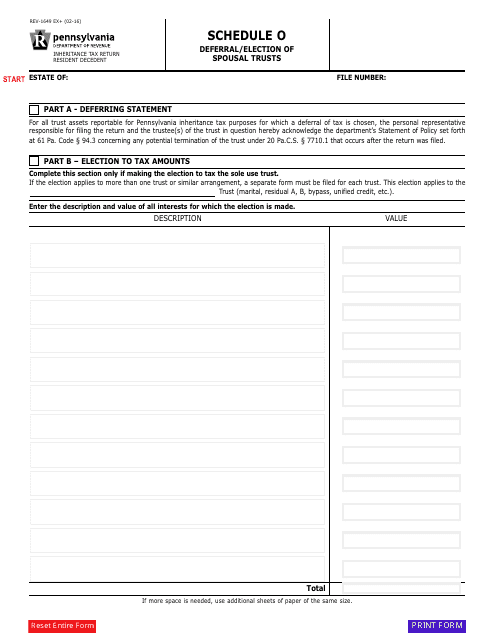

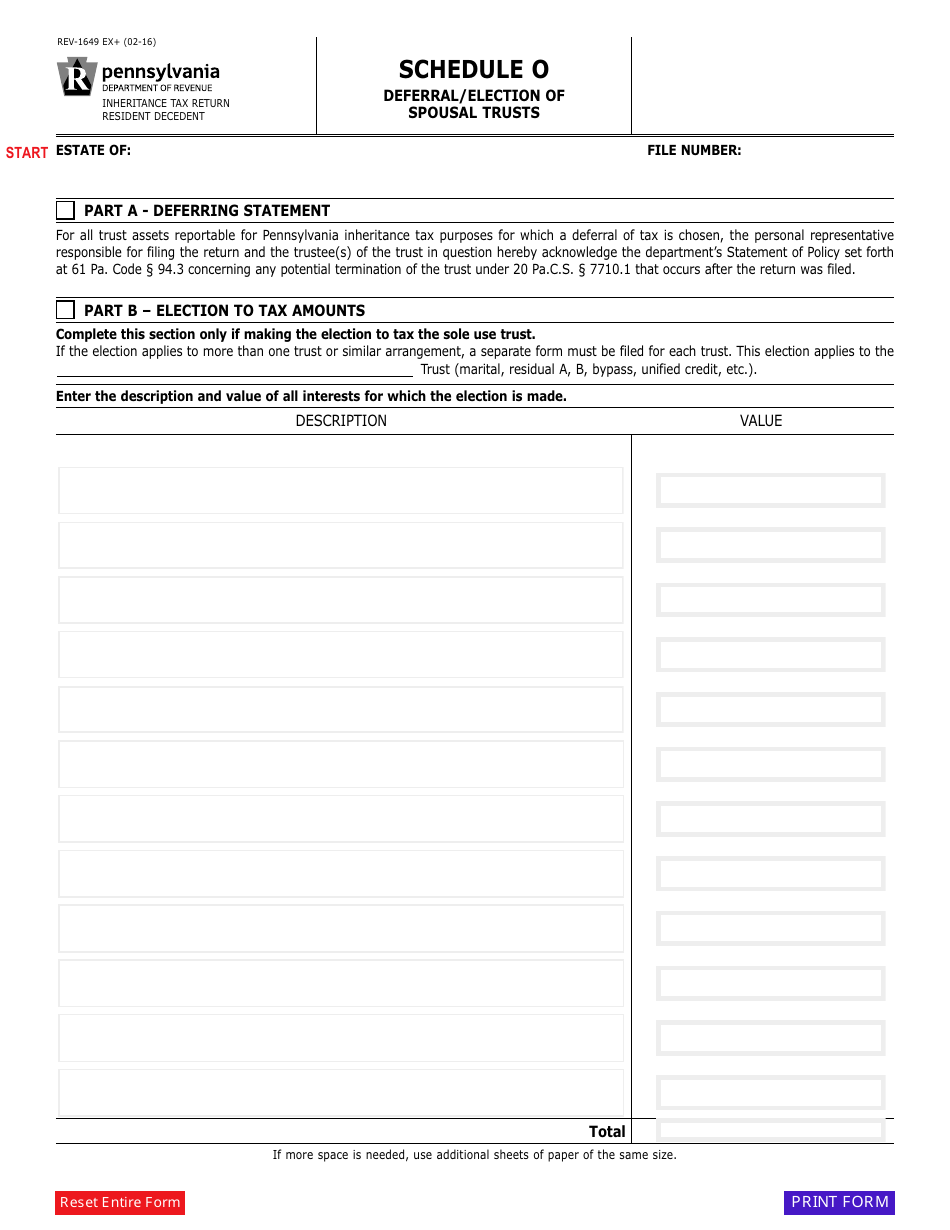

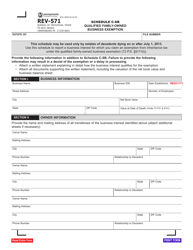

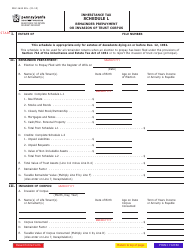

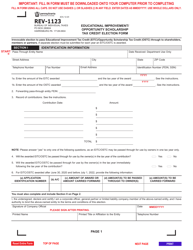

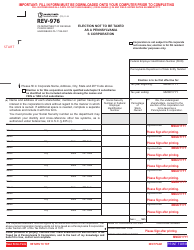

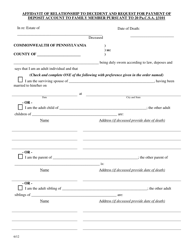

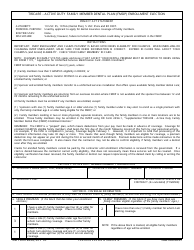

Form REV-1649 Schedule O Deferral / Election of Spousal Trusts - Pennsylvania

What Is Form REV-1649 Schedule O?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

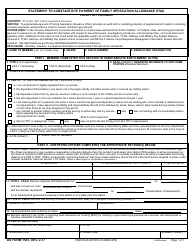

Q: What is Form REV-1649 Schedule O?

A: Form REV-1649 Schedule O is a form used in Pennsylvania to defer or elect spousal trusts.

Q: What is the purpose of Form REV-1649 Schedule O?

A: The purpose of Form REV-1649 Schedule O is to allow taxpayers to defer taxes or make certain elections related to spousal trusts.

Q: Who needs to file Form REV-1649 Schedule O?

A: Taxpayers who have spousal trusts and want to defer taxes or make elections related to these trusts need to file Form REV-1649 Schedule O.

Q: When is the deadline to file Form REV-1649 Schedule O?

A: The deadline to file Form REV-1649 Schedule O is usually the same as the deadline to file your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any specific instructions for completing Form REV-1649 Schedule O?

A: Yes, there are specific instructions provided with the form that explain how to properly complete and submit it.

Q: What should I do if I have questions or need assistance with Form REV-1649 Schedule O?

A: If you have questions or need assistance with Form REV-1649 Schedule O, you can contact the Pennsylvania Department of Revenue or seek help from a tax professional.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1649 Schedule O by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.