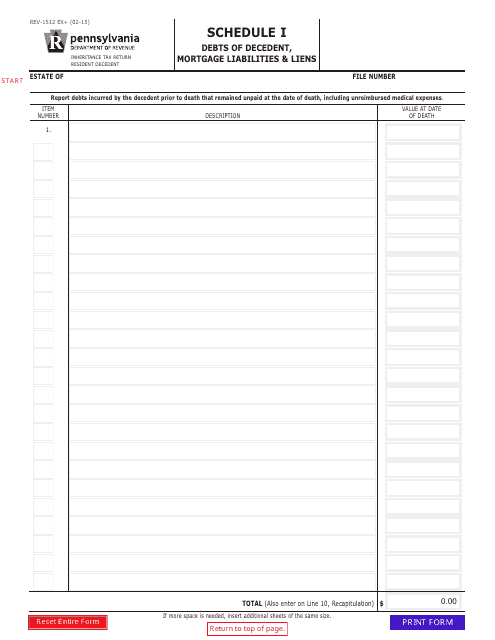

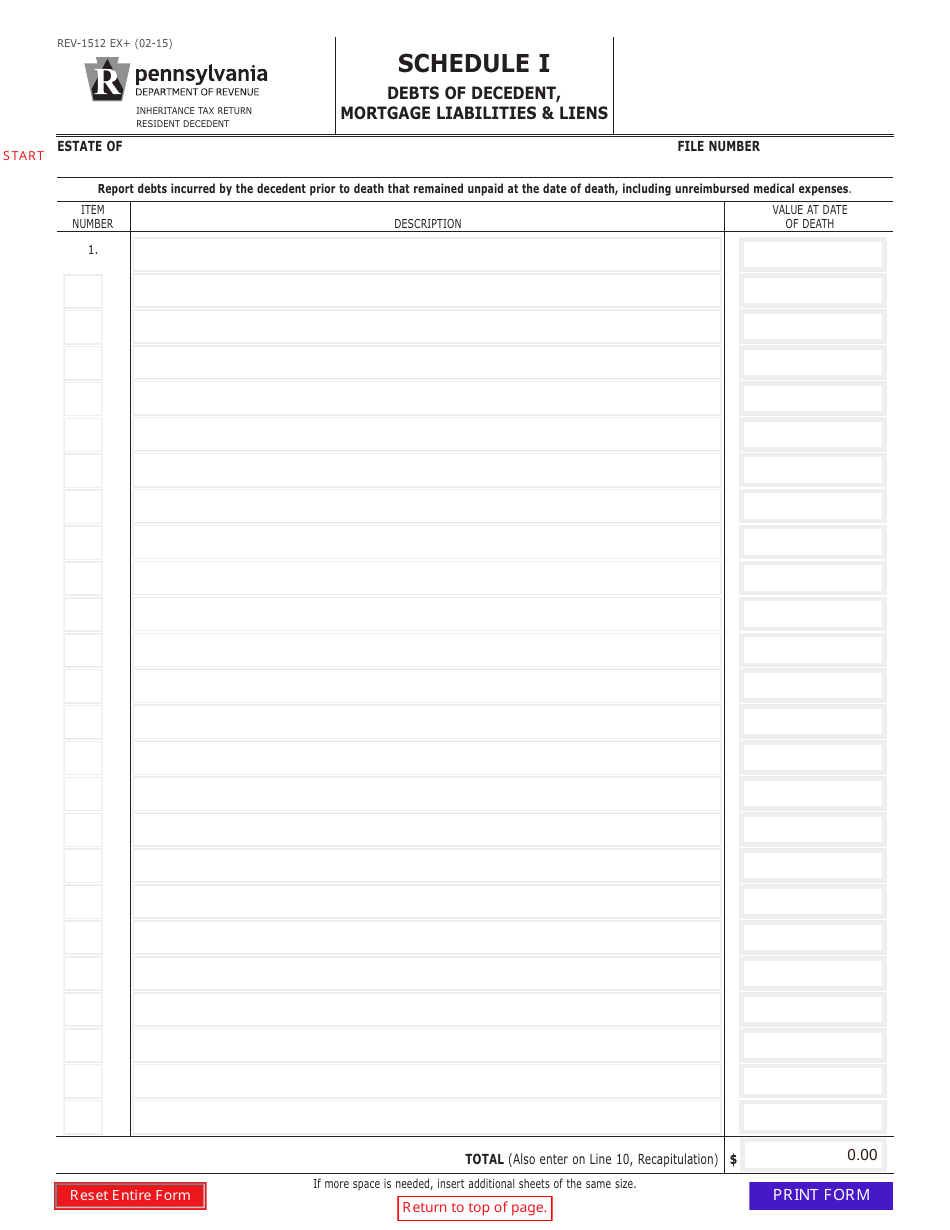

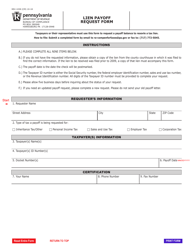

Form REV-1512 Schedule I Debts of Decedent, Mortgage Liabilities & Liens - Pennsylvania

What Is Form REV-1512 Schedule I?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form REV-1512 Schedule I?

A: Form REV-1512 Schedule I is a document used in Pennsylvania to report the debts, mortgage liabilities, and liens of a deceased person.

Q: What does Schedule I of Form REV-1512 cover?

A: Schedule I of Form REV-1512 covers the debts, mortgage liabilities, and liens of the decedent.

Q: Why is it important to report debts, mortgage liabilities, and liens?

A: Reporting debts, mortgage liabilities, and liens is important to accurately determine the estate's financial obligations and distribute assets.

Q: Who needs to fill out and file Form REV-1512 Schedule I?

A: The executor or administrator of the estate needs to fill out and file Form REV-1512 Schedule I.

Q: When is Form REV-1512 Schedule I due?

A: Form REV-1512 Schedule I is typically due within 9 months from the date of the decedent's death.

Q: Are there any penalties for not filing Form REV-1512 Schedule I?

A: Yes, there may be penalties for not filing Form REV-1512 Schedule I, including interest charges and potential legal consequences.

Q: Can I amend Form REV-1512 Schedule I if I made a mistake?

A: Yes, you can amend Form REV-1512 Schedule I if you made a mistake. You should file an amended schedule as soon as possible.

Q: Do I need to attach supporting documentation to Form REV-1512 Schedule I?

A: No, you do not need to attach supporting documentation to Form REV-1512 Schedule I when filing, but you should keep it in your records in case of an audit.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1512 Schedule I by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.