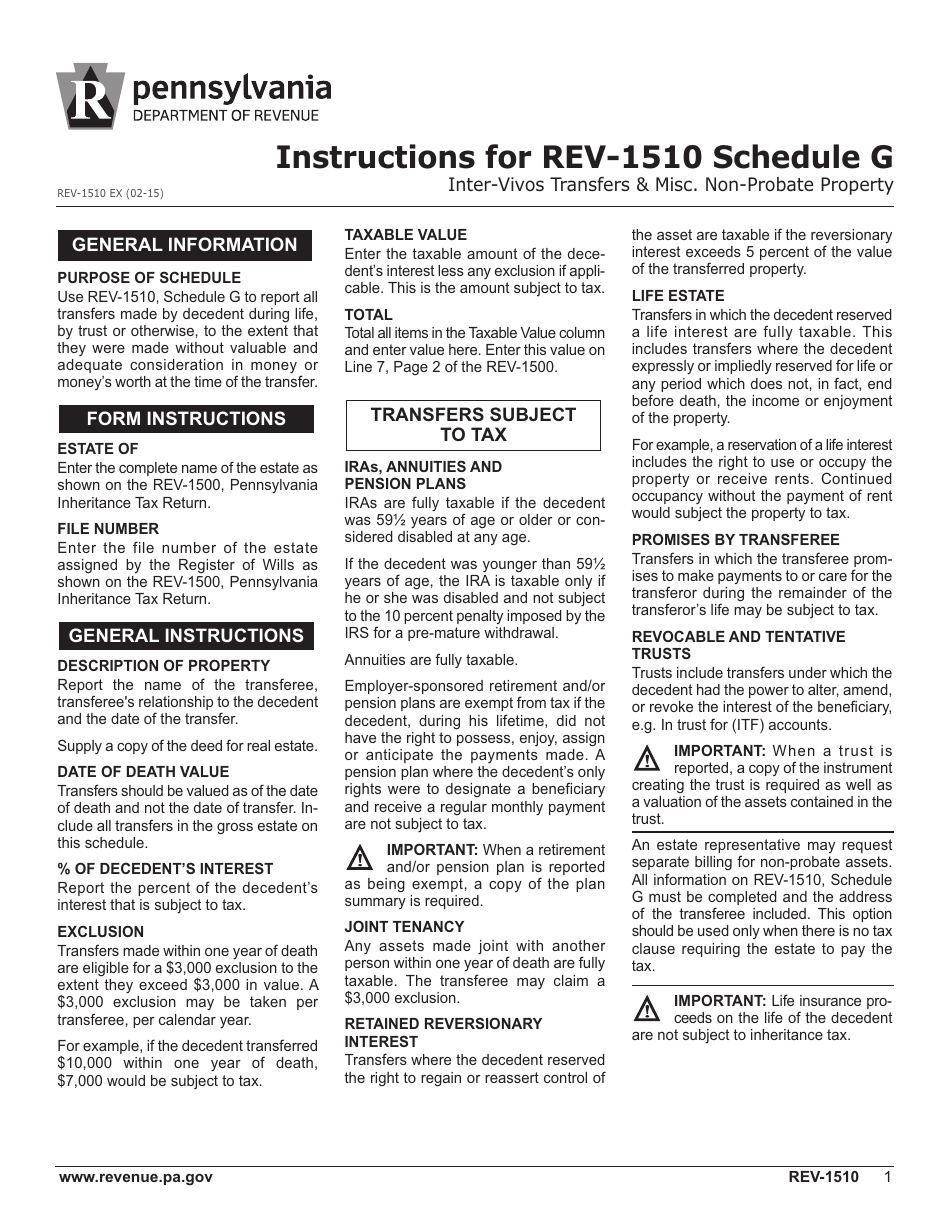

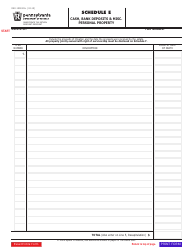

Instructions for Form REV-1510 Schedule G Inter-Vivos Transfers & Misc. Non-probate Property - Pennsylvania

This document contains official instructions for Form REV-1510 Schedule G, Inter-Vivos Transfers & Misc. Non-probate Property - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1510 Schedule G is available for download through this link.

FAQ

Q: What is Form REV-1510 Schedule G?

A: Form REV-1510 Schedule G is a tax form used in Pennsylvania to report inter-vivos transfers and miscellaneous non-probate property.

Q: What are inter-vivos transfers?

A: Inter-vivos transfers, also known as lifetime transfers, refer to the transfer of property or assets during a person's lifetime.

Q: What is non-probate property?

A: Non-probate property refers to assets that are not subject to the probate process after a person's death.

Q: Who needs to file Form REV-1510 Schedule G?

A: Individuals who have made inter-vivos transfers or have non-probate property in Pennsylvania may need to file Form REV-1510 Schedule G.

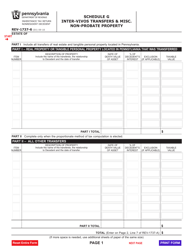

Q: What information is required on Form REV-1510 Schedule G?

A: Form REV-1510 Schedule G requires information about the property or assets transferred, their value, and details about the transferor and transferee.

Q: When is the deadline to file Form REV-1510 Schedule G?

A: The deadline to file Form REV-1510 Schedule G is typically the same as the deadline for filing your Pennsylvania state tax return.

Q: Are there any penalties for not filing Form REV-1510 Schedule G?

A: Failure to file Form REV-1510 Schedule G or reporting incorrect information may result in penalties and interest charges.

Q: Is Form REV-1510 Schedule G specific to Pennsylvania?

A: Yes, Form REV-1510 Schedule G is specific to reporting inter-vivos transfers and non-probate property in Pennsylvania.

Q: Do I need to submit any supporting documents with Form REV-1510 Schedule G?

A: You may be required to attach supporting documents, such as deeds or contracts, depending on the nature of the inter-vivos transfer or non-probate property.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.