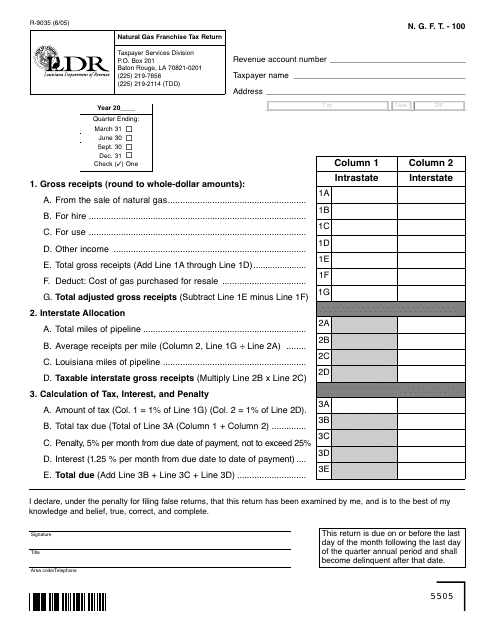

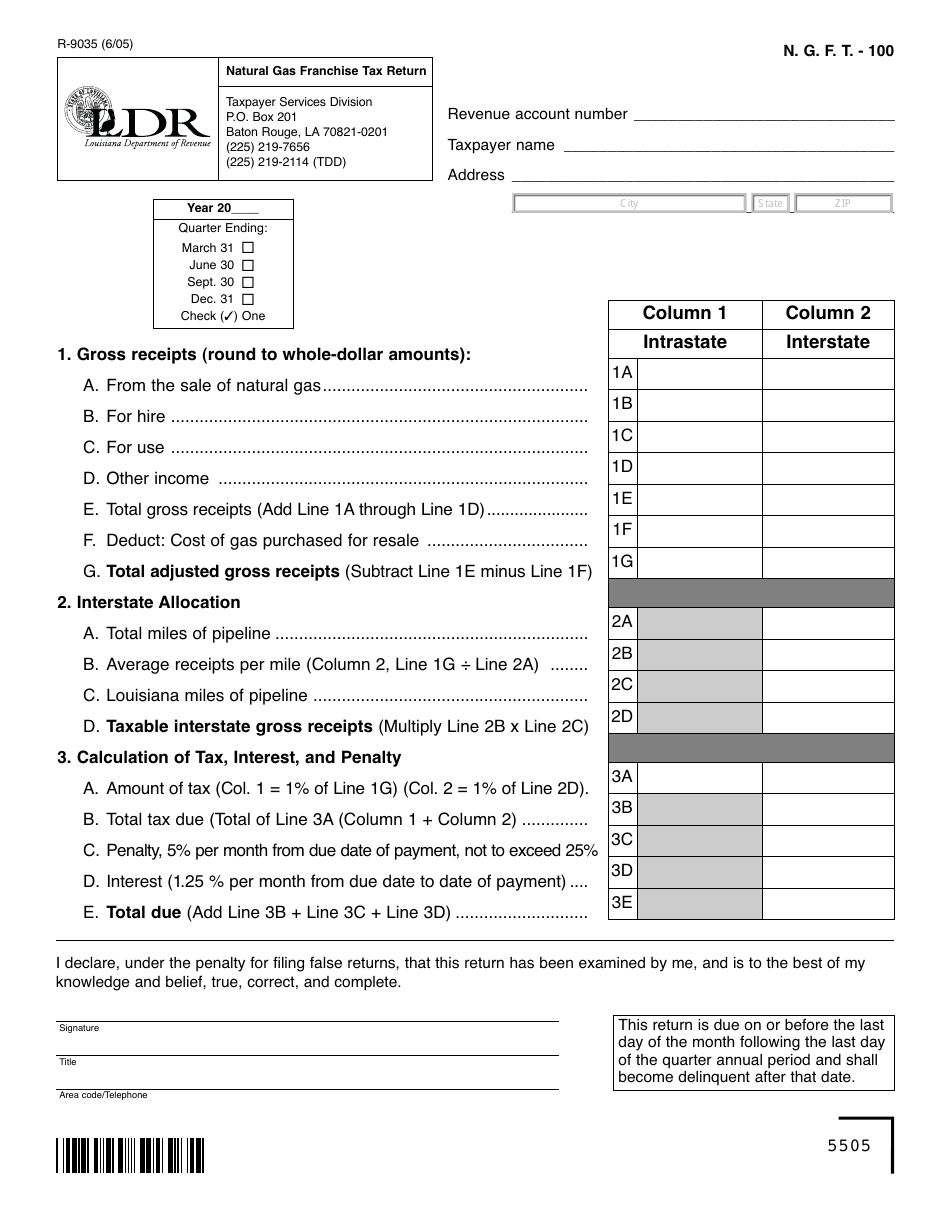

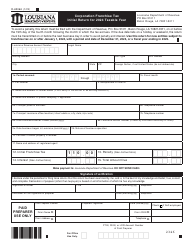

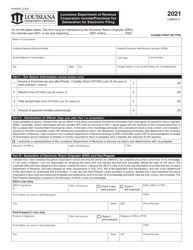

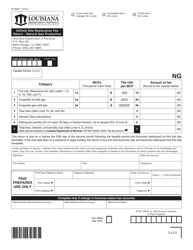

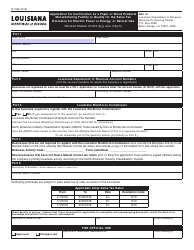

Form R-9035 (N.G.F.T.-100) Natural Gas Franchise Tax Return - Louisiana

What Is Form R-9035 (N.G.F.T.-100)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-9035?

A: Form R-9035 is the Natural GasFranchise Tax Return used in Louisiana.

Q: Who needs to file Form R-9035?

A: Natural gas companies operating in Louisiana need to file Form R-9035.

Q: What is the purpose of Form R-9035?

A: Form R-9035 is used to report and pay the natural gas franchise tax in Louisiana.

Q: When is the due date for filing Form R-9035?

A: The due date for filing Form R-9035 is on or before the 20th day of each month.

Q: Are there any penalties for late filing of Form R-9035?

A: Yes, there are penalties for late filing of Form R-9035. It is important to file on time to avoid penalties.

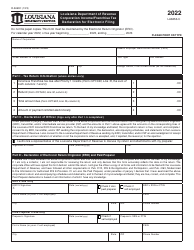

Form Details:

- Released on June 1, 2005;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-9035 (N.G.F.T.-100) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.