This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-PC Schedule M-3

for the current year.

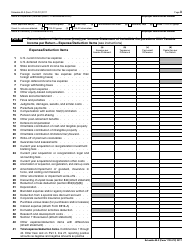

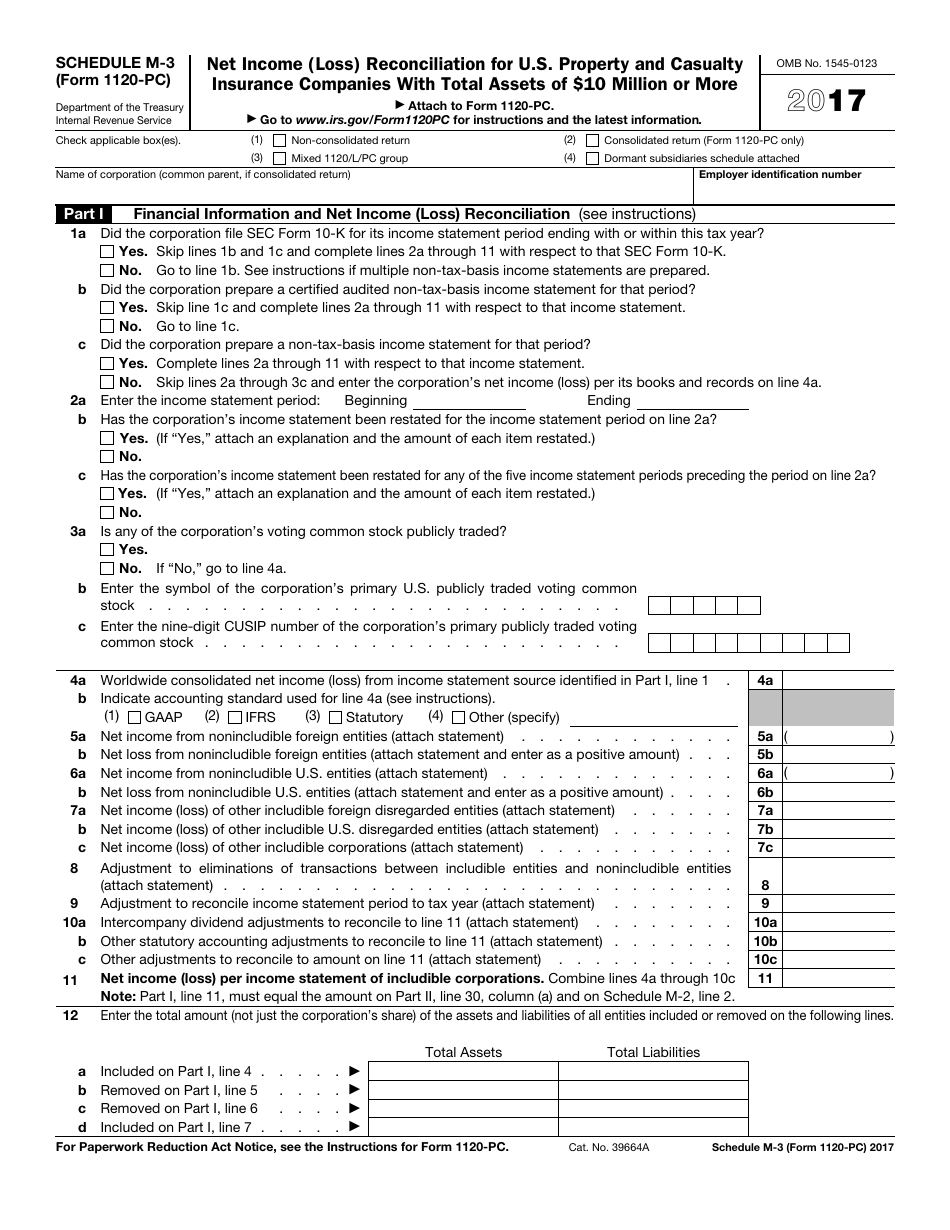

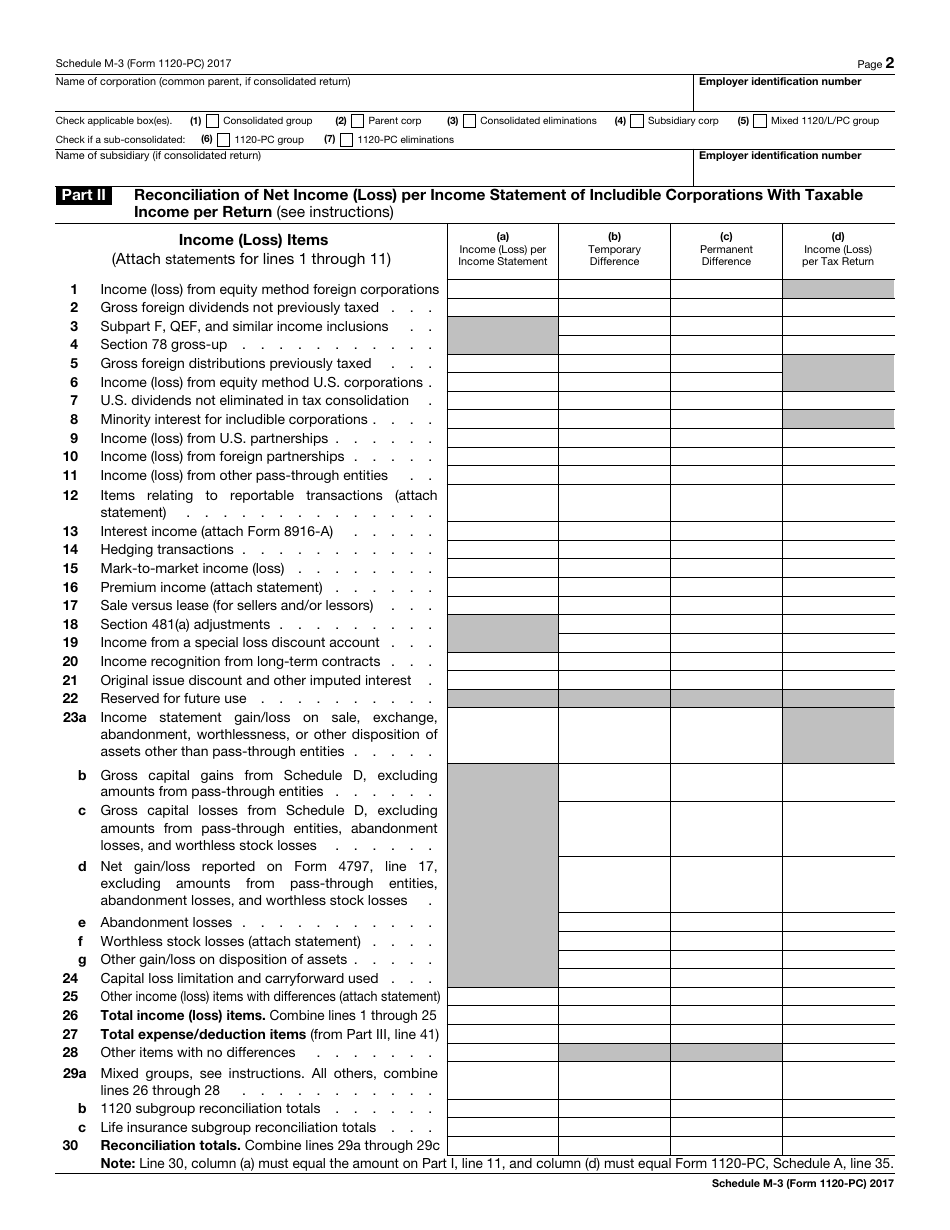

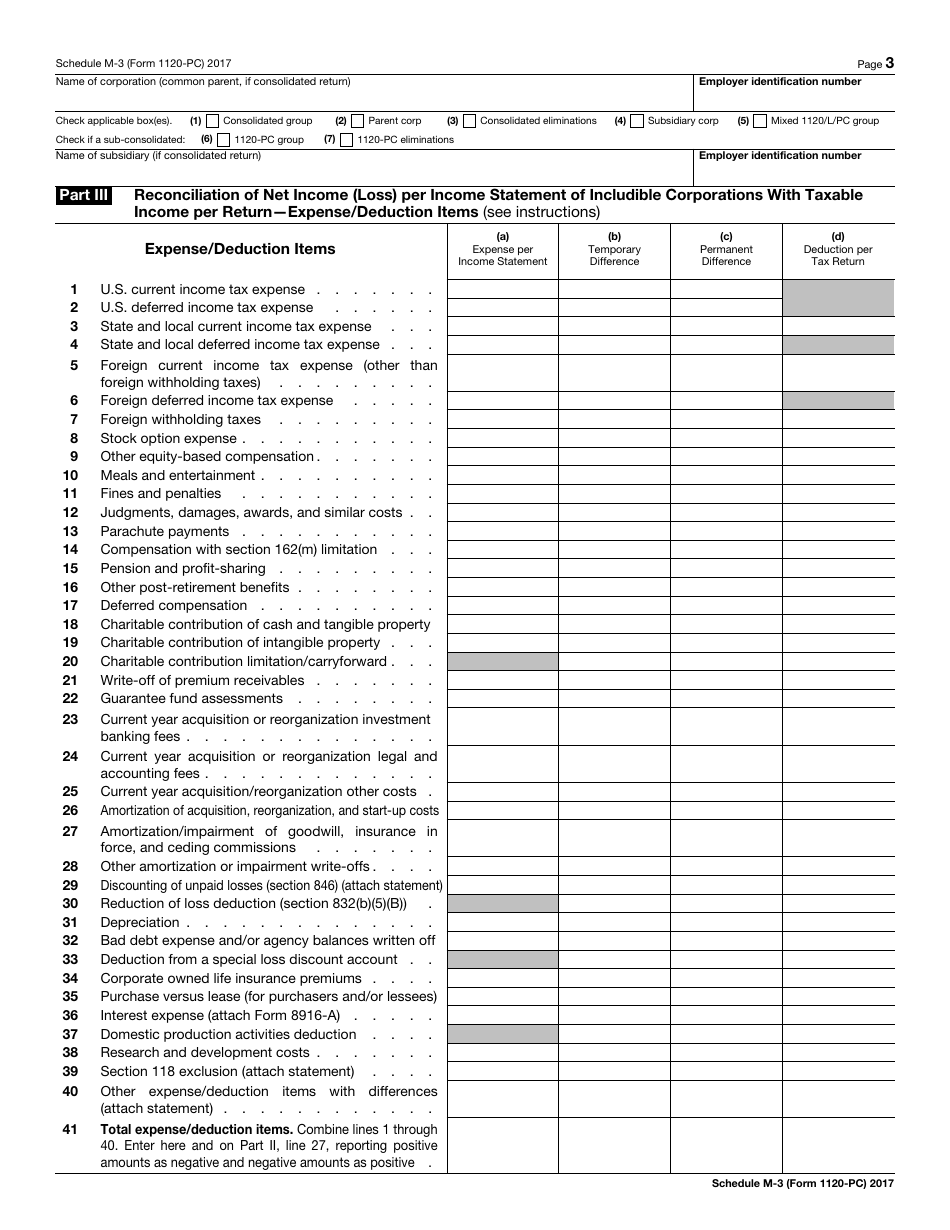

IRS Form 1120-PC Schedule M-3 Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More

What Is IRS Form 1120-PC Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is a tax form used by U.S. property and casualtyinsurance companies with total assets of $10 million or more to report their net income (loss) reconciliation.

Q: What is Schedule M-3?

A: Schedule M-3 is a specific section of IRS Form 1120-PC that is used to reconcile the net income (loss) of U.S. property and casualty insurance companies with their financial statement.

Q: Who needs to file Form 1120-PC Schedule M-3?

A: U.S. property and casualty insurance companies with total assets of $10 million or more are required to file Form 1120-PC Schedule M-3.

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to reconcile the net income (loss) of U.S. property and casualty insurance companies with their financial statement, providing a more accurate and detailed picture of their financial activities.

Q: What information is included in Schedule M-3?

A: Schedule M-3 requires the reporting of various components of income, deductions, and credits, as well as certain balance sheet items, to reconcile the net income (loss) of a property and casualty insurance company.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-PC Schedule M-3 through the link below or browse more documents in our library of IRS Forms.