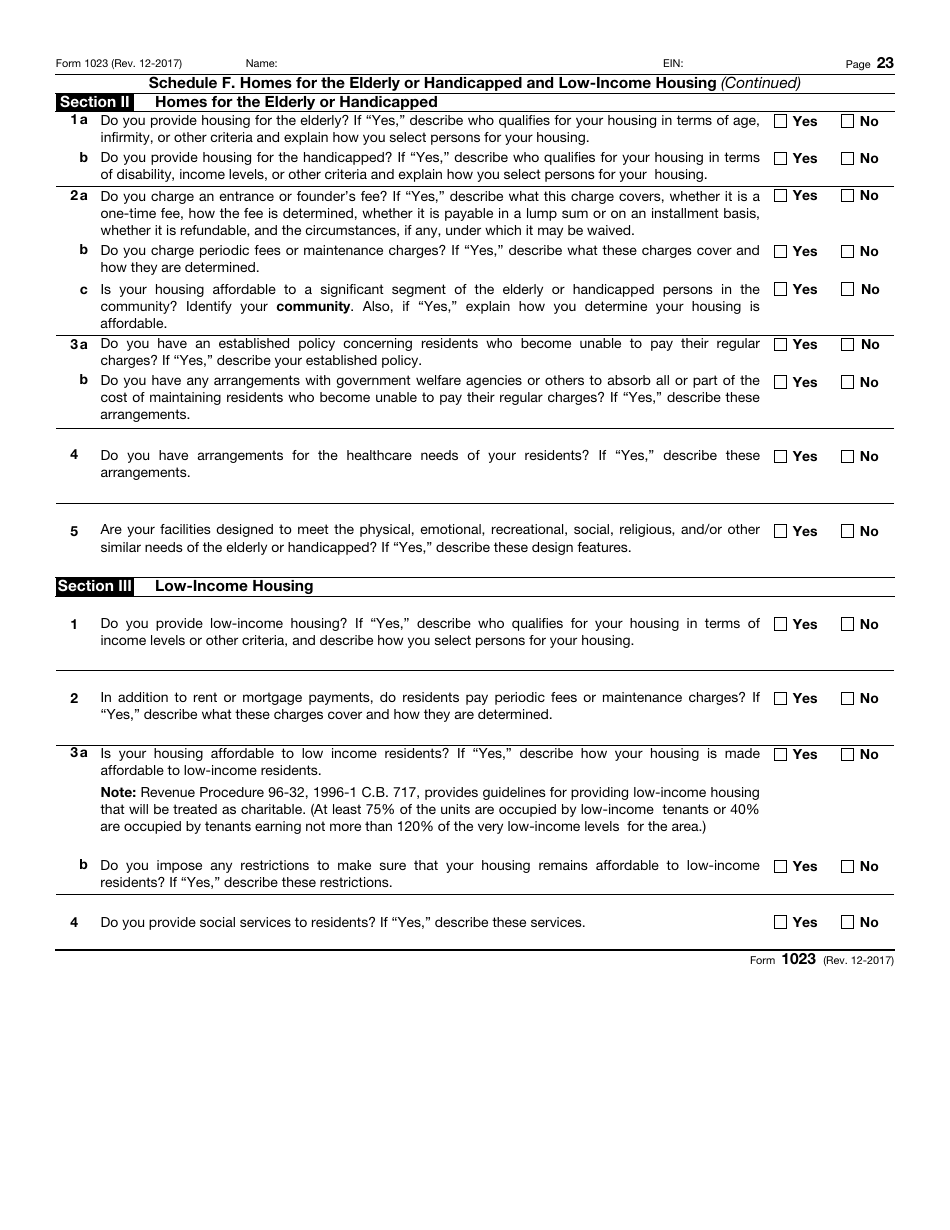

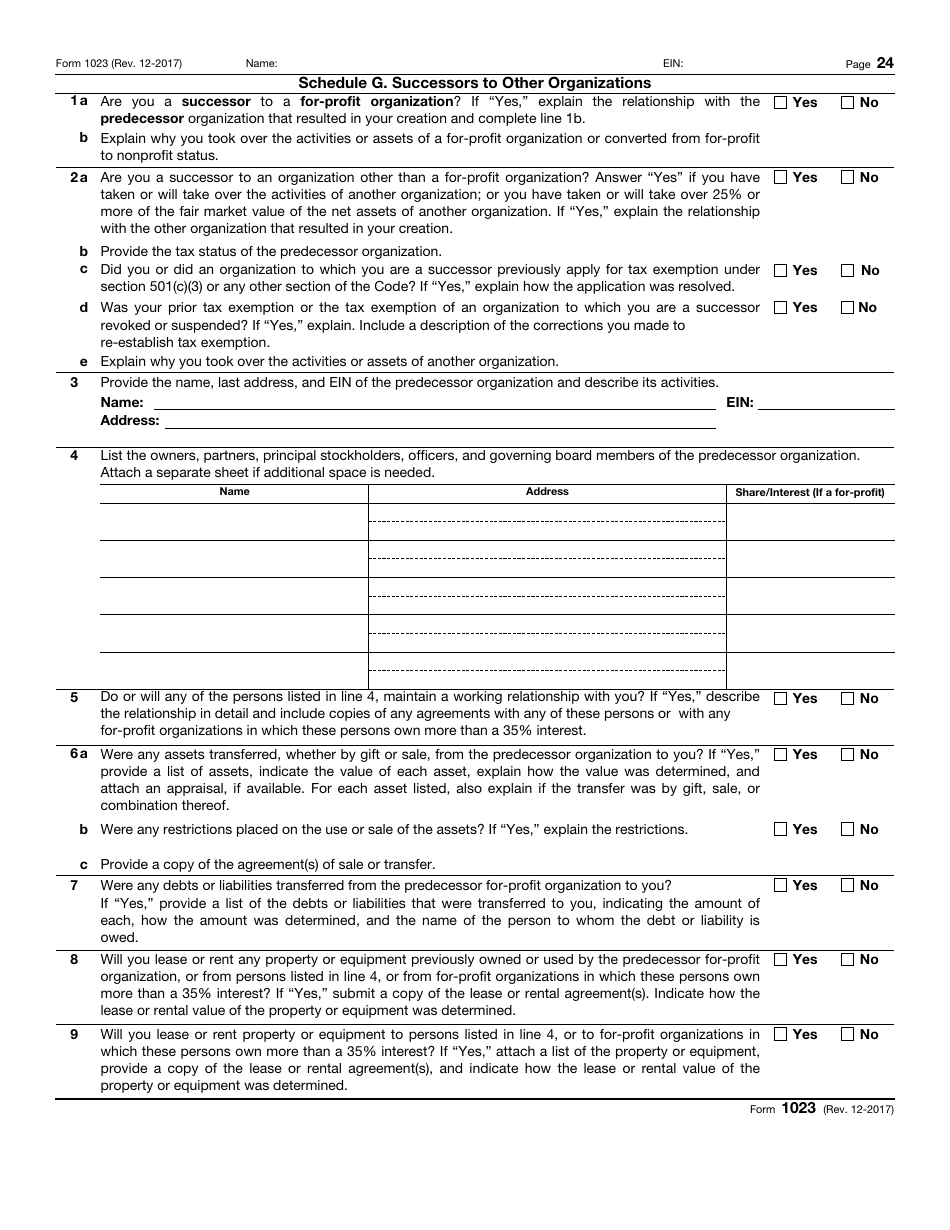

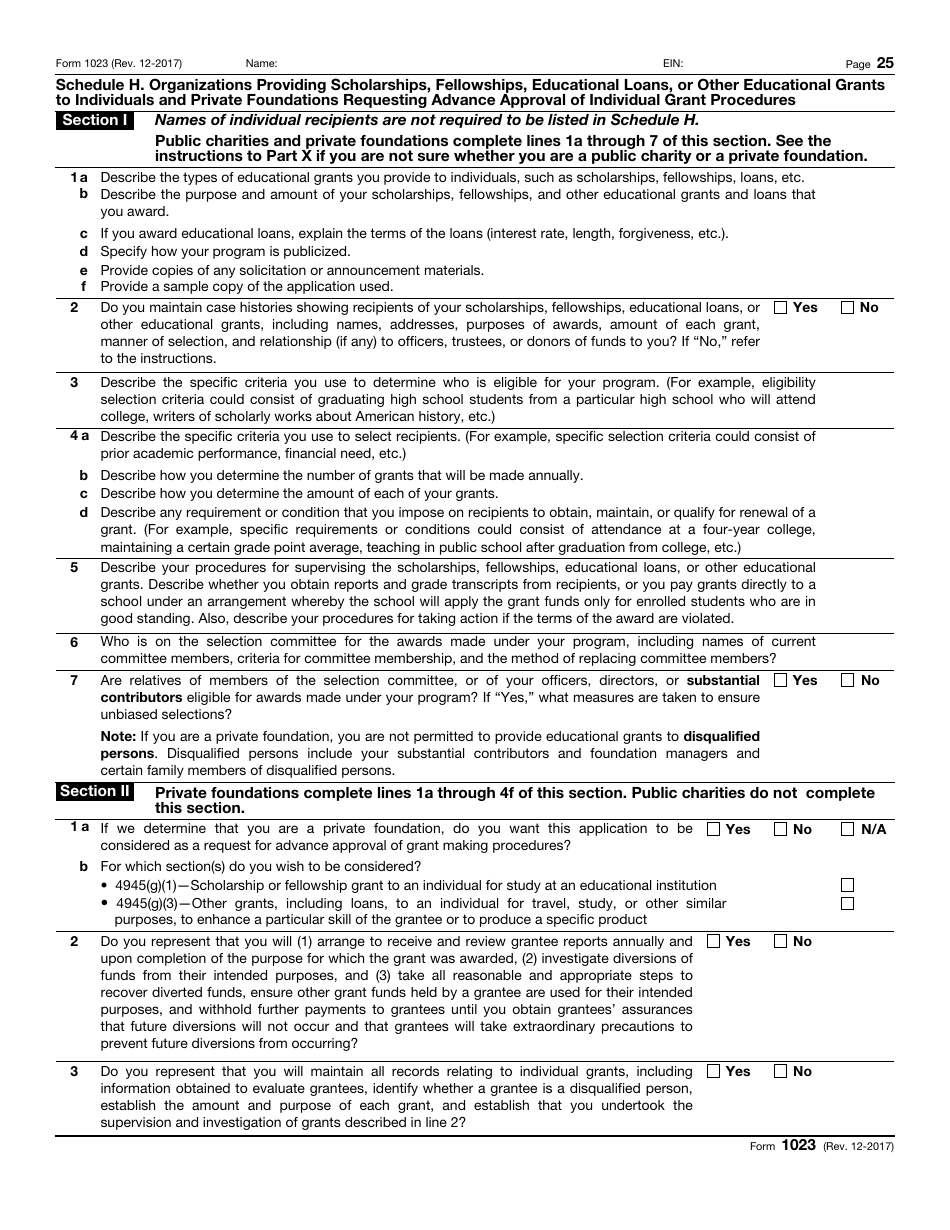

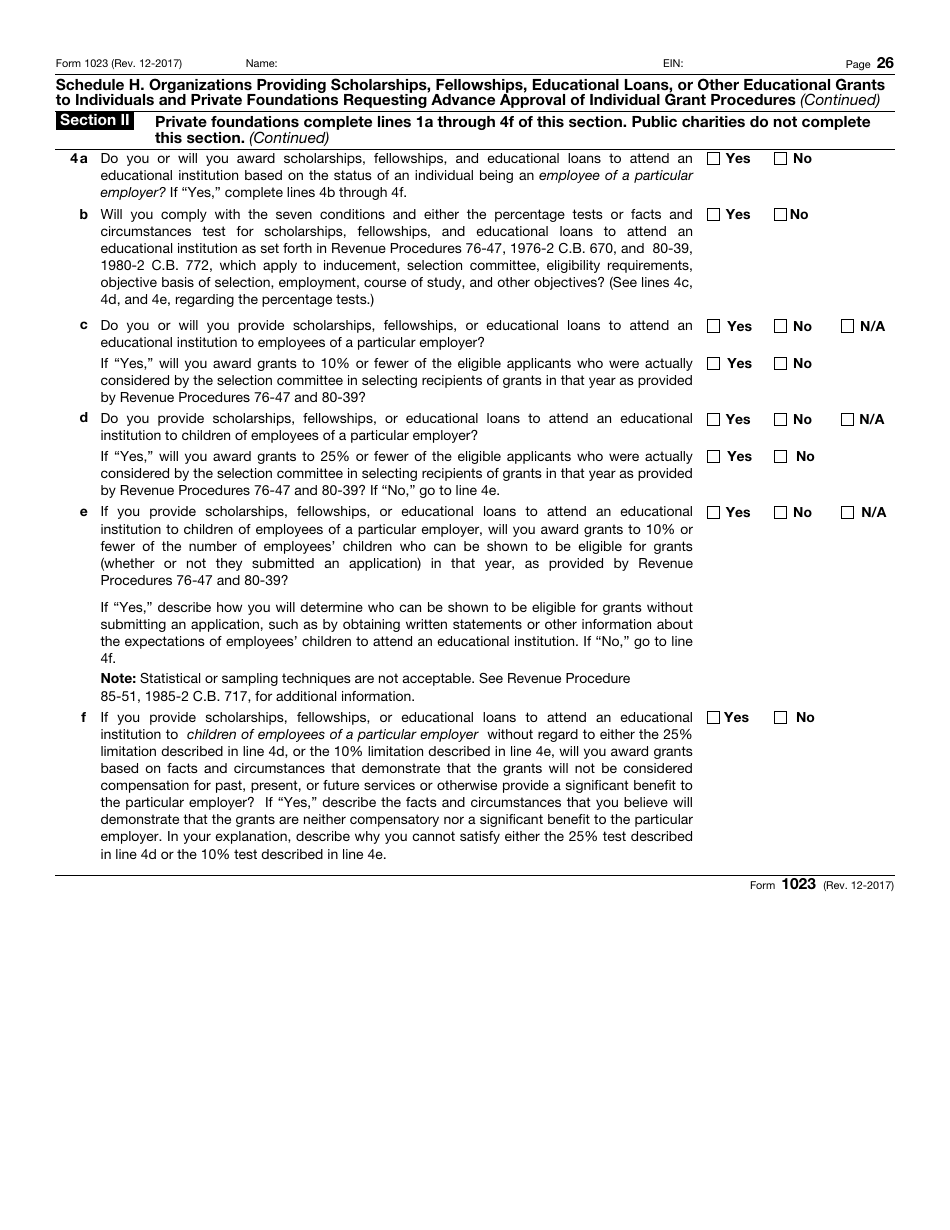

IRS Form 1023 Application for Recognition of Exemption

What Is IRS Form 1023?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1023?

A: IRS Form 1023 is an application for recognition of exemption by charitable organizations.

Q: Who needs to file IRS Form 1023?

A: Charitable organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code need to file Form 1023.

Q: What is the purpose of IRS Form 1023?

A: The purpose of IRS Form 1023 is to apply for tax-exempt status, which allows charitable organizations to avoid paying federal income tax.

Q: Is there a fee to file IRS Form 1023?

A: Yes, there is a fee to file IRS Form 1023. The fee varies depending on the organization's gross receipts.

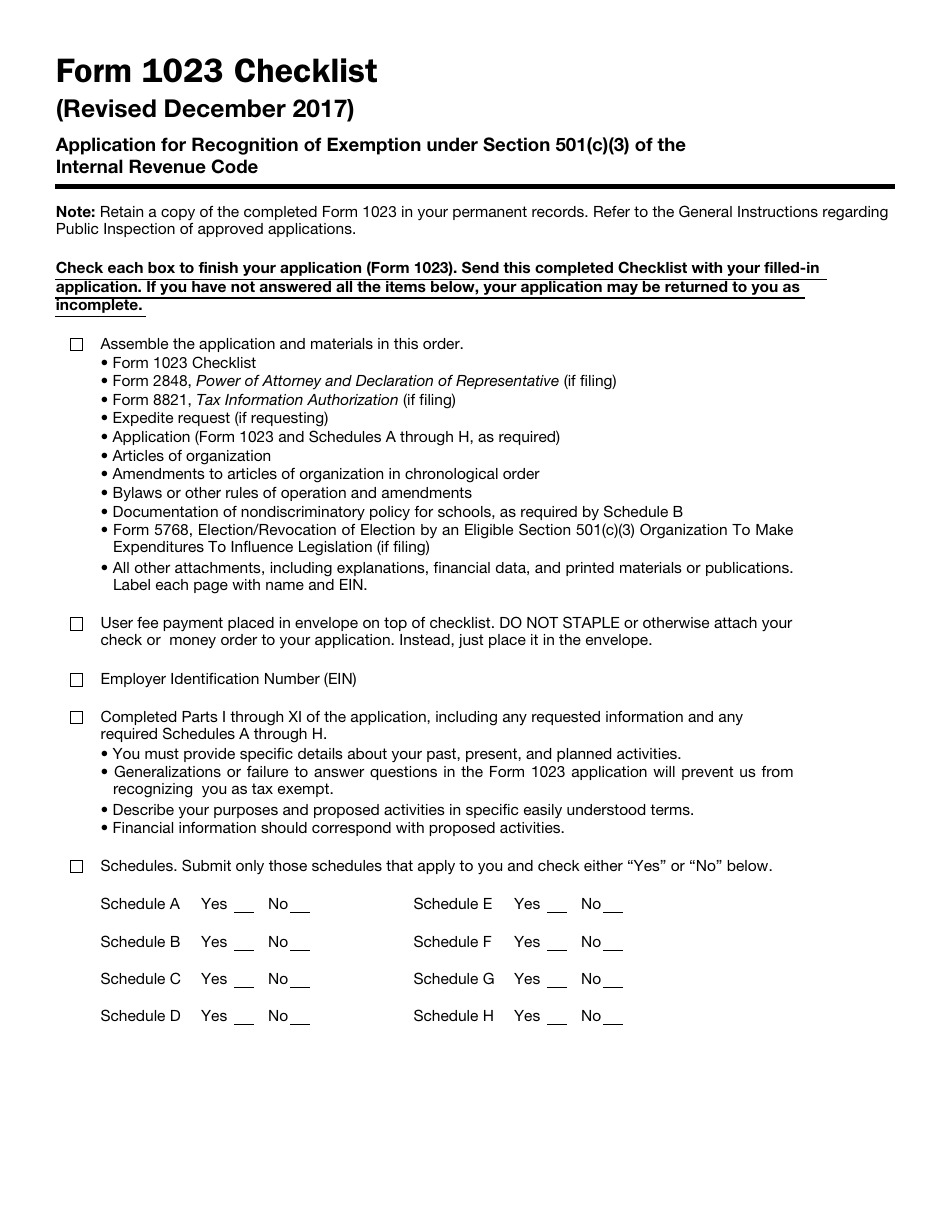

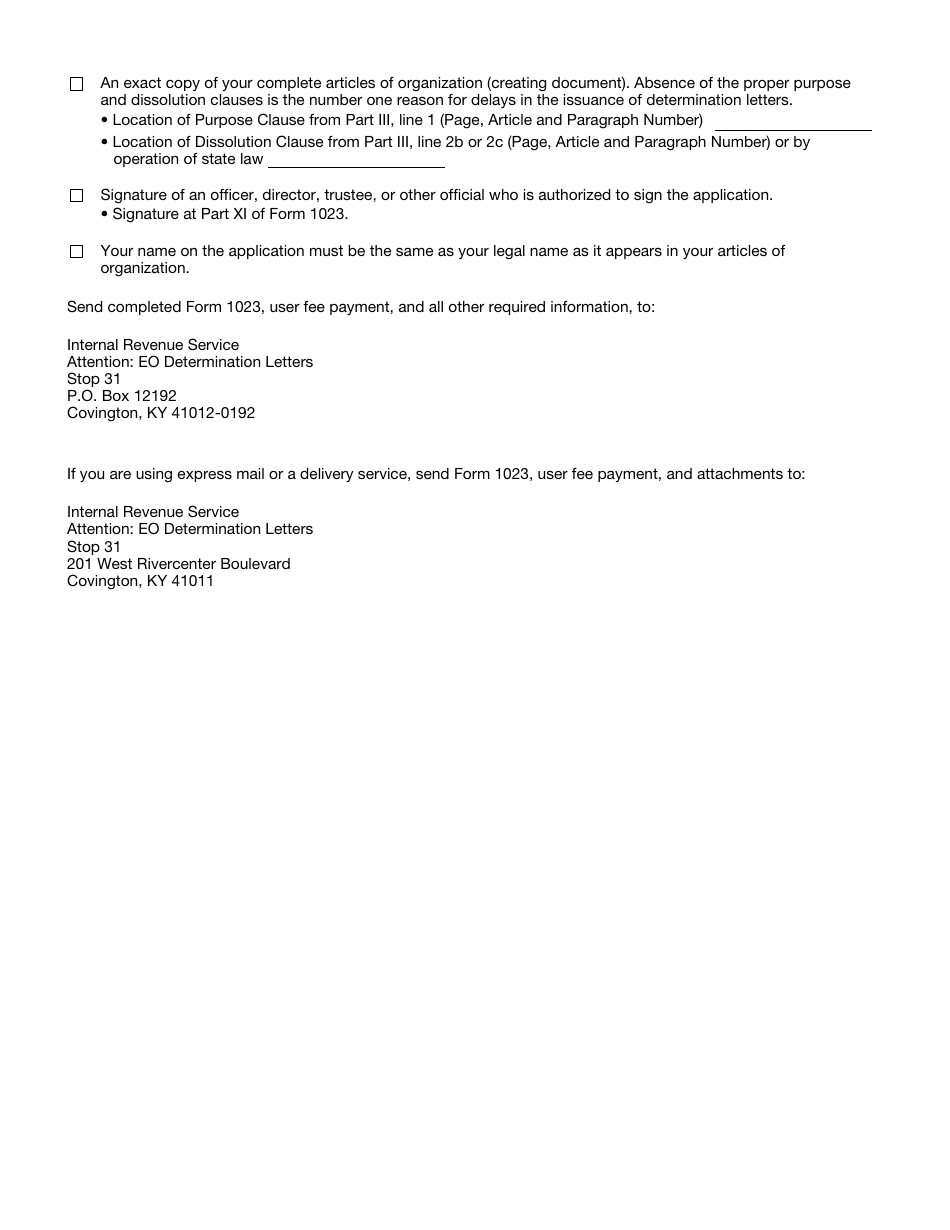

Q: What documents are required to be submitted along with IRS Form 1023?

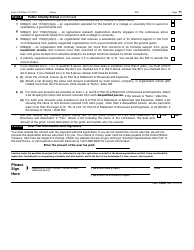

A: Along with IRS Form 1023, organizations need to submit a narrative description of activities, financial statements, and other supporting documents.

Q: How long does it take for the IRS to review Form 1023?

A: The processing time for IRS Form 1023 can vary, but it generally takes several months for the IRS to review and make a determination.

Q: What happens after submitting IRS Form 1023?

A: After submitting IRS Form 1023, the organization will receive a notification from the IRS regarding their tax-exempt status.

Q: Can I file IRS Form 1023 electronically?

A: No, IRS Form 1023 cannot be filed electronically. It must be mailed to the appropriate IRS address.

Q: Are there any alternatives to IRS Form 1023 to obtain tax-exempt status?

A: Yes, small organizations with gross receipts of $50,000 or less can file IRS Form 1023-EZ, which is a shorter and simplified application for tax-exempt status.

Form Details:

- A 28-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1023 through the link below or browse more documents in our library of IRS Forms.