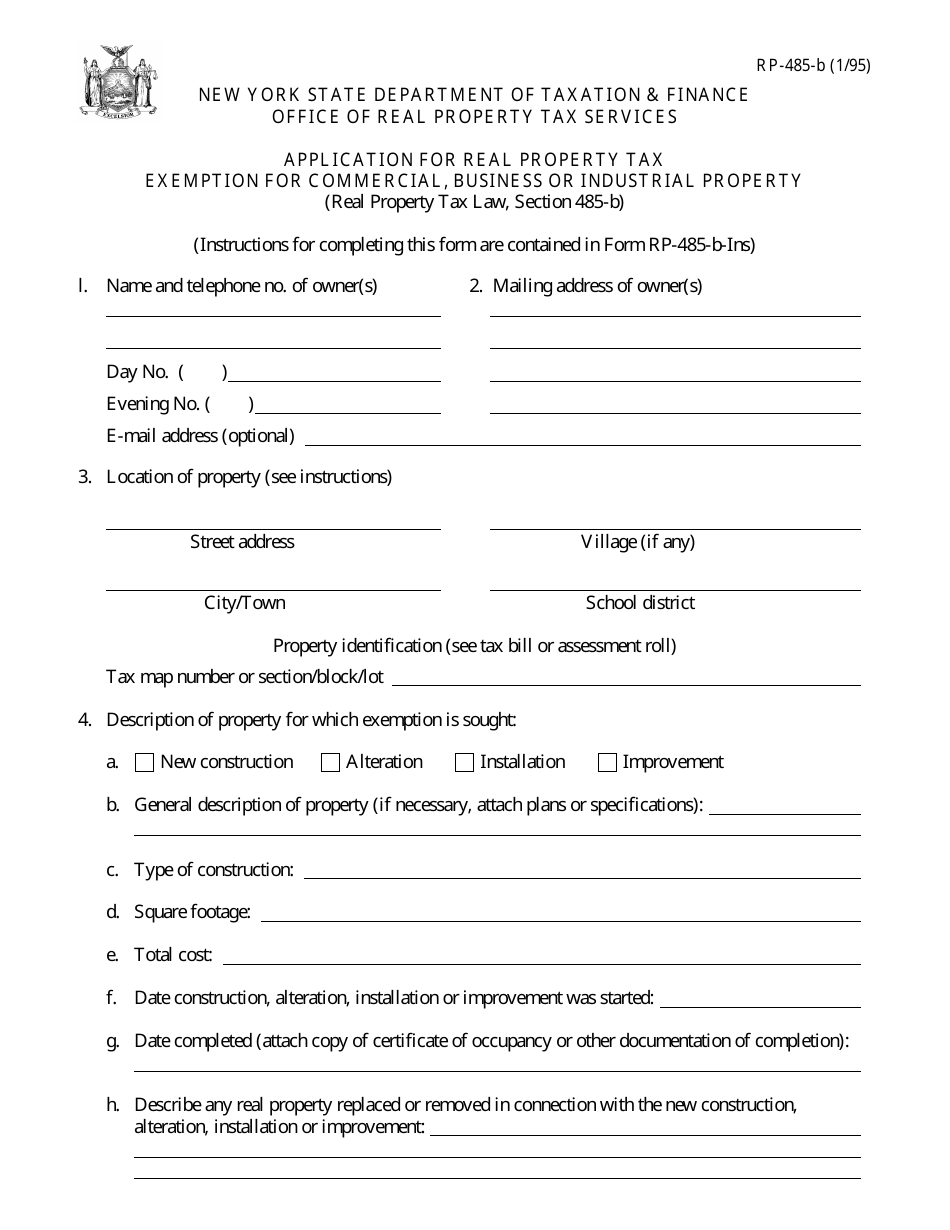

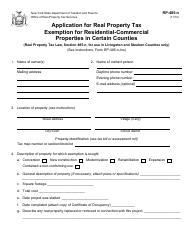

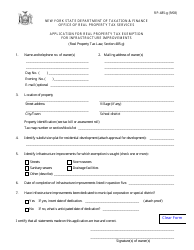

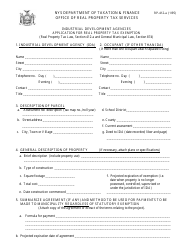

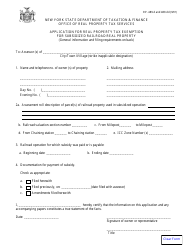

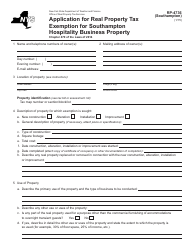

Form RP-485-b Application for Real Property Tax Exemption for Commercial, Business or Industrial Property - New York

What Is Form RP-485-b?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-485-b?

A: Form RP-485-b is an application for real property tax exemption for commercial, business or industrial property in New York.

Q: Who can use Form RP-485-b?

A: This form can be used by owners of commercial, business, or industrial property in New York who are seeking a real property tax exemption.

Q: What is the purpose of Form RP-485-b?

A: The purpose of this form is to apply for a real property tax exemption for commercial, business or industrial property in New York.

Q: Is Form RP-485-b specific to New York?

A: Yes, Form RP-485-b is specific to New York and cannot be used for other states.

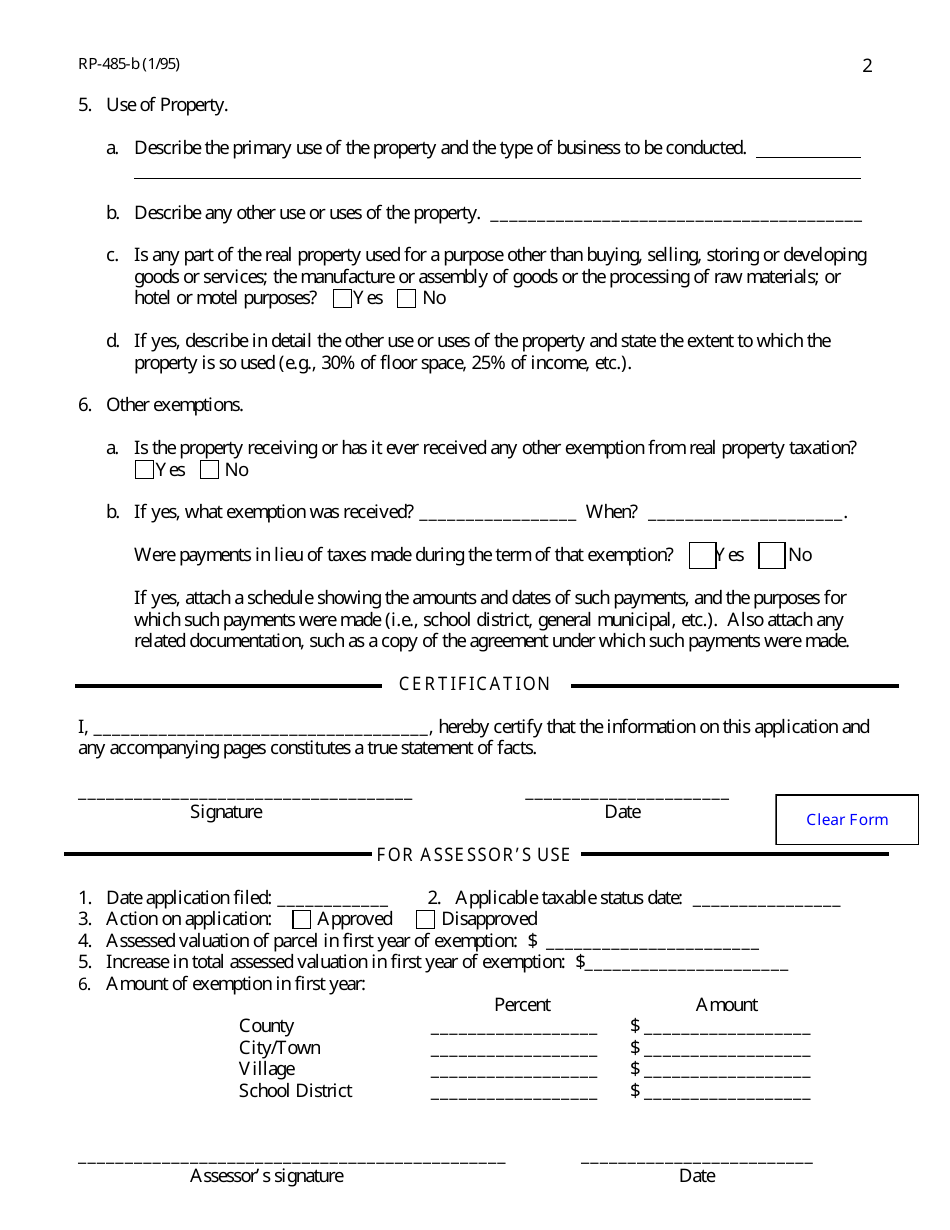

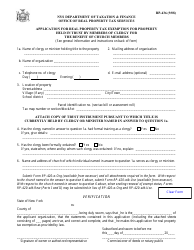

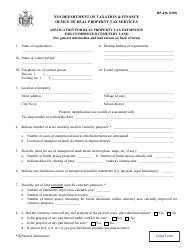

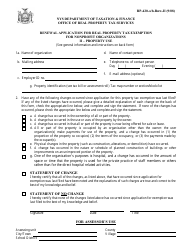

Q: What information is required on Form RP-485-b?

A: The form requires information about the property, the owner, the intended use of the property, and supporting documentation.

Q: Are there any filing fees for Form RP-485-b?

A: There are no filing fees for Form RP-485-b.

Q: What is the deadline for filing Form RP-485-b?

A: The deadline for filing Form RP-485-b is usually March 1st of each year, but it is recommended to check with the local tax office for any variations.

Q: How long does it take to process Form RP-485-b?

A: The processing time for Form RP-485-b can vary, but it typically takes several weeks to several months.

Q: What happens after submitting Form RP-485-b?

A: After submitting Form RP-485-b, the application will be reviewed by the local tax office and a determination will be made regarding the tax exemption eligibility.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-b by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.