This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule A, B, G, J, K-1

for the current year.

Instructions for IRS Form 1041 Schedule A, B, G, J, K-1 U.S. Income Tax Return for Estates and Trusts

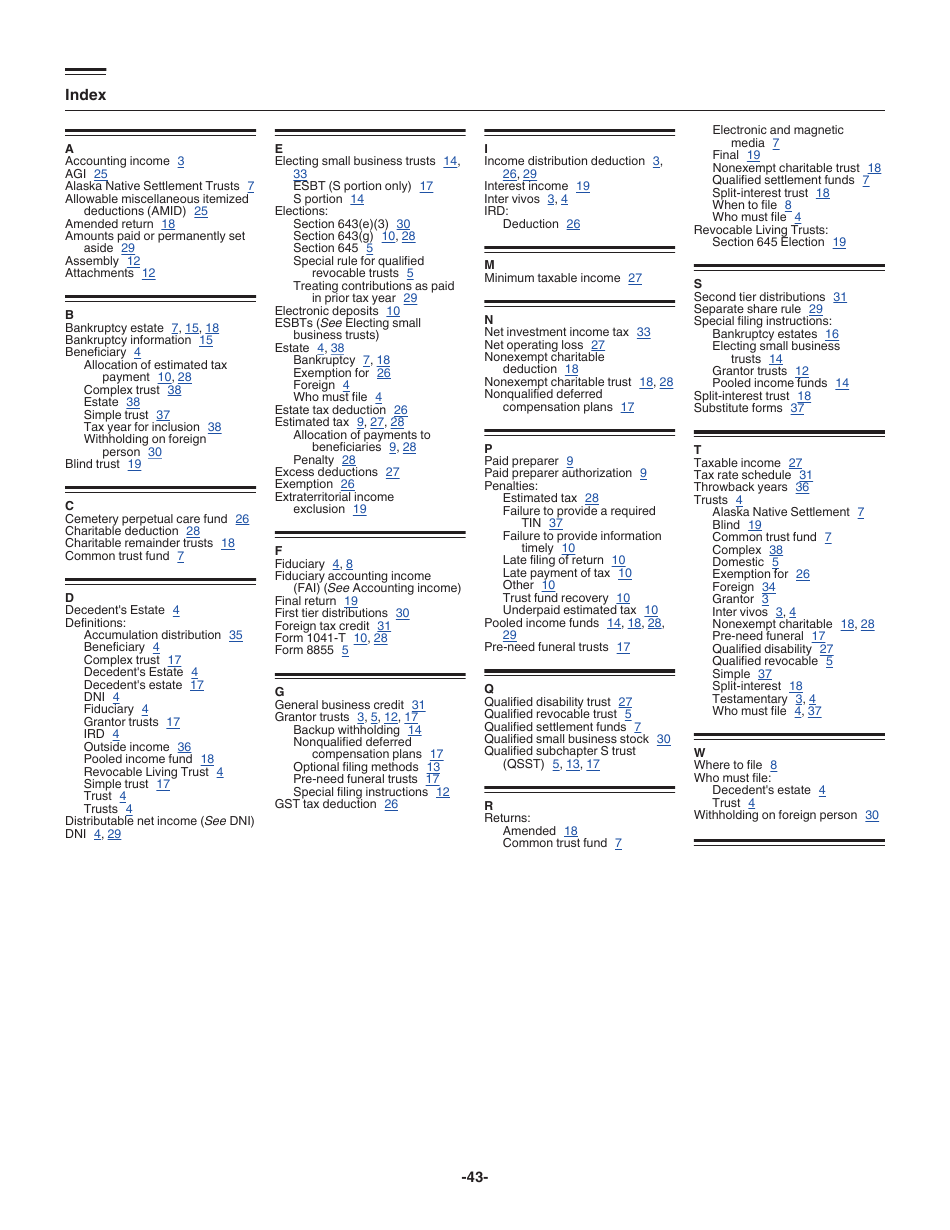

This document contains official instructions for Schedule A , Schedule B , Schedule G , Schedule J , and Schedule K-1 for IRS Form 1041 . These documents are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1041 Schedule A?

A: IRS Form 1041 Schedule A is a part of the U.S. Income Tax Return for Estates and Trusts that is used to report deductions and expenses.

Q: What is IRS Form 1041 Schedule B?

A: IRS Form 1041 Schedule B is a part of the U.S. Income Tax Return for Estates and Trusts that is used to report interest and dividend income.

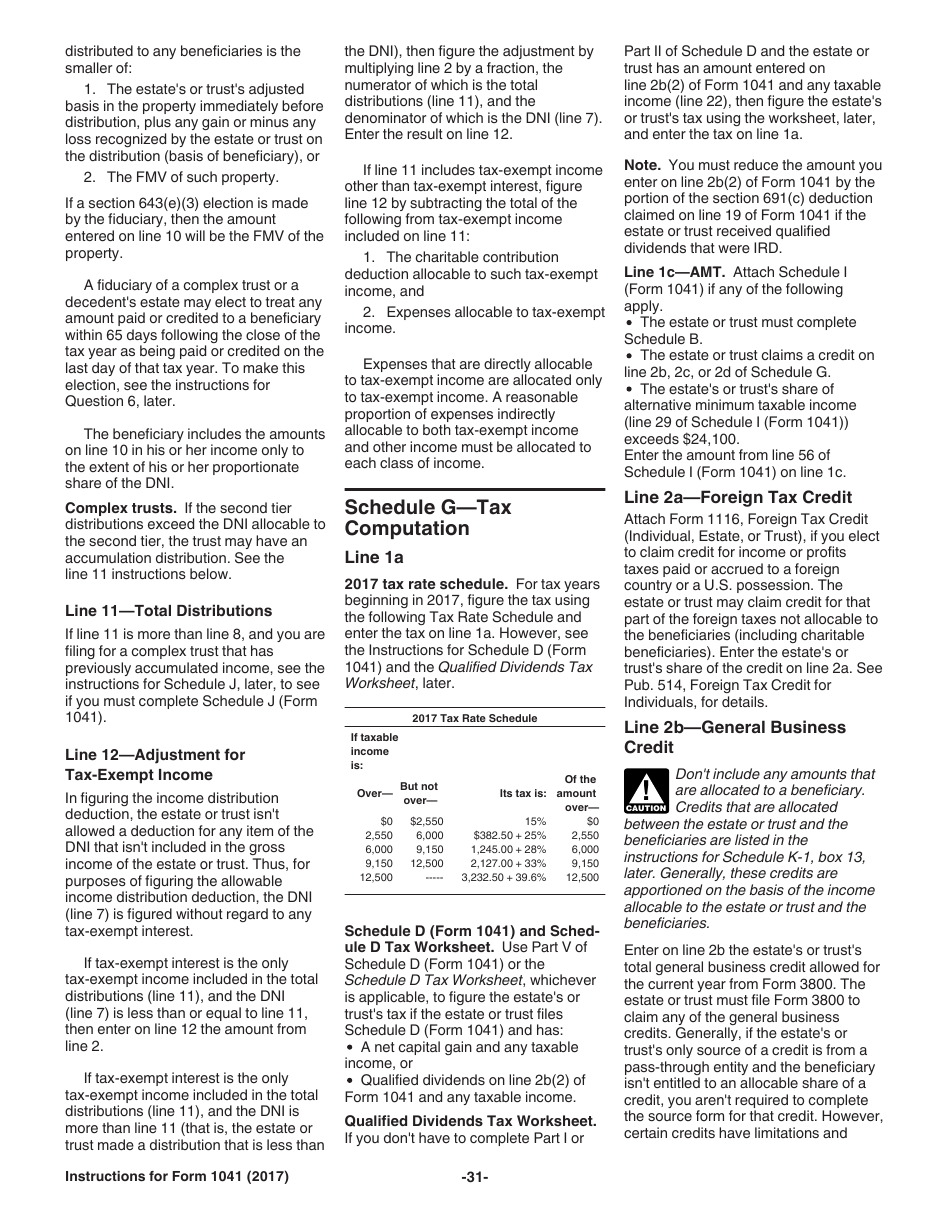

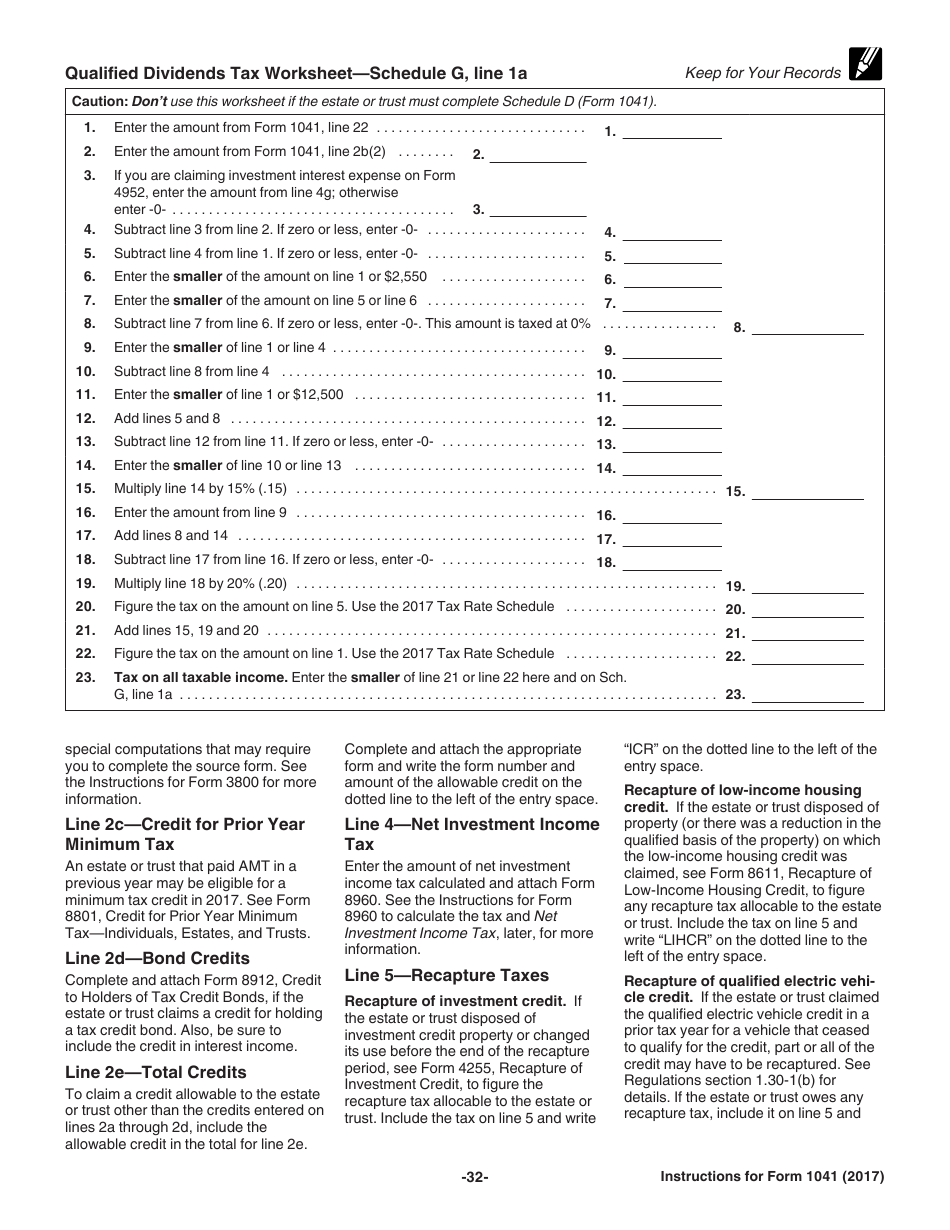

Q: What is IRS Form 1041 Schedule G?

A: IRS Form 1041 Schedule G is a part of the U.S. Income Tax Return for Estates and Trusts that is used to report unreported income.

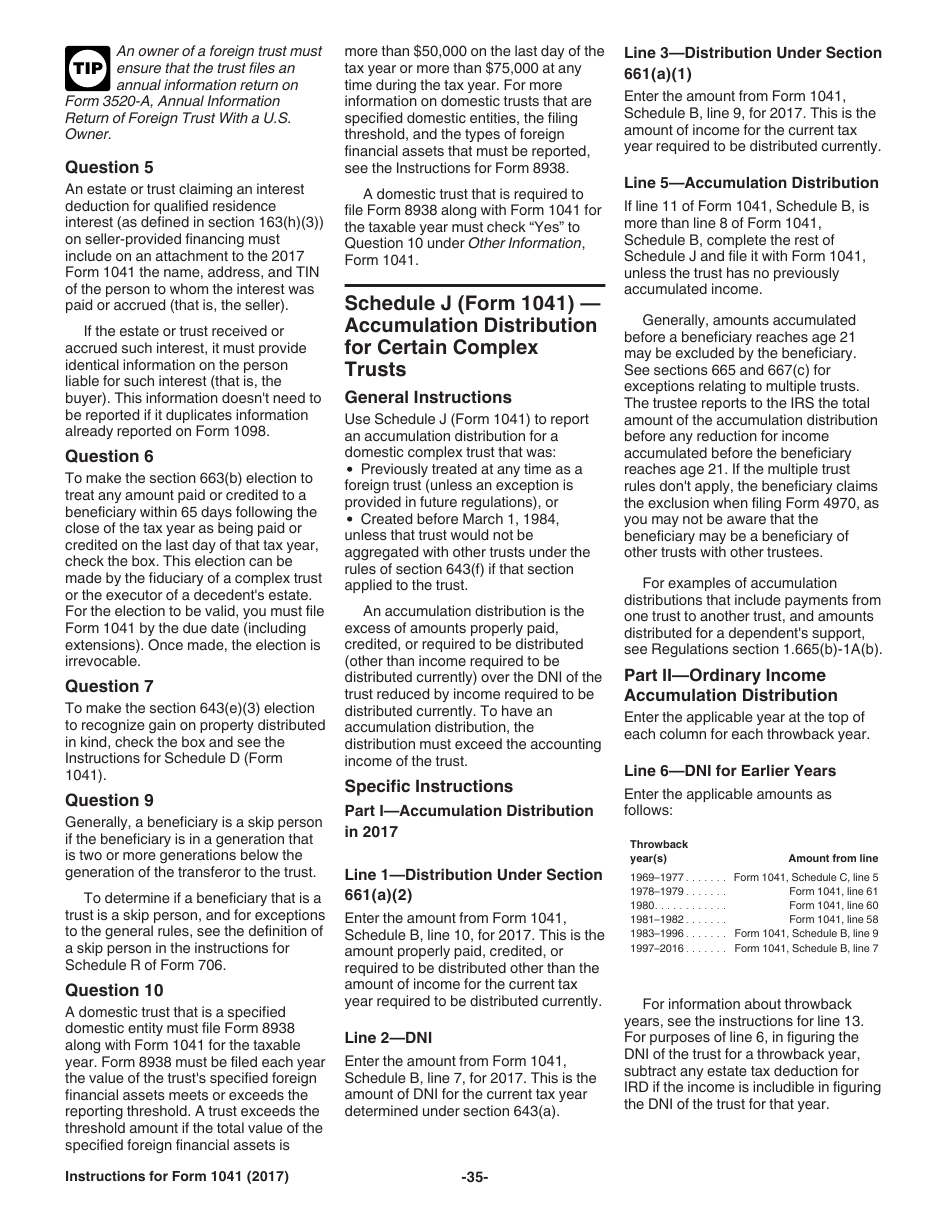

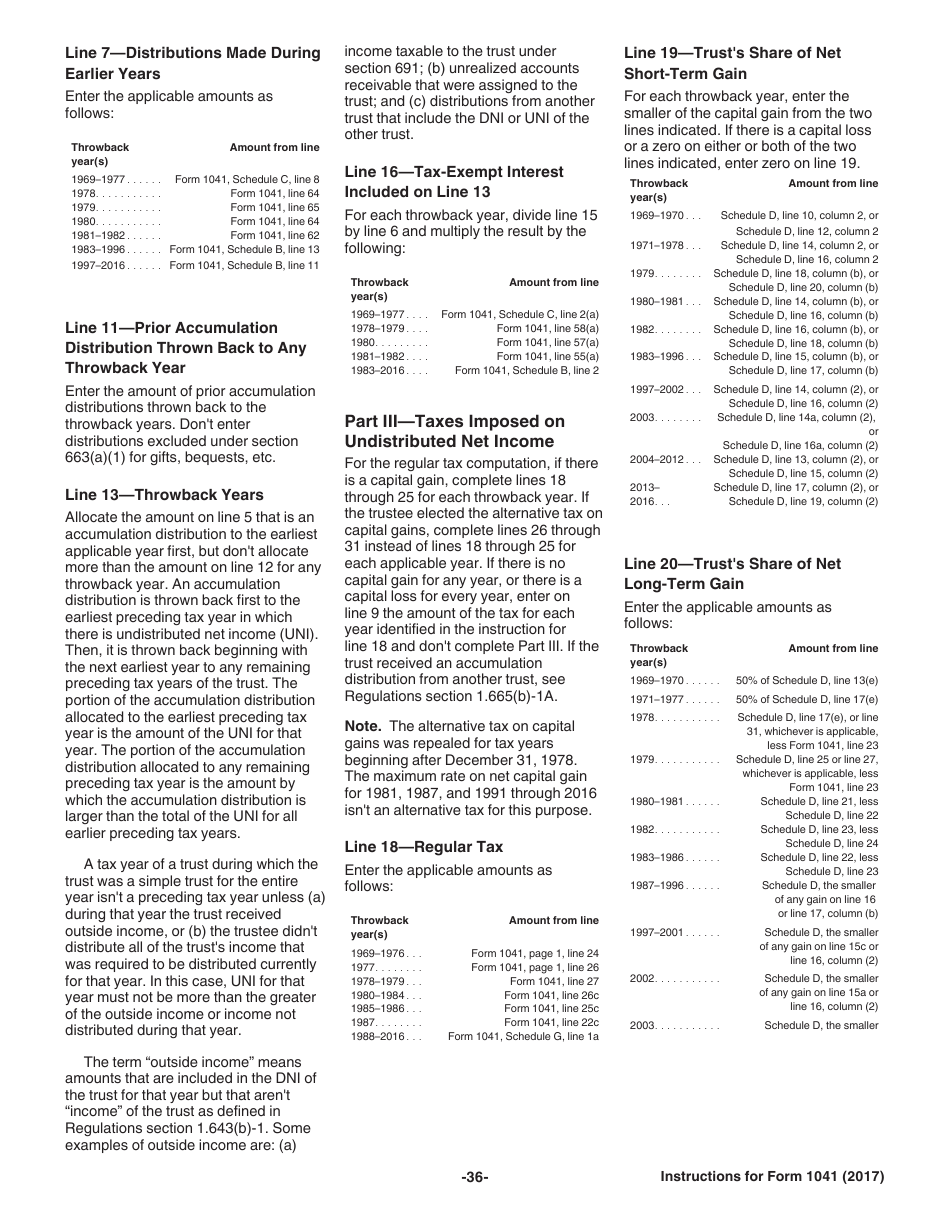

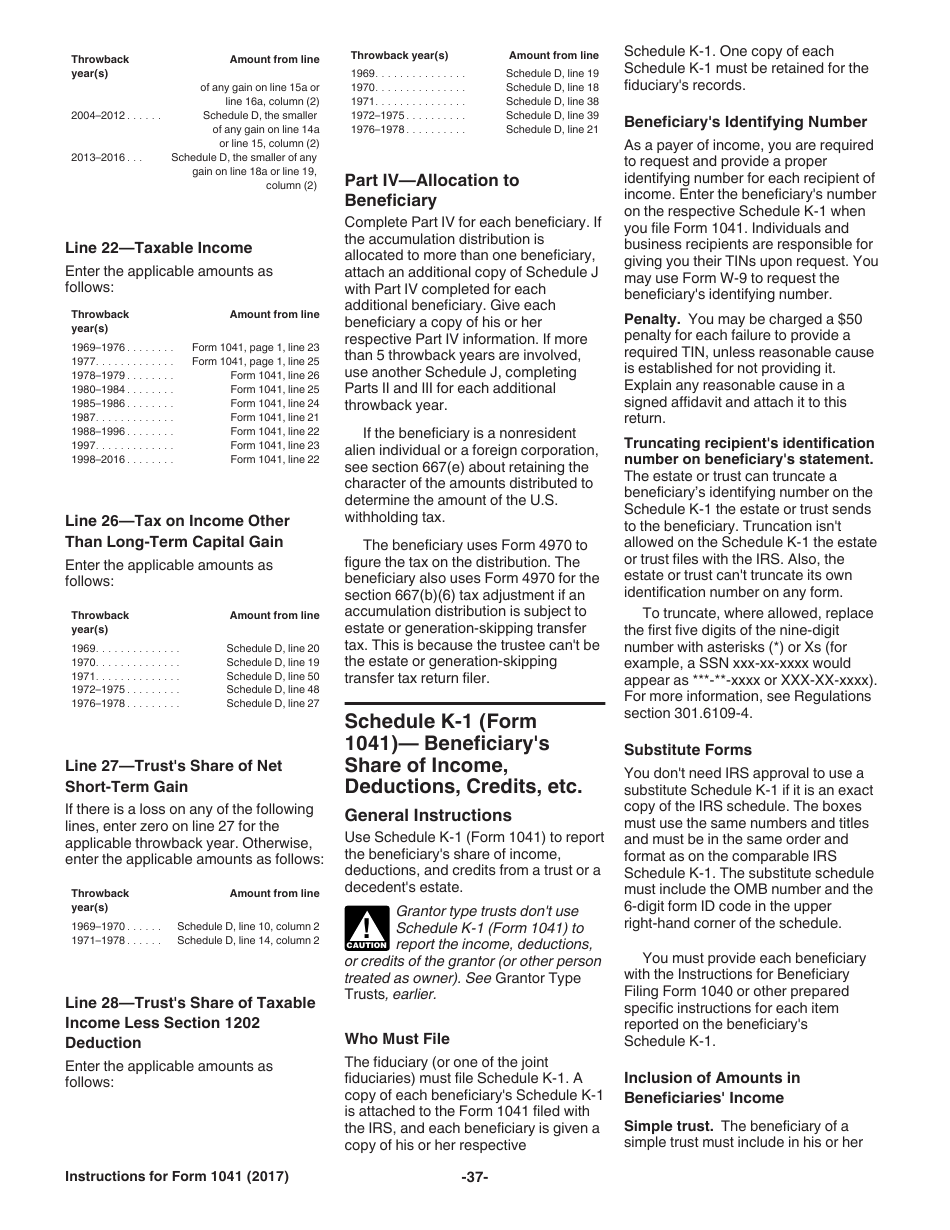

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a part of the U.S. Income Tax Return for Estates and Trusts that is used to figure out the tax on accumulated income distributions.

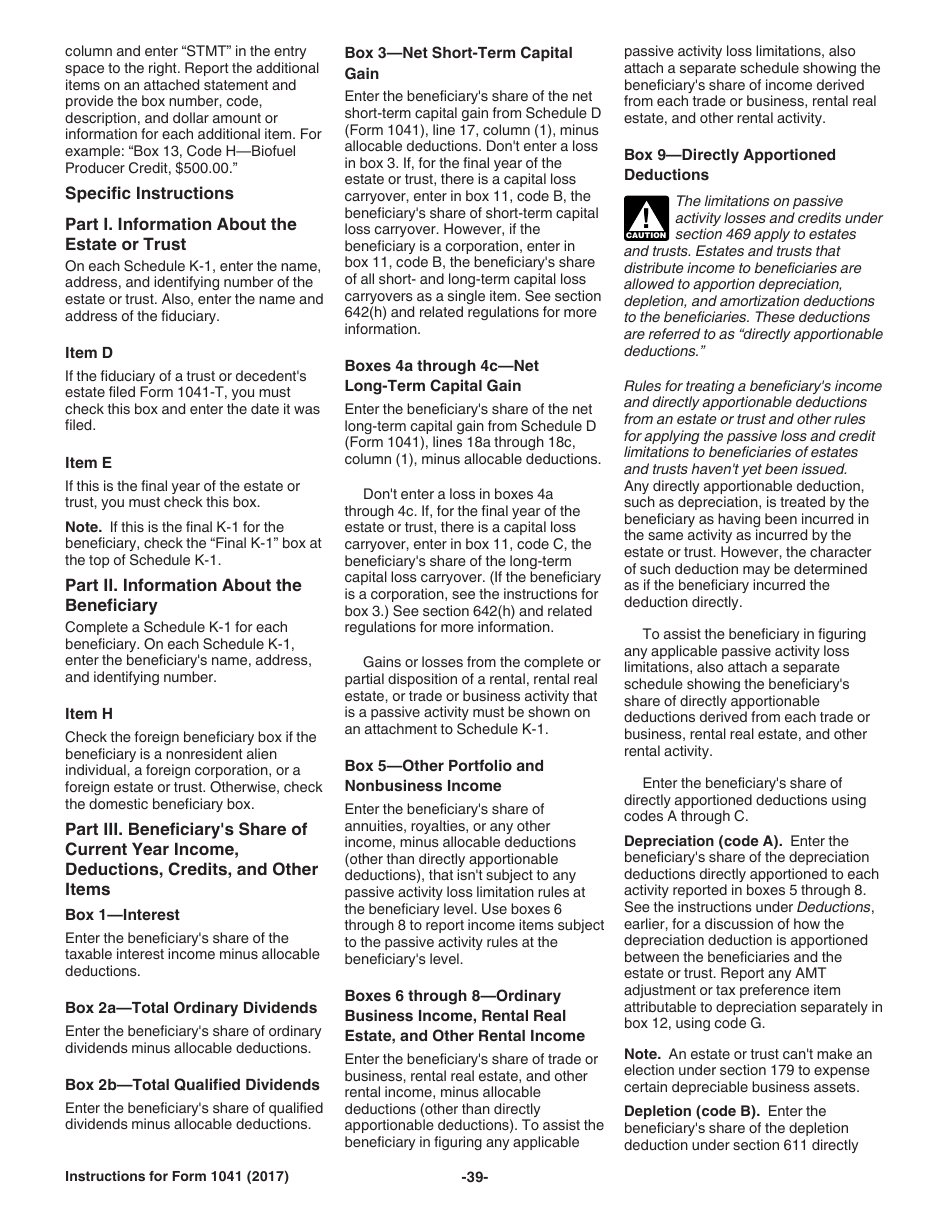

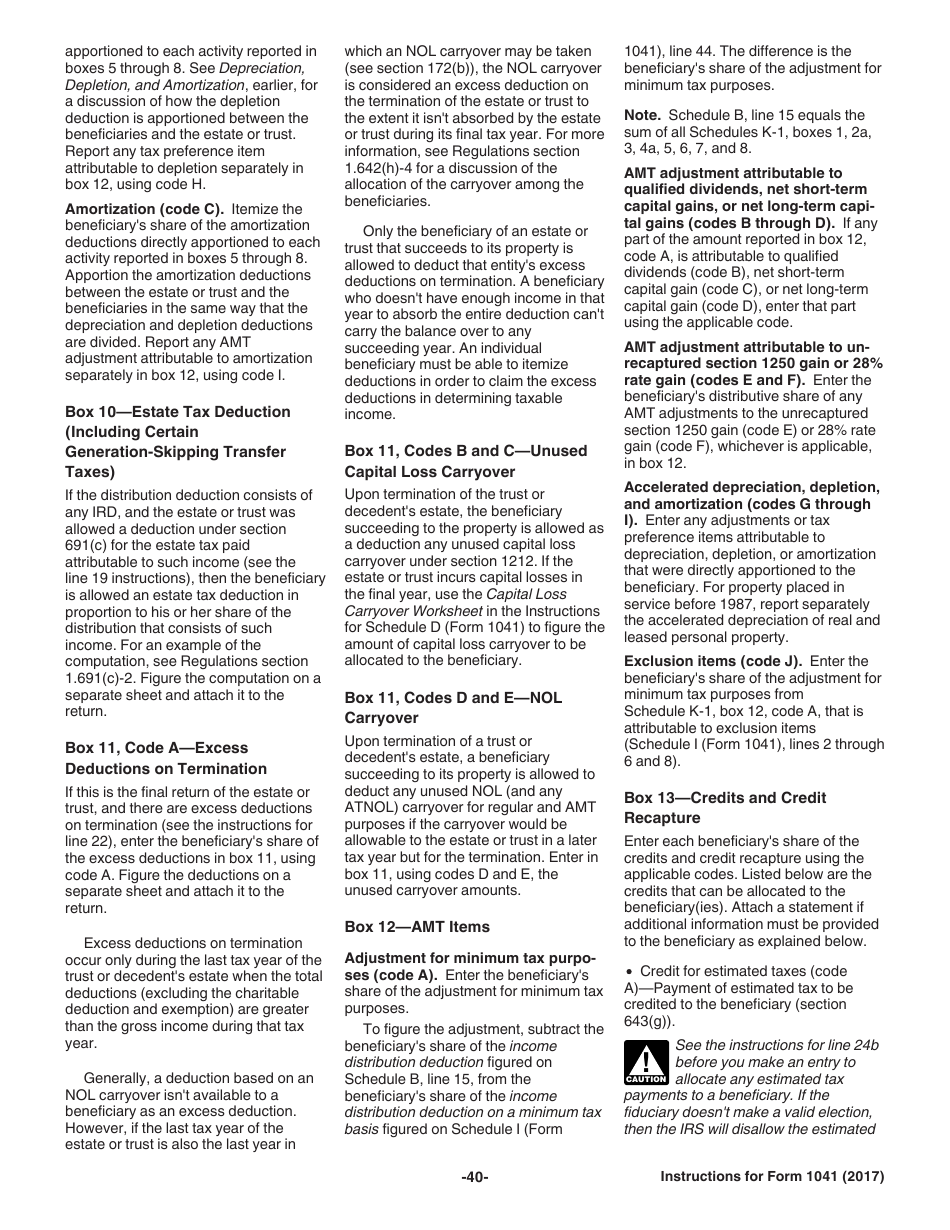

Q: What is IRS Form 1041 Schedule K-1?

A: IRS Form 1041 Schedule K-1 is a part of the U.S. Income Tax Return for Estates and Trusts that is used to report a beneficiary's share of income, deductions, and credits.

Q: Who should file IRS Form 1041?

A: Estates and trusts with gross income exceeding $600 should file IRS Form 1041.

Q: When is the deadline to file IRS Form 1041?

A: The deadline to file IRS Form 1041 is typically April 15th, unless an extension is granted.

Q: Are there any penalties for late filing of IRS Form 1041?

A: Yes, there are penalties for late filing of IRS Form 1041. It's best to file on time or request an extension if needed.

Q: What should I do if I need help with IRS Form 1041?

A: If you need help with IRS Form 1041, you can consult a tax professional or contact the IRS for assistance.

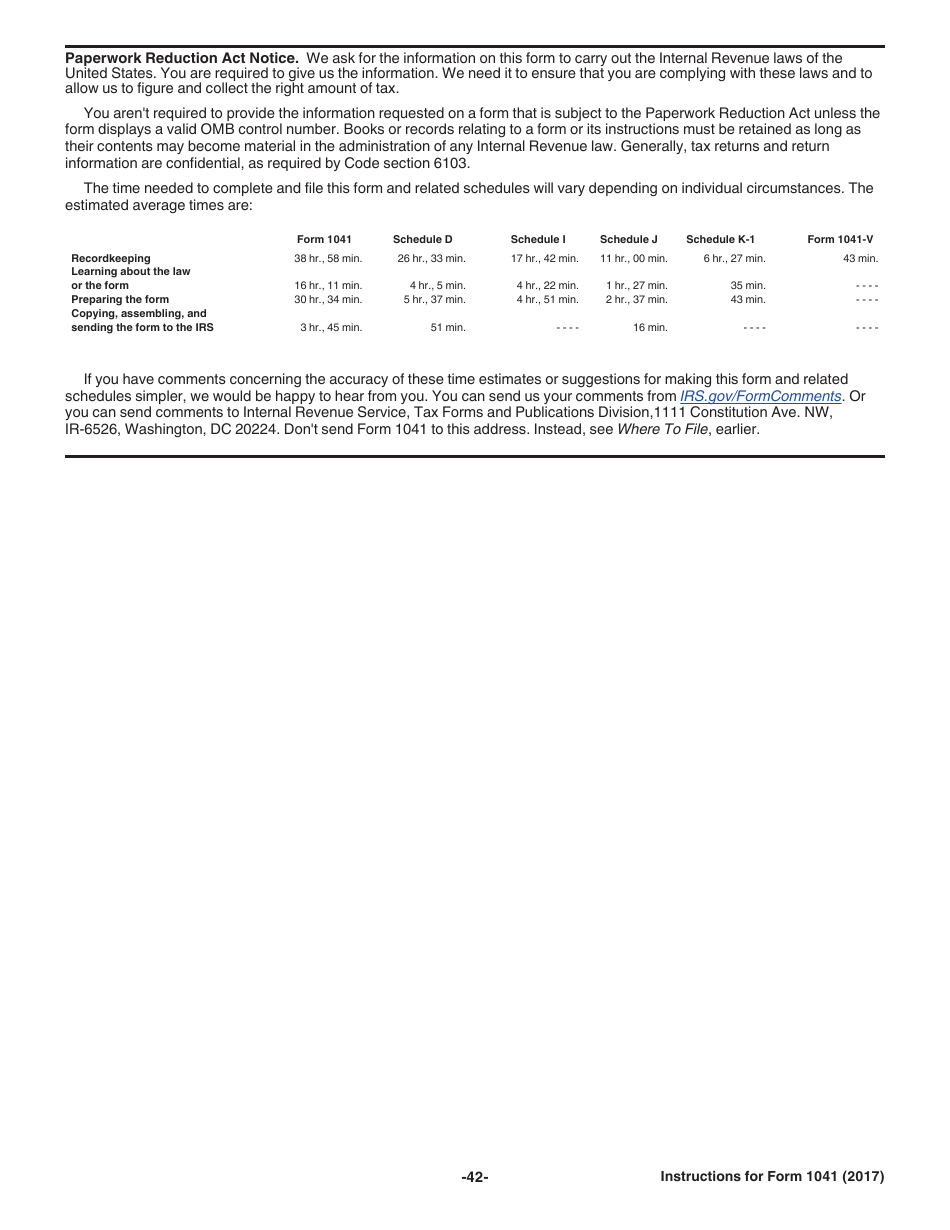

Instruction Details:

- This 43-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.