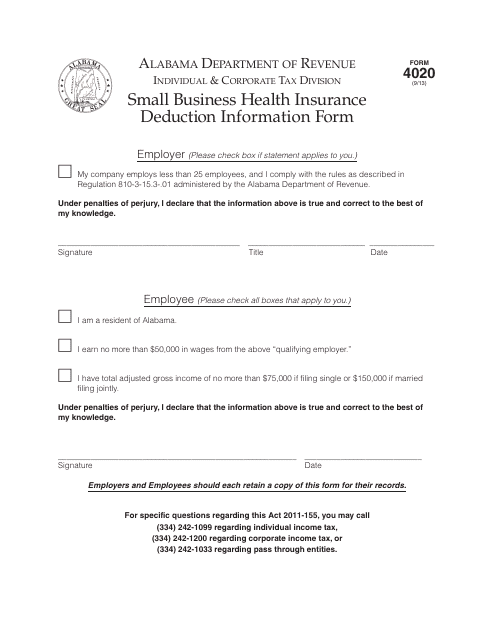

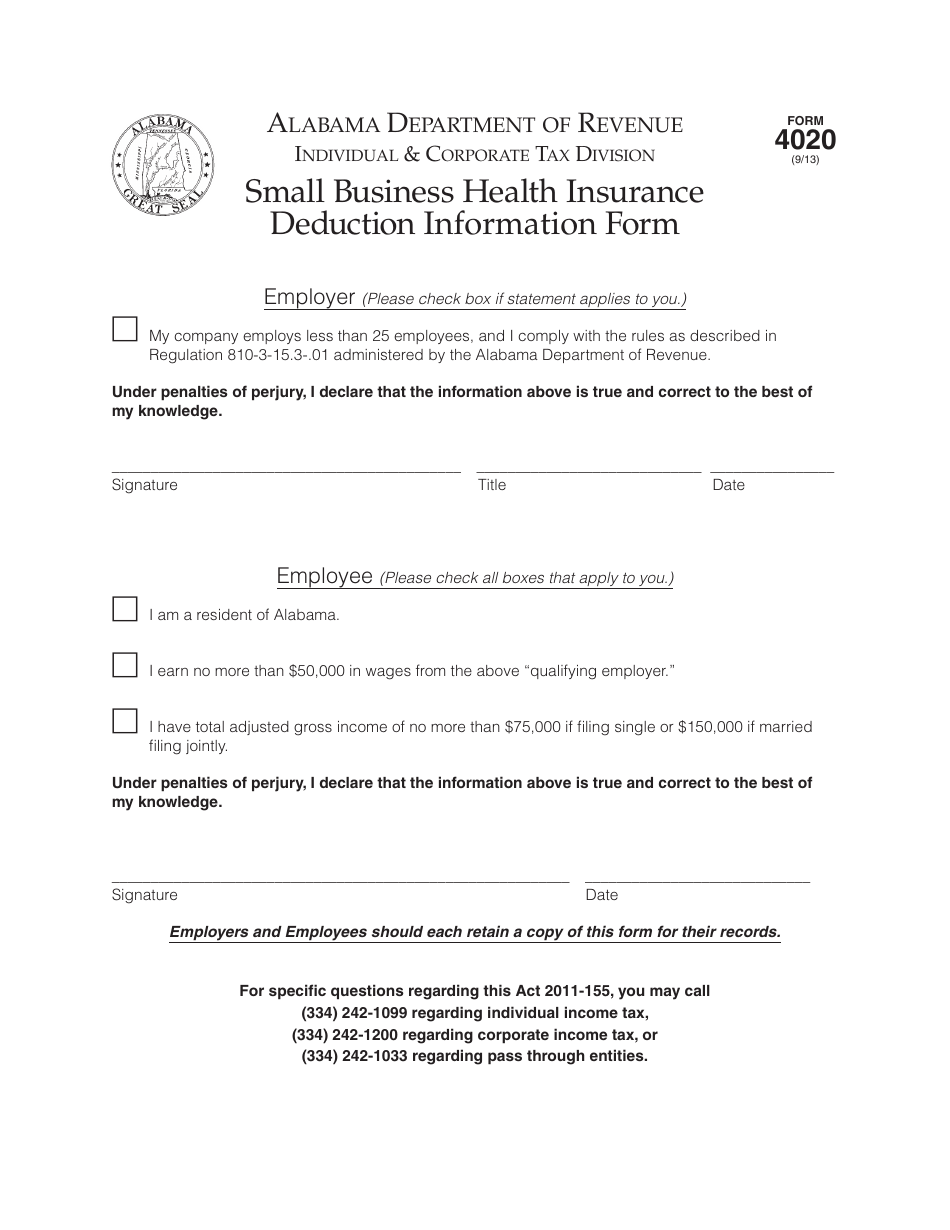

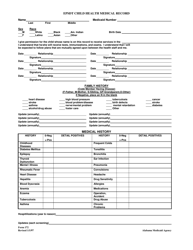

Form 4020 Small Business Health Insurance Deduction Information Form - Alabama

What Is Form 4020?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4020 Small Business Health Insurance Deduction Information Form?

A: Form 4020 is a document used in Alabama to claim a deduction for small business health insurance expenses.

Q: Who can use Form 4020?

A: Small business owners in Alabama who provide health insurance to their employees can use Form 4020.

Q: What is the purpose of Form 4020?

A: Form 4020 is used to report and claim deductions for small business health insurance expenses in Alabama.

Q: What information do I need to complete Form 4020?

A: To complete Form 4020, you will need information about your small business health insurance expenses, including total premiums paid and the number of employees covered.

Q: When is the deadline to file Form 4020?

A: The deadline to file Form 4020 is typically the same as the federal tax return deadline, which is April 15th of each year.

Q: Are there any penalties for not filing Form 4020?

A: Failure to file Form 4020 or claiming false information may result in penalties or legal consequences, so it's important to comply with the requirements.

Q: Can I e-file Form 4020?

A: No, as of now, Form 4020 cannot be e-filed. It must be filed by mail with the Alabama Department of Revenue.

Q: Can I claim deductions for health insurance expenses for myself as a small business owner?

A: Yes, as a small business owner in Alabama, you may be able to claim deductions for health insurance expenses for yourself and your eligible dependents.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4020 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.