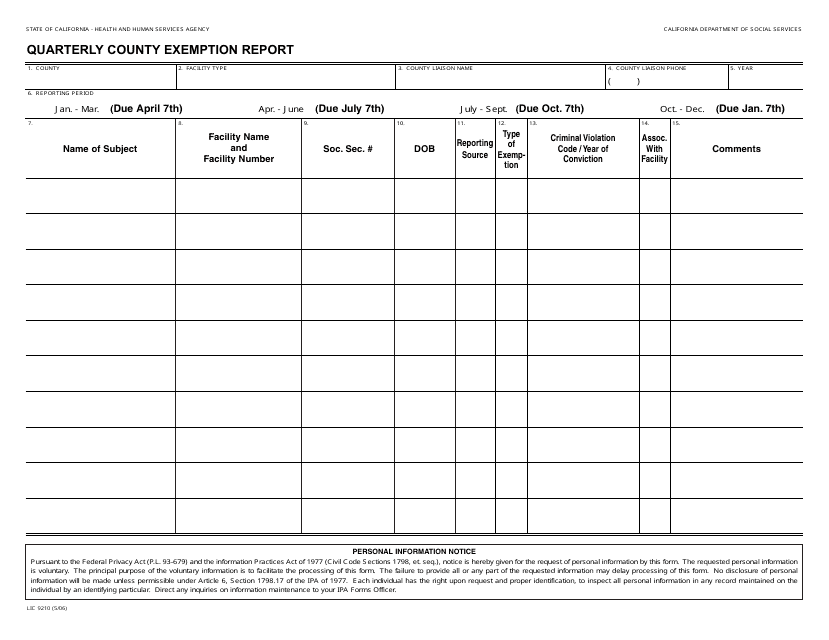

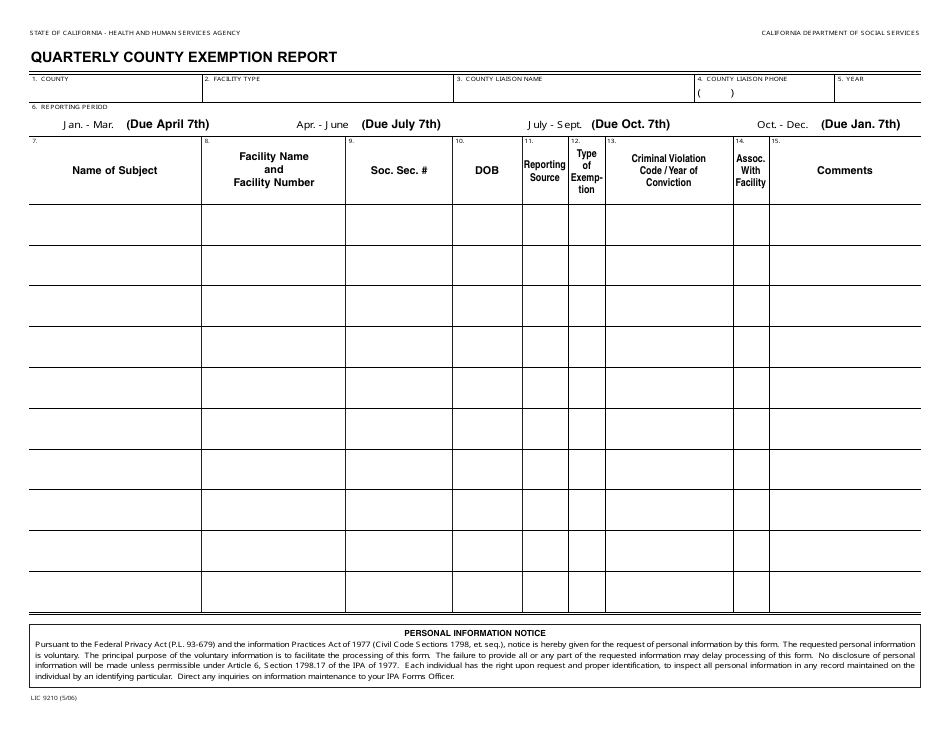

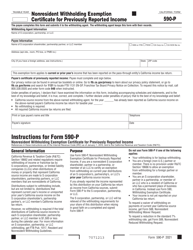

Form LIC9210 Quarterly County Exemption Report - California

What Is Form LIC9210?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

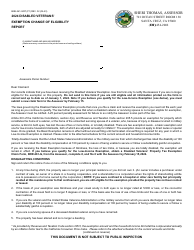

Q: What is LIC9210 Quarterly County Exemption Report?

A: LIC9210 Quarterly County Exemption Report is a form used in California to report exemptions from local business taxes.

Q: Who needs to file the LIC9210 Quarterly County Exemption Report?

A: Businesses in California that are claiming an exemption from local business taxes need to file the LIC9210 Quarterly County Exemption Report.

Q: When is the LIC9210 Quarterly County Exemption Report due?

A: The LIC9210 Quarterly County Exemption Report is due on a quarterly basis.

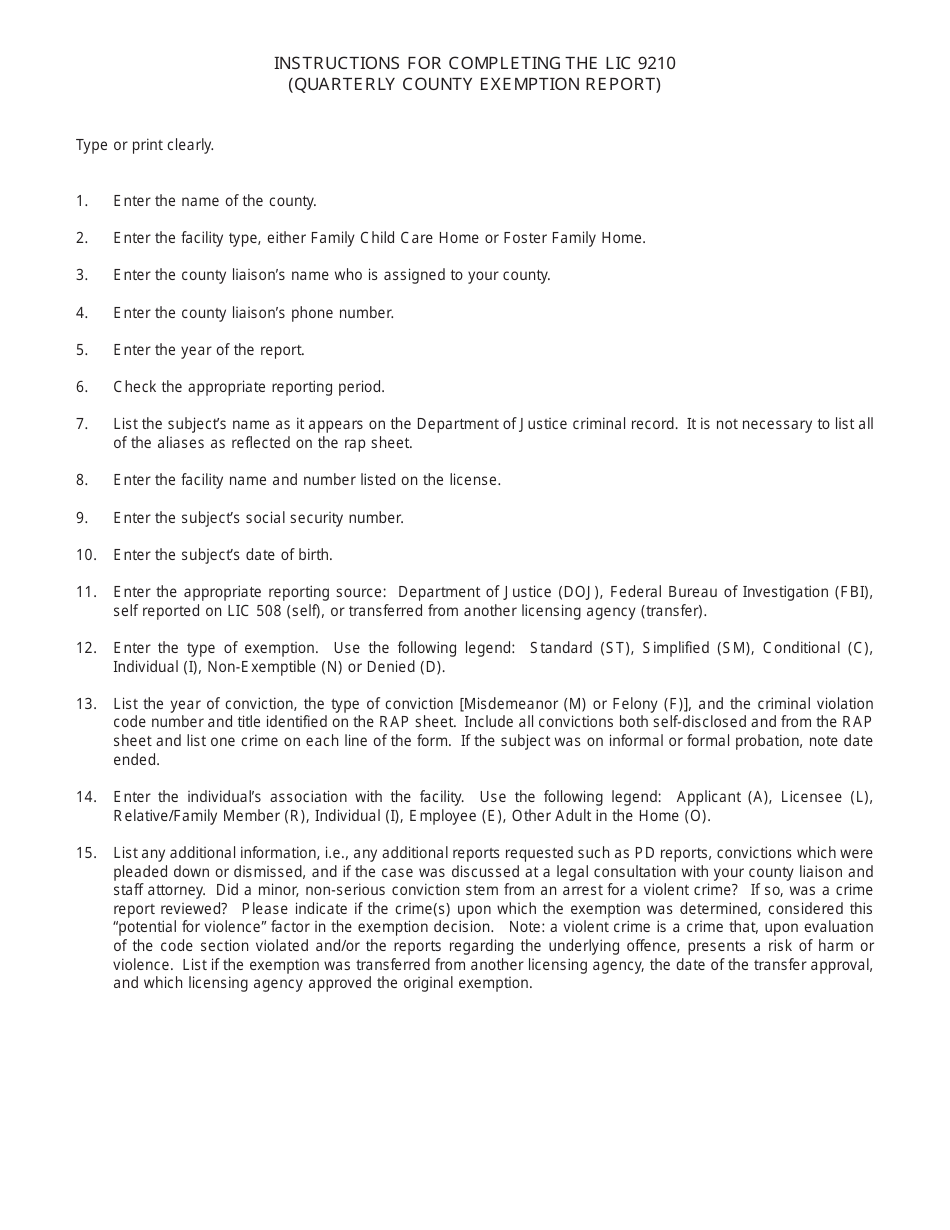

Q: How do I fill out the LIC9210 Quarterly County Exemption Report?

A: The LIC9210 Quarterly County Exemption Report needs to be filled out with information about your business and the reason for claiming the exemption.

Q: What are the consequences of not filing the LIC9210 Quarterly County Exemption Report?

A: Not filing the LIC9210 Quarterly County Exemption Report can result in penalties and fines from the local county tax office.

Form Details:

- Released on May 1, 2006;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC9210 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.