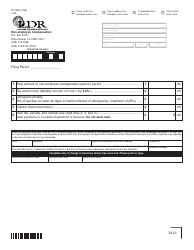

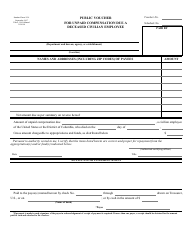

Instructions for Form R-1309 Non-employee Compensation - Louisiana

This document contains official instructions for Form R-1309 , Non-employee Compensation - a form released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-1309 (L-99) is available for download through this link.

FAQ

Q: What is Form R-1309?

A: Form R-1309 is a form used to report non-employee compensation in the state of Louisiana.

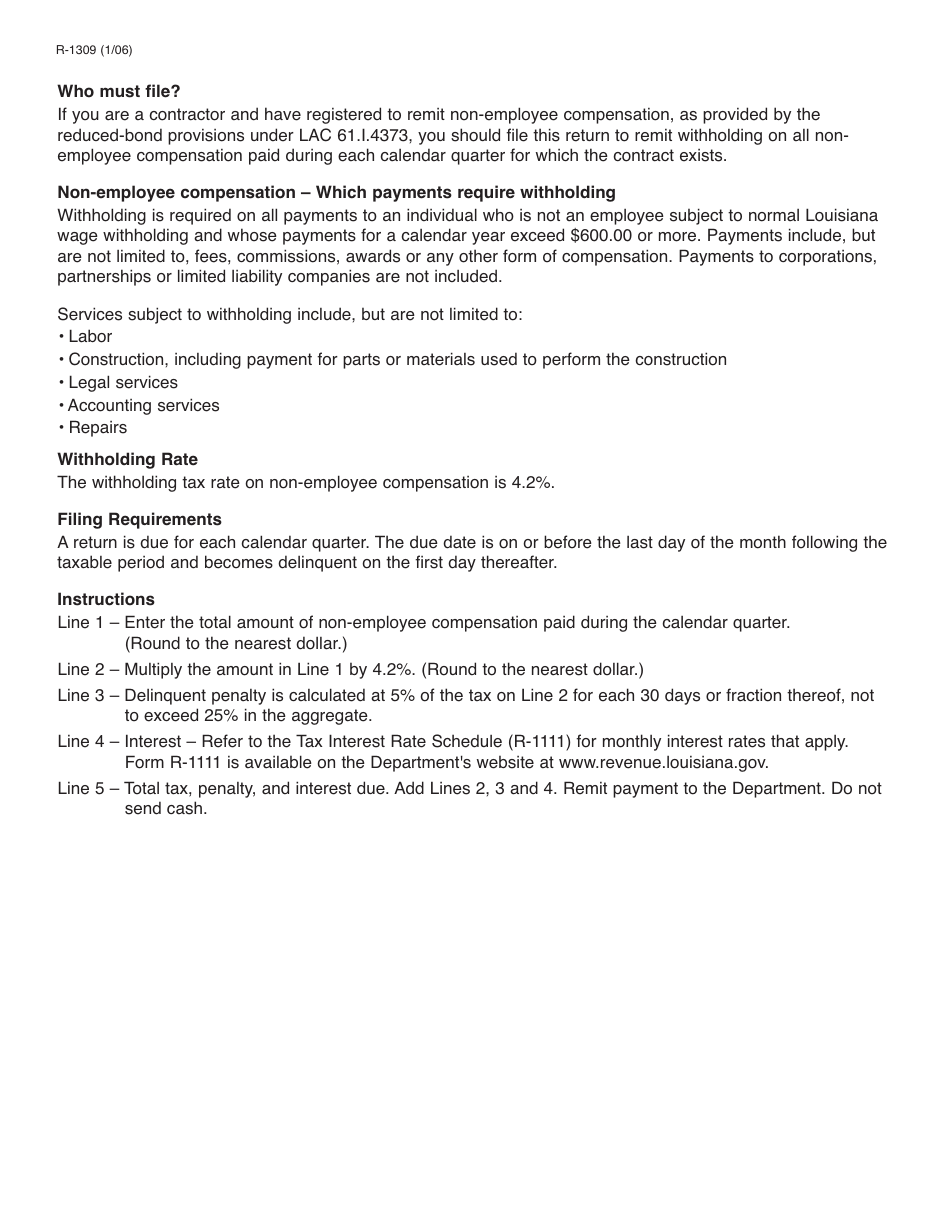

Q: Who needs to file Form R-1309?

A: Individuals or businesses who pay non-employee compensation in Louisiana need to file Form R-1309.

Q: What is considered non-employee compensation?

A: Non-employee compensation includes payments made to independent contractors or self-employed individuals.

Q: Do I need to provide a copy of Form R-1309 to the recipient?

A: Yes, you are required to provide a copy of Form R-1309 to the recipient of the non-employee compensation.

Q: When is the deadline to file Form R-1309?

A: Form R-1309 must be filed by January 31st of the following year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form R-1309. It is important to file on time to avoid these penalties.

Q: Are there any exemptions from filing Form R-1309?

A: There are certain exemptions from filing Form R-1309. It is recommended to consult the instructions or the Louisiana Department of Revenue for more information.

Q: Is Form R-1309 specific to Louisiana?

A: Yes, Form R-1309 is specific to reporting non-employee compensation in the state of Louisiana.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.