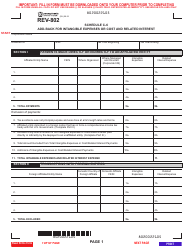

Instructions for Form REV-1647 Schedule M Future Interest Compromise - Pennsylvania

This document contains official instructions for Form REV-1647 Schedule M, Future Interest Compromise - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1647 Schedule M is available for download through this link.

FAQ

Q: What is Form REV-1647?

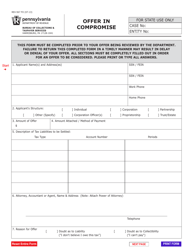

A: Form REV-1647 is a Pennsylvania tax form used to request a compromise on future interest owed.

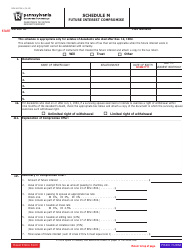

Q: What is Schedule M?

A: Schedule M is a part of Form REV-1647 that provides details about the future interest compromise request.

Q: What is a future interest compromise?

A: A future interest compromise is a request to reduce or eliminate the amount of interest that will be charged on a tax liability.

Q: How do I complete Schedule M?

A: You need to provide certain information, such as your contact details, tax period, tax liability amount, and reasons for requesting the compromise.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.