Instructions for Form REV-1512 Schedule I Debts of Decedent, Mortgage Liabilities & Liens - Pennsylvania

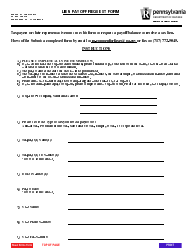

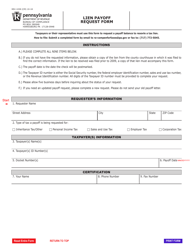

This document contains official instructions for Form REV-1512 Schedule I, Debts of Decedent, Mortgage Liabilities & Liens - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1512 Schedule I is available for download through this link.

FAQ

Q: What is Form REV-1512 Schedule I?

A: Form REV-1512 Schedule I is a schedule used in Pennsylvania to report debts of a deceased individual, including mortgage liabilities and liens.

Q: When should I file Form REV-1512 Schedule I?

A: Form REV-1512 Schedule I should be filed as part of the Pennsylvania inheritance tax return within 9 months after the date of death.

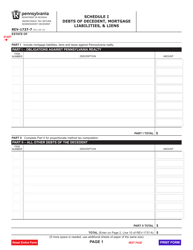

Q: What information do I need to provide on Form REV-1512 Schedule I?

A: You need to provide the details of any debts, mortgage liabilities, and liens that the decedent had at the time of their death, including the names of creditors and the amounts owed.

Q: Are all debts reported on Form REV-1512 Schedule I subject to inheritance tax?

A: No, not all debts are subject to inheritance tax. Only certain types of debts, such as mortgages and liens, need to be reported on this form.

Q: Do I need to attach any supporting documents with Form REV-1512 Schedule I?

A: Yes, you may need to attach supporting documents such as loan statements, mortgages, and other relevant paperwork to substantiate the reported debts.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.