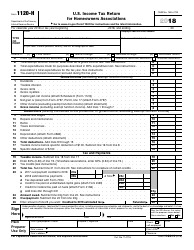

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-C

for the current year.

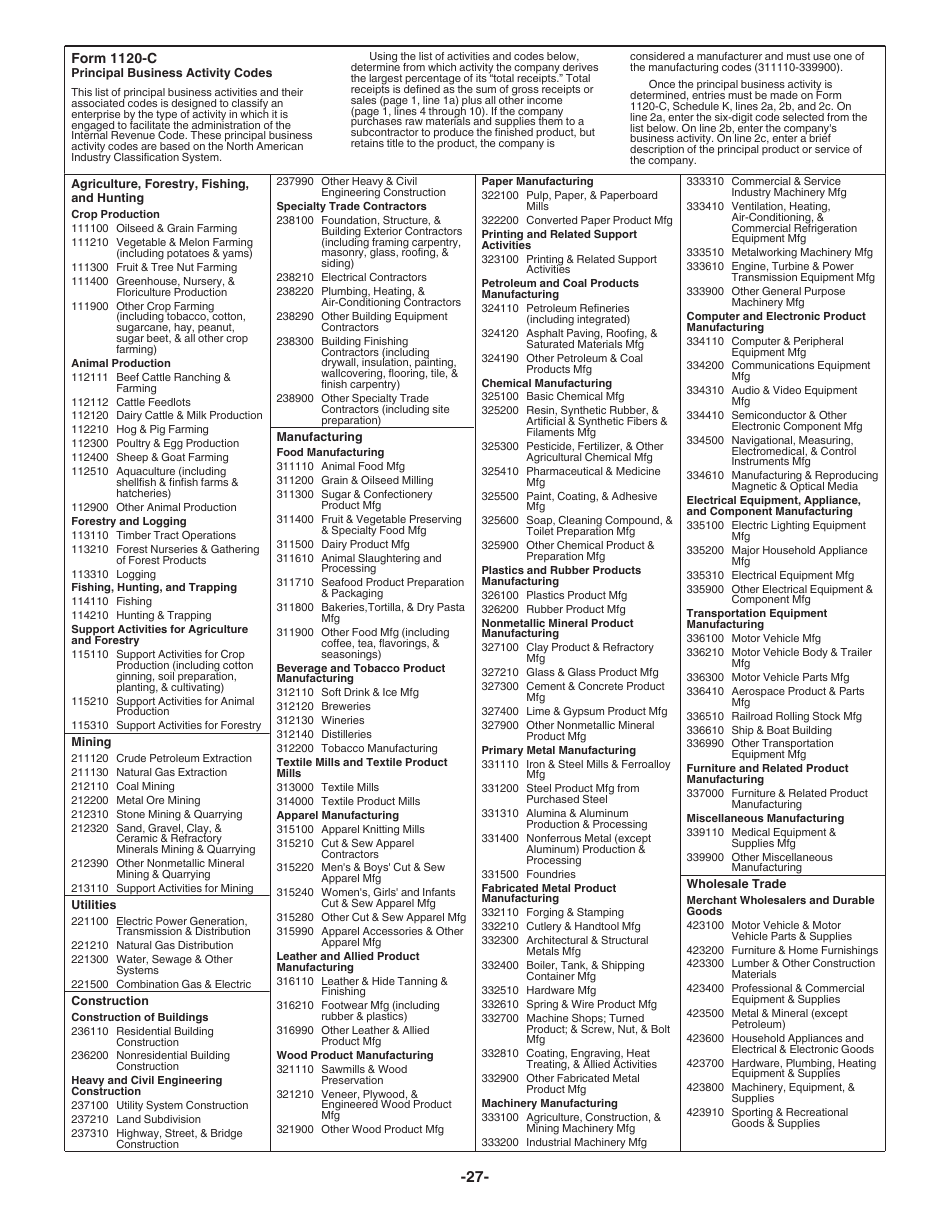

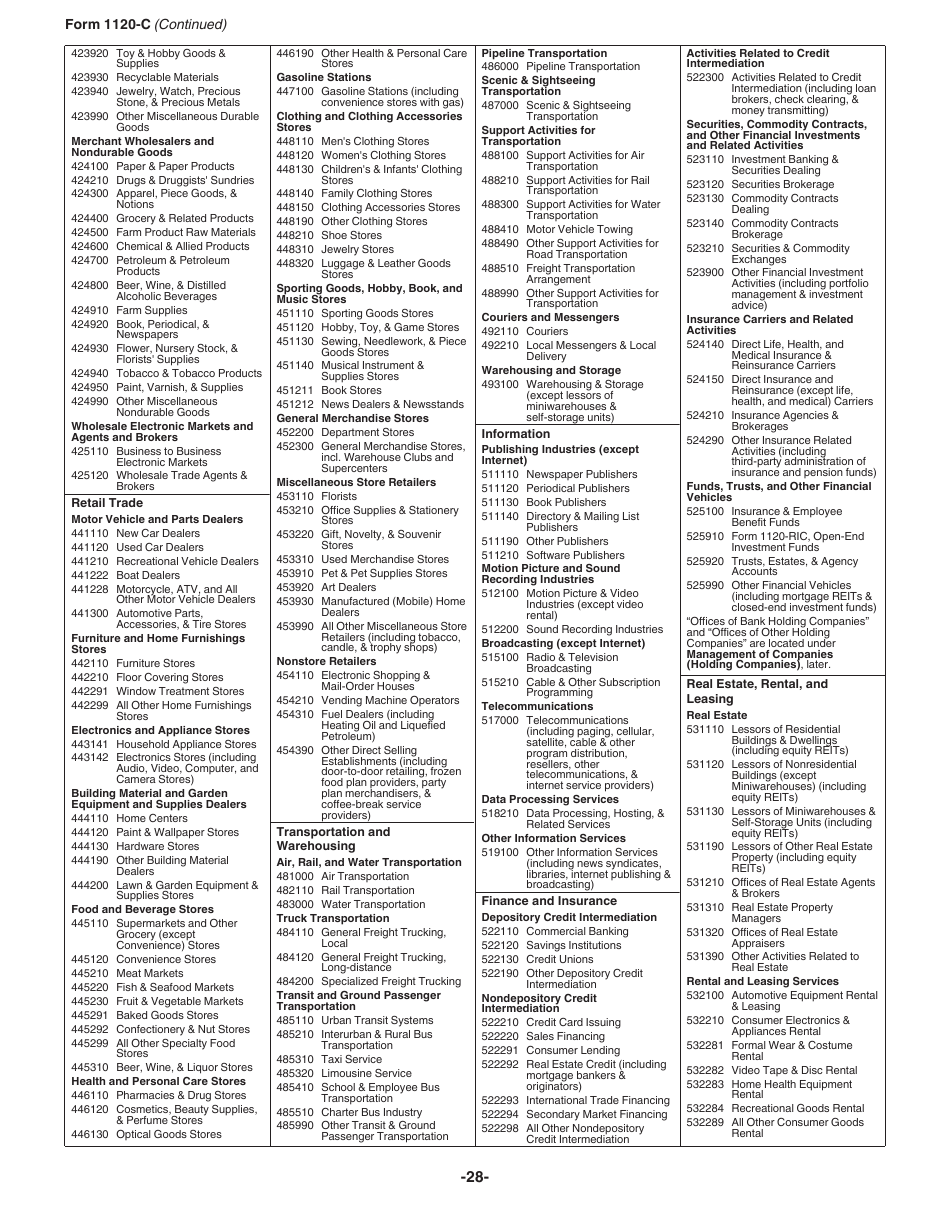

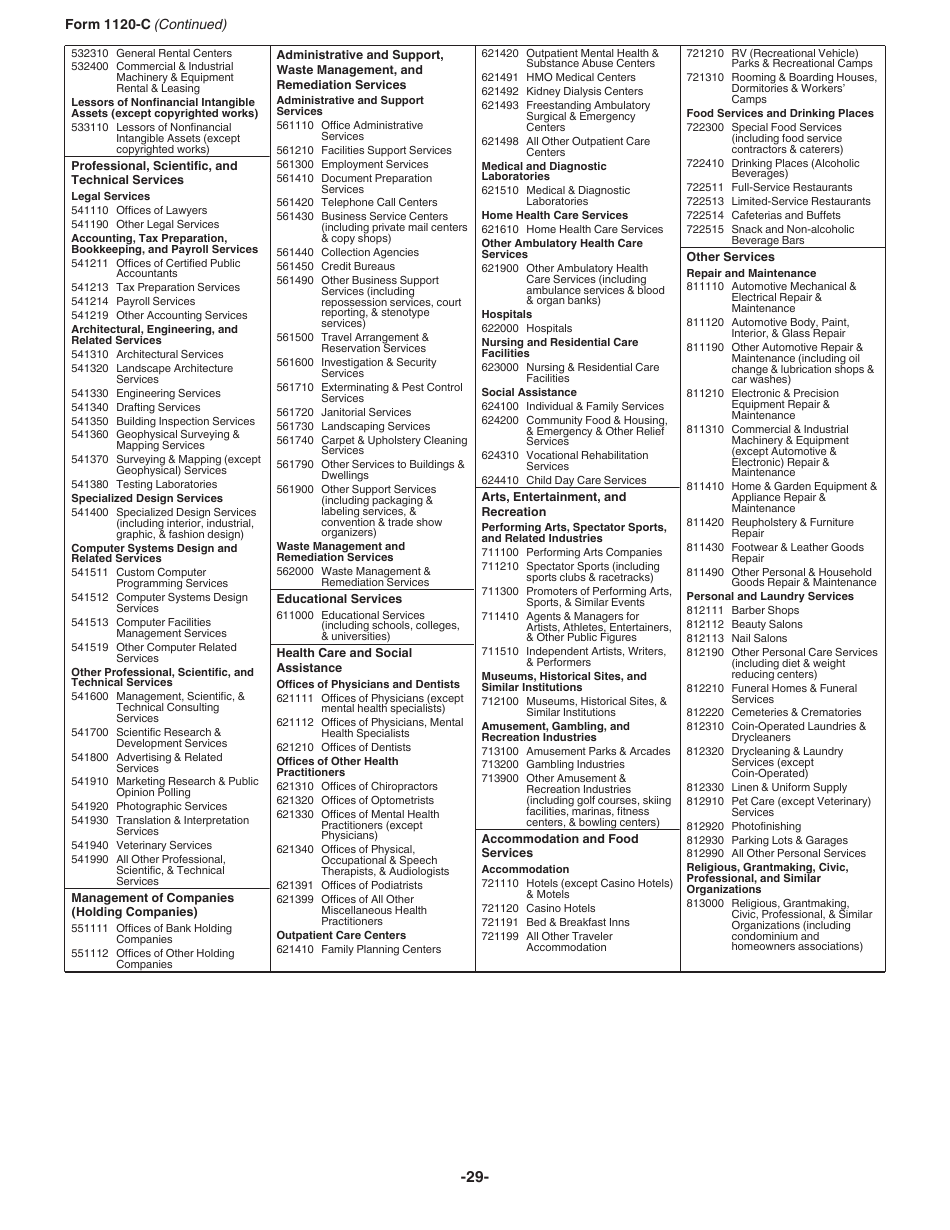

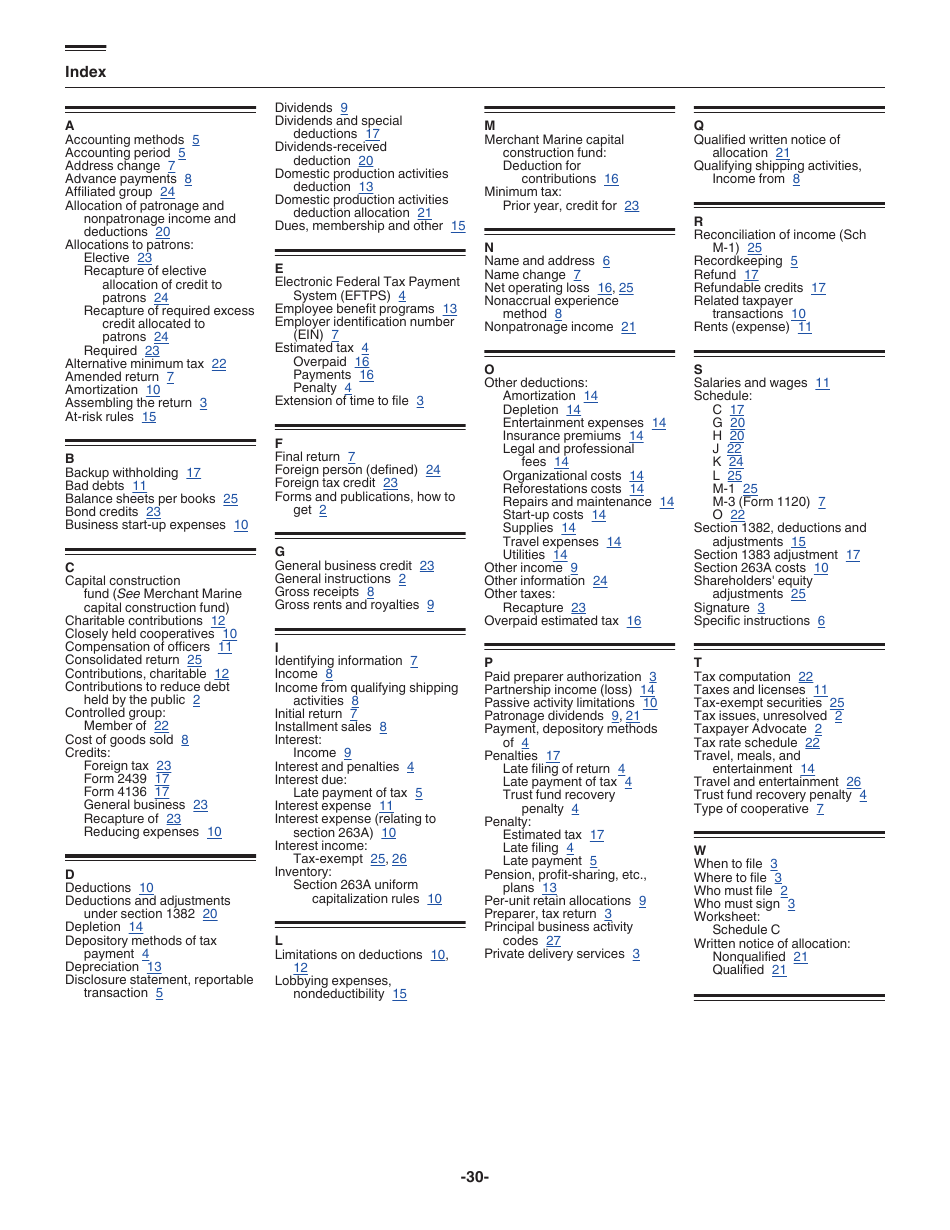

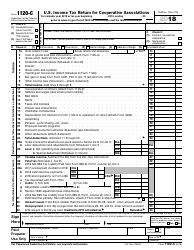

Instructions for IRS Form 1120-C U.S. Income Tax Return for Cooperative Associations

This document contains official instructions for IRS Form 1120-C , U.S. Income Tax Return for Cooperative Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-C?

A: IRS Form 1120-C is the U.S. Income Tax Return specifically for Cooperative Associations.

Q: Who should use IRS Form 1120-C?

A: Cooperative Associations should use IRS Form 1120-C to file their income tax returns.

Q: What information is required on IRS Form 1120-C?

A: IRS Form 1120-C requires information about the cooperative association's income, deductions, credits, and other relevant details.

Q: When is the deadline to file IRS Form 1120-C?

A: The deadline to file IRS Form 1120-C is generally the 15th day of the 4th month after the end of the cooperative association's tax year.

Q: Are there any penalties for not filing IRS Form 1120-C?

A: Yes, there can be penalties for not filing IRS Form 1120-C. It is important to meet the filing deadline to avoid any potential penalties.

Q: Can IRS Form 1120-C be filed electronically?

A: Yes, IRS Form 1120-C can be filed electronically using the IRS e-file system.

Q: Are there any separate instructions for filling out IRS Form 1120-C?

A: Yes, there are separate instructions provided by the IRS for filling out IRS Form 1120-C. These instructions provide detailed guidance on how to complete the form correctly.

Instruction Details:

- This 30-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.