Instructions for Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax - Oregon

This document contains official instructions for Form 390 (WO) , and Form 391 (EO) . Both forms are released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax?

A: Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax is a tax form used in Oregon to report and pay the severance tax for small tract forestland.

Q: Who needs to file Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax?

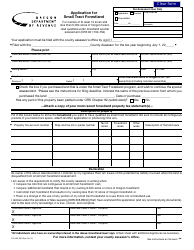

A: Any individual or business that owns or operates small tract forestland in Oregon and engages in the severance of timber products needs to file this form.

Q: What is considered small tract forestland in Oregon?

A: In Oregon, small tract forestland refers to privately owned contiguous forestland that is 5,000 acres or less in size.

Q: What is the purpose of the severance tax?

A: The severance tax is imposed on the removal of timber products from small tract forestland in Oregon and is used to support various forest-related programs.

Q: How often do I need to file Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax?

A: This form needs to be filed annually by April 15th for the previous calendar year.

Q: What information do I need to provide on Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax?

A: You will need to provide information about the owner and operator of the forestland, the amount and value of timber products severed, and any applicable deductions or exemptions.

Q: Are there any penalties for late or non-filing of Form 390 (WO), 391 (EO) Small Tract Forestland (Stf) Severance Tax?

A: Yes, late or non-filing of this form may result in penalties, interest, or other enforcement actions by the Oregon Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.