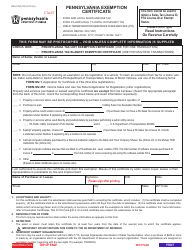

This version of the form is not currently in use and is provided for reference only. Download this version of

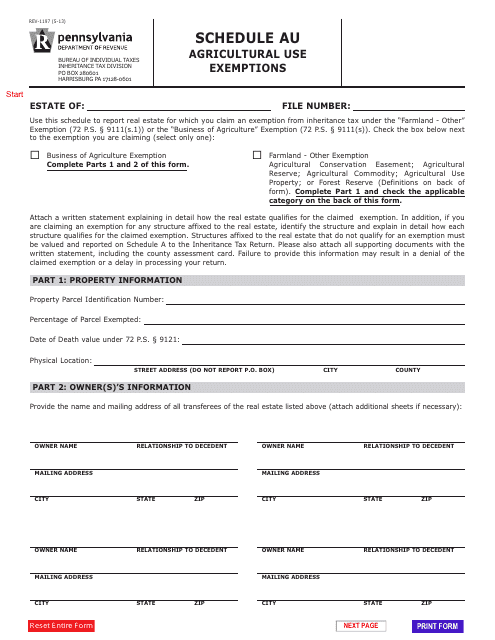

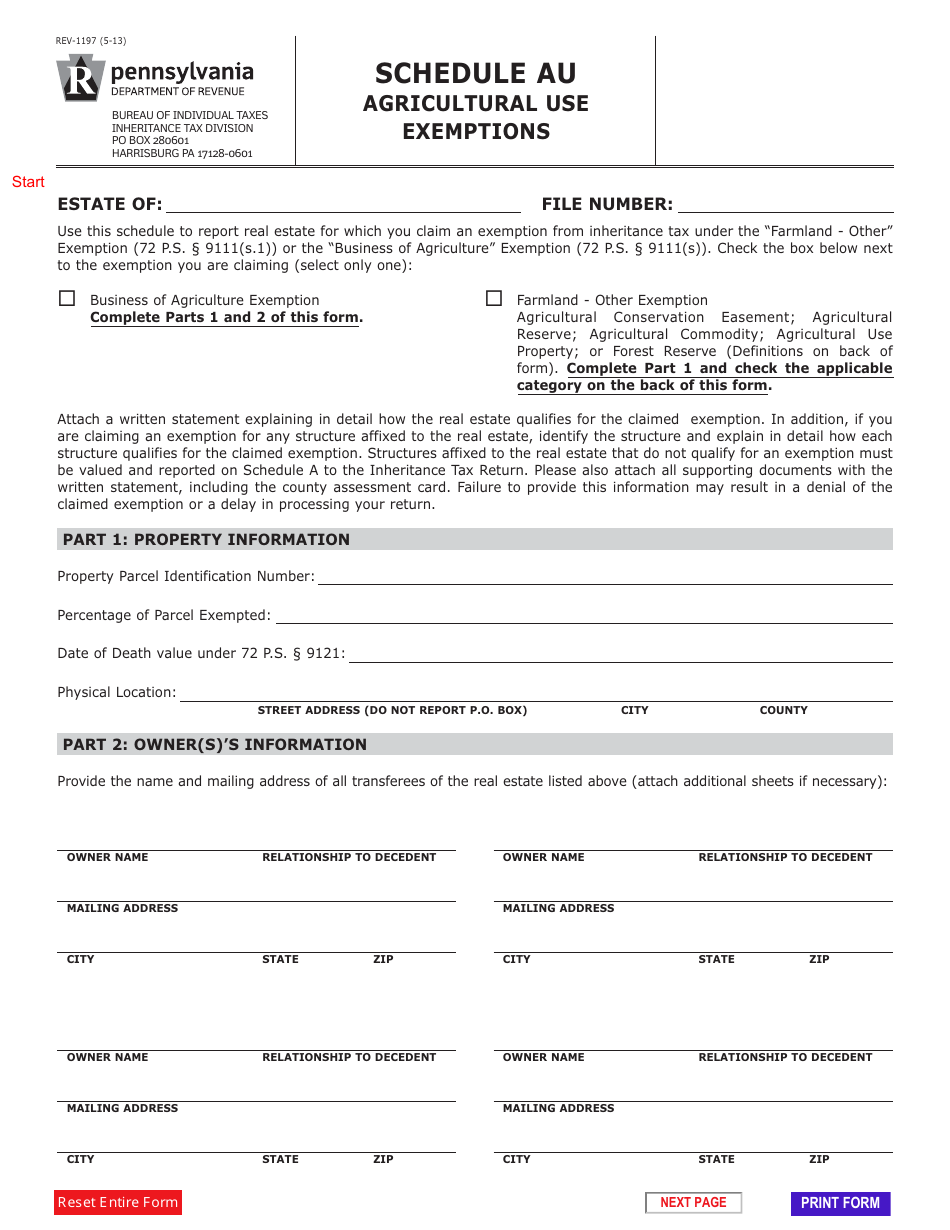

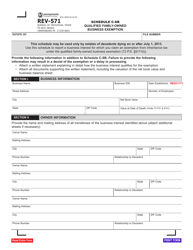

Form REV-1197 Schedule AU

for the current year.

Form REV-1197 Schedule AU Agricultural Use Exemptions - Pennsylvania

What Is Form REV-1197 Schedule AU?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1197 Schedule AU?

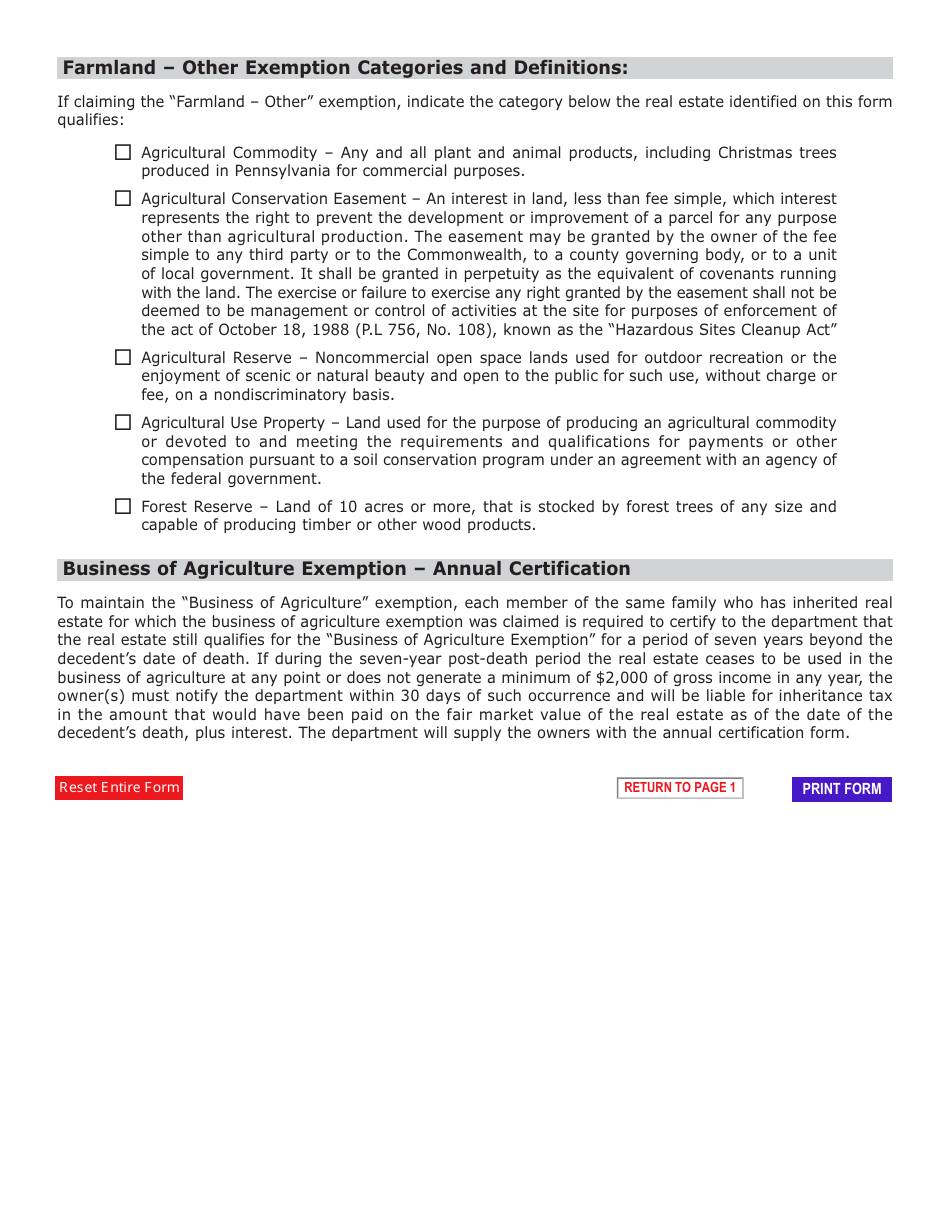

A: Form REV-1197 Schedule AU is a document used in Pennsylvania to claim agricultural use exemptions for property tax purposes.

Q: What is an agricultural use exemption?

A: An agricultural use exemption is a tax relief program that allows qualifying agricultural properties to be assessed at a lower value for property tax purposes.

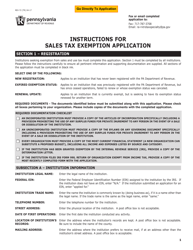

Q: Who is eligible to claim agricultural use exemptions?

A: Eligibility for agricultural use exemptions varies by state, but generally, individuals who own and operate agricultural properties may qualify. Specific criteria may include minimum acreage, income generated from agricultural activities, and adherence to agricultural practices.

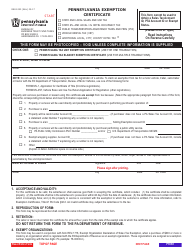

Q: What information is required on Form REV-1197 Schedule AU?

A: Form REV-1197 Schedule AU typically requires information about the property, including its location, acreage, and details about its agricultural use. It may also require supporting documentation such as income statements, production records, and proof of compliance with agricultural practices.

Q: How does claiming an agricultural use exemption benefit property owners?

A: Claiming an agricultural use exemption can result in a lower property tax assessment, which may significantly reduce property tax liabilities for qualified agricultural properties.

Q: When is Form REV-1197 Schedule AU due?

A: The due date for Form REV-1197 Schedule AU varies by state and municipality. Property owners should consult their local tax assessor's office or the Pennsylvania Department of Revenue for specific deadlines.

Q: Is there a fee associated with filing Form REV-1197 Schedule AU?

A: The filing of Form REV-1197 Schedule AU may or may not have a fee associated with it, depending on the requirements of the taxing authority.

Q: Can I claim an agricultural use exemption if I have a small garden or hobby farm?

A: The eligibility criteria for agricultural use exemptions typically require a certain minimum acreage and income from agricultural activities. Small gardens or hobby farms may not meet these requirements, but it is advisable to consult the local tax assessor's office or the Pennsylvania Department of Revenue for specific eligibility guidelines.

Q: How often do I need to file Form REV-1197 Schedule AU?

A: The frequency of filing Form REV-1197 Schedule AU depends on the requirements of the taxing authority. Some jurisdictions may require annual filings, while others may have different filing periods. Property owners should consult their local tax assessor's office or the Pennsylvania Department of Revenue for specific guidelines.

Q: Can I claim an agricultural use exemption if I lease my agricultural property to someone else?

A: The eligibility for claiming an agricultural use exemption while leasing property to someone else varies by state. It is advisable to consult the local tax assessor's office or the Pennsylvania Department of Revenue for specific guidelines on this matter.

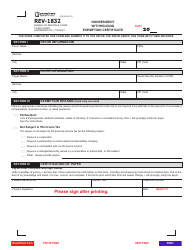

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1197 Schedule AU by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.