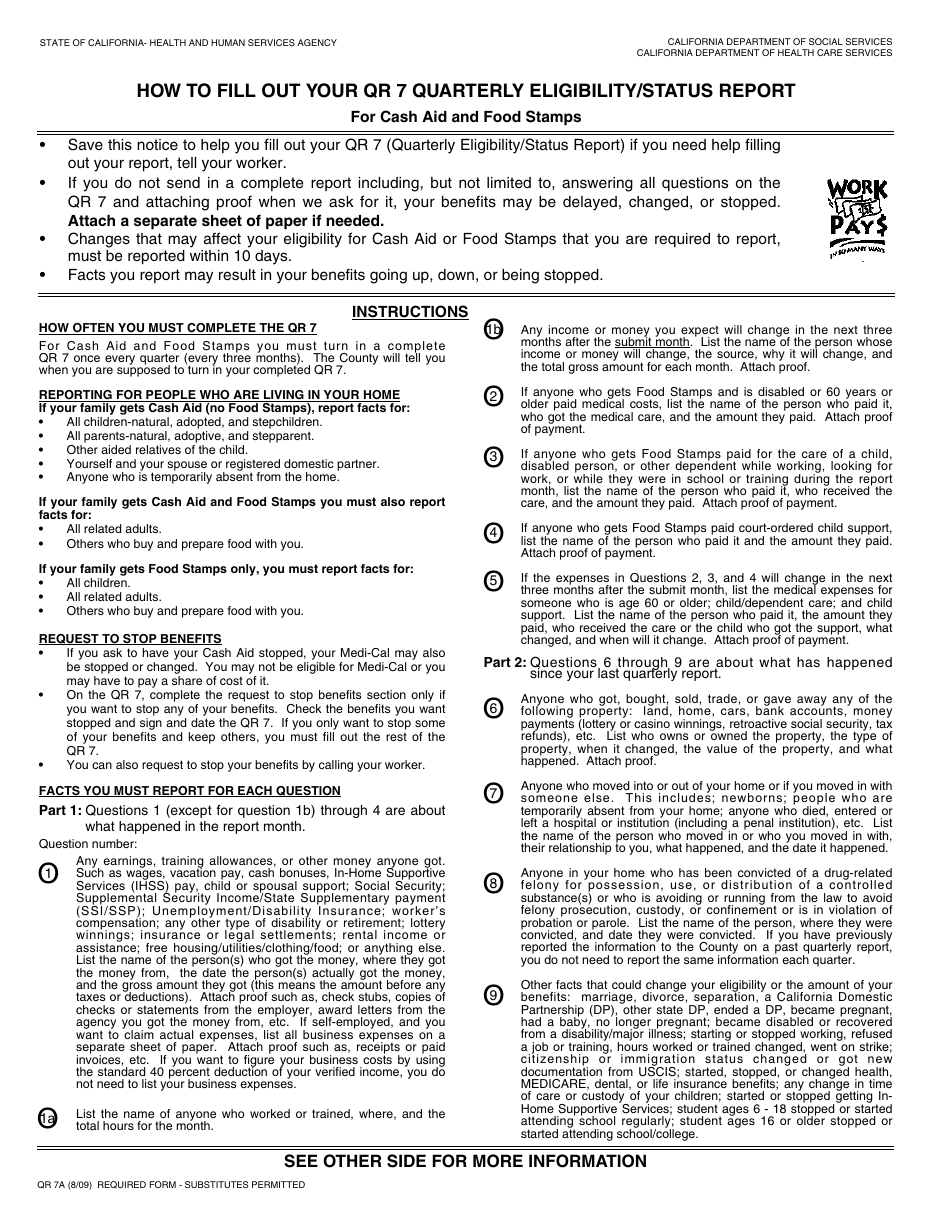

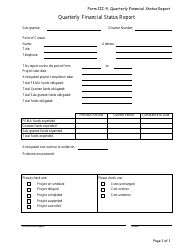

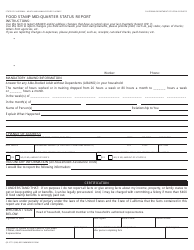

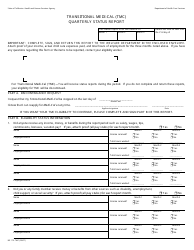

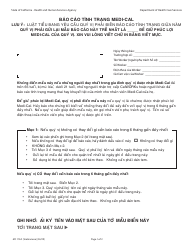

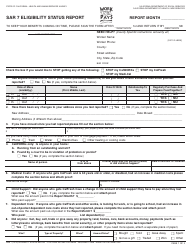

Instructions for Form QR7A, QR-7 Quarterly Eligibility / Status Report - California

This document contains official instructions for Form QR7A , and Form QR-7 . Both forms are released and collected by the California Department of Social Services.

FAQ

Q: What is Form QR7A?

A: Form QR7A is the QR-7 Quarterly Eligibility/Status Report for California.

Q: What is the purpose of Form QR7A?

A: The purpose of Form QR7A is to report your eligibility and status for public assistance programs in California.

Q: Who needs to file Form QR7A?

A: Recipients of public assistance programs in California, such as CalWORKs, CalFresh, and Medi-Cal, need to file Form QR7A.

Q: How often do you need to file Form QR7A?

A: Form QR7A needs to be filed every quarter, or every three months.

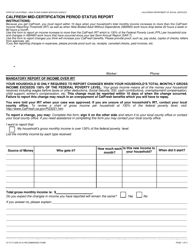

Q: What information do you need to provide on Form QR7A?

A: You need to provide information about your household composition, income, expenses, and any changes in your circumstances.

Q: When is the deadline for filing Form QR7A?

A: The deadline for filing Form QR7A is usually within the first 10 days of the month following the end of the quarter.

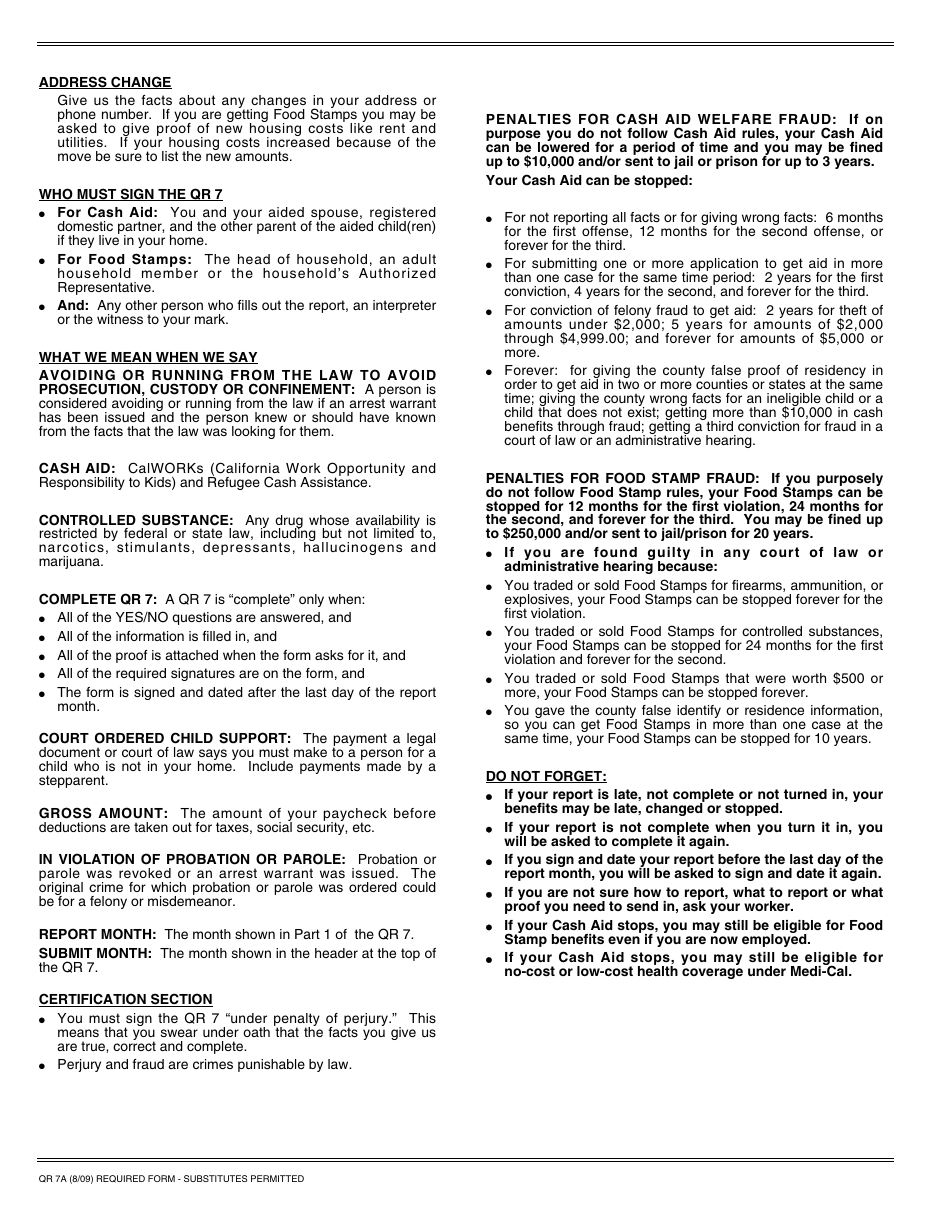

Q: What happens if you don't file Form QR7A?

A: If you fail to file Form QR7A, your public assistance benefits may be discontinued or reduced.

Q: What should you do if you have questions about Form QR7A?

A: If you have questions about Form QR7A, you should contact your local county social services office for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Social Services.