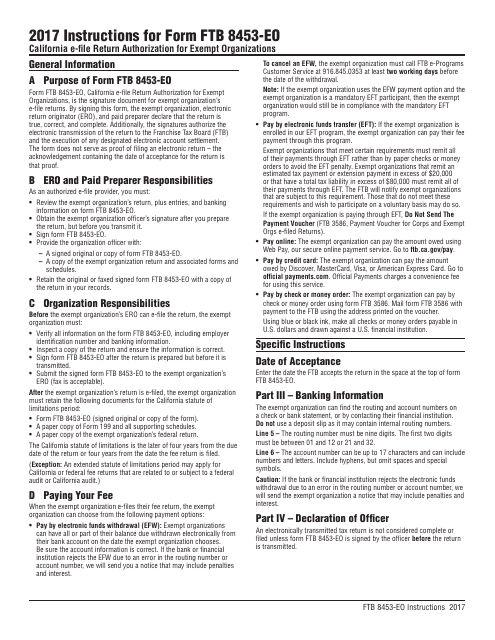

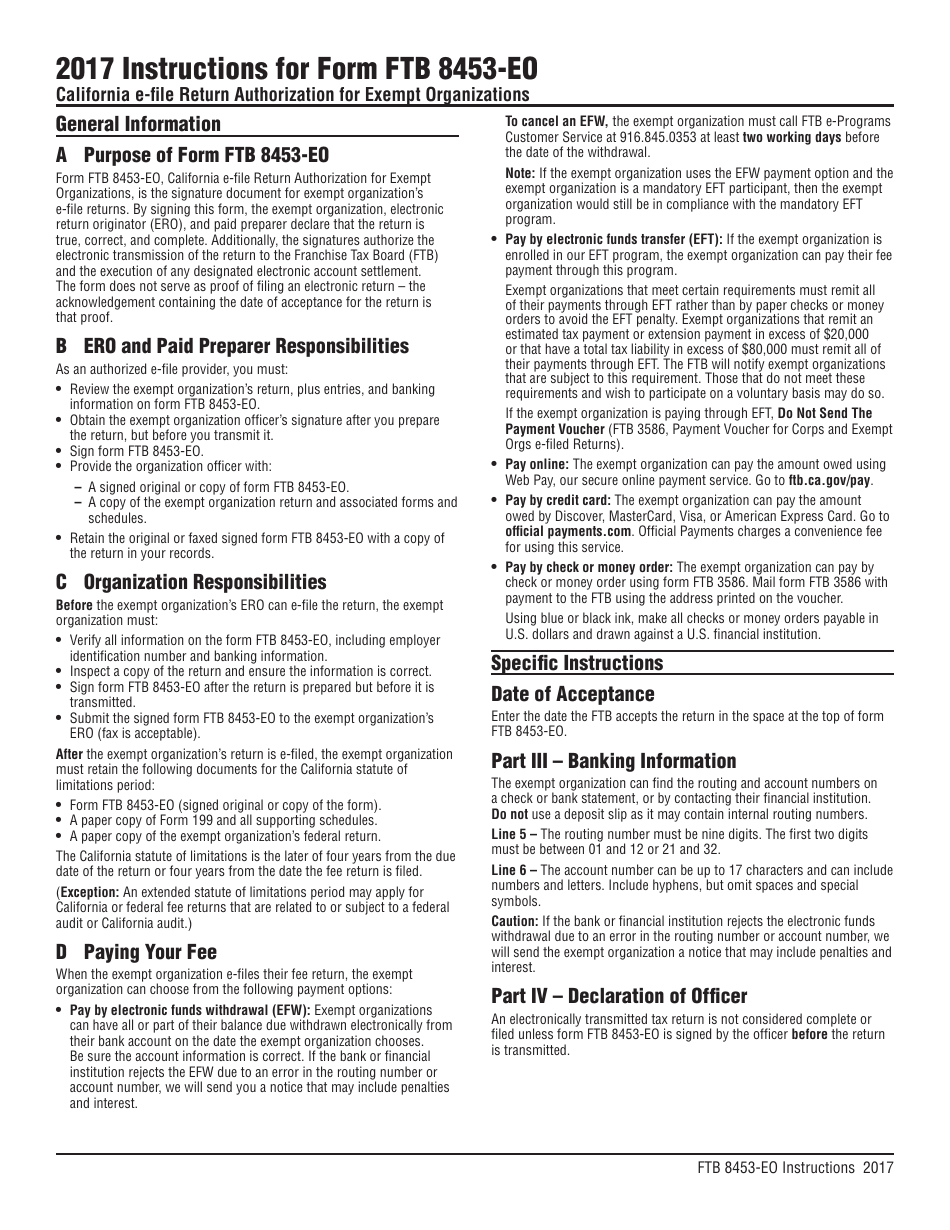

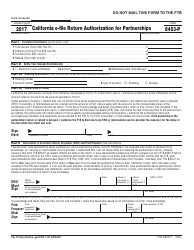

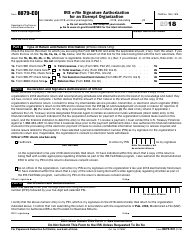

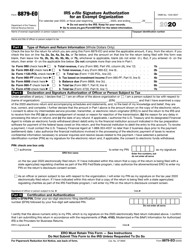

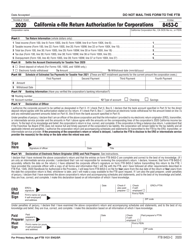

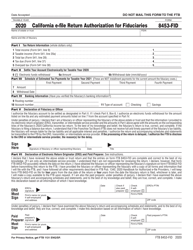

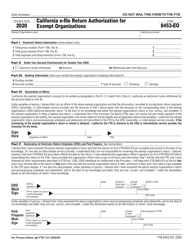

Instructions for Form FTB8453-EO California E-File Return Authorization for Exempt Organizations - California

This document contains official instructions for Form FTB8453-EO , California E-File Return Authorization for Exempt Organizations - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form FTB8453-EO?

A: Form FTB8453-EO is the California E-File Return Authorization for Exempt Organizations, required for electronically filing tax returns for exempt organizations in California.

Q: Who needs to file Form FTB8453-EO?

A: Exempt organizations in California that choose to electronically file their tax returns need to file Form FTB8453-EO.

Q: What is the purpose of Form FTB8453-EO?

A: Form FTB8453-EO authorizes the electronic filing of tax returns for exempt organizations in California.

Q: How do I fill out Form FTB8453-EO?

A: Specific instructions for filling out Form FTB8453-EO can be found on the form itself.

Q: Can Form FTB8453-EO be filed electronically?

A: Yes, Form FTB8453-EO is specifically designed for electronic filing of tax returns for exempt organizations in California.

Q: What is the deadline for filing Form FTB8453-EO?

A: The deadline for filing Form FTB8453-EO is the same as the deadline for the tax return it authorizes.

Q: Are there any fees associated with filing Form FTB8453-EO?

A: There are no fees associated with filing Form FTB8453-EO.

Q: Can I submit Form FTB8453-EO by mail?

A: No, Form FTB8453-EO is specifically designed for electronic filing and cannot be submitted by mail.

Q: What documents should be attached to Form FTB8453-EO?

A: Form FTB8453-EO does not require any attachments. It serves as an authorization for electronic filing of tax returns.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.