This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8963

for the current year.

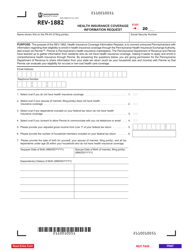

Instructions for IRS Form 8963 Report of Health Insurance Provider Information

This document contains official instructions for IRS Form 8963 , Report of Health Insurance Provider Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8963?

A: IRS Form 8963 is the Report of Health Insurance Provider Information.

Q: Who needs to file IRS Form 8963?

A: Health insurance providers are required to file IRS Form 8963.

Q: What information does IRS Form 8963 require?

A: IRS Form 8963 requires health insurance providers to report certain information, such as the number of individuals provided with minimum essential coverage.

Q: When is the deadline to file IRS Form 8963?

A: The deadline to file IRS Form 8963 is usually February 28th, or March 31st if filing electronically.

Q: Can IRS Form 8963 be filed electronically?

A: Yes, IRS Form 8963 can be filed electronically.

Q: Are there any penalties for not filing IRS Form 8963?

A: Yes, there may be penalties for not filing IRS Form 8963 or for filing it late.

Q: What is the purpose of IRS Form 8963?

A: The purpose of IRS Form 8963 is to gather information about health insurance coverage provided by insurance providers.

Q: Do individuals need to file IRS Form 8963?

A: No, individuals do not need to file IRS Form 8963. It is only required for health insurance providers.

Q: What if I make a mistake on IRS Form 8963?

A: If you make a mistake on IRS Form 8963, you can file an amended form to correct the error.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.