This version of the form is not currently in use and is provided for reference only. Download this version of

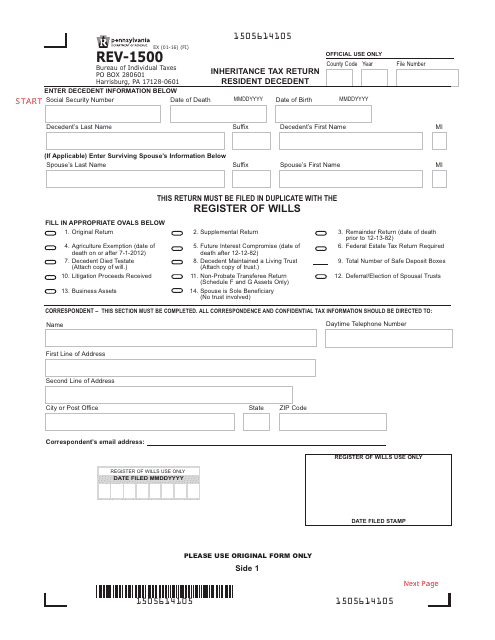

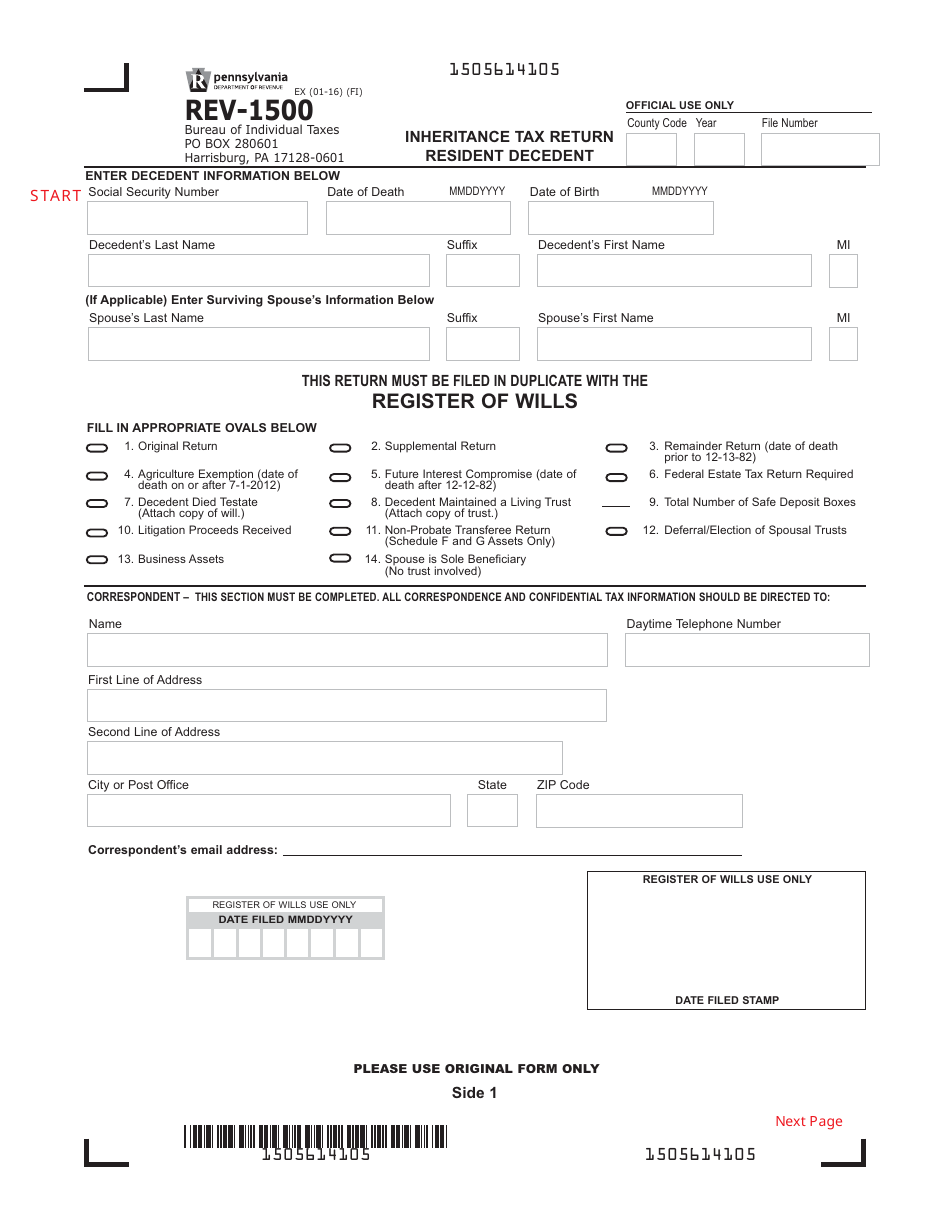

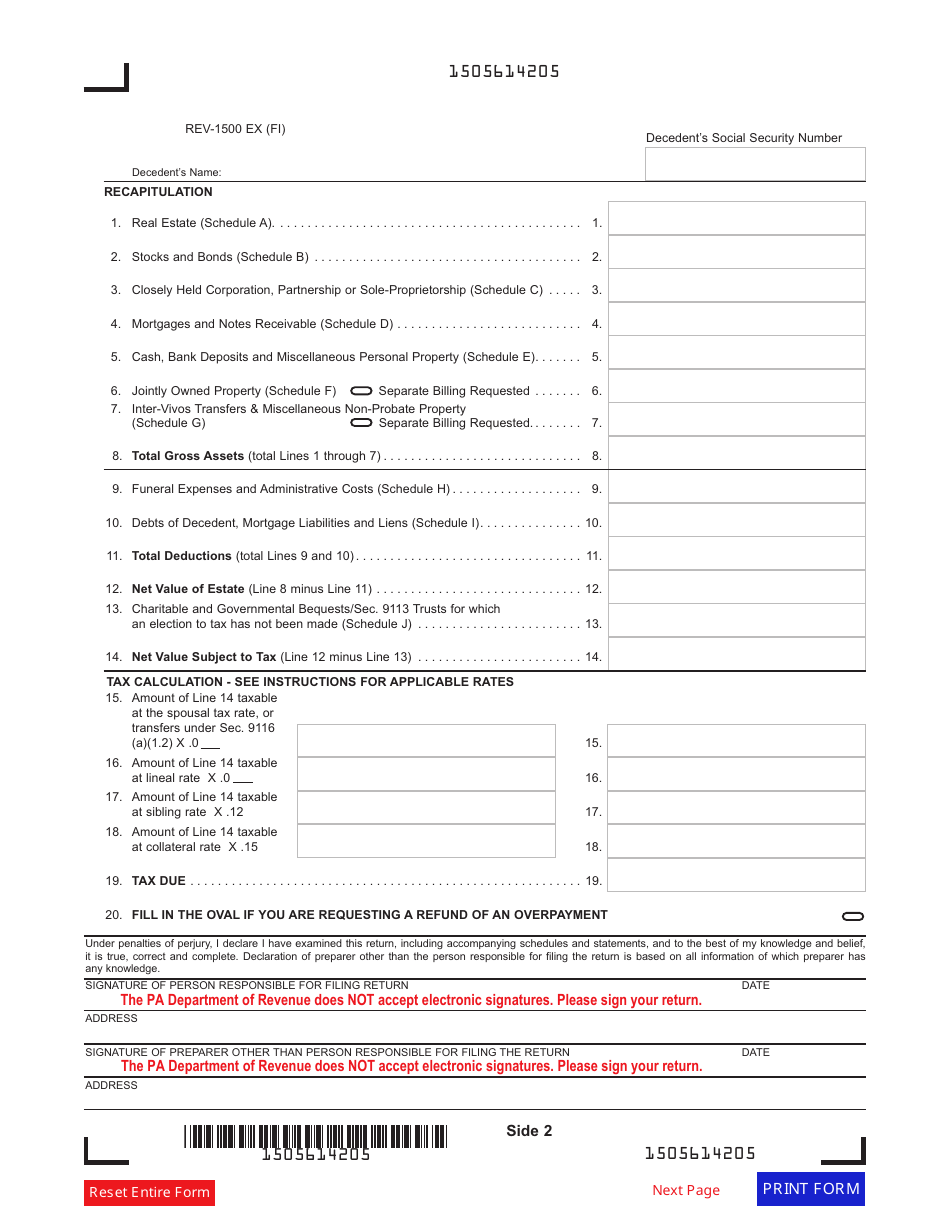

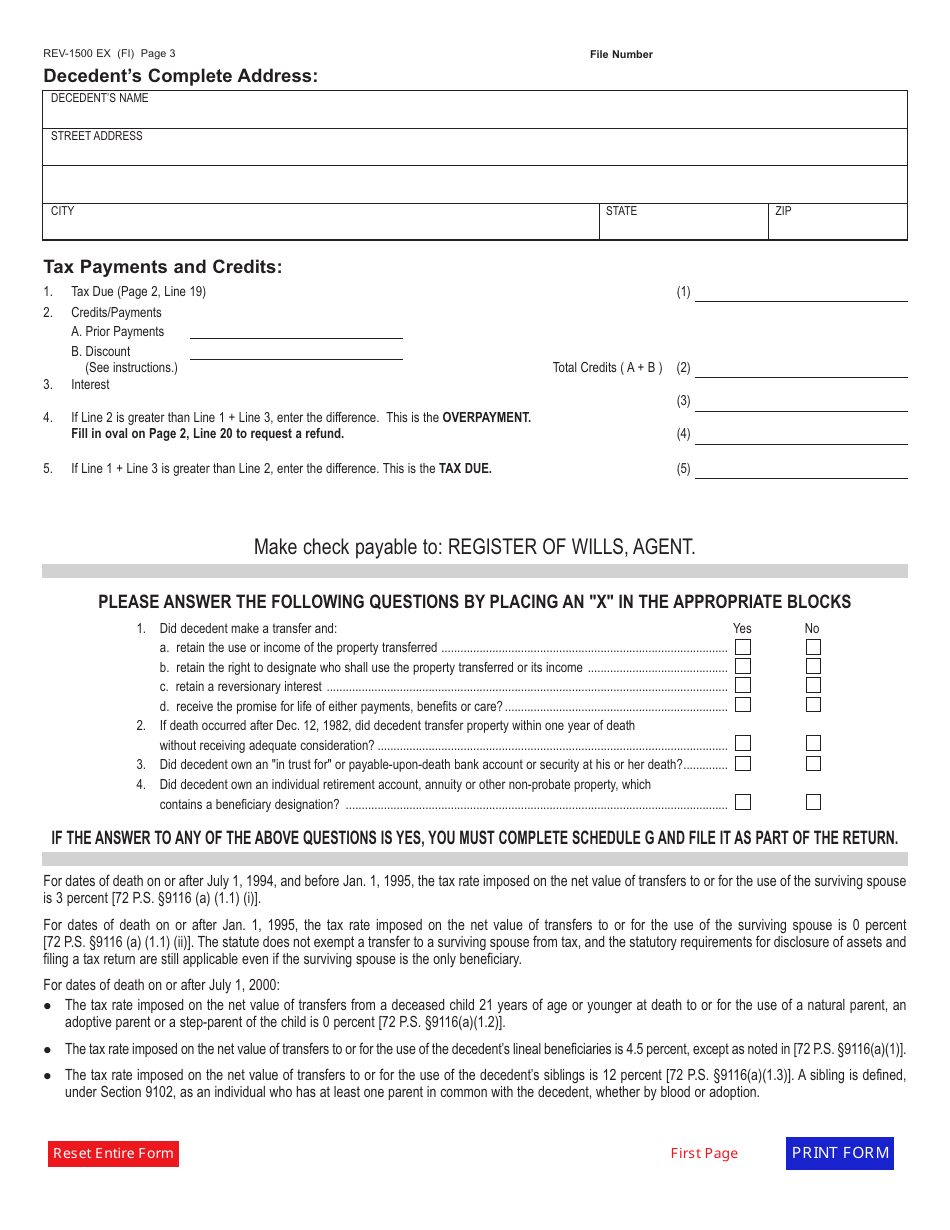

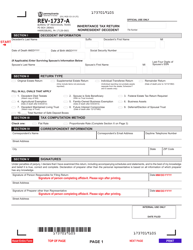

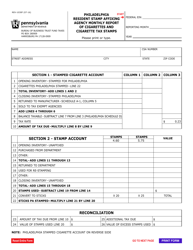

Form REV-1500

for the current year.

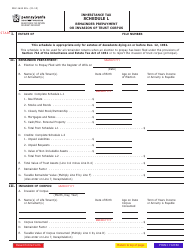

Form REV-1500 Inheritance Tax Return Resident Decedent - Pennsylvania

What Is Form REV-1500?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1500?

A: Form REV-1500 is the Inheritance Tax Return for a Resident Decedent in Pennsylvania.

Q: Who needs to file Form REV-1500?

A: The personal representative or administrator of the estate needs to file Form REV-1500 for a resident decedent in Pennsylvania.

Q: What is the purpose of Form REV-1500?

A: The purpose of Form REV-1500 is to report and pay the inheritance tax on assets received from a resident decedent in Pennsylvania.

Q: When should Form REV-1500 be filed?

A: Form REV-1500 should be filed within nine months from the date of death of the decedent.

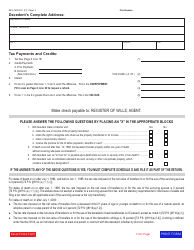

Q: What information is required on Form REV-1500?

A: Form REV-1500 requires information about the decedent, the estate assets, and the beneficiaries.

Q: Are there any exemptions or deductions available on Form REV-1500?

A: Yes, there are certain exemptions and deductions available on Form REV-1500, such as the family exemption and the agricultural land exemption.

Q: How is the inheritance tax calculated on Form REV-1500?

A: The inheritance tax is calculated based on the value of the assets received and the relationship between the decedent and the beneficiary.

Q: What are the consequences of not filing Form REV-1500?

A: Not filing Form REV-1500 or not paying the inheritance tax on time may result in penalties and interest charges.

Q: Can I get assistance in completing Form REV-1500?

A: Yes, you can seek assistance from a tax professional or consult the instructions provided with the form for guidance in completing Form REV-1500.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1500 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.