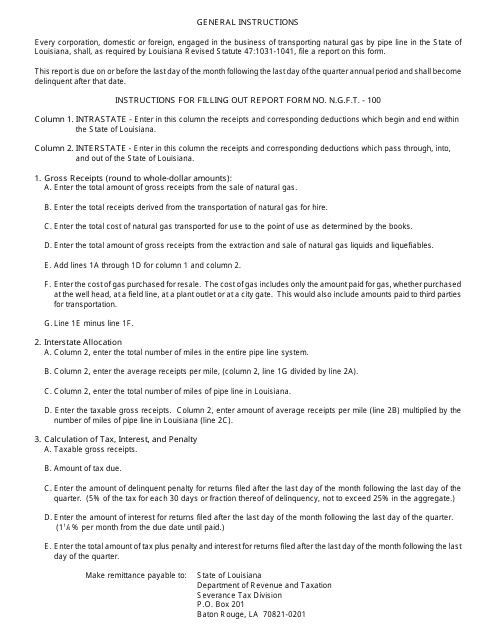

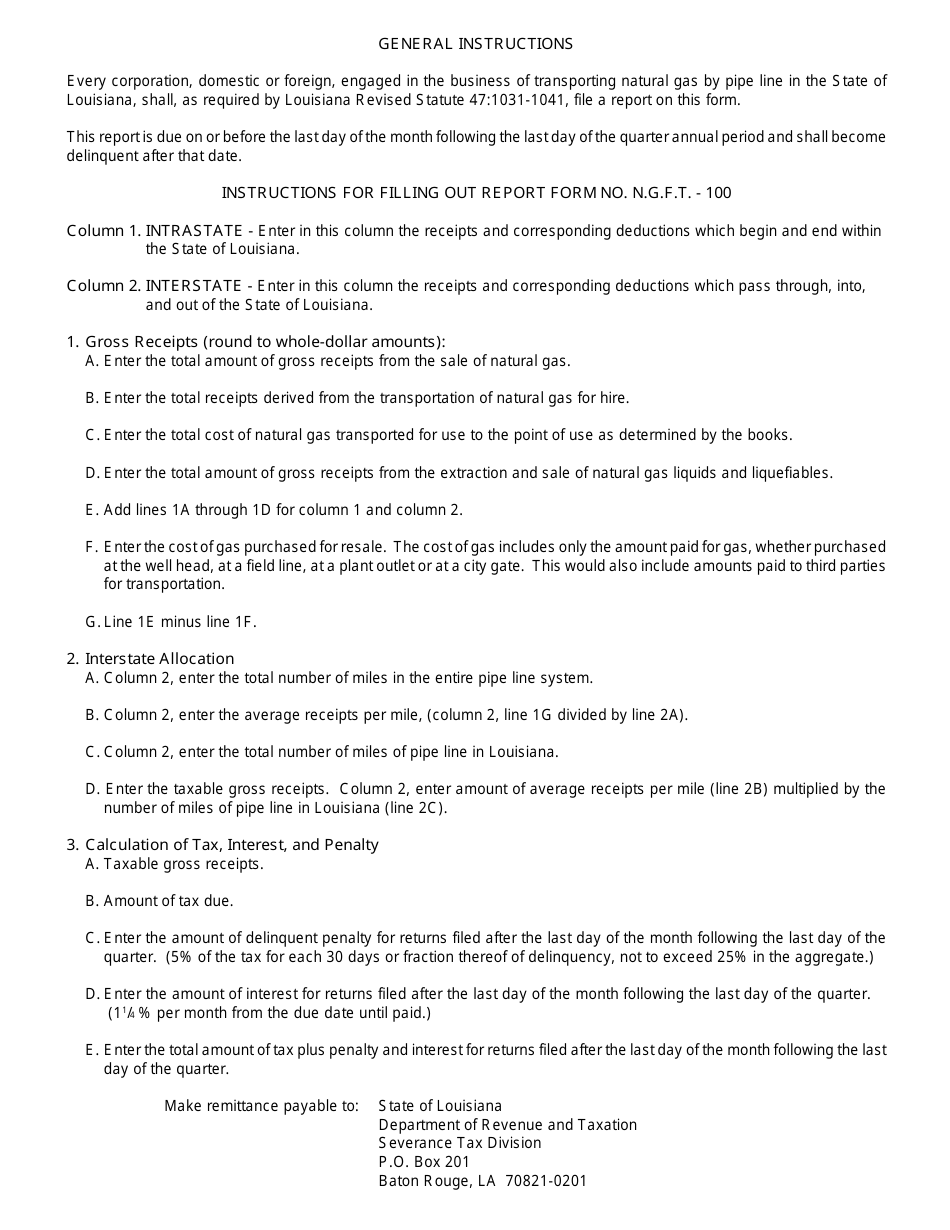

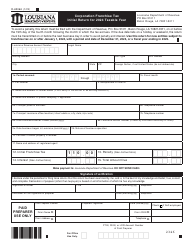

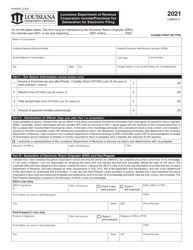

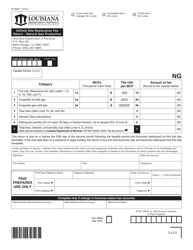

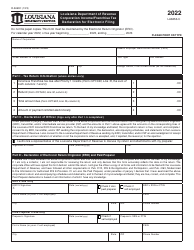

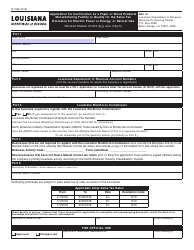

Instructions for Form R-9035, N.G.F.T.-100 Natural Gas Franchise Tax Return - Louisiana

This document contains official instructions for Form R-9035 , and Form N.G.F.T.-100 . Both forms are released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-9035 (N.G.F.T.-100) is available for download through this link.

FAQ

Q: What is Form R-9035?

A: Form R-9035 is the N.G.F.T.-100 Natural GasFranchise Tax Return in Louisiana.

Q: Who needs to file Form R-9035?

A: Natural gas franchise taxpayers in Louisiana need to file Form R-9035.

Q: What is the purpose of Form R-9035?

A: Form R-9035 is used to report and pay the natural gas franchise tax in Louisiana.

Q: What is the due date for filing Form R-9035?

A: Form R-9035 is due on or before the 20th day of the fourth month following the close of the tax year.

Q: What happens if Form R-9035 is filed late?

A: If Form R-9035 is filed late, penalties and interest may be assessed on the unpaid tax amount.

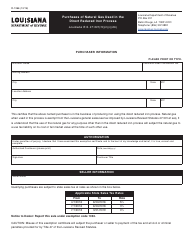

Q: Are there any exemptions or exclusions for the natural gas franchise tax?

A: Yes, certain exemptions and exclusions may apply. Please refer to the instructions for Form R-9035 for more information.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.