This version of the form is not currently in use and is provided for reference only. Download this version of

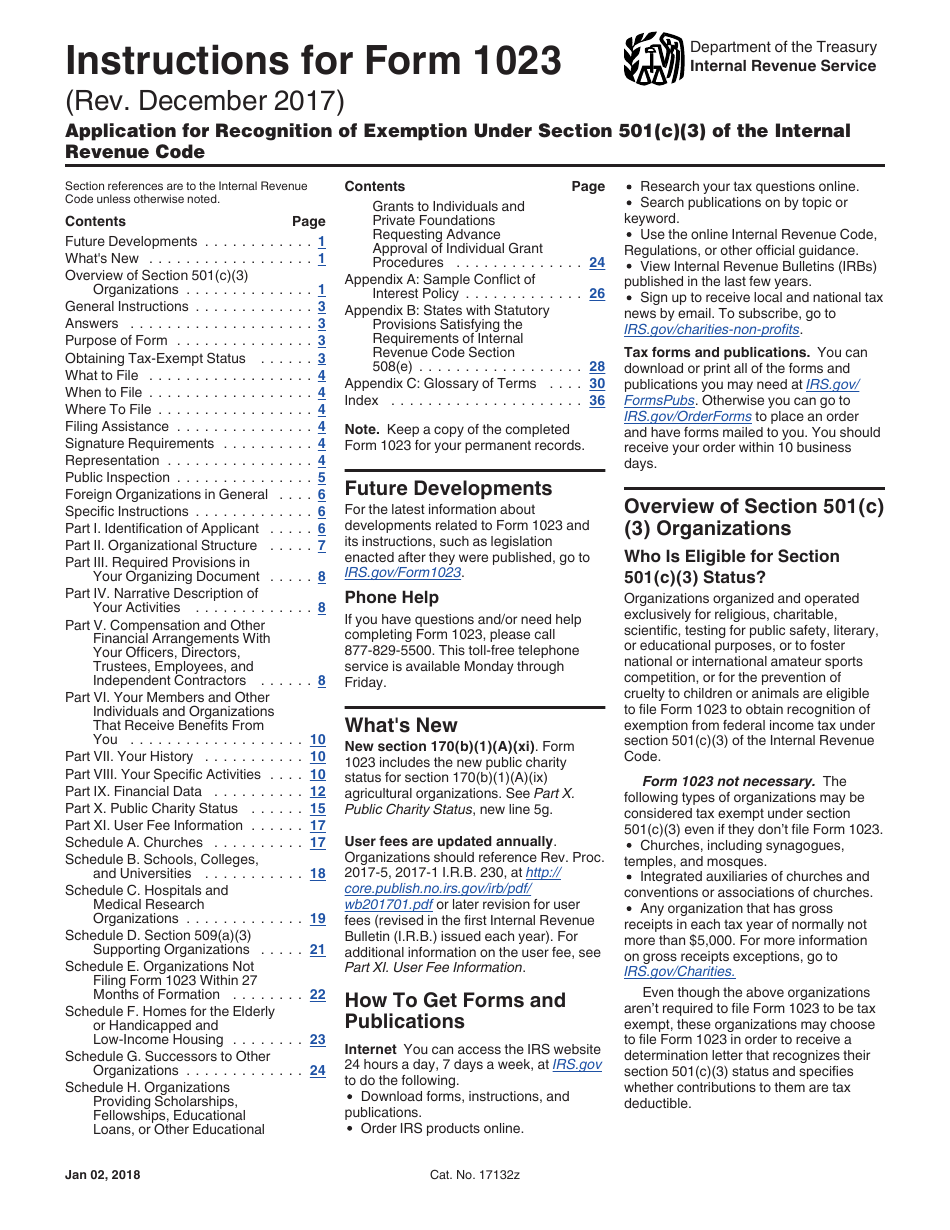

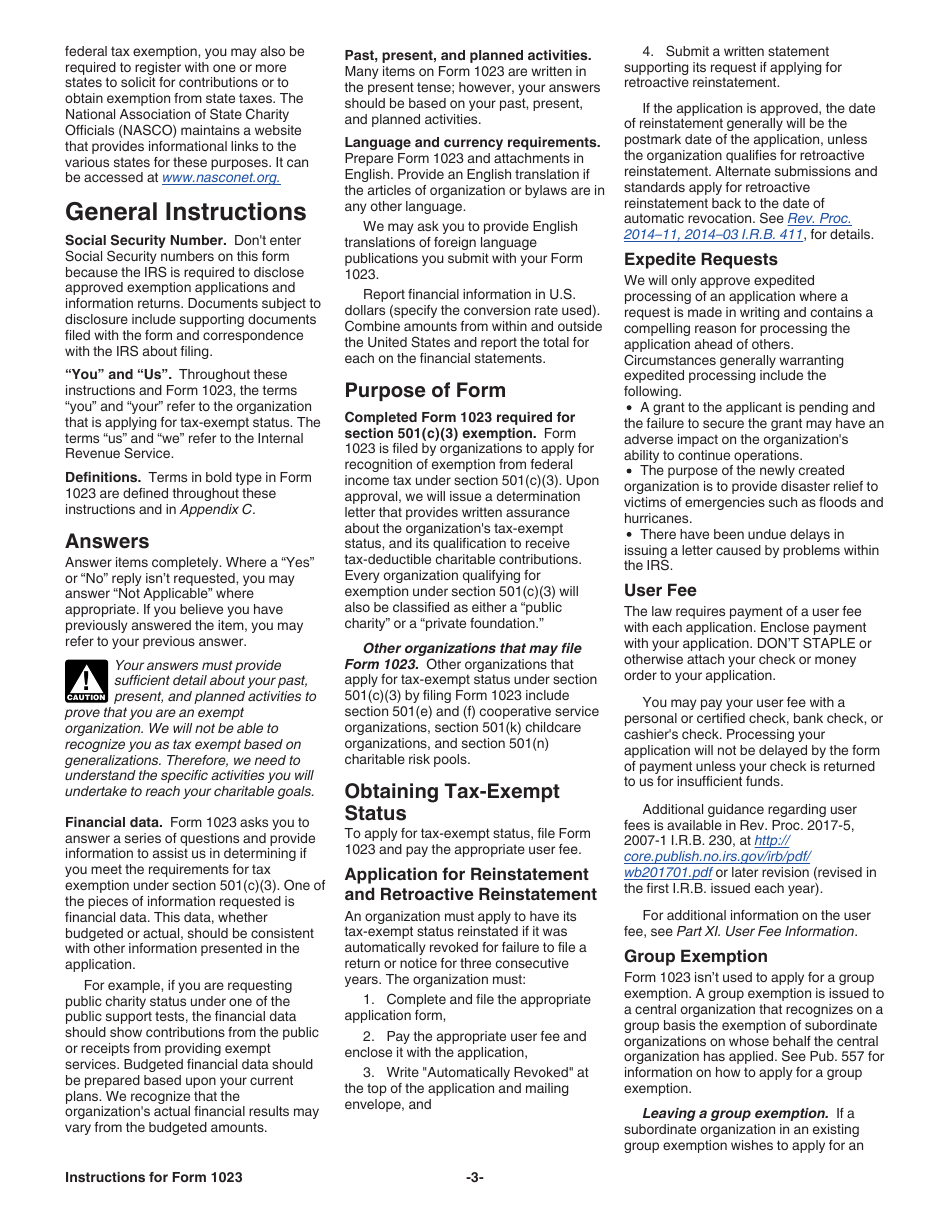

Instructions for IRS Form 1023

for the current year.

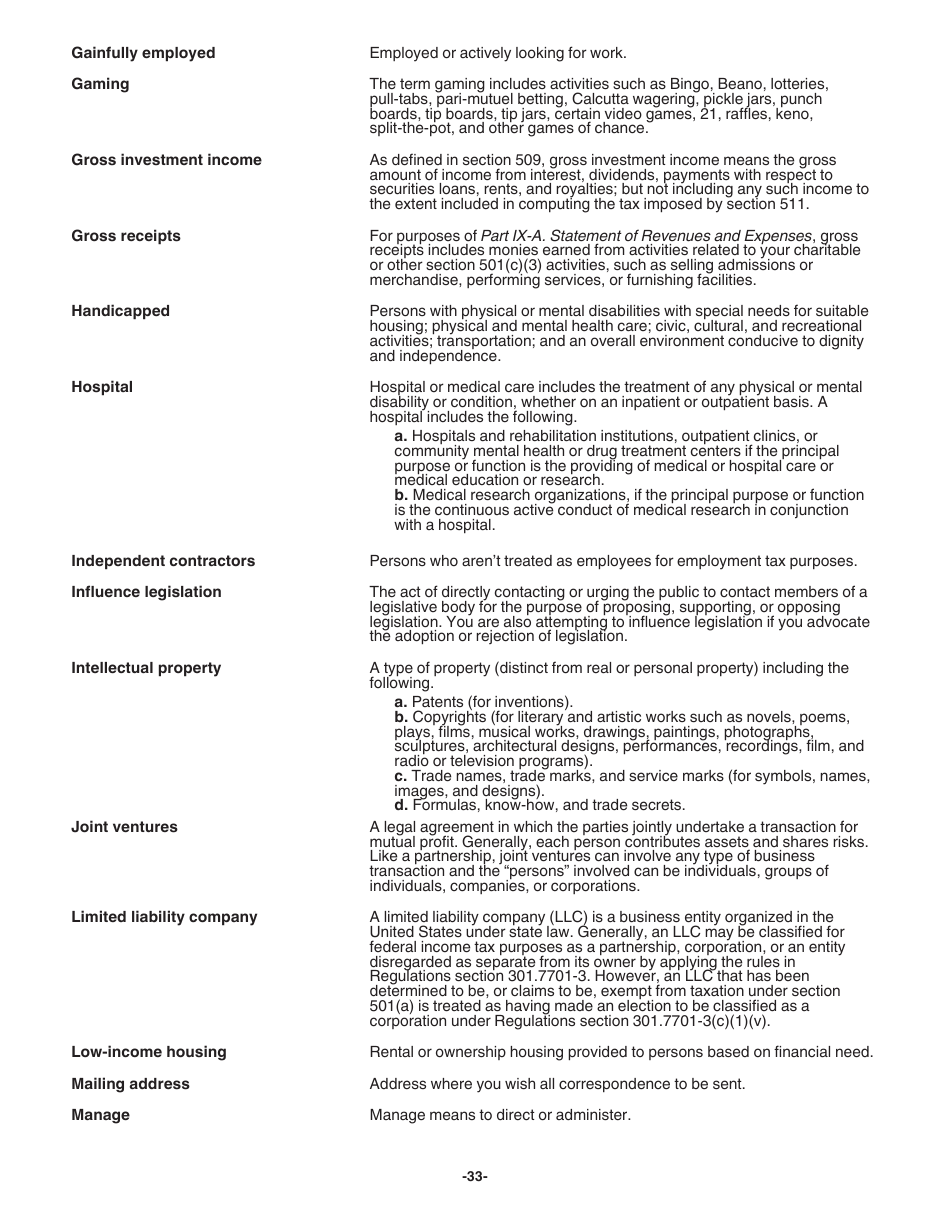

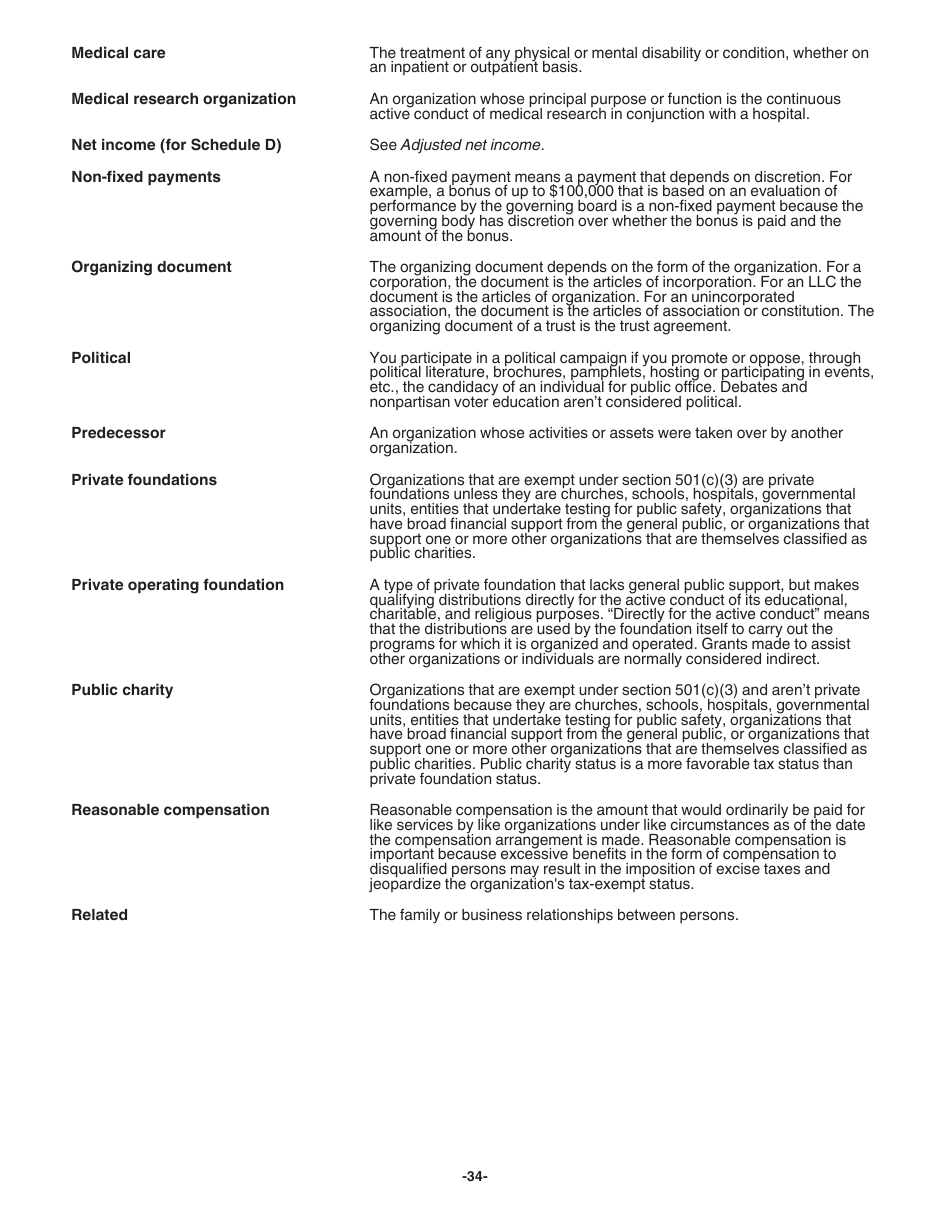

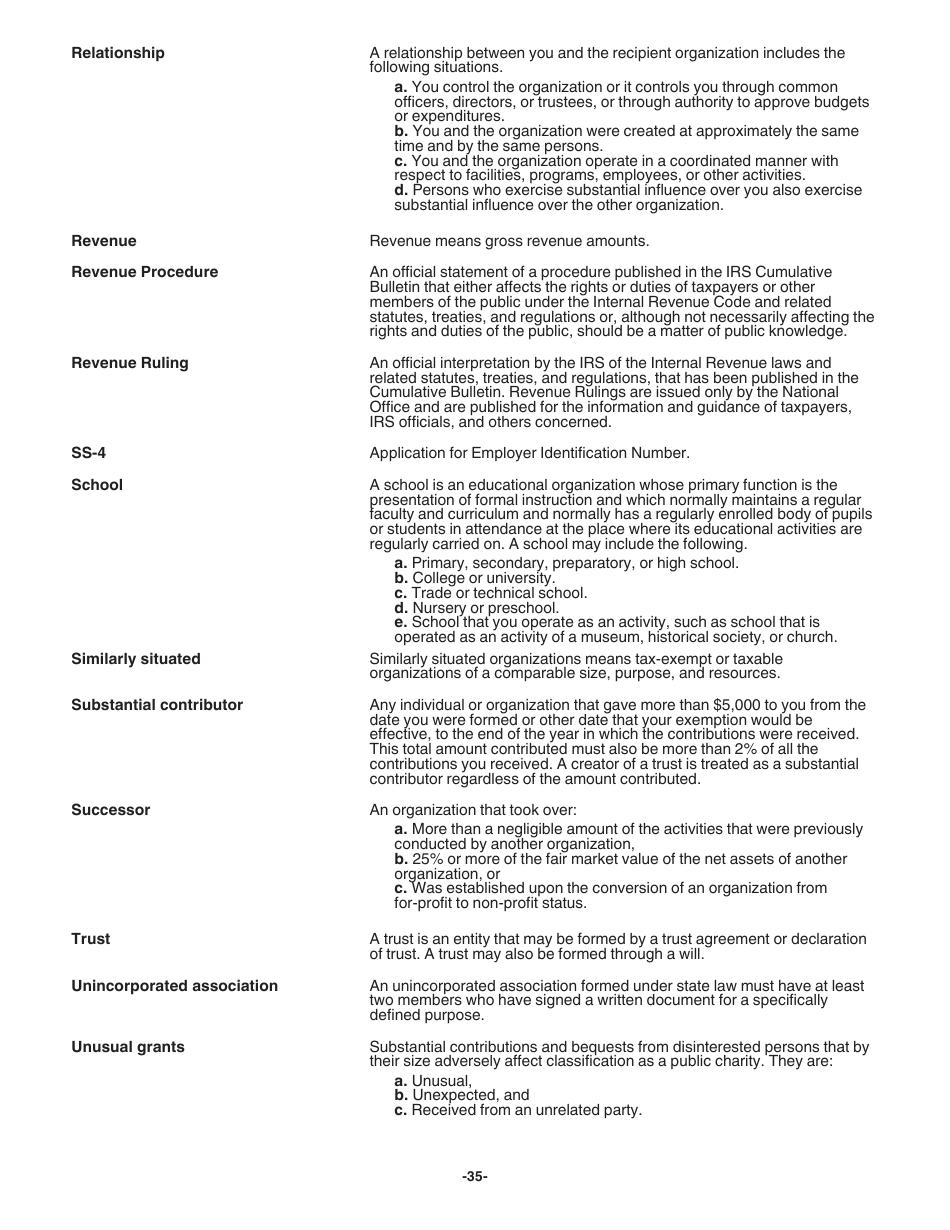

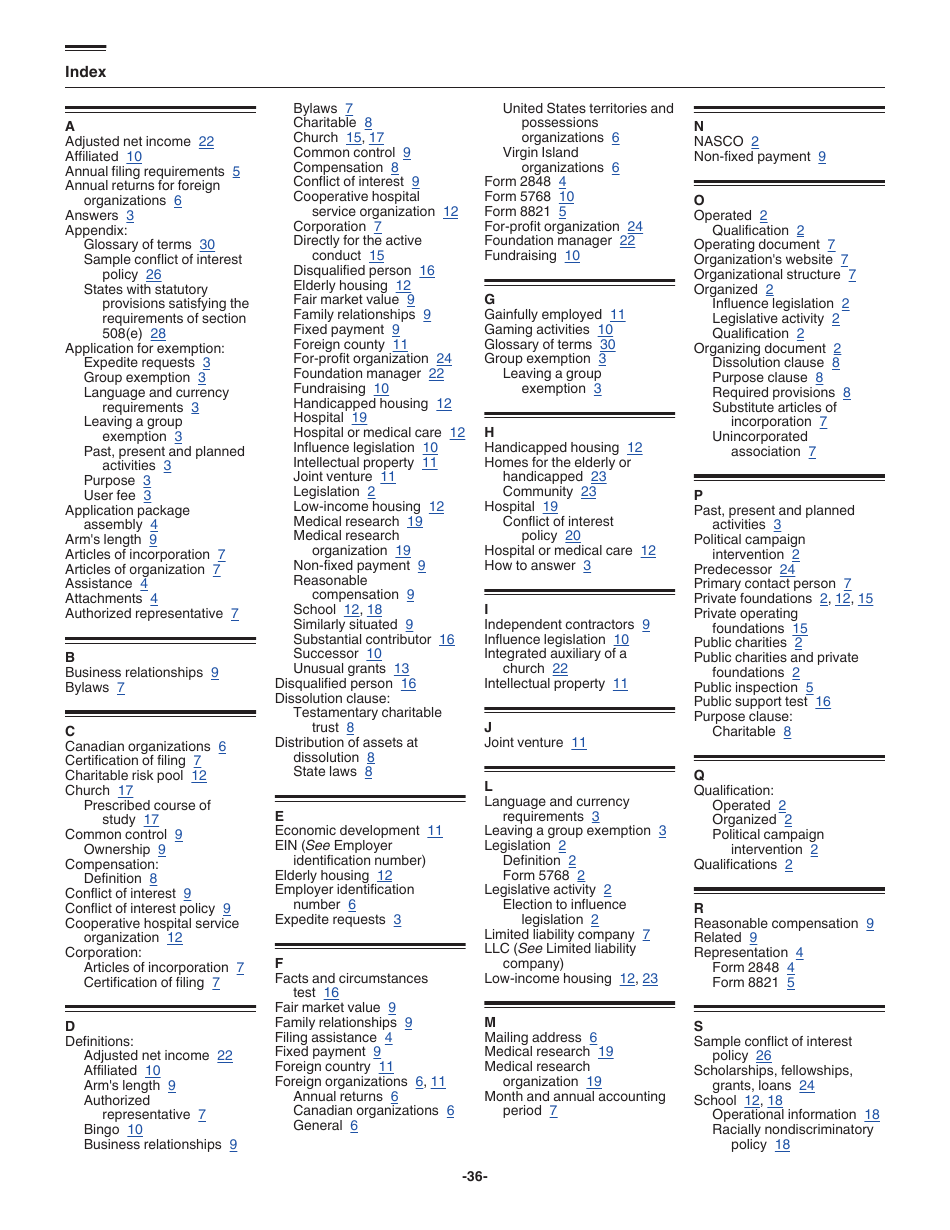

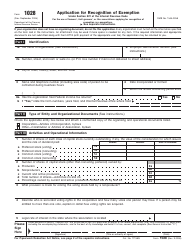

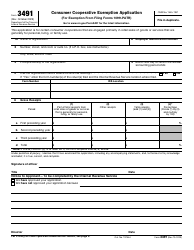

Instructions for IRS Form 1023 Application for Recognition of Exemption Under Section 501(C)(3) of the Internal Revenue Code

This document contains official instructions for IRS Form 1023 , Application for Recognition of Exemption Under Section 501(C)(3) of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1023 is available for download through this link.

FAQ

Q: What is IRS Form 1023?

A: IRS Form 1023 is an application used to request recognition of exemption under section 501(c)(3) of the Internal Revenue Code.

Q: Who should use IRS Form 1023?

A: Organizations seeking tax-exempt status under section 501(c)(3) should use IRS Form 1023.

Q: What is the purpose of IRS Form 1023?

A: The purpose of IRS Form 1023 is to apply for recognition of exemption from federal income tax for organizations described in section 501(c)(3).

Q: Is there a fee for filing IRS Form 1023?

A: Yes, there is a fee for filing IRS Form 1023. The current fee varies depending on the organization's annual gross receipts.

Q: How long does it take to process IRS Form 1023?

A: The processing time for IRS Form 1023 can vary, but it can take several months.

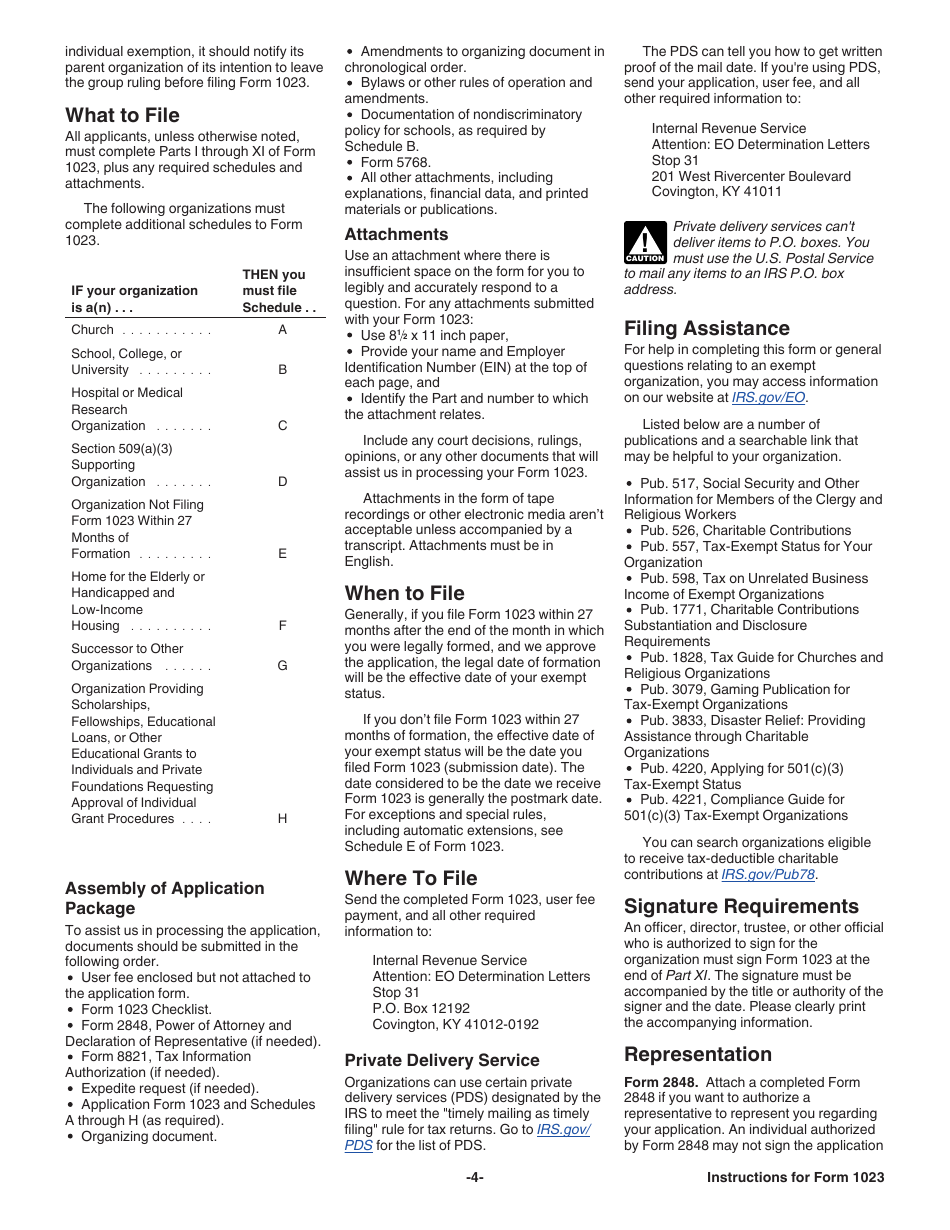

Q: What documents should be included with IRS Form 1023?

A: Various documents should be included with IRS Form 1023, such as organizing documents, financial information, and descriptions of activities and policies.

Q: Can I file IRS Form 1023 electronically?

A: No, IRS Form 1023 cannot be filed electronically. It must be mailed to the appropriate IRS address.

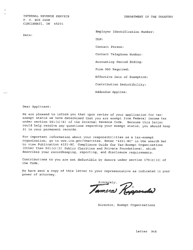

Q: What happens after filing IRS Form 1023?

A: After filing IRS Form 1023, the organization will receive a determination letter from the IRS, either granting or denying tax-exempt status.

Q: What if my application for tax-exempt status is denied?

A: If an application for tax-exempt status is denied, the organization has the option to appeal the decision within a certain timeframe.

Instruction Details:

- This 37-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.