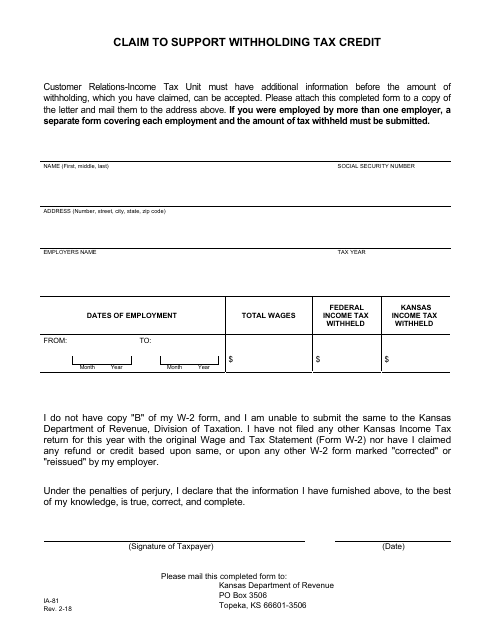

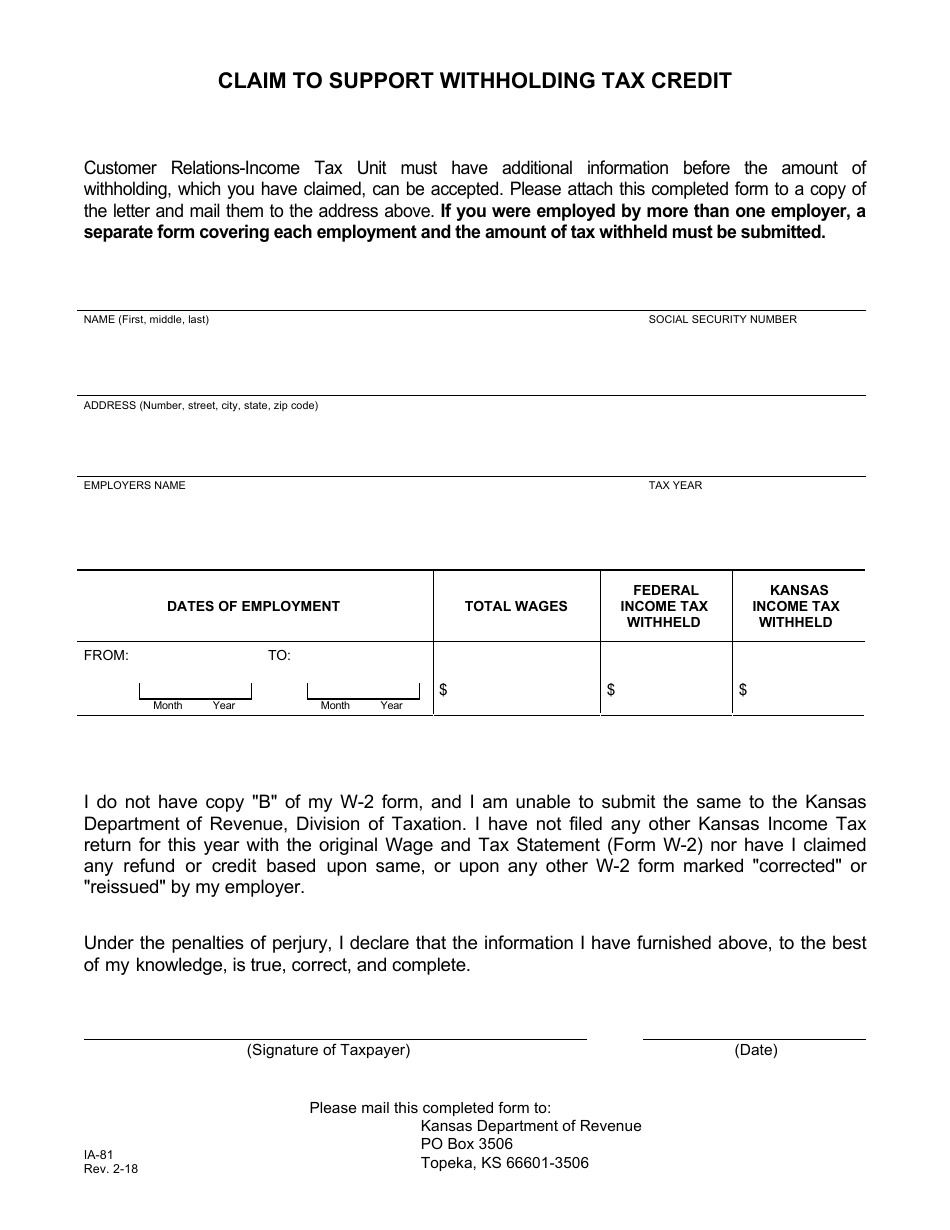

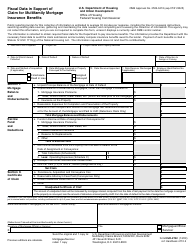

Form IA-81 Claim to Support Withholding Tax Credit - Kansas

What Is Form IA-81?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA-81?

A: Form IA-81 is a claim form used to request a credit for withholding taxes paid to the state of Kansas.

Q: Who can use Form IA-81?

A: Form IA-81 can be used by individuals or businesses who have had Kansas state income tax withheld from their income.

Q: What is the purpose of Form IA-81?

A: The purpose of Form IA-81 is to claim a credit for the Kansas state income tax that was withheld from your income.

Q: What information do I need to provide on Form IA-81?

A: You will need to provide your personal information, details about the withholding tax, and any supporting documentation.

Q: Is there a deadline for submitting Form IA-81?

A: Yes, Form IA-81 must be submitted by the due date of your Kansas state income tax return.

Q: Can I claim a refund if I don't owe any Kansas state income tax?

A: No, you can only claim a refund for the amount of Kansas state income tax that has been withheld from your income.

Q: What should I do if I have questions about Form IA-81?

A: If you have questions about Form IA-81, you can contact the Kansas Department of Revenue for assistance.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA-81 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.