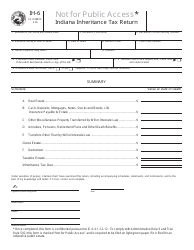

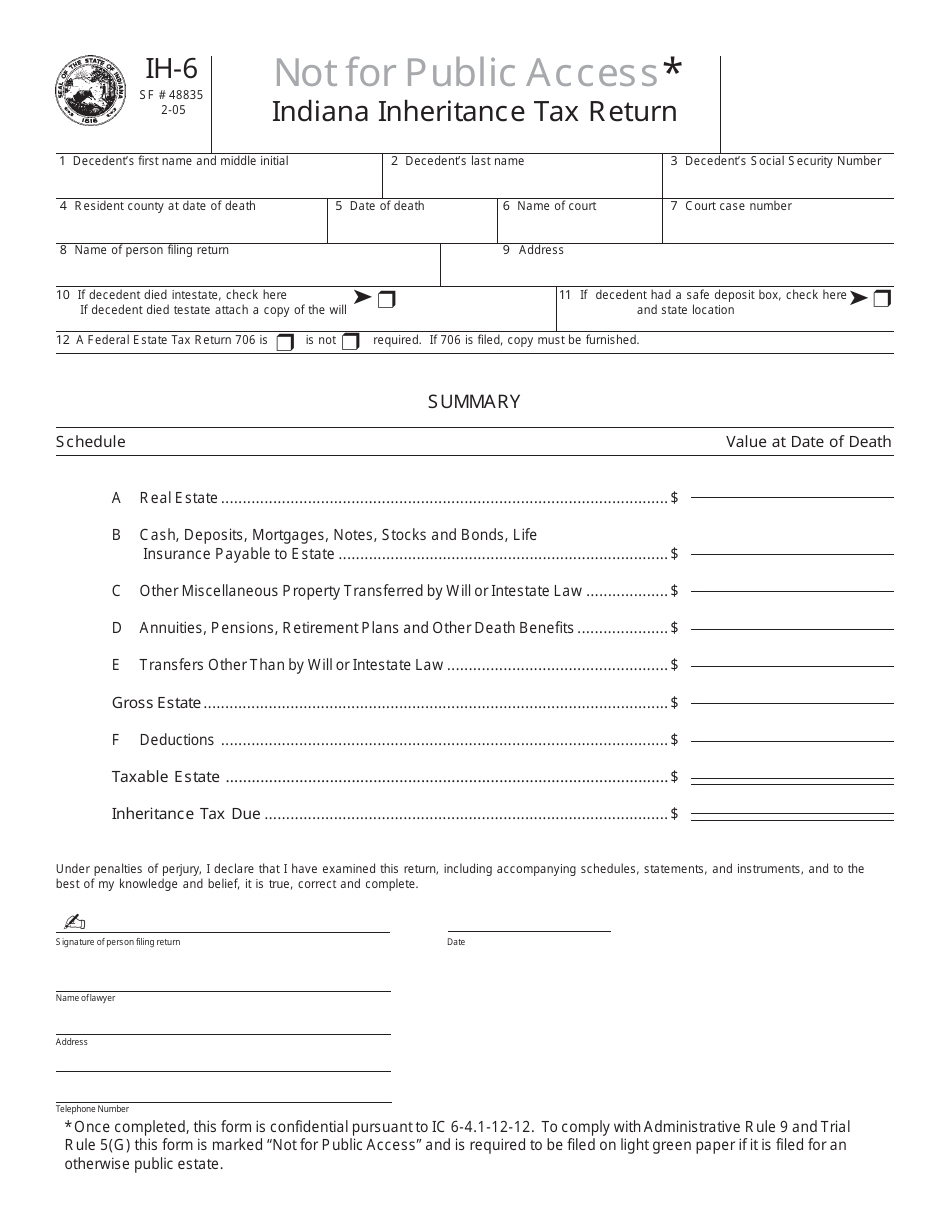

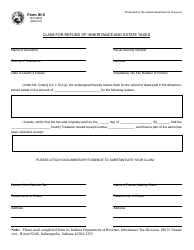

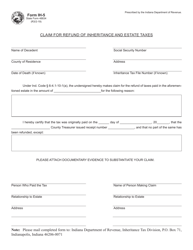

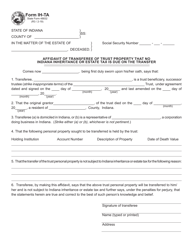

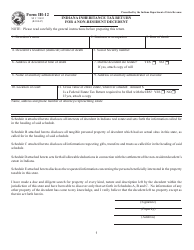

Form IH-6 Indiana Inheritance Tax Return - Indiana

What Is Form IH-6?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IH-6?

A: Form IH-6 is the Indiana Inheritance Tax Return.

Q: Who needs to file Form IH-6?

A: Individuals who are responsible for filing the Indiana Inheritance Tax Return need to file Form IH-6.

Q: What is the purpose of Form IH-6?

A: The purpose of Form IH-6 is to report and pay any inheritance taxes owed to the state of Indiana.

Q: When is Form IH-6 due?

A: Form IH-6 is due within nine months after the date of death of the decedent.

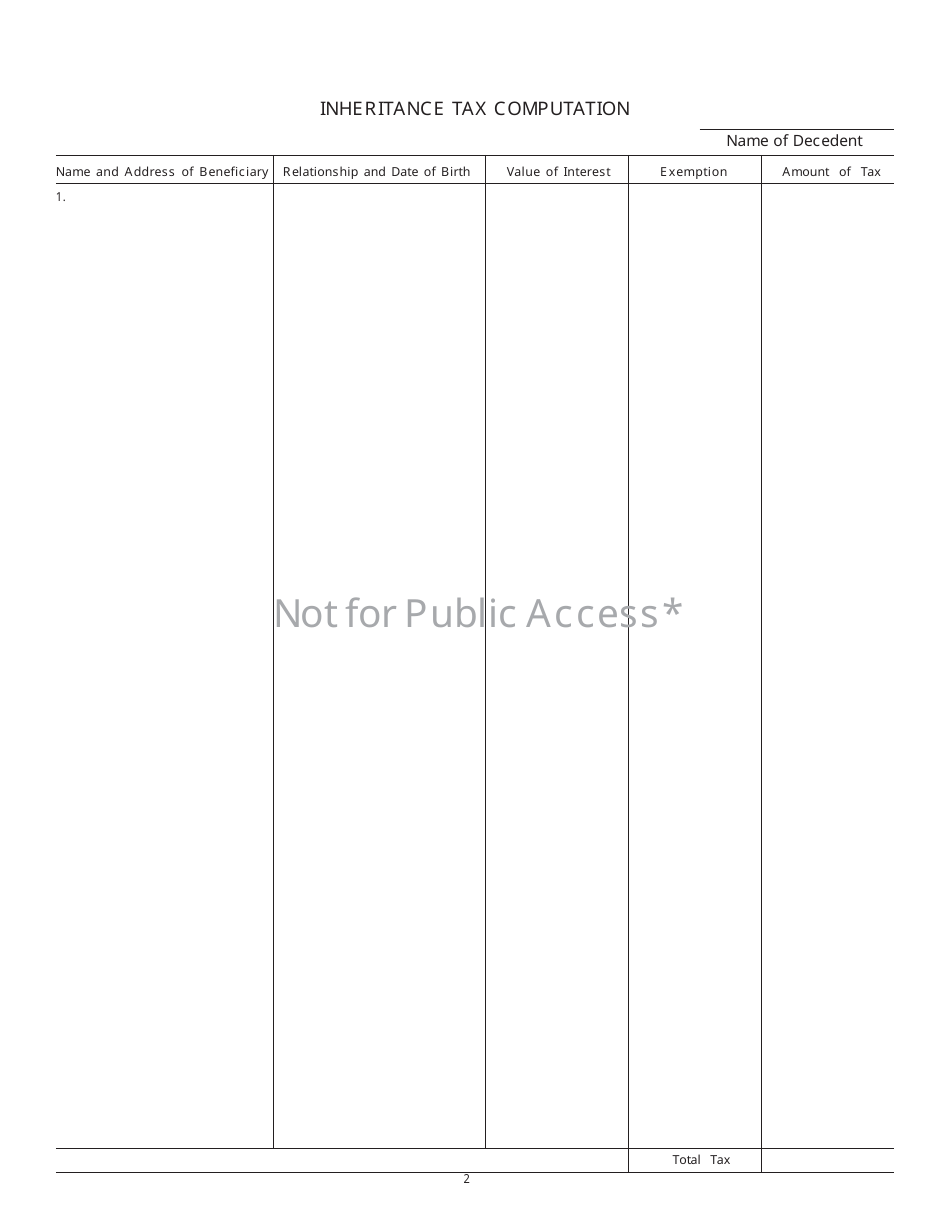

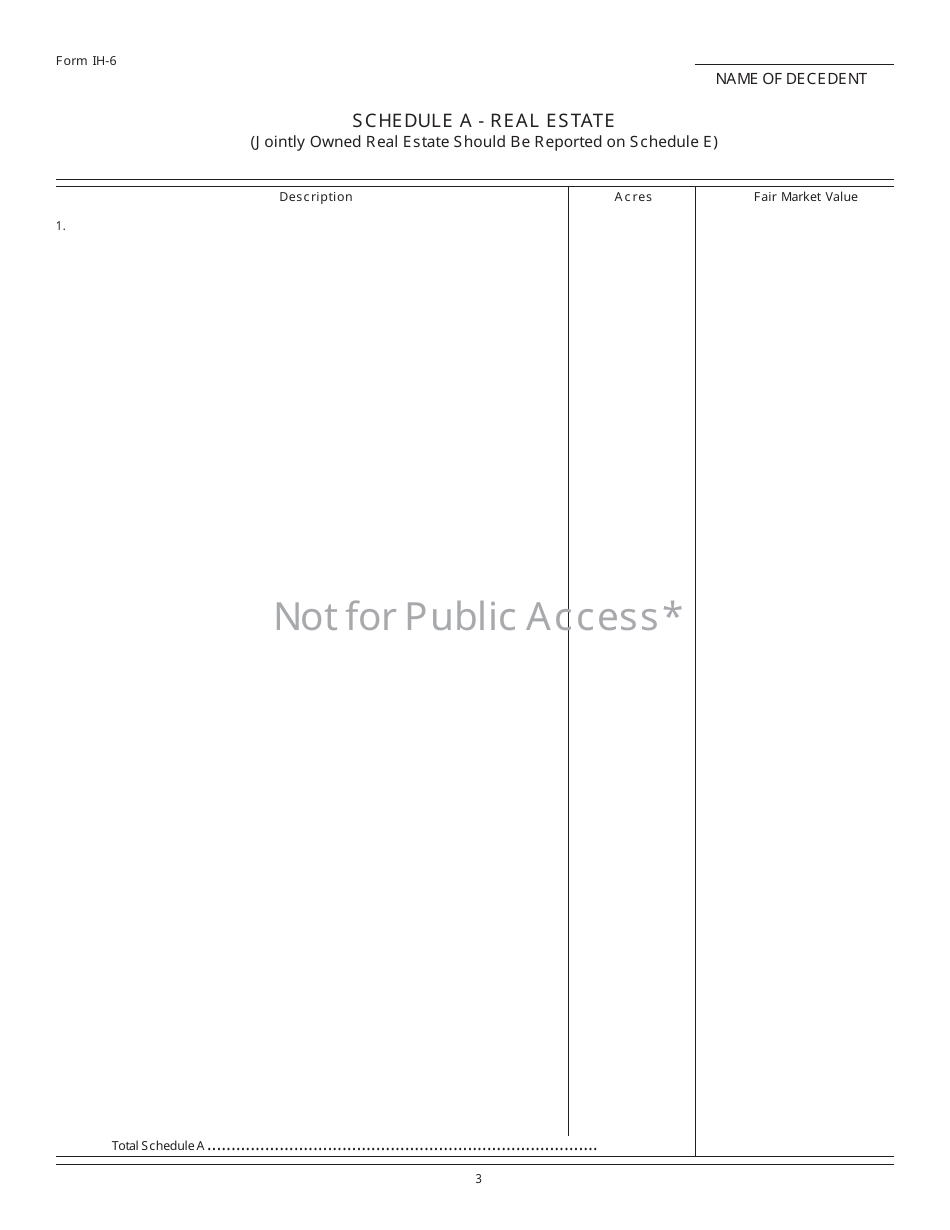

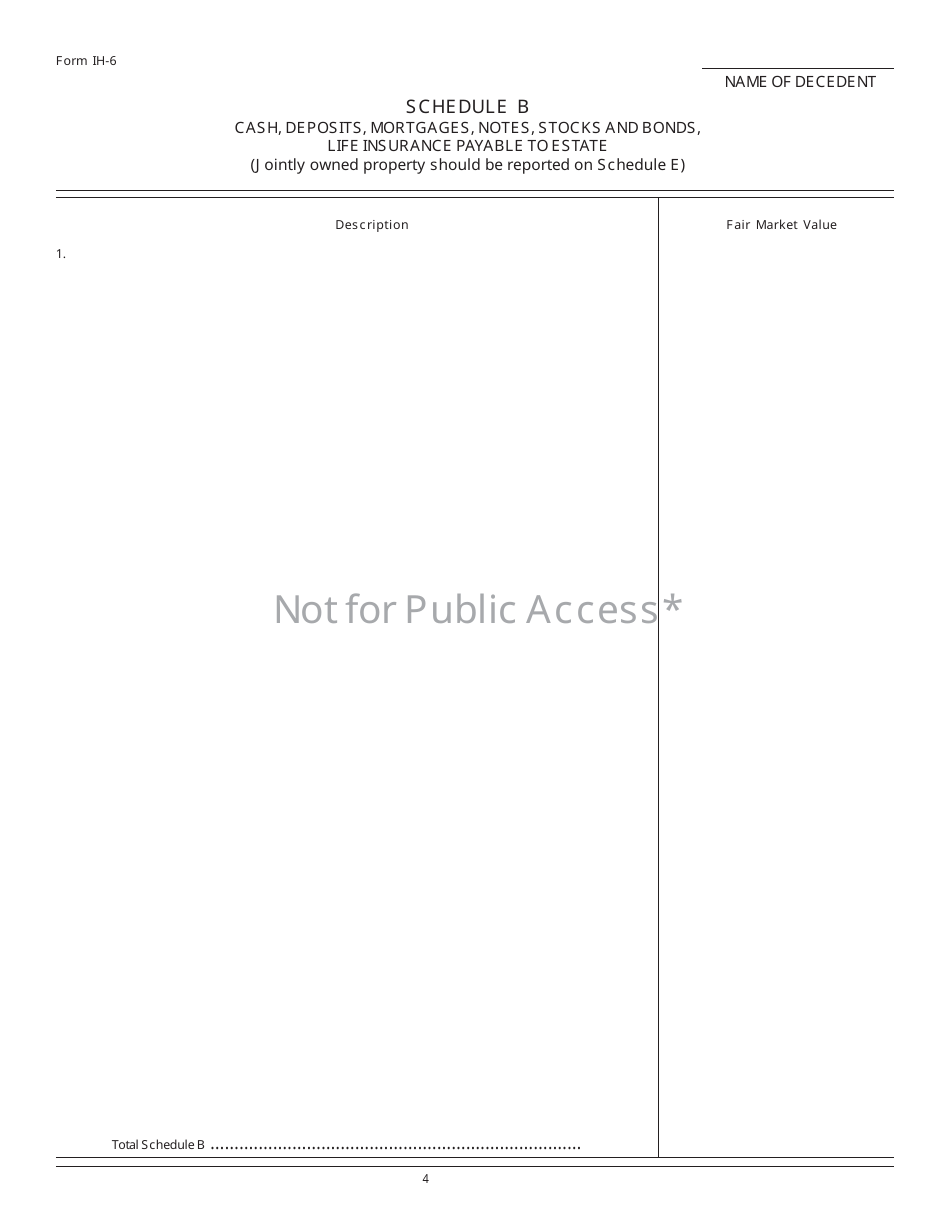

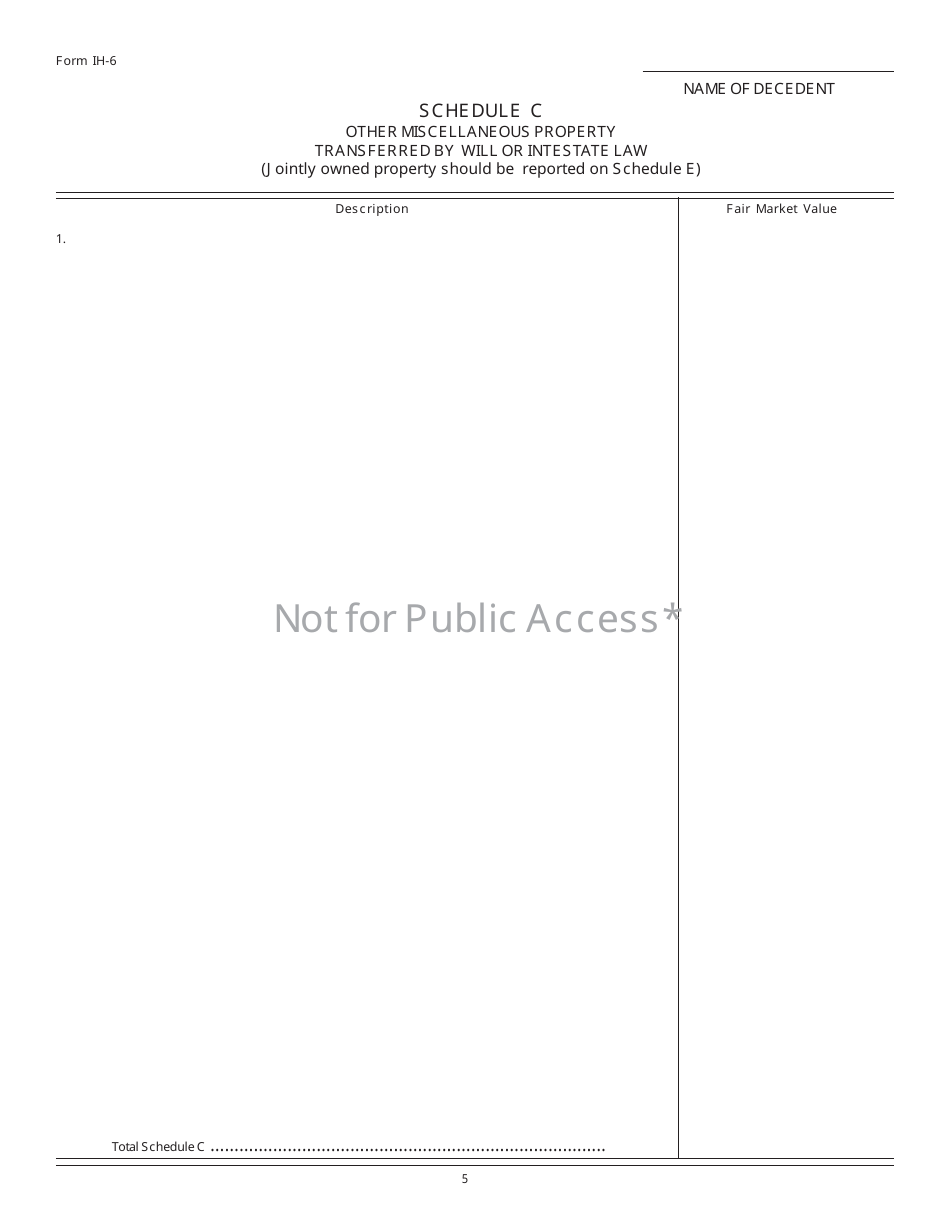

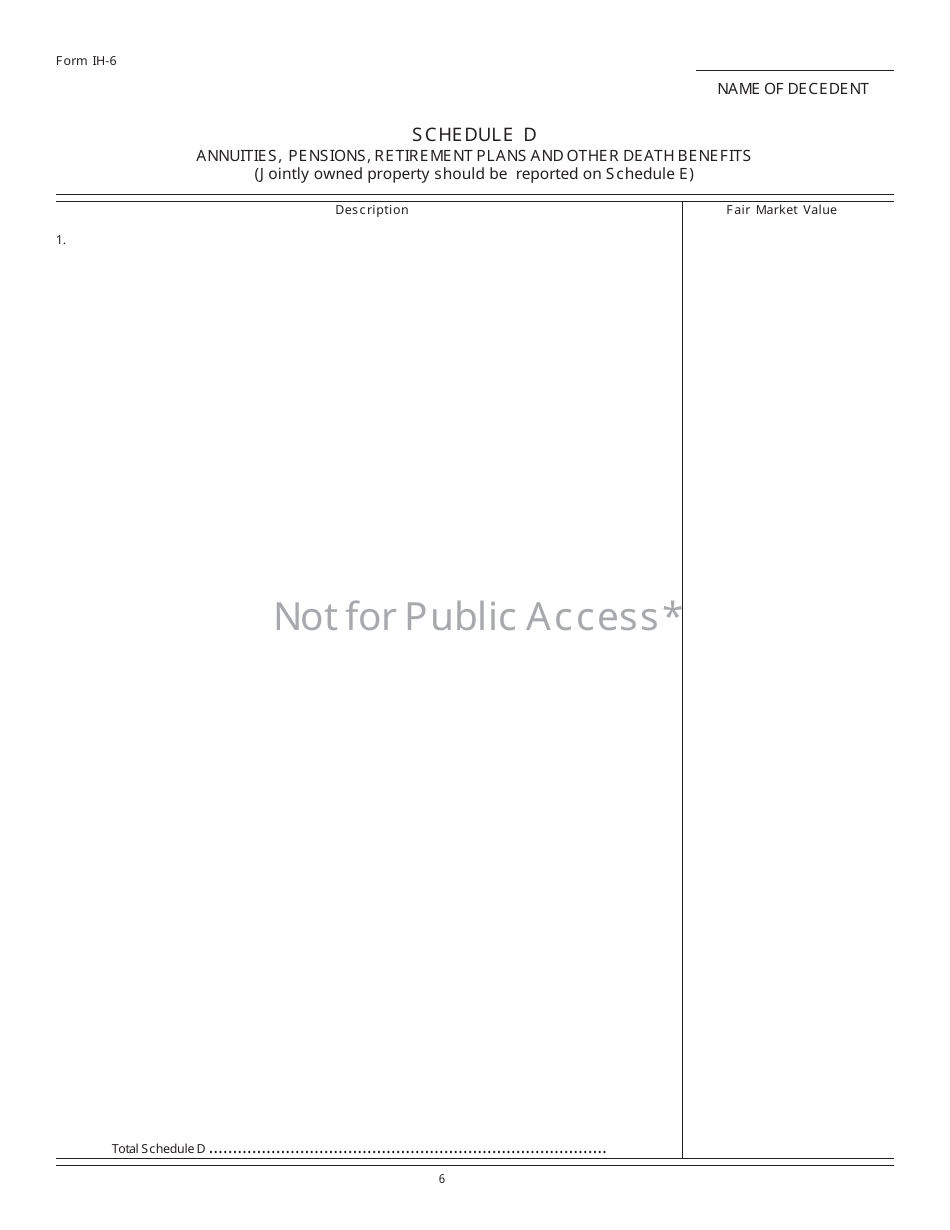

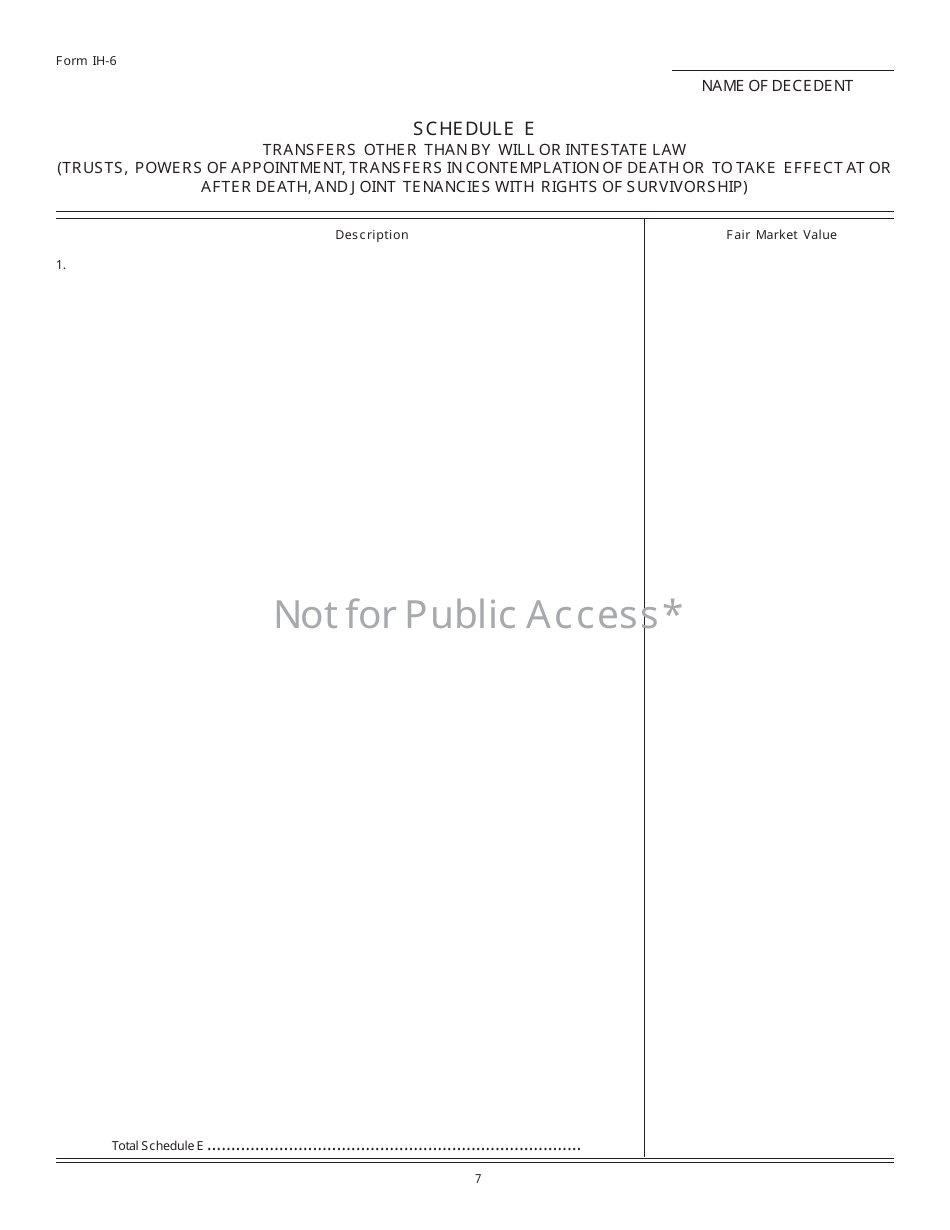

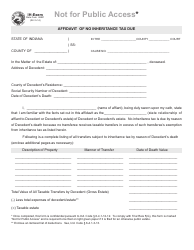

Q: What information is required on Form IH-6?

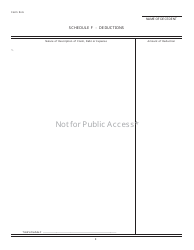

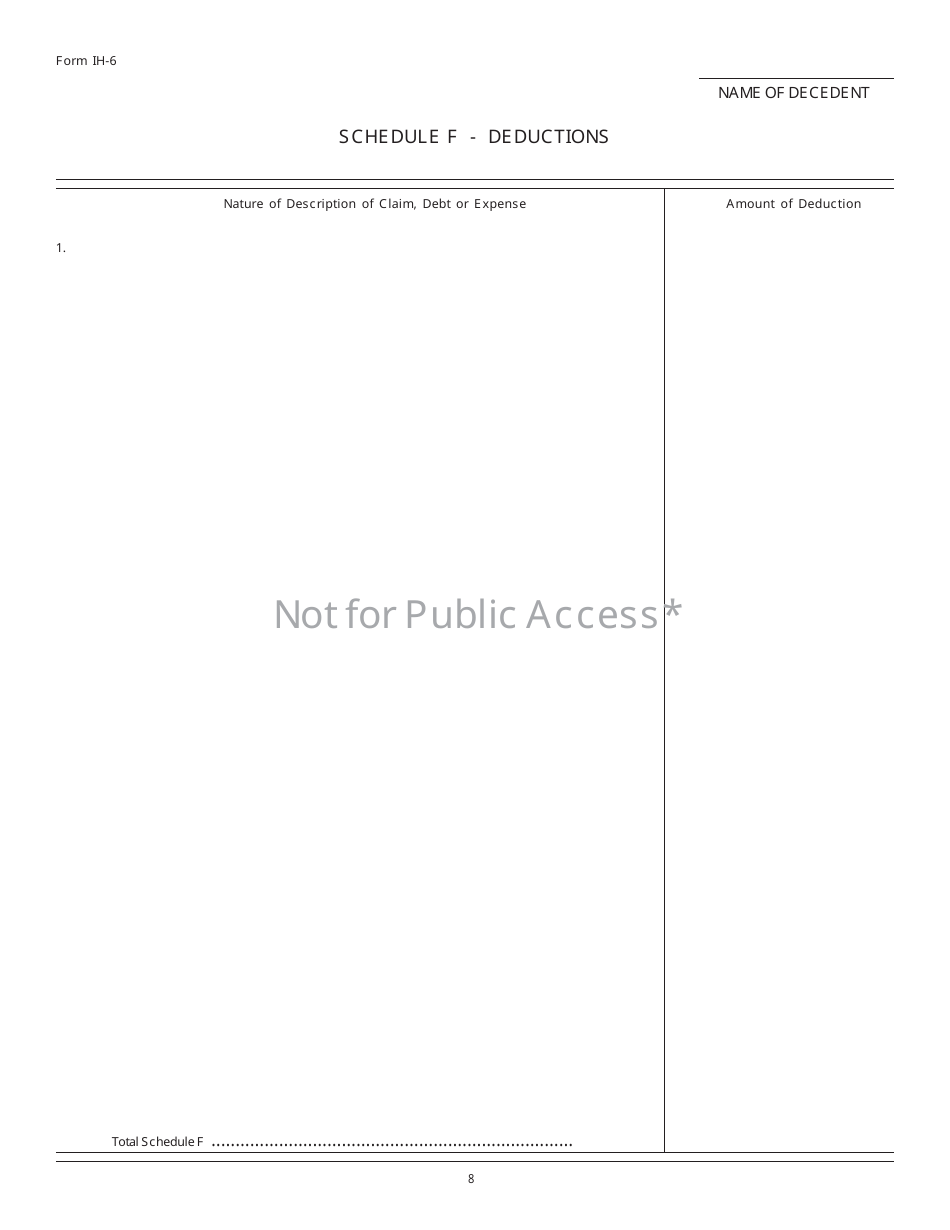

A: Form IH-6 requires information about the decedent, the estate, and the beneficiaries, as well as details about the taxable assets and deductions.

Q: Are there any exemptions or deductions available on Form IH-6?

A: Yes, there are certain exemptions and deductions available on Form IH-6, such as the spousal exemption.

Q: What happens if I fail to file Form IH-6 or pay the inheritance taxes owed?

A: If you fail to file Form IH-6 or pay the inheritance taxes owed, you may be subject to penalties and interest.

Form Details:

- Released on February 1, 2005;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IH-6 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.