This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1042-S

for the current year.

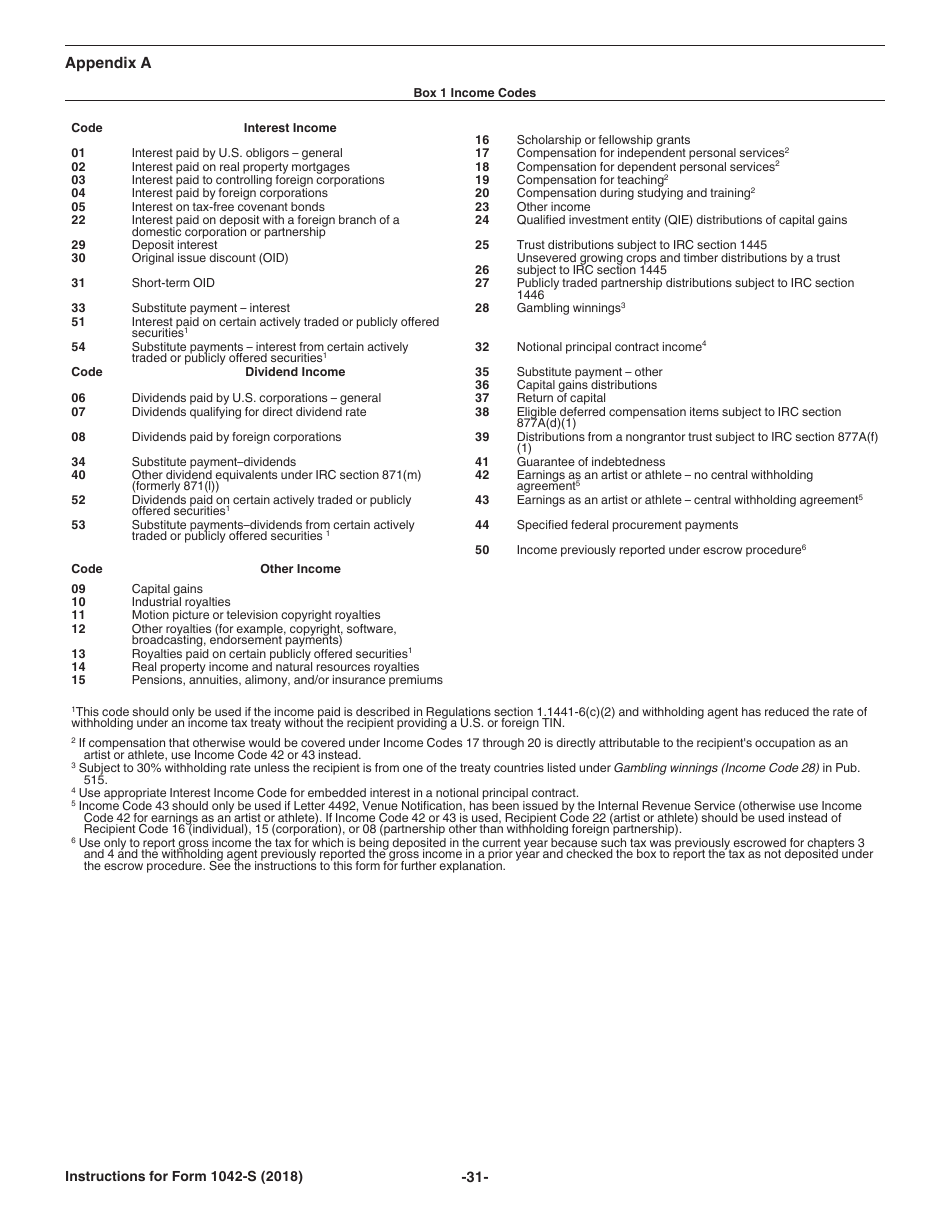

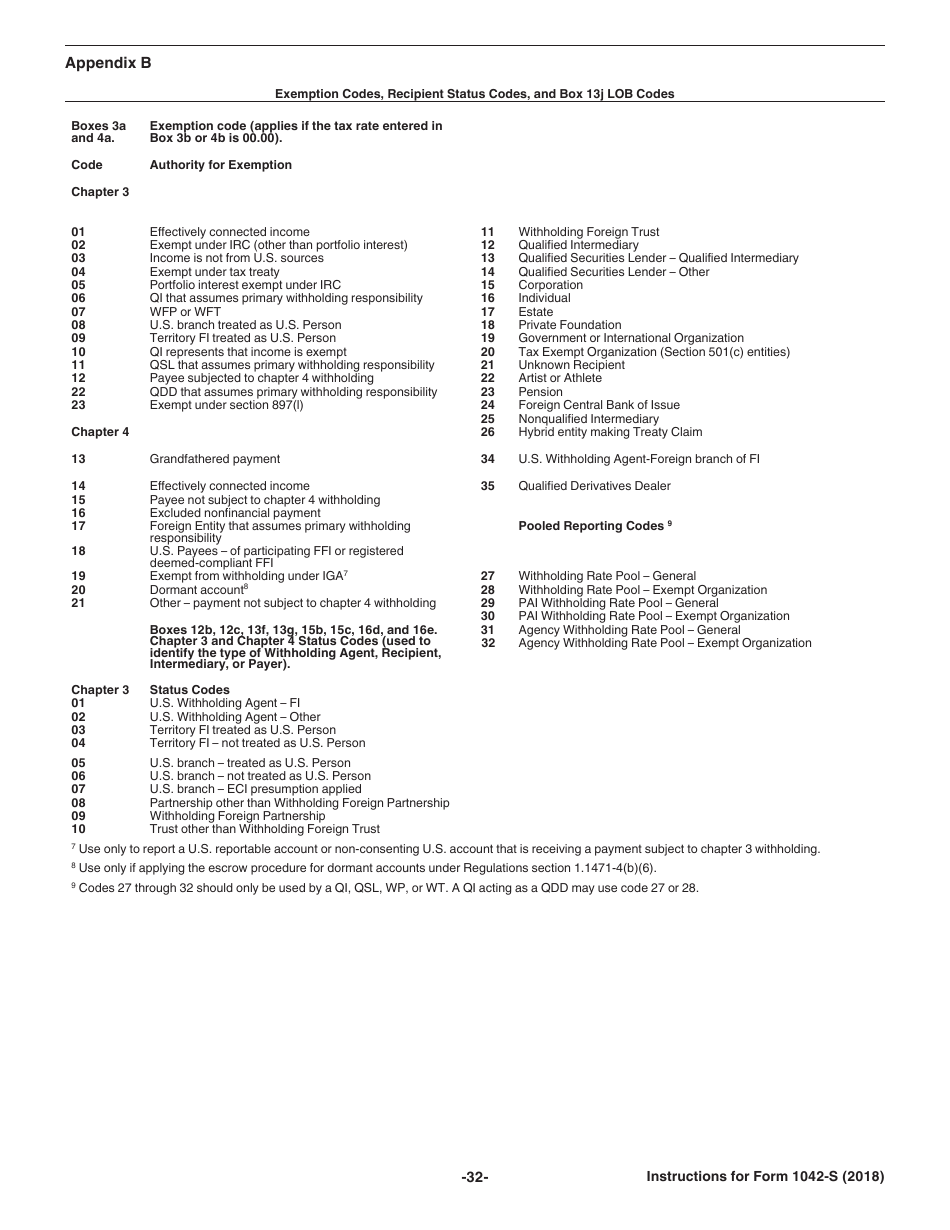

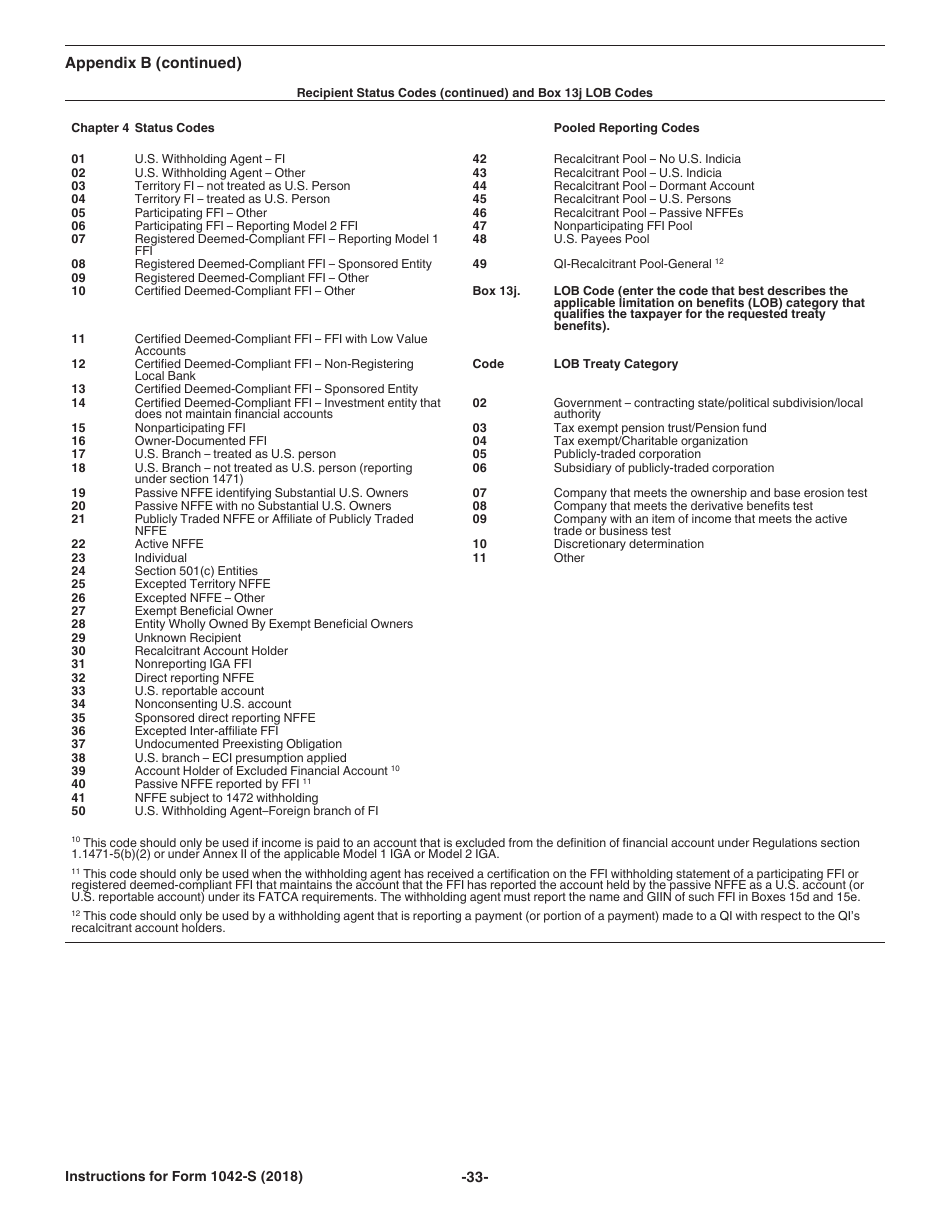

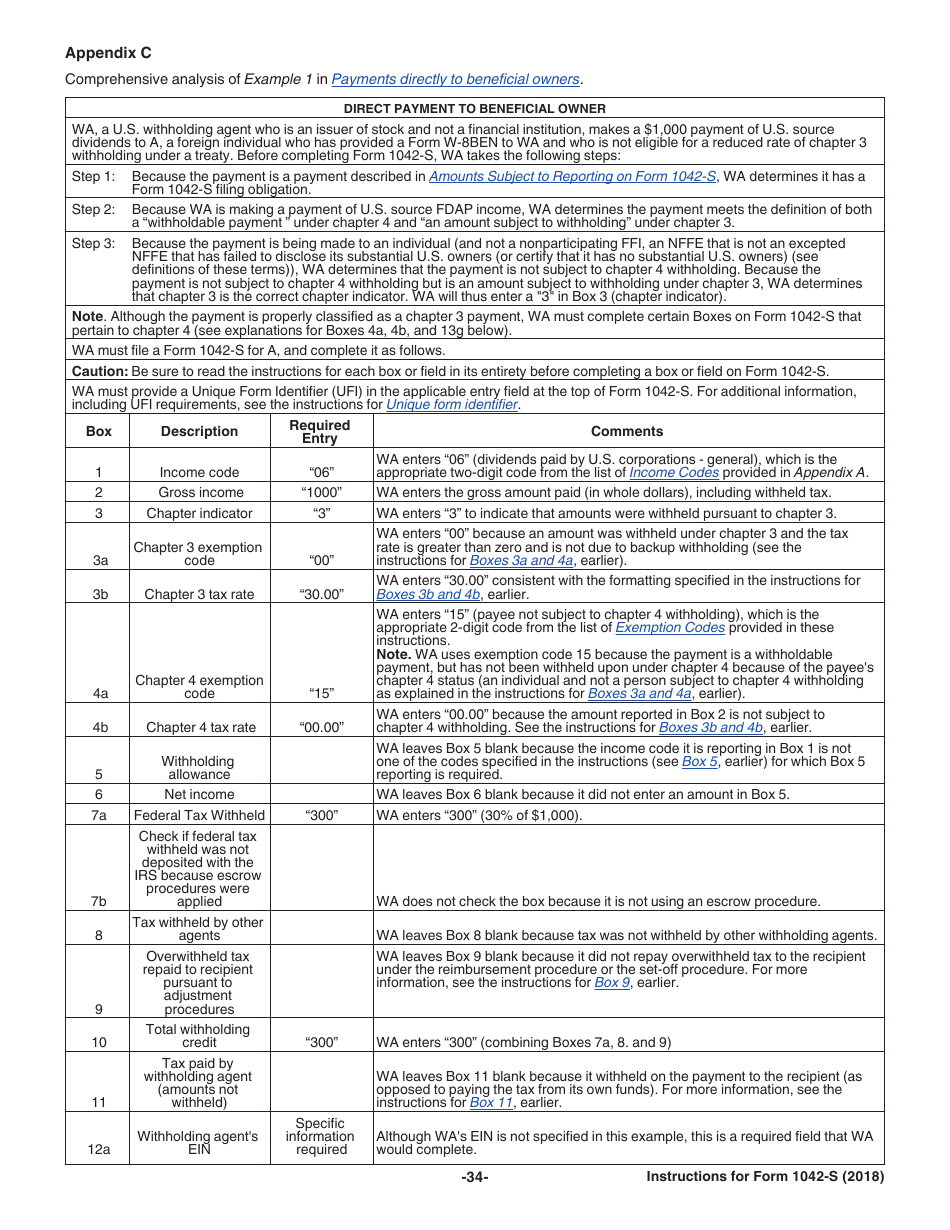

Instructions for IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

This document contains official instructions for IRS Form 1042-S , Foreign Person's U.S. Source Income Subject to Withholding - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1042-S?

A: IRS Form 1042-S is a tax form used to report income paid to foreign individuals or entities subject to U.S. withholding.

Q: Who needs to fill out IRS Form 1042-S?

A: Any person or entity that made payments subject to U.S. tax withholding to foreign individuals or entities needs to fill out Form 1042-S.

Q: What income is reported on IRS Form 1042-S?

A: Form 1042-S is used to report U.S. source income, such as wages, scholarships, and royalties, paid to foreign individuals or entities subject to withholding.

Q: When should IRS Form 1042-S be filed?

A: Form 1042-S must be filed by March 15th of the year following the calendar year in which the income was paid.

Q: Are there any penalties for not filing Form 1042-S?

A: Yes, there may be penalties for failing to file Form 1042-S or for filing an incorrect or incomplete form. It's important to meet the filing requirements to avoid potential penalties.

Instruction Details:

- This 37-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.