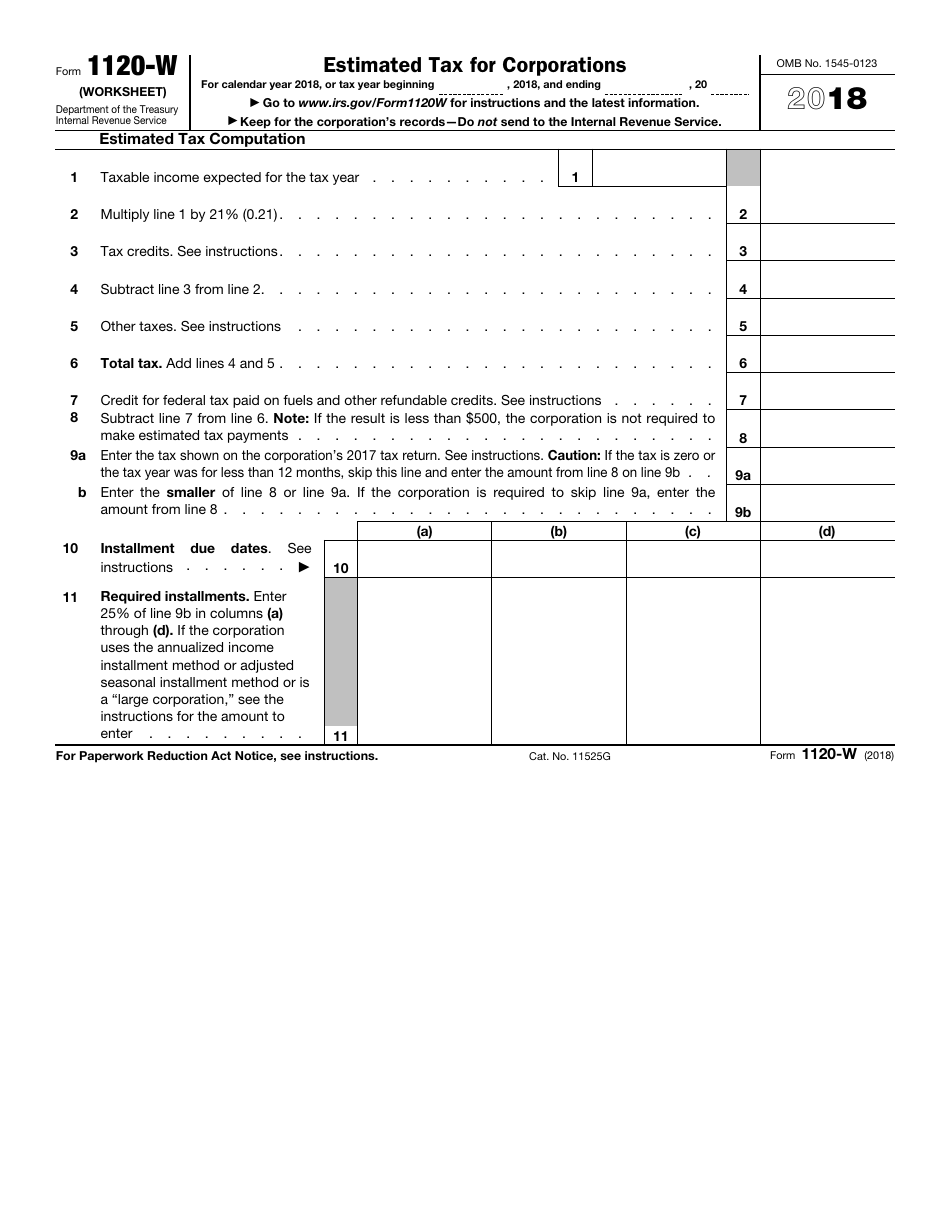

This version of the form is not currently in use and is provided for reference only. Download this version of

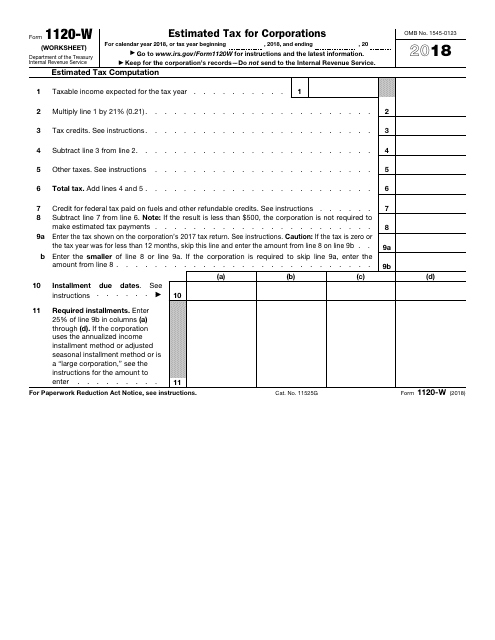

IRS Form 1120-W

for the current year.

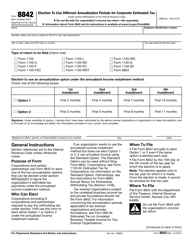

IRS Form 1120-W Estimated Tax for Corporations

What Is IRS Form 1120-W?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-W?

A: IRS Form 1120-W is used to calculate estimated tax payments for corporations.

Q: Who needs to file IRS Form 1120-W?

A: Corporations that expect to owe more than $500 in tax for the year must file Form 1120-W.

Q: When is IRS Form 1120-W due?

A: Form 1120-W is generally due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

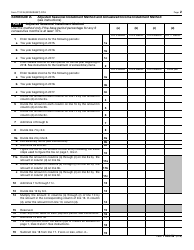

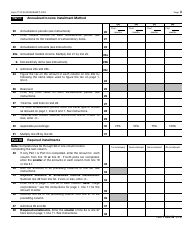

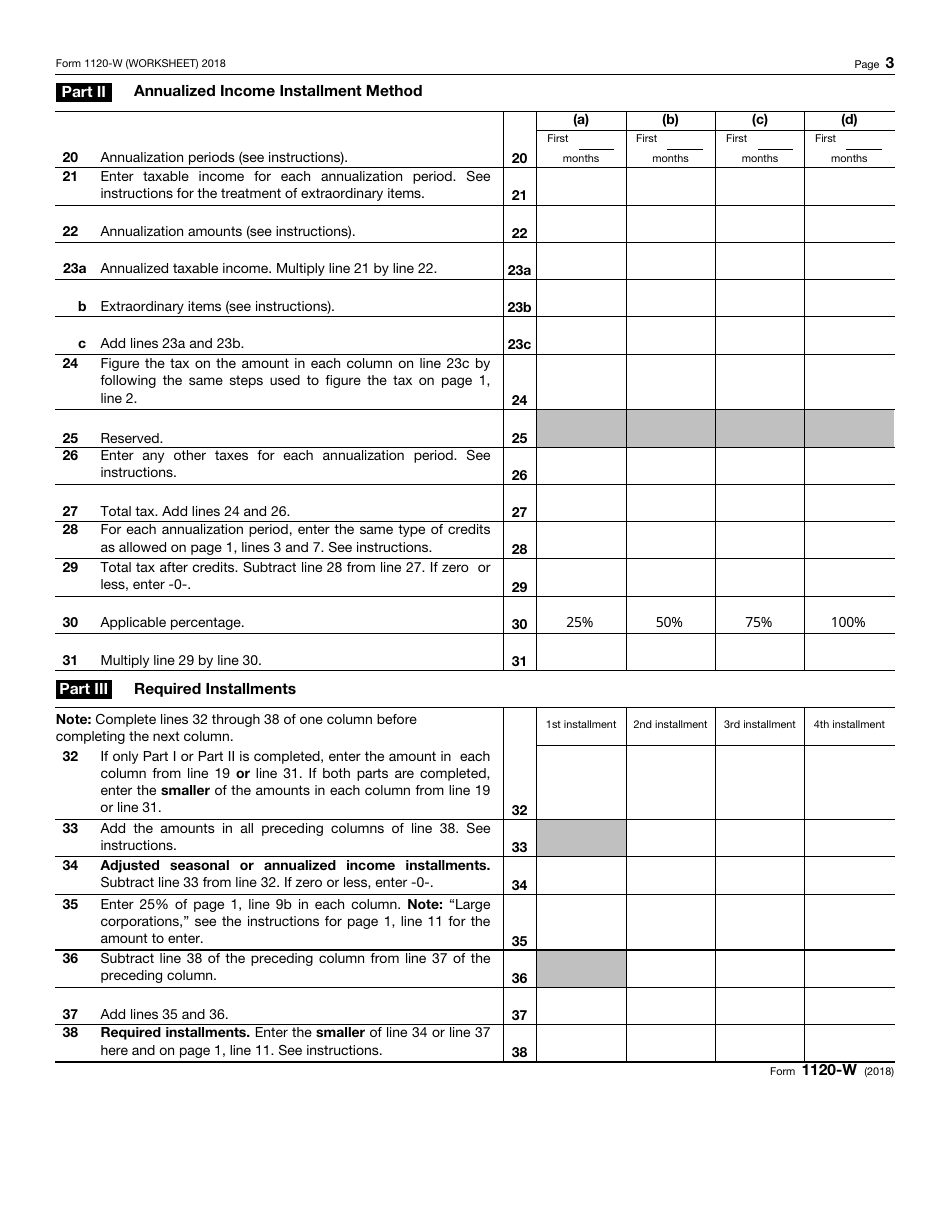

Q: How do I calculate estimated tax using IRS Form 1120-W?

A: Form 1120-W helps corporations estimate their tax liability by taking into account income, deductions, and credits for the year.

Q: Can I file IRS Form 1120-W electronically?

A: Yes, corporations can file Form 1120-W electronically using the IRS's e-file system.

Q: What happens if I don't file IRS Form 1120-W?

A: Failure to file Form 1120-W or pay estimated taxes may result in penalties and interest on the underpayment.

Q: Can I use IRS Form 1120-W for my personal income tax?

A: No, IRS Form 1120-W is specifically for corporations and cannot be used for personal income tax calculations.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-W through the link below or browse more documents in our library of IRS Forms.