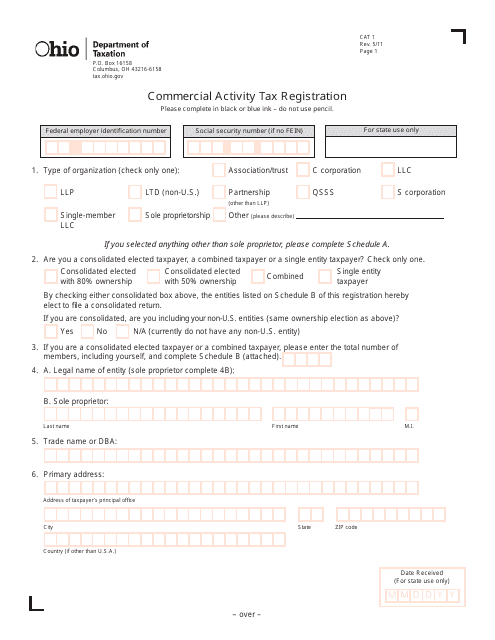

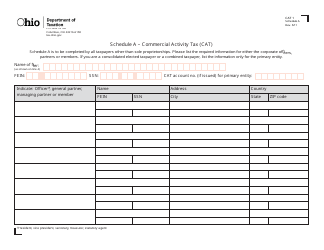

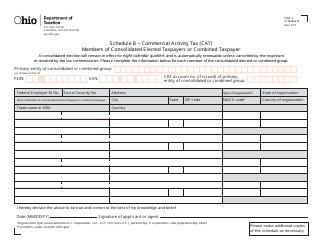

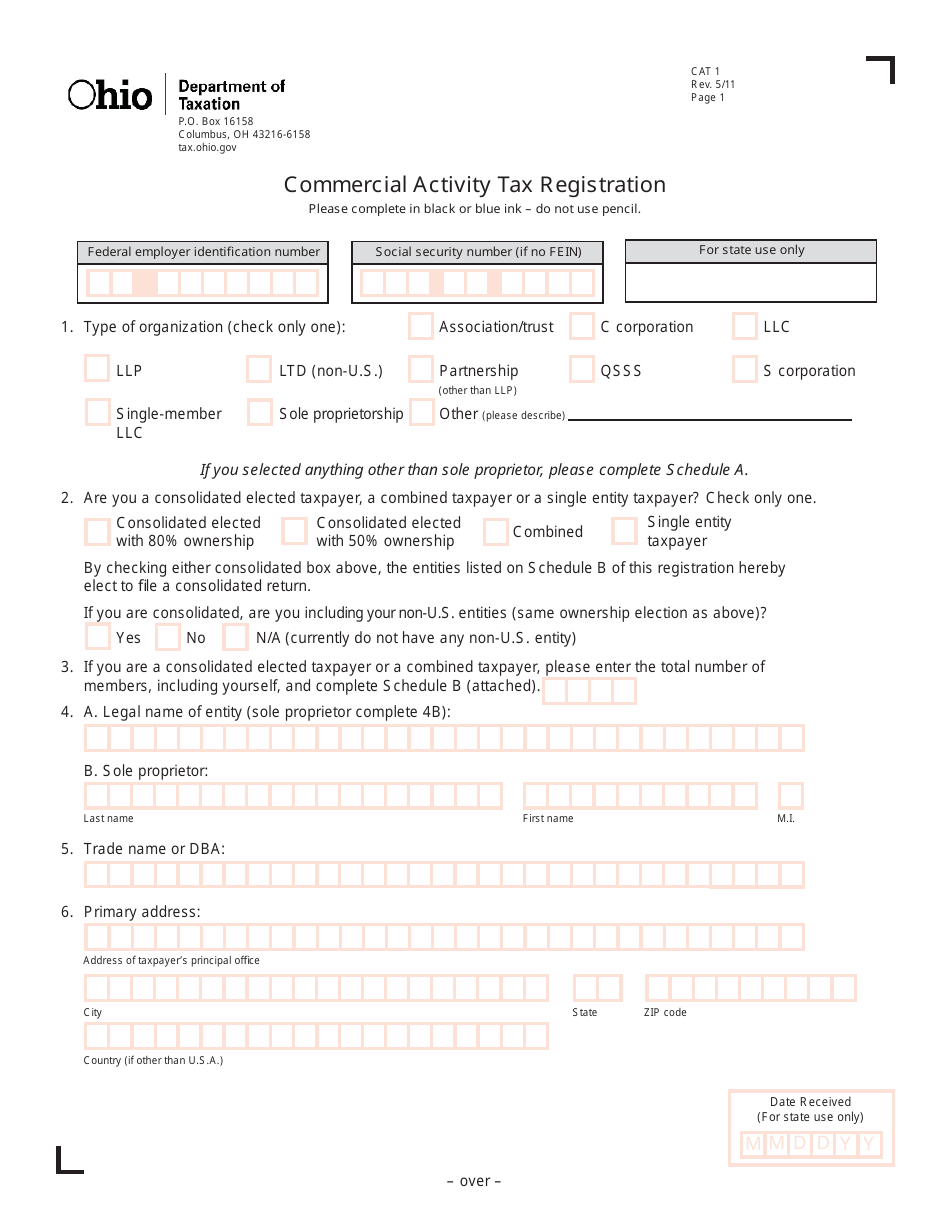

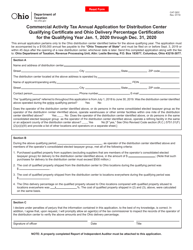

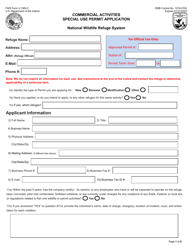

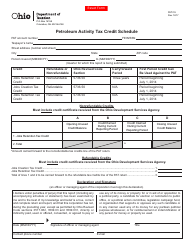

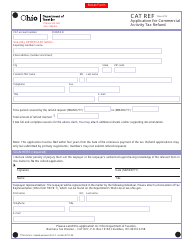

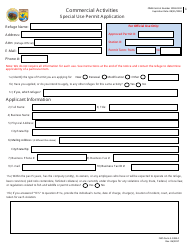

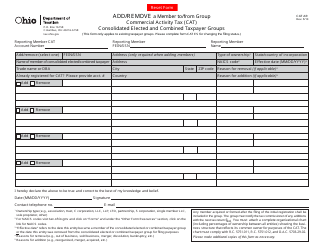

Form CAT1 Commercial Activity Tax Registration - Ohio

What Is Form CAT1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the CAT1 form?

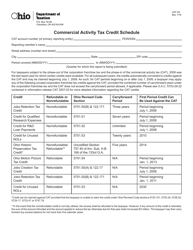

A: The CAT1 form is the Commercial Activity Tax Registration form in Ohio.

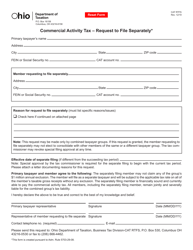

Q: Who needs to file the CAT1 form?

A: Businesses engaged in taxable commercial activity in Ohio need to file the CAT1 form.

Q: What is the purpose of the CAT1 form?

A: The purpose of the CAT1 form is to register businesses for the Commercial Activity Tax.

Q: When is the CAT1 form due?

A: The CAT1 form is due within 30 days of starting business in Ohio.

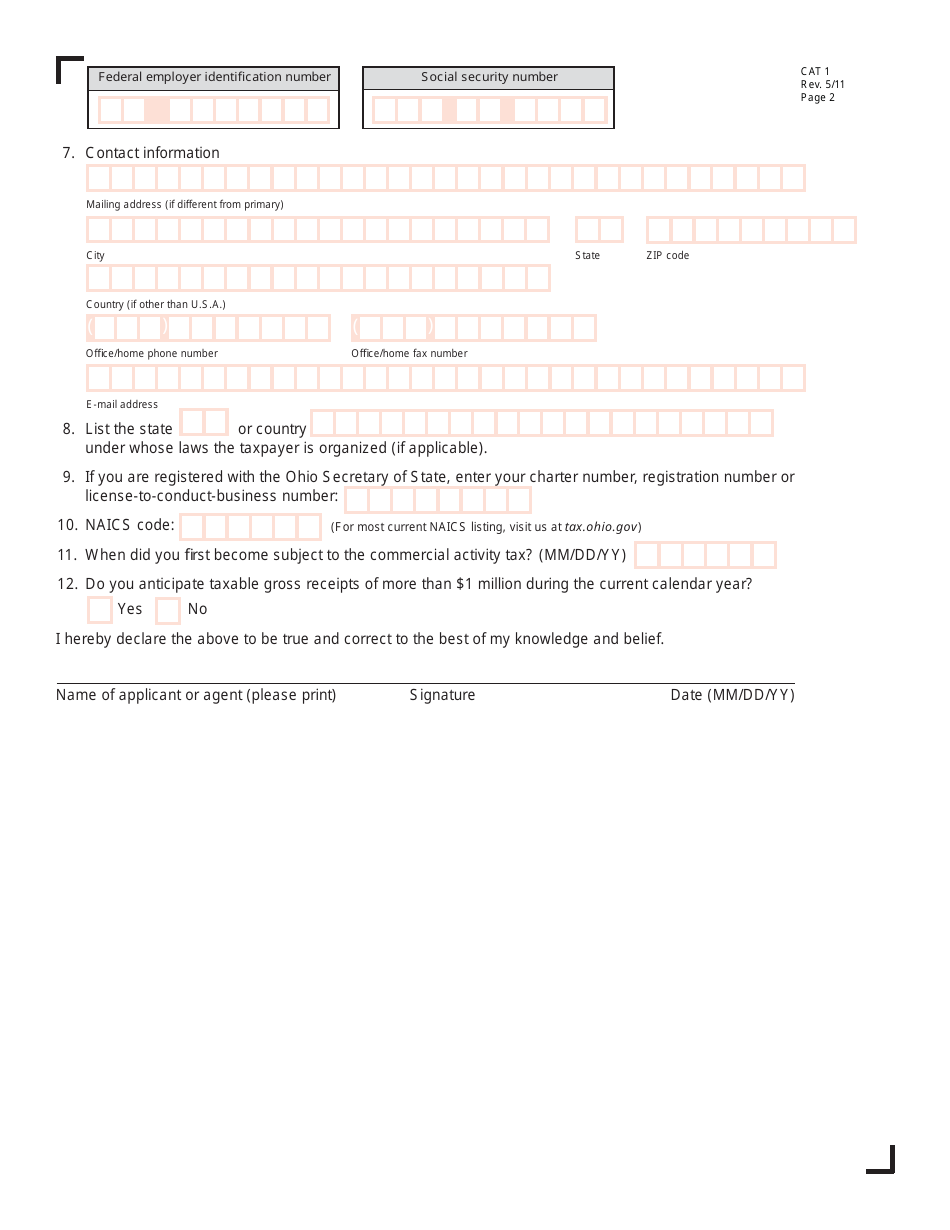

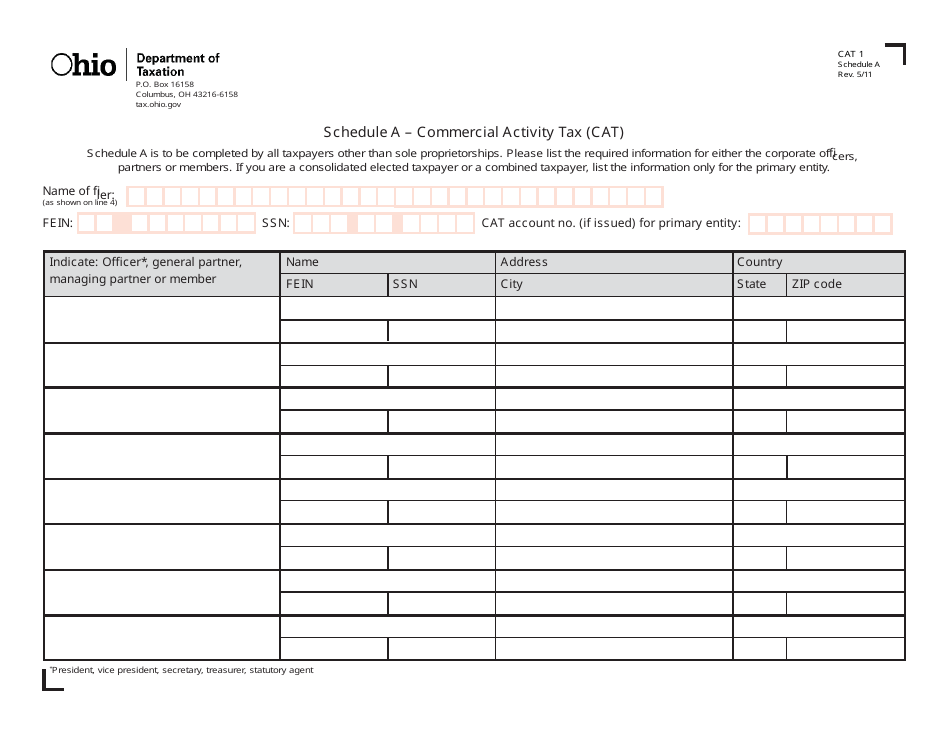

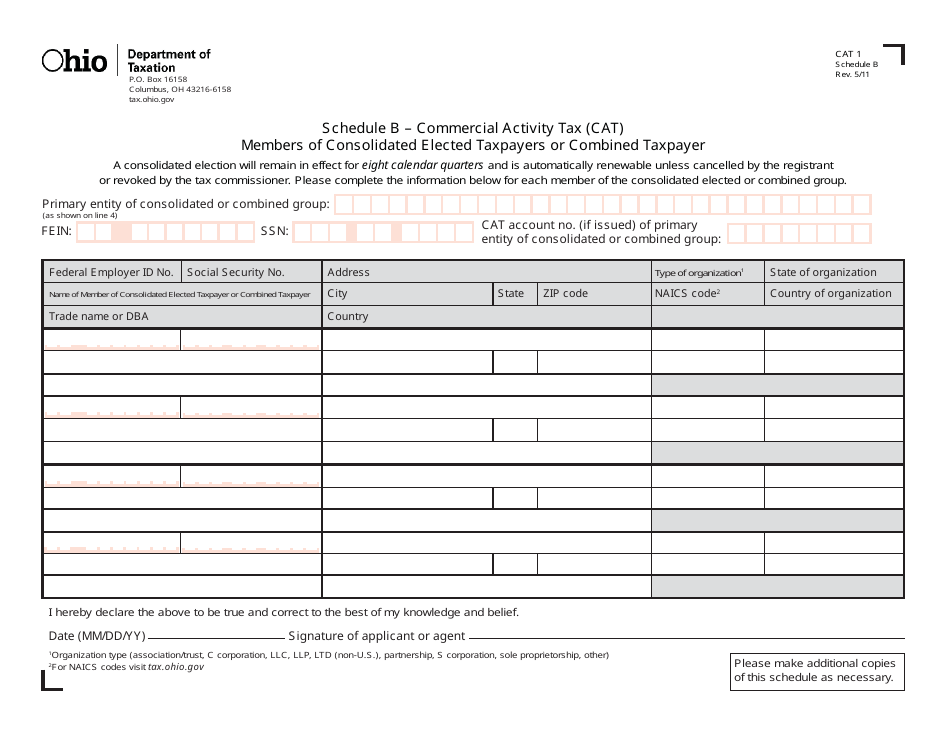

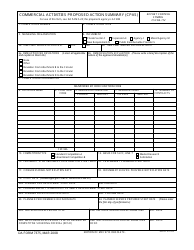

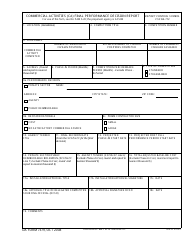

Q: What information is required on the CAT1 form?

A: The CAT1 form requires information such as business name, address, federal tax ID, and NAICS code.

Q: Are there any fees associated with filing the CAT1 form?

A: No, there are no fees associated with filing the CAT1 form.

Q: What happens after I file the CAT1 form?

A: After filing the CAT1 form, you will receive a confirmation letter and your business will be registered for the Commercial Activity Tax.

Q: Do I need to renew my CAT registration?

A: No, CAT registrations do not need to be renewed unless there are changes to your business information.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAT1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.