This version of the form is not currently in use and is provided for reference only. Download this version of

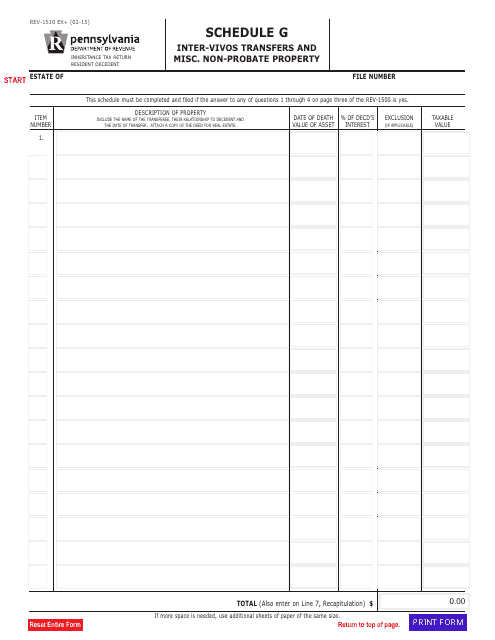

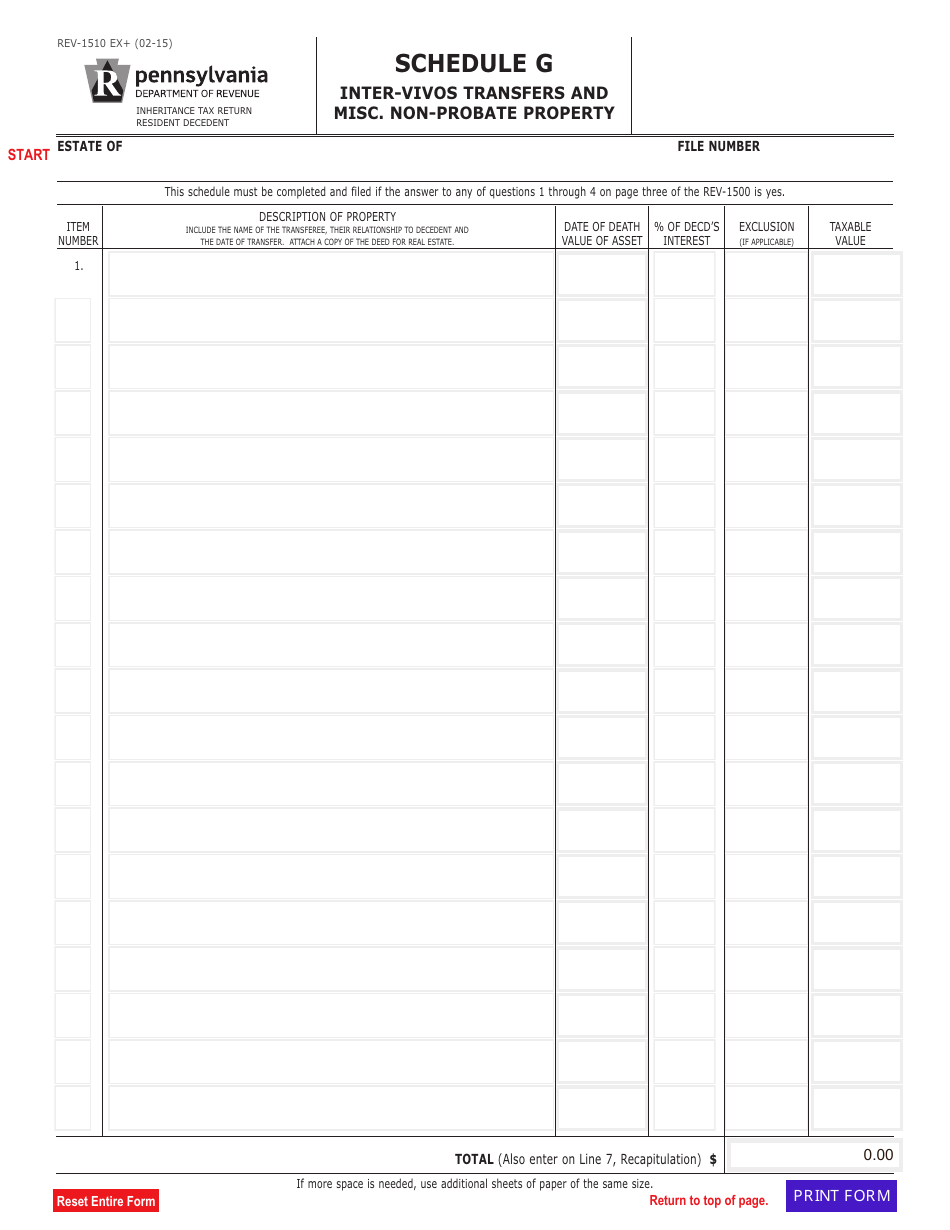

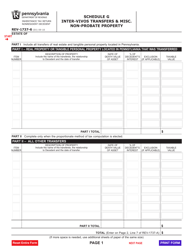

Form REV-1510 Schedule G

for the current year.

Form REV-1510 Schedule G Inter-Vivos Transfers and Misc. Non-probate Property - Pennsylvania

What Is Form REV-1510 Schedule G?

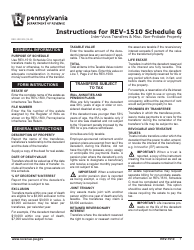

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form REV-1510 Schedule G?

A: Form REV-1510 Schedule G is used for reporting inter-vivos transfers and miscellaneous non-probate property in Pennsylvania.

Q: What are inter-vivos transfers?

A: Inter-vivos transfers refer to transfers of property that occur during the owner's lifetime.

Q: What is non-probate property?

A: Non-probate property refers to assets that are not subject to the probate process.

Q: When is Form REV-1510 Schedule G used?

A: Form REV-1510 Schedule G is used when reporting inter-vivos transfers and non-probate property on your Pennsylvania state tax return.

Q: Is Form REV-1510 Schedule G required?

A: Yes, if you have inter-vivos transfers or non-probate property to report in Pennsylvania, you are required to use Form REV-1510 Schedule G.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1510 Schedule G by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.