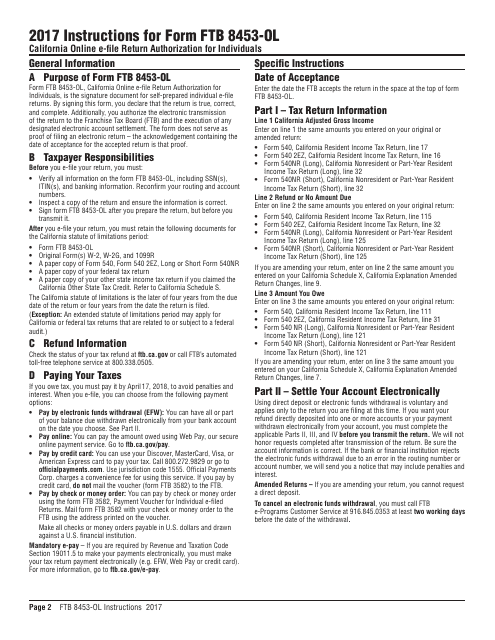

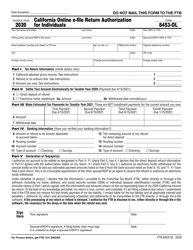

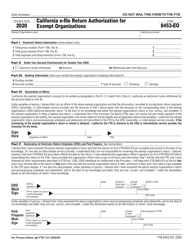

Instructions for Form FTB8453-OL California Online E-File Return Authorization for Individuals - California

This document contains official instructions for Form FTB8453-OL , California Online E-File Return Authorization for Individuals - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is the purpose of Form FTB8453-OL?

A: The purpose of Form FTB8453-OL is to authorize the electronic filing of your California tax return.

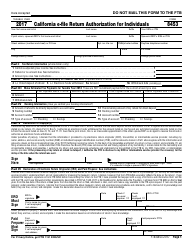

Q: Can Form FTB8453-OL be filed electronically?

A: Yes, Form FTB8453-OL can be filed electronically.

Q: Is there a fee to file Form FTB8453-OL?

A: No, there is no fee to file Form FTB8453-OL.

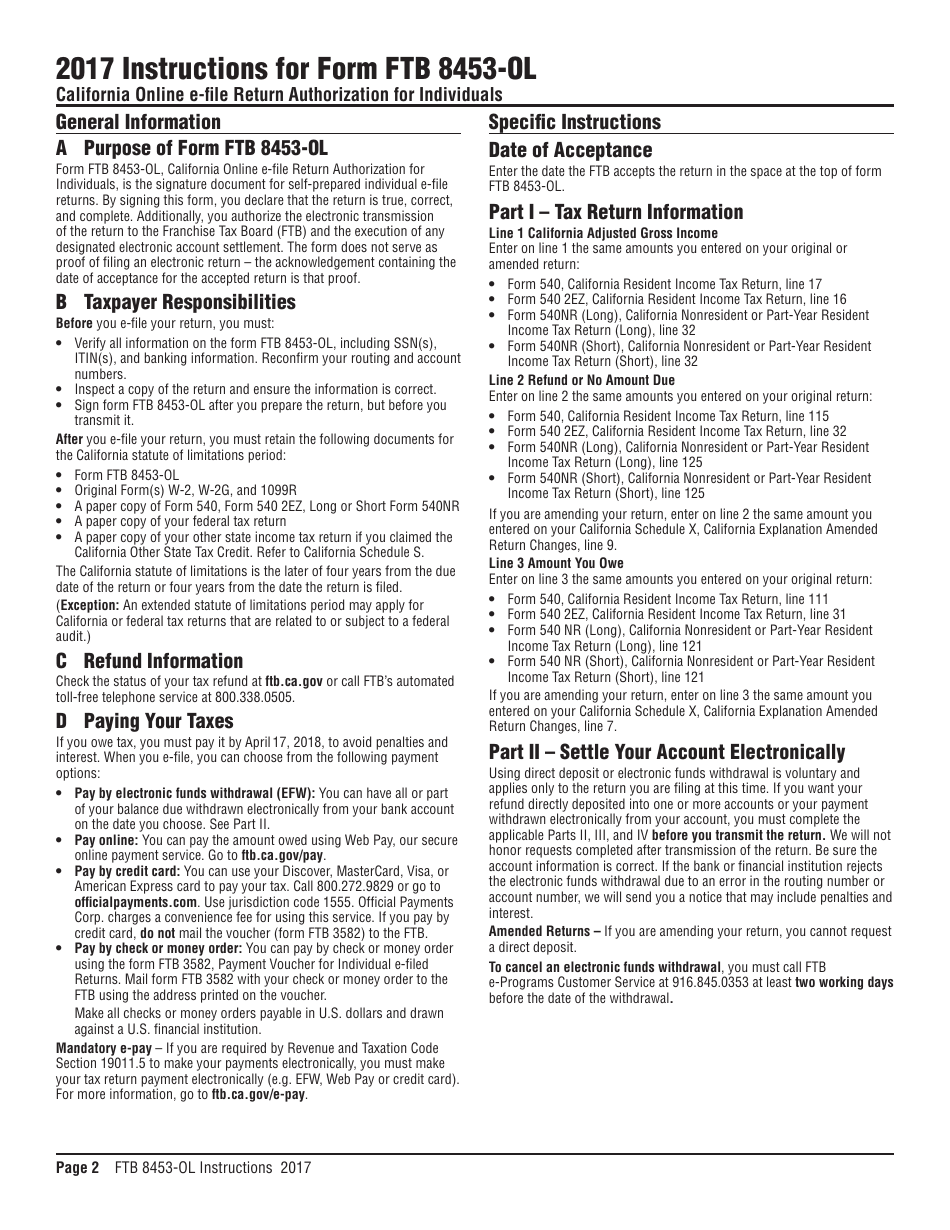

Q: What information do I need to complete Form FTB8453-OL?

A: To complete Form FTB8453-OL, you will need your personal information, including your name, Social Security number, and address, as well as information about your California tax return.

Q: When is the deadline to file Form FTB8453-OL?

A: The deadline to file Form FTB8453-OL is the same as the deadline to file your California tax return, which is usually April 15th.

Q: Do I need to mail a copy of Form FTB8453-OL after filing electronically?

A: No, you do not need to mail a copy of Form FTB8453-OL after filing electronically.

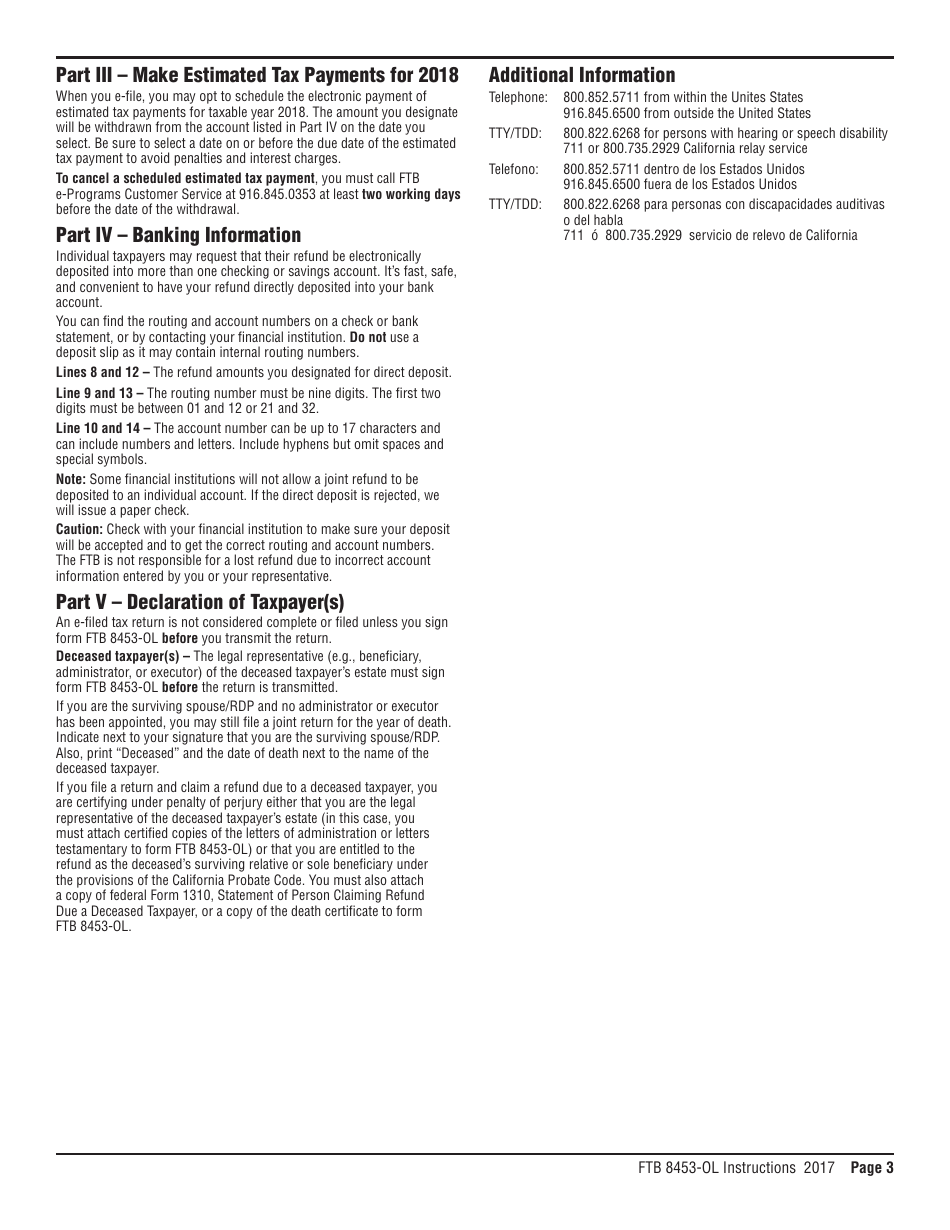

Q: What should I do if I made a mistake on Form FTB8453-OL?

A: If you made a mistake on Form FTB8453-OL, you can file an amended form to correct the error.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.