This version of the form is not currently in use and is provided for reference only. Download this version of

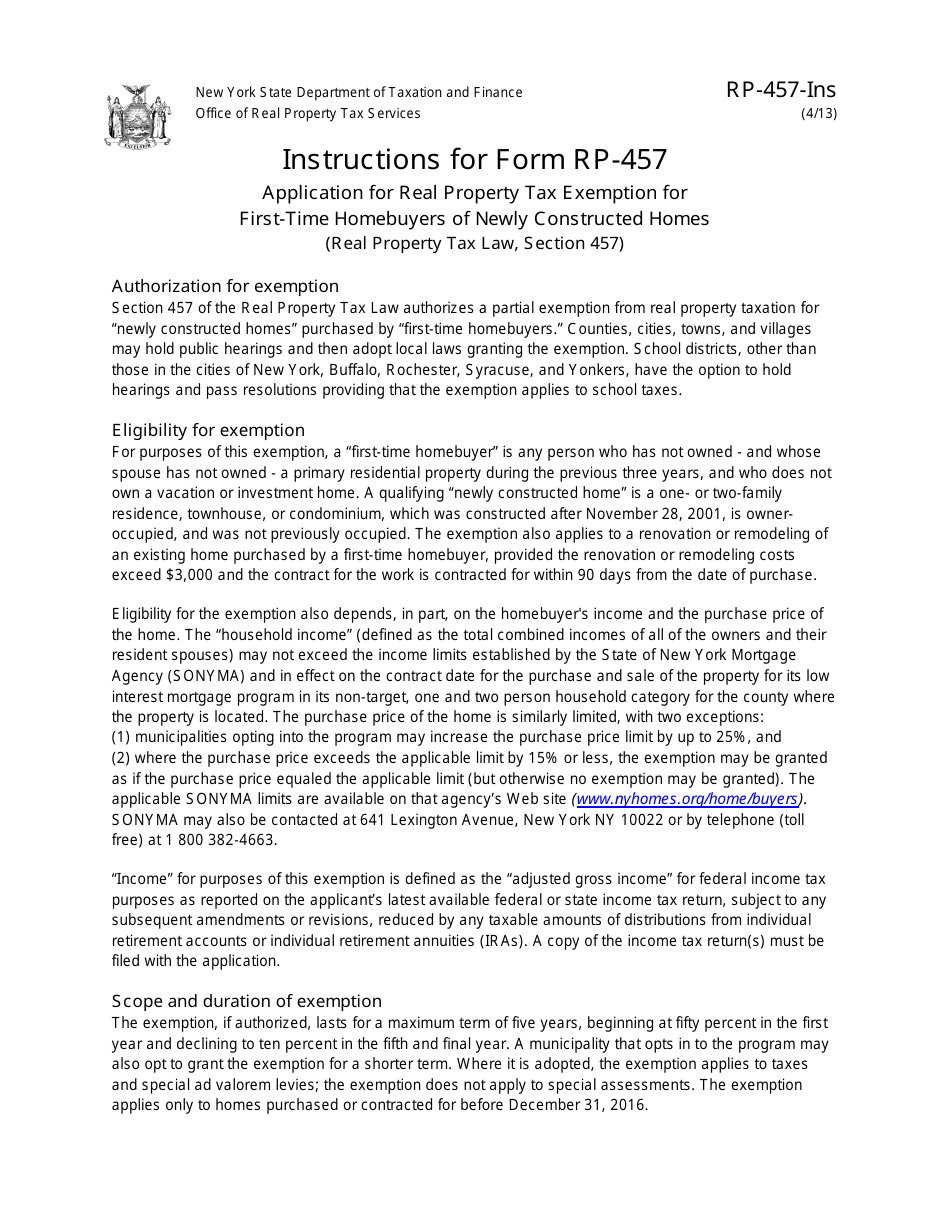

Instructions for Form RP-457

for the current year.

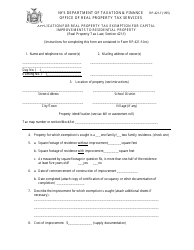

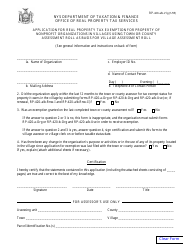

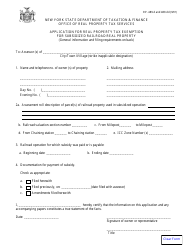

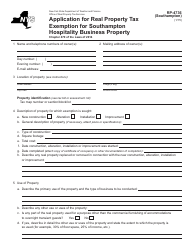

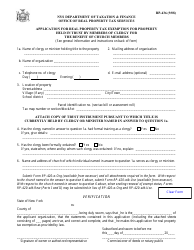

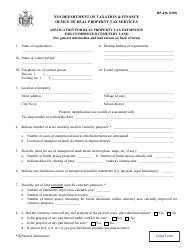

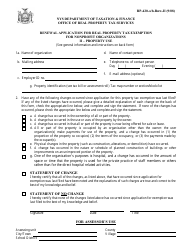

Instructions for Form RP-457 Application for Real Property Tax Exemption for First-Time Homebuyers of Newly Constructed Homes - New York

This document contains official instructions for Form RP-457 , Application for Real Property Tax Exemption for First-Time Homebuyers of Newly Constructed Homes - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-457 is available for download through this link.

FAQ

Q: What is Form RP-457?

A: Form RP-457 is an application for real property tax exemption for first-time homebuyers of newly constructed homes in New York.

Q: Who is eligible to use Form RP-457?

A: First-time homebuyers of newly constructed homes in New York are eligible to use Form RP-457.

Q: What is the purpose of Form RP-457?

A: The purpose of Form RP-457 is to apply for a real property tax exemption for first-time homebuyers of newly constructed homes in New York.

Q: What documents are required to be submitted with Form RP-457?

A: You may need to submit documents such as proof of first-time homebuyer status, a copy of the home purchase contract, and other supporting documents as requested by the assessor's office.

Q: Is there a deadline for submitting Form RP-457?

A: Yes, there is a deadline for submitting Form RP-457. The specific deadline will be indicated on the form or you can check with your local assessor's office for the deadline.

Q: What happens after submitting Form RP-457?

A: After submitting Form RP-457, the assessor's office will review your application and notify you of their decision. If approved, you will receive a real property tax exemption for a certain period of time.

Q: How long does the real property tax exemption last?

A: The duration of the real property tax exemption can vary depending on the specific program and requirements. You should refer to the form instructions or contact your local assessor's office for more information.

Q: Are there any other conditions or requirements for the real property tax exemption?

A: Yes, there may be additional conditions or requirements for the real property tax exemption. You should carefully review the form instructions or consult with your local assessor's office for complete details.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.