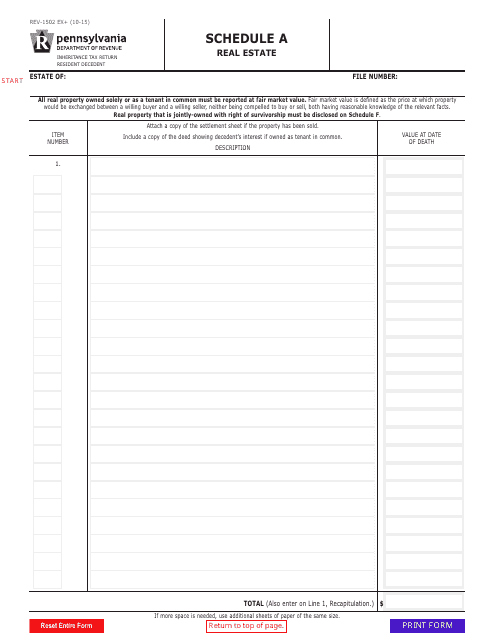

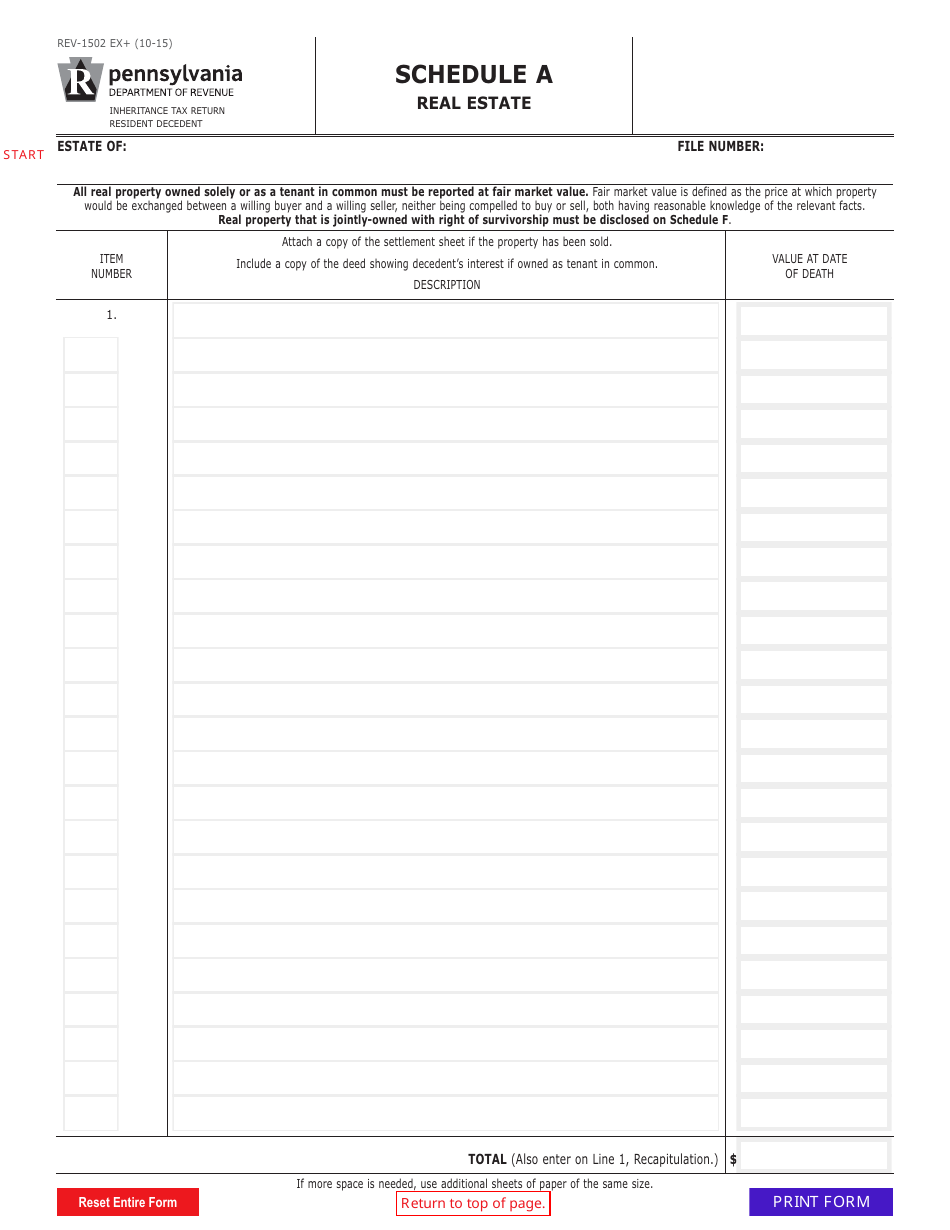

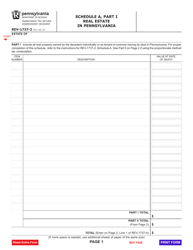

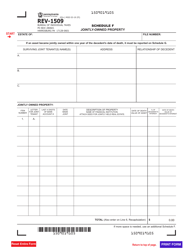

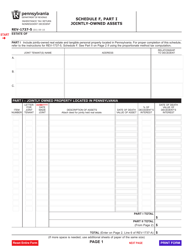

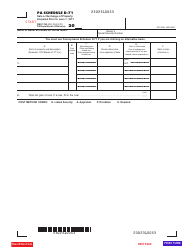

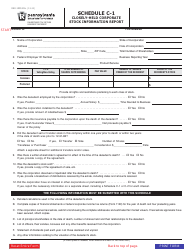

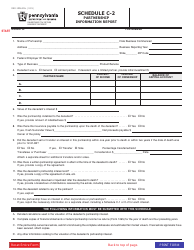

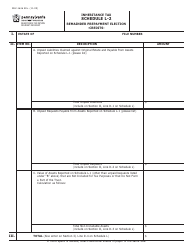

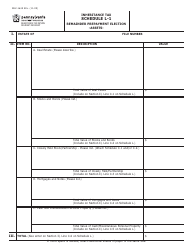

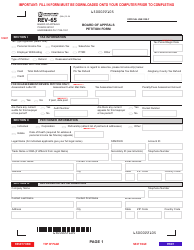

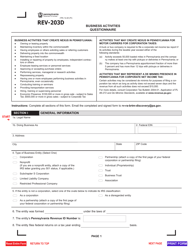

Form REV-1502 Schedule A Real Estate - Pennsylvania

What Is Form REV-1502 Schedule A?

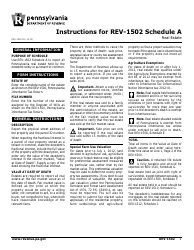

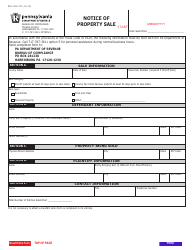

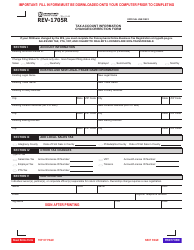

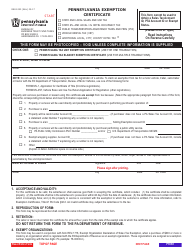

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1502 Schedule A Real Estate?

A: Form REV-1502 Schedule A Real Estate is a tax form used in Pennsylvania to report real estate owned by businesses or individuals.

Q: Who needs to file Form REV-1502 Schedule A Real Estate?

A: Businesses and individuals who own real estate in Pennsylvania need to file Form REV-1502 Schedule A Real Estate.

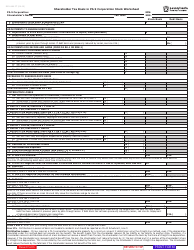

Q: What information is required on Form REV-1502 Schedule A Real Estate?

A: On Form REV-1502 Schedule A Real Estate, you will need to provide details about the real estate you own, including address, property type, and assessed value.

Q: When is the deadline to file Form REV-1502 Schedule A Real Estate?

A: The deadline to file Form REV-1502 Schedule A Real Estate in Pennsylvania is typically April 15th of each year.

Q: Are there any fees associated with filing Form REV-1502 Schedule A Real Estate?

A: No, there are no fees associated with filing Form REV-1502 Schedule A Real Estate.

Q: What should I do if I have questions about Form REV-1502 Schedule A Real Estate?

A: If you have questions about Form REV-1502 Schedule A Real Estate, you can contact the Pennsylvania Department of Revenue or consult a tax professional.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1502 Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.