This version of the form is not currently in use and is provided for reference only. Download this version of

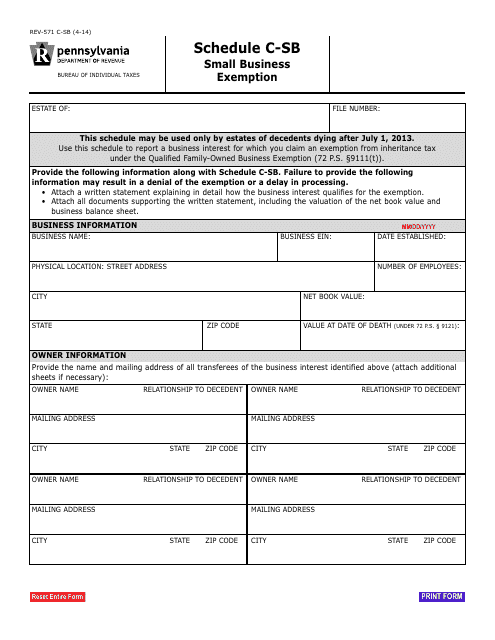

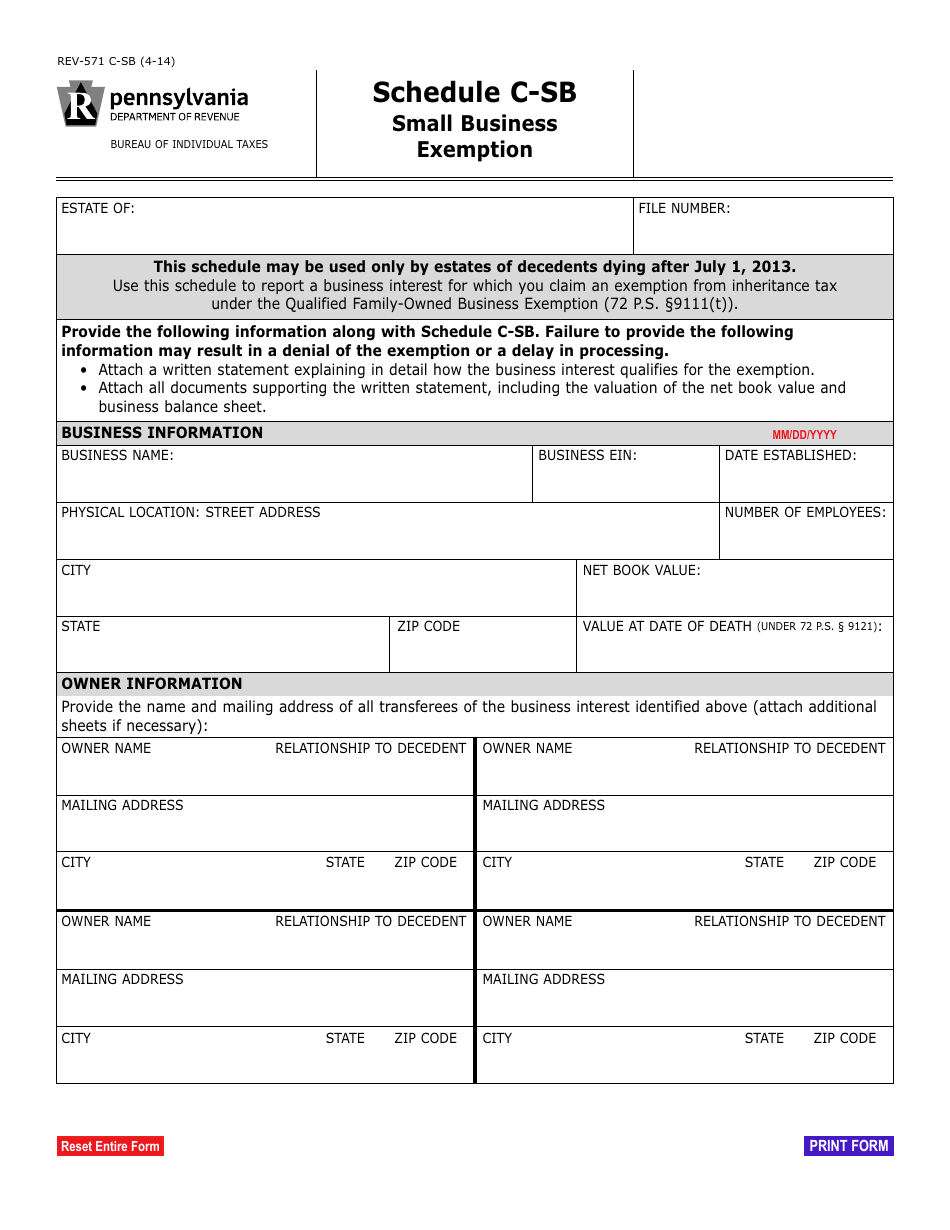

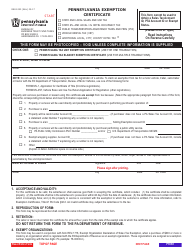

Form REV-571 Schedule C-SB

for the current year.

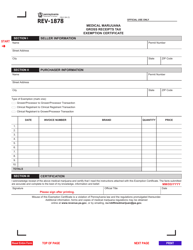

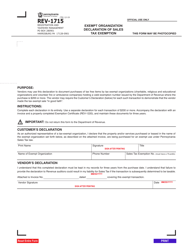

Form REV-571 Schedule C-SB Small Business Exemption - Pennsylvania

What Is Form REV-571 Schedule C-SB?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-571 Schedule C-SB?

A: Form REV-571 Schedule C-SB is a tax form used by small businesses in the state of Pennsylvania to apply for a small business exemption from certain tax obligations.

Q: Who needs to file Form REV-571 Schedule C-SB?

A: Small businesses in Pennsylvania that meet certain criteria may need to file Form REV-571 Schedule C-SB to claim a small business exemption.

Q: What is the purpose of Form REV-571 Schedule C-SB?

A: The purpose of Form REV-571 Schedule C-SB is to allow small businesses in Pennsylvania to apply for an exemption from certain tax obligations, such as the capital stock/foreign franchise tax.

Q: What are the eligibility criteria for the small business exemption?

A: To be eligible for the small business exemption, a business must meet certain criteria, such as having total gross receipts of $200,000 or less for the tax year.

Q: Is there a deadline for filing Form REV-571 Schedule C-SB?

A: Yes, the deadline for filing Form REV-571 Schedule C-SB is the same as the deadline for filing your Pennsylvania business tax return, which is generally April 15th.

Q: Are there any fees for filing Form REV-571 Schedule C-SB?

A: No, there are no fees for filing Form REV-571 Schedule C-SB.

Q: What should I do if I have questions or need assistance with Form REV-571 Schedule C-SB?

A: If you have questions or need assistance with Form REV-571 Schedule C-SB, you can contact the Pennsylvania Department of Revenue directly or seek assistance from a tax professional.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-571 Schedule C-SB by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.