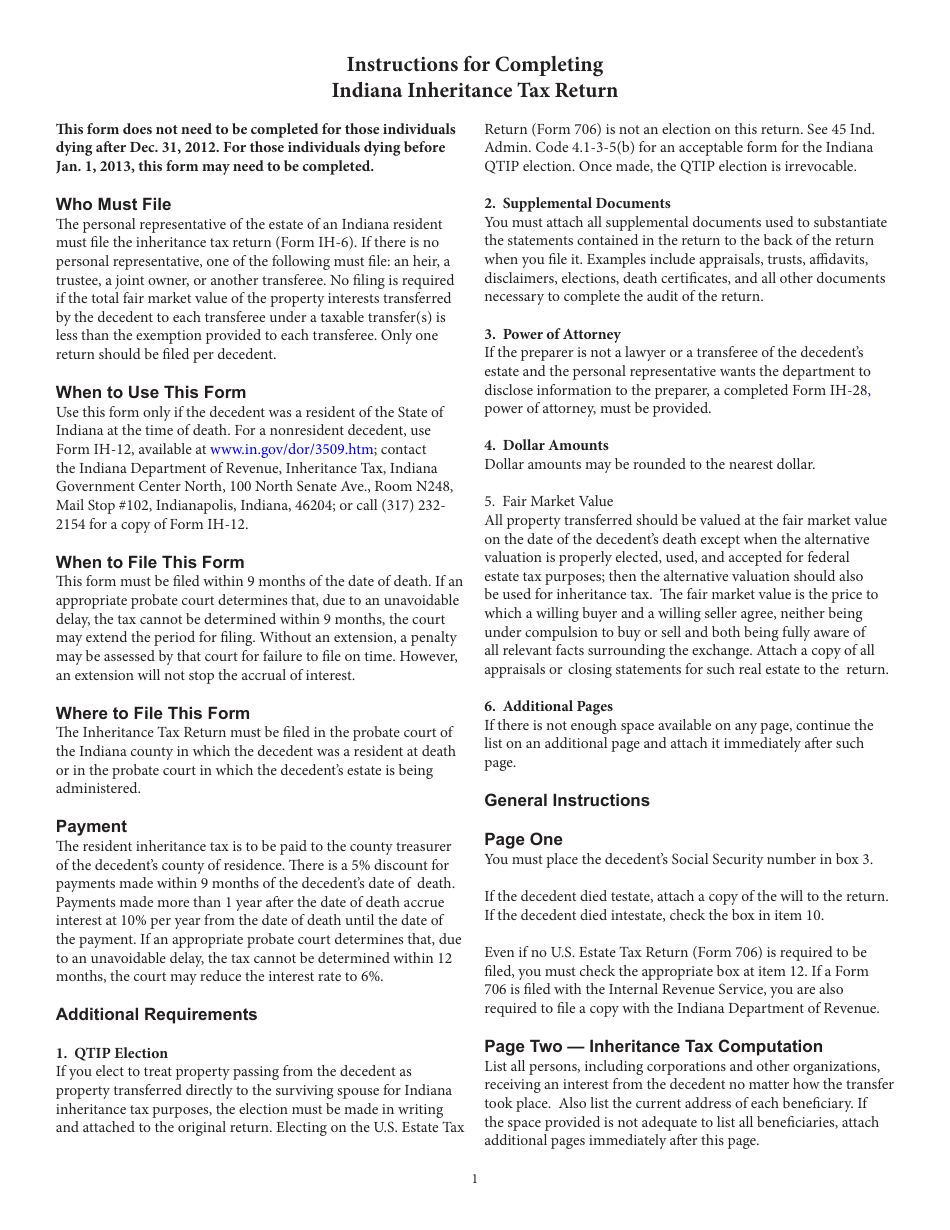

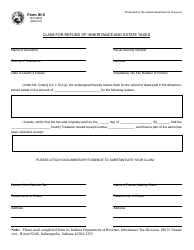

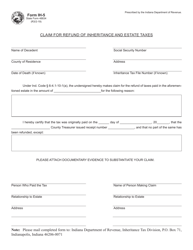

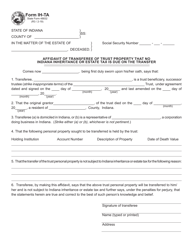

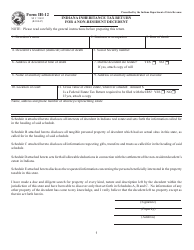

Instructions for Form IH-6 Indiana Inheritance Tax Return - Indiana

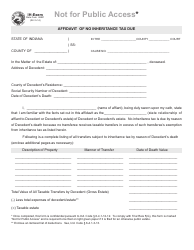

This document contains official instructions for Form IH-6 , Indiana Inheritance Tax Return - a form released and collected by the Indiana Department of Revenue. An up-to-date fillable Form IH-6 is available for download through this link.

FAQ

Q: What is Form IH-6?

A: Form IH-6 is the Indiana Inheritance Tax Return.

Q: Who needs to file Form IH-6?

A: Anyone who is responsible for paying Indiana inheritance tax on behalf of a deceased person's estate needs to file Form IH-6.

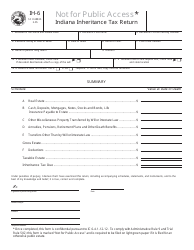

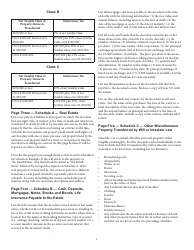

Q: What information do I need to complete Form IH-6?

A: You will need information about the deceased person's estate, including their assets, debts, and beneficiaries.

Q: When is the deadline for filing Form IH-6?

A: Form IH-6 should be filed within nine months from the date of death of the deceased person.

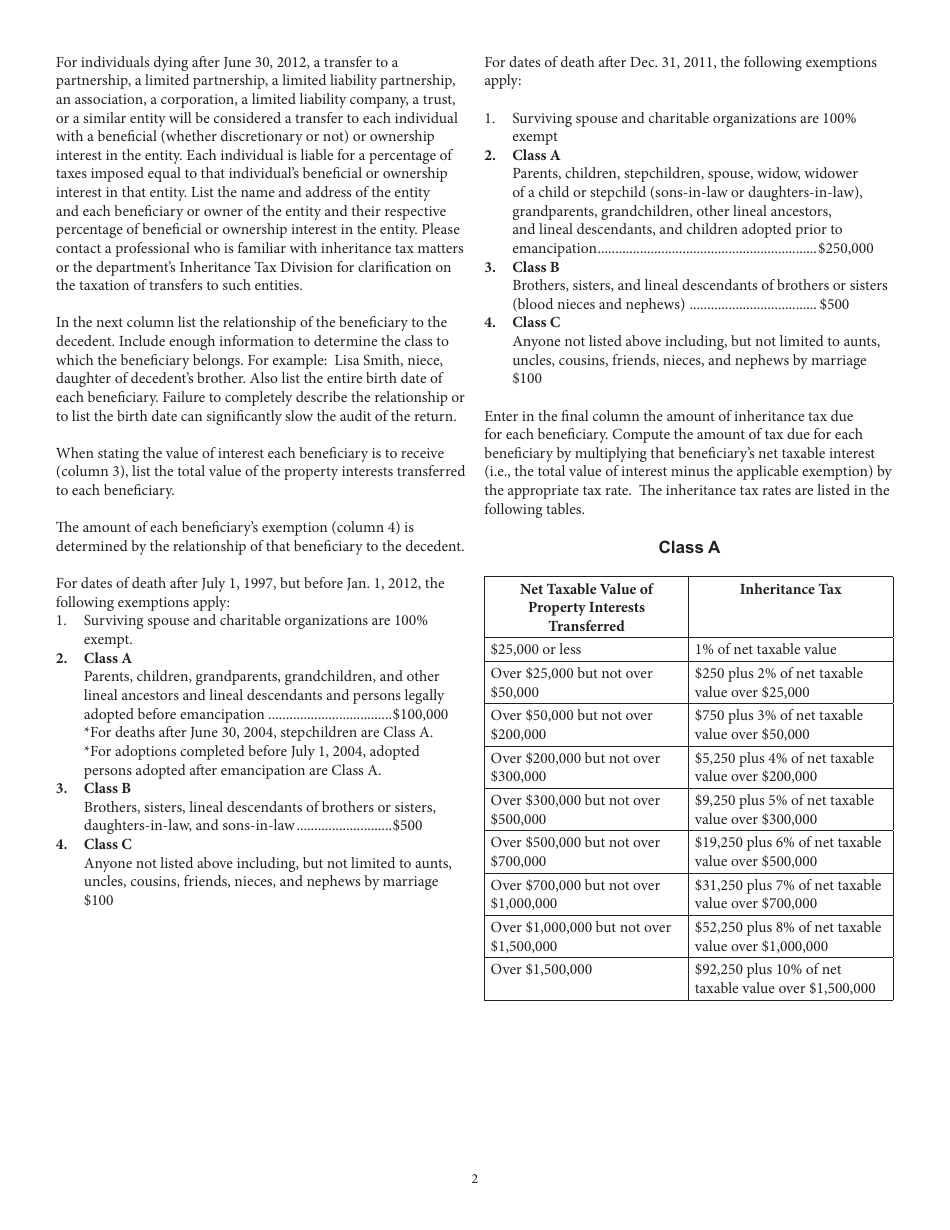

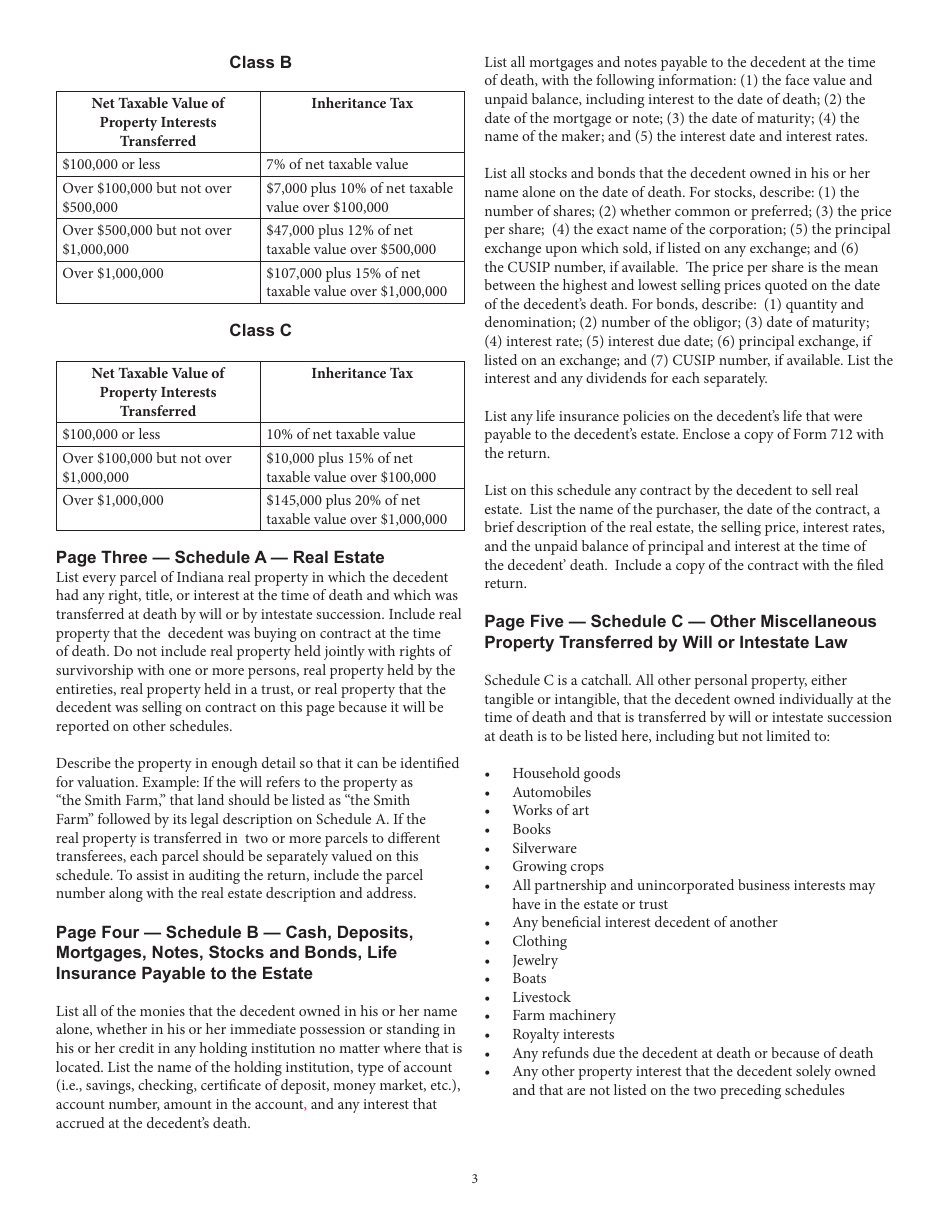

Q: Are there any exemptions or deductions available for Indiana inheritance tax?

A: Yes, there are exemptions and deductions available for certain types of property and transfers. These are detailed in the instructions for Form IH-6.

Q: Do I need to include payment with Form IH-6?

A: Yes, if there is a tax liability, payment should be included with Form IH-6.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Indiana Department of Revenue.