This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-PC

for the current year.

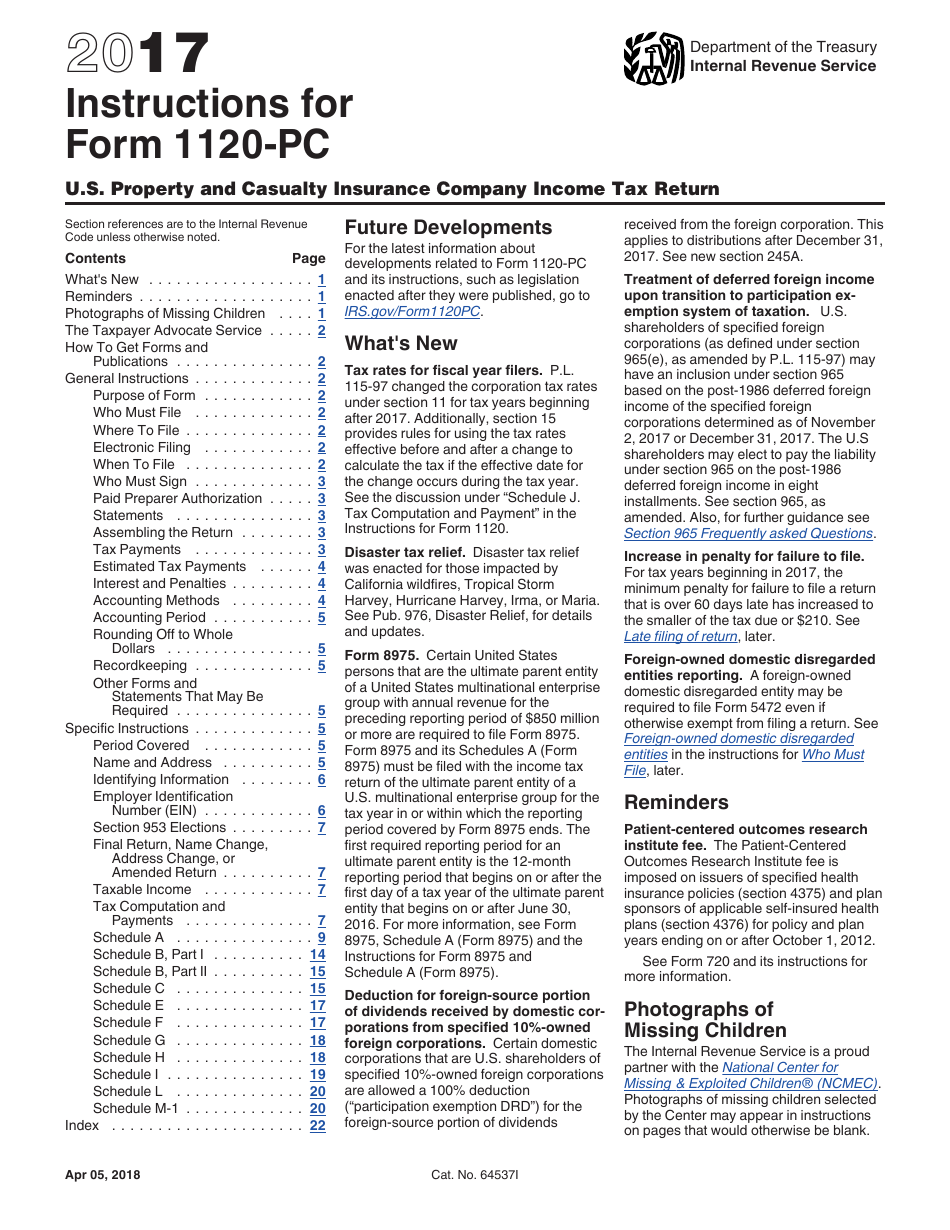

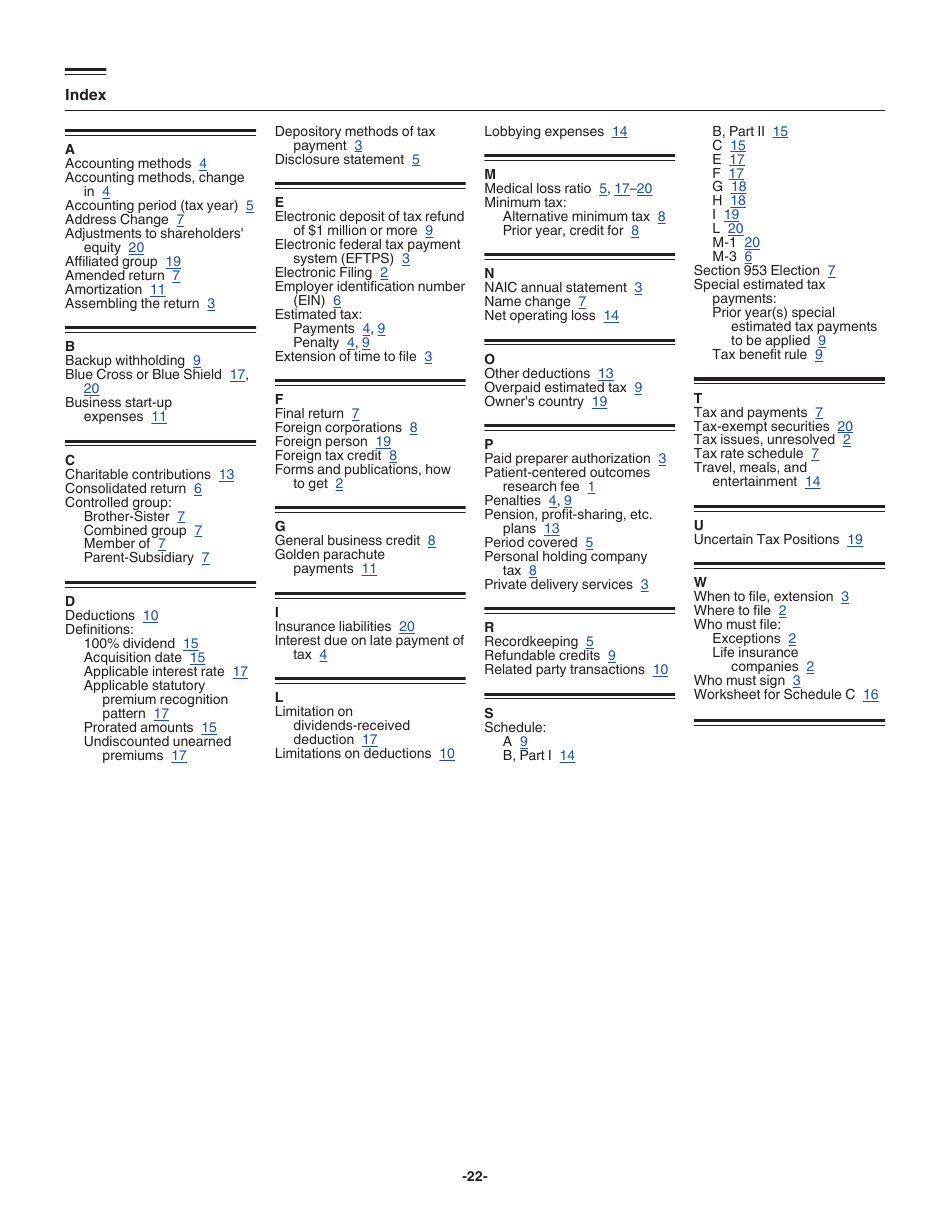

Instructions for IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-PC , U.S. Property and Casualty Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-PC Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who is required to file Form 1120-PC?

A: Property and Casualty Insurance Companies in the U.S. are required to file Form 1120-PC.

Q: What does Form 1120-PC cover?

A: Form 1120-PC covers income tax for U.S. Property and Casualty Insurance Companies.

Q: When is the deadline to file Form 1120-PC?

A: The deadline to file Form 1120-PC is generally March 15th or the 15th day of the 3rd month after the end of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form 1120-PC. It's important to file on time to avoid these penalties.

Q: What supporting documents are required for Form 1120-PC?

A: You may need to provide documents such as financial statements, schedules, and other tax forms when filing Form 1120-PC.

Q: Can I file Form 1120-PC electronically?

A: Yes, you can file Form 1120-PC electronically using the IRS e-file system.

Q: What if I need an extension to file Form 1120-PC?

A: If you need more time to file Form 1120-PC, you can request an extension by filing Form 7004.

Instruction Details:

- This 22-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.