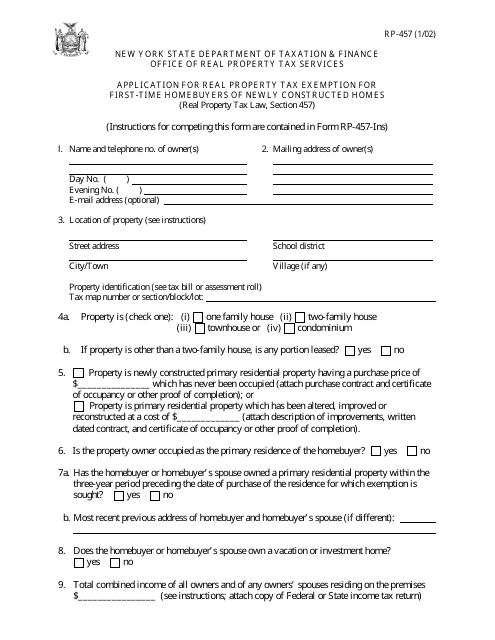

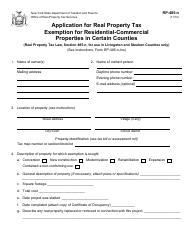

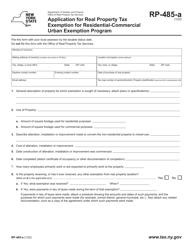

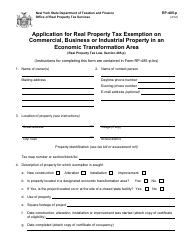

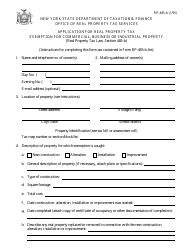

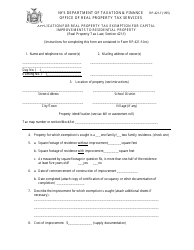

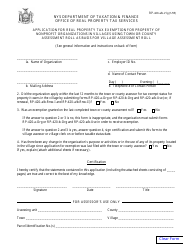

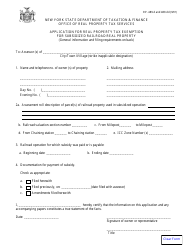

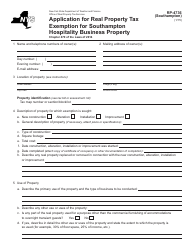

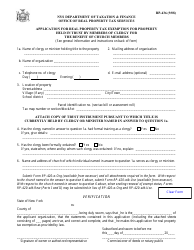

Form RP-457 Application for Real Property Tax Exemption for First-Time Homebuyers of Newly Constructed Homes - New York

What Is Form RP-457?

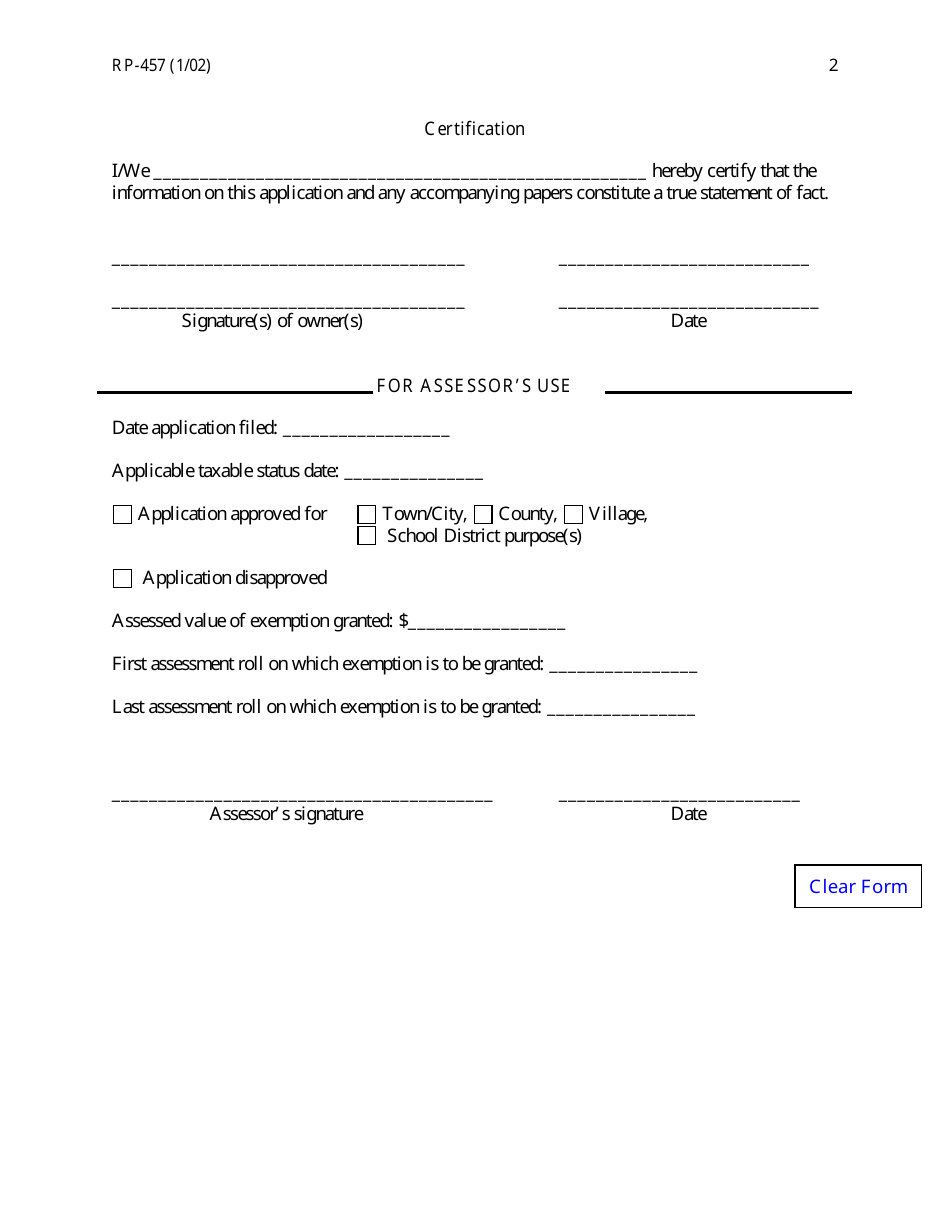

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

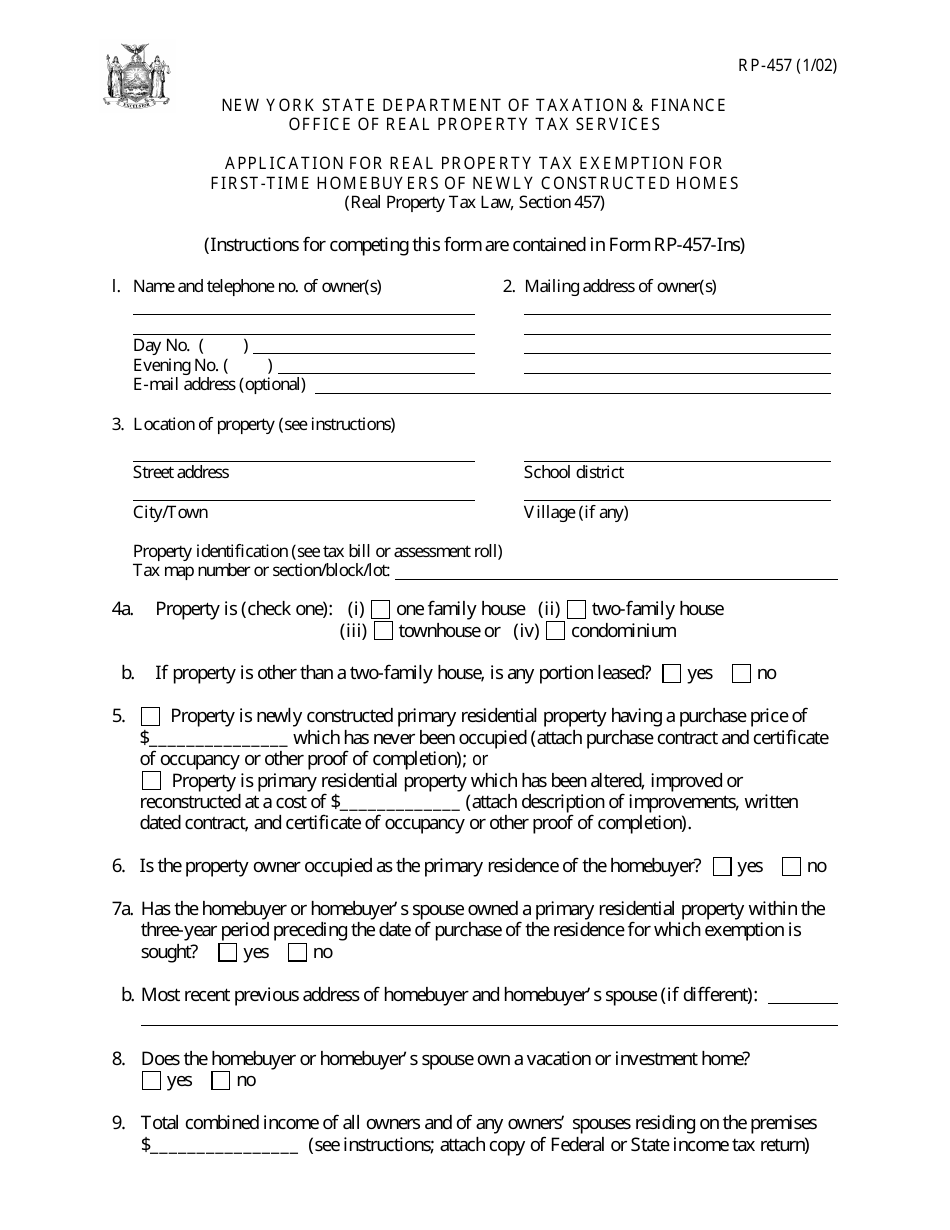

Q: Who can apply for the RP-457 Application for Real Property Tax Exemption?

A: First-time homebuyers of newly constructed homes in New York.

Q: What is the purpose of the RP-457 Application?

A: To apply for a real property tax exemption for first-time homebuyers of newly constructed homes.

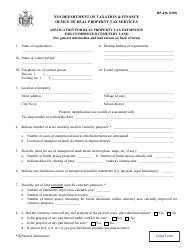

Q: What is the eligibility criteria for the tax exemption?

A: The applicant must be a first-time homebuyer and the home must be newly constructed.

Q: What documents do I need to submit with the application?

A: You will need to provide proof of purchase, proof of residency, and other supporting documents as required.

Q: What is the deadline for submitting the application?

A: The application must be filed with the assessor's office within 30 days of moving into the newly constructed home.

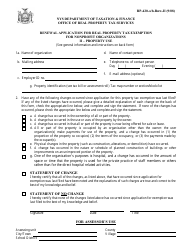

Q: What benefits are provided by the tax exemption?

A: The tax exemption can provide a reduction in property taxes for eligible first-time homebuyers of newly constructed homes.

Q: Is the tax exemption permanent?

A: The tax exemption may be subject to certain conditions and restrictions, and it may expire after a specified period of time.

Q: Can I apply for the tax exemption if I am not a first-time homebuyer?

A: No, the tax exemption is specifically for first-time homebuyers of newly constructed homes.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-457 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.