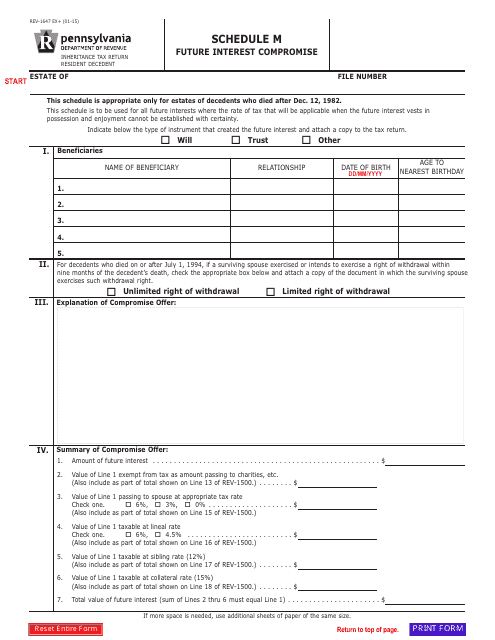

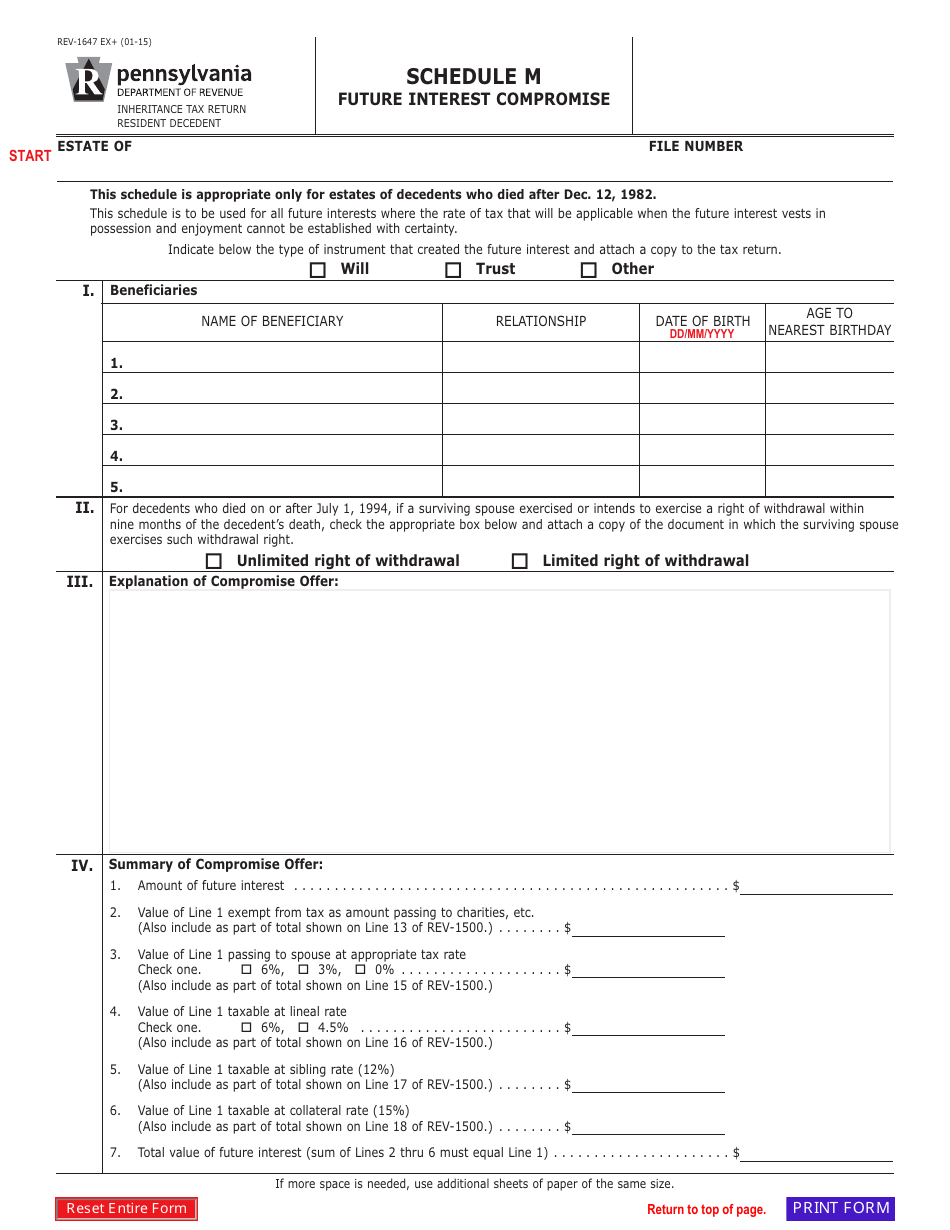

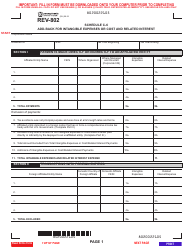

Form REV-1647 Schedule M Future Interest Compromise - Pennsylvania

What Is Form REV-1647 Schedule M?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a REV-1647 Schedule M Future Interest Compromise?

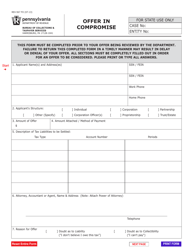

A: The REV-1647 Schedule M Future Interest Compromise is a form used in Pennsylvania for individuals or businesses that owe future interest on a tax delinquency and want to negotiate a compromise with the Pennsylvania Department of Revenue (DOR).

Q: Who is eligible to use the REV-1647 Schedule M Future Interest Compromise form?

A: Any individual or business that owes future interest on a tax delinquency in Pennsylvania can use the REV-1647 Schedule M Future Interest Compromise form to negotiate a compromise with the DOR.

Q: What is the purpose of the REV-1647 Schedule M form?

A: The purpose of the REV-1647 Schedule M form is to allow individuals or businesses to propose a compromise plan to the DOR for the future interest owed on a tax delinquency.

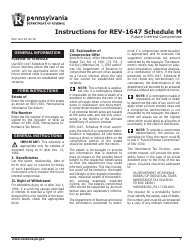

Q: How does the REV-1647 Schedule M Future Interest Compromise process work?

A: The process begins with the taxpayer completing the REV-1647 Schedule M form, proposing a compromise plan for the future interest owed. This form is then submitted to the DOR for review and consideration. The DOR will evaluate the proposal and may accept, reject, or propose modifications to the compromise plan. If the proposal is accepted, the taxpayer will enter into a written agreement with the DOR to fulfill the terms of the compromise.

Q: What are the benefits of using the REV-1647 Schedule M Future Interest Compromise process?

A: Using the REV-1647 Schedule M Future Interest Compromise process can provide individuals or businesses with an opportunity to negotiate a reduced amount of future interest on a tax delinquency and potentially avoid penalties and other consequences of non-payment.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1647 Schedule M by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.