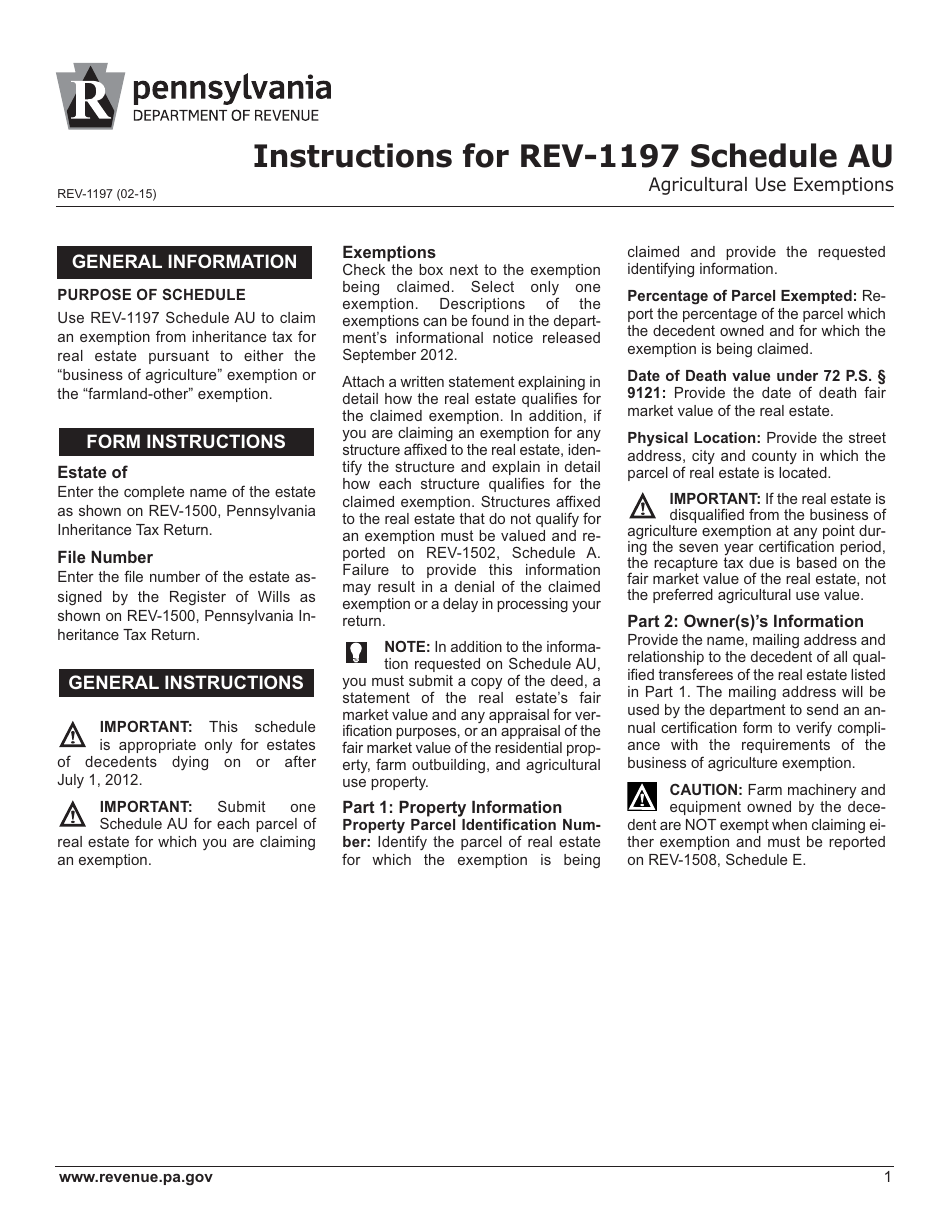

Instructions for Form REV-1197 Schedule AU Agricultural Use Exemptions - Pennsylvania

This document contains official instructions for Form REV-1197 Schedule AU, Agricultural Use Exemptions - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1197 Schedule AU is available for download through this link.

FAQ

Q: What is Form REV-1197 Schedule AU?

A: Form REV-1197 Schedule AU is a tax form specifically for reporting agricultural use exemptions in Pennsylvania.

Q: Who needs to file Form REV-1197 Schedule AU?

A: Farm owners in Pennsylvania who want to claim an agricultural use exemption need to file this form.

Q: What is an agricultural use exemption?

A: An agricultural use exemption is a tax benefit provided to eligible farmers in Pennsylvania to reduce their property tax liability.

Q: What information is required to complete Form REV-1197 Schedule AU?

A: Farm owners need to provide details about their agricultural property and its use, including acreage, crops or livestock produced, and income derived from the farm.

Q: When is the deadline to file Form REV-1197 Schedule AU?

A: The deadline to file this form is usually April 1st, but it may vary depending on the county. It is best to check with the local tax assessor's office.

Q: Are there any penalties for not filing Form REV-1197 Schedule AU?

A: Failure to file this form or providing false information may result in the loss of the agricultural use exemption and potential penalties.

Q: Can I claim multiple agricultural use exemptions on one Form REV-1197 Schedule AU?

A: No, you need to file a separate form for each agricultural property you wish to claim an exemption for.

Q: Who should I contact if I have questions about Form REV-1197 Schedule AU?

A: If you have questions about this form or need assistance, you can contact the Pennsylvania Department of Revenue or your local tax assessor's office.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.