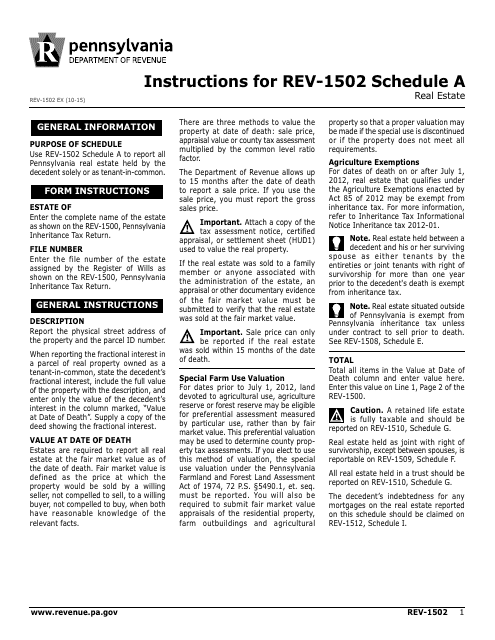

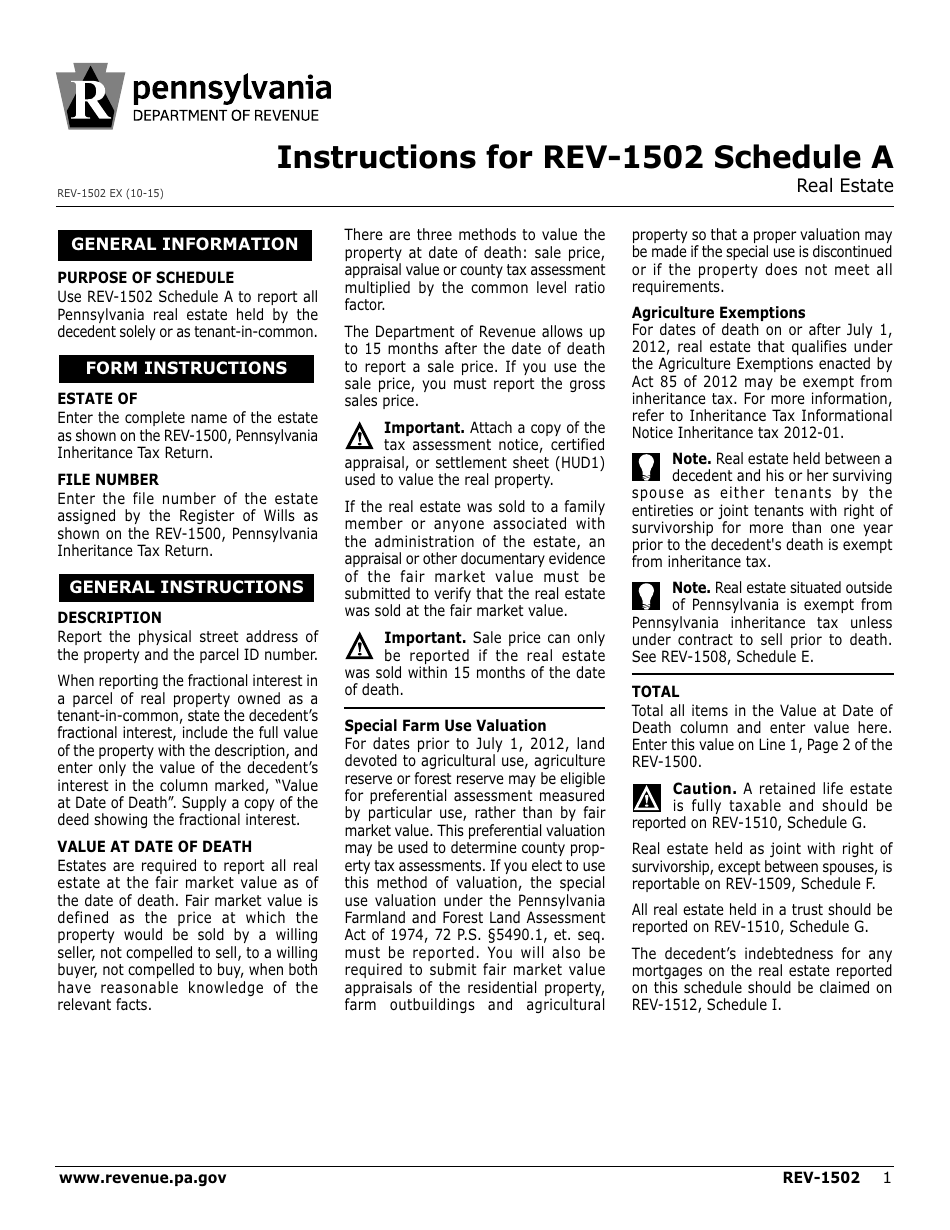

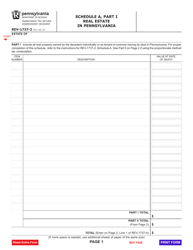

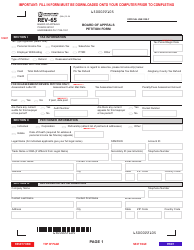

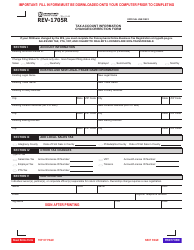

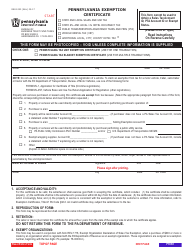

Instructions for Form REV-1502 Schedule A Real Estate - Pennsylvania

This document contains official instructions for Form REV-1502 Schedule A, Real Estate - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1502 Schedule A is available for download through this link.

FAQ

Q: What is Form REV-1502 Schedule A?

A: Form REV-1502 Schedule A is a document used in Pennsylvania to report real estate transactions.

Q: Who needs to file Form REV-1502 Schedule A?

A: Any individual or entity involved in real estate transactions in Pennsylvania needs to file Form REV-1502 Schedule A.

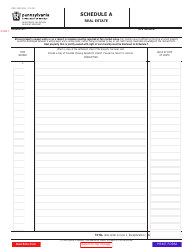

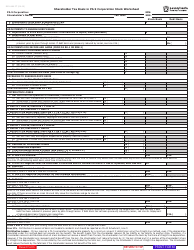

Q: What information is required on Form REV-1502 Schedule A?

A: Form REV-1502 Schedule A requires information such as the seller's and buyer's names, property details, and purchase price.

Q: When is Form REV-1502 Schedule A due?

A: Form REV-1502 Schedule A is due within 30 days of the real estate transaction.

Q: Are there any fees associated with filing Form REV-1502 Schedule A?

A: No, there are no fees associated with filing Form REV-1502 Schedule A.

Q: What happens if I don't file Form REV-1502 Schedule A?

A: Failure to file Form REV-1502 Schedule A can result in penalties and interest charges.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.