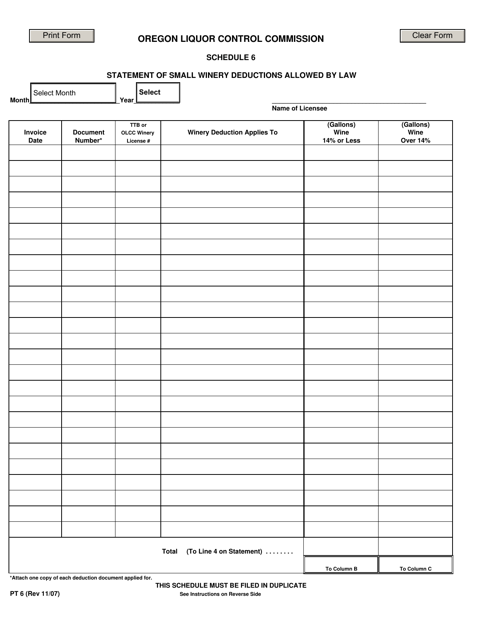

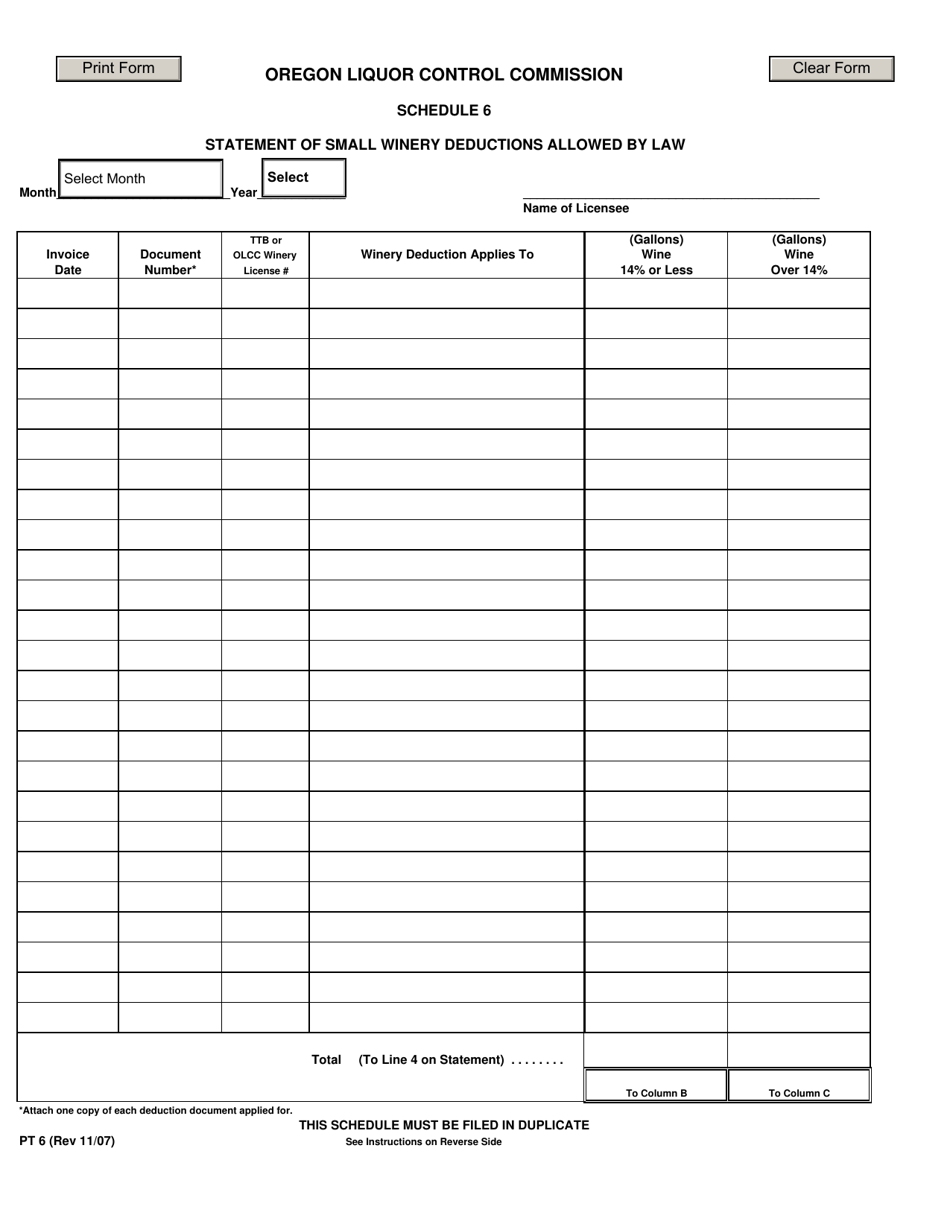

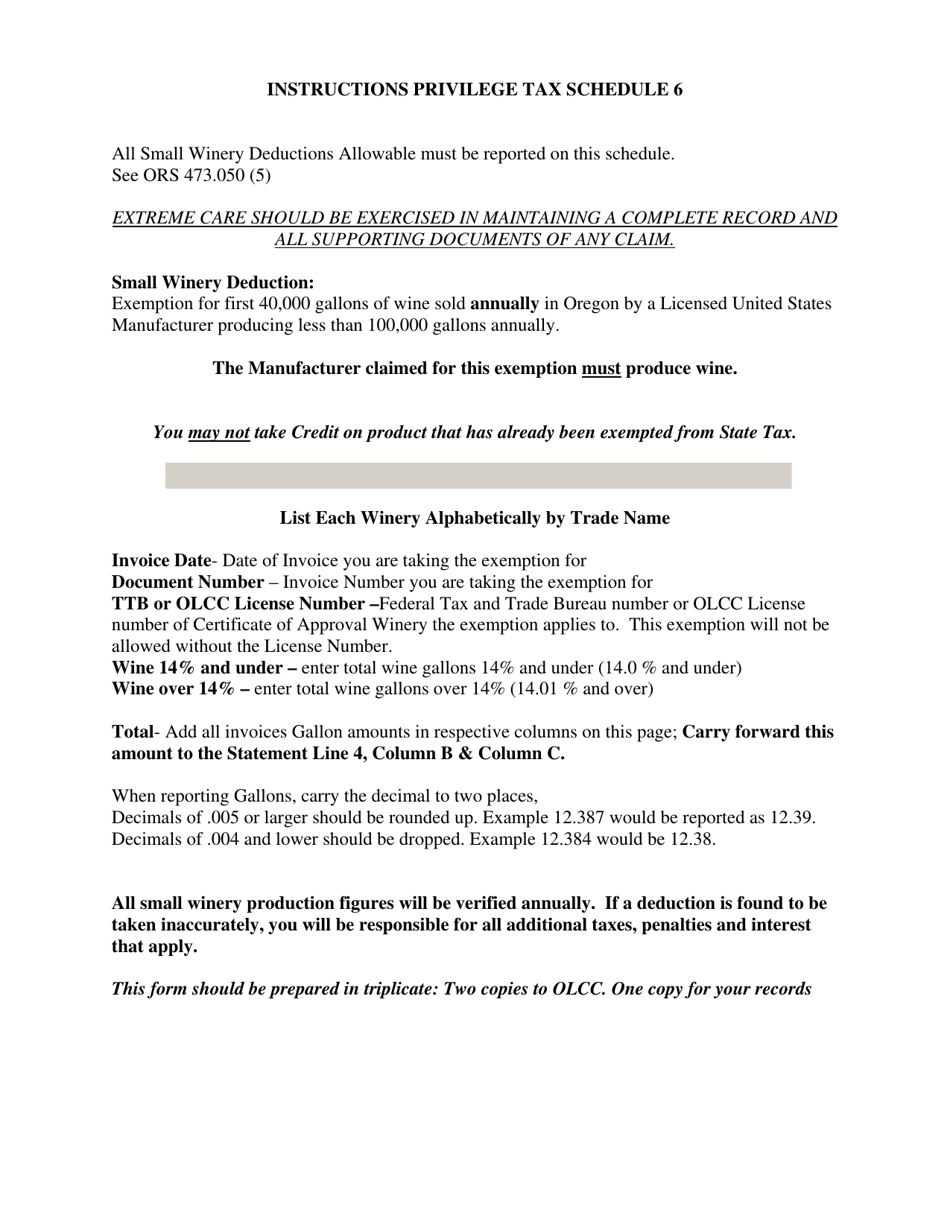

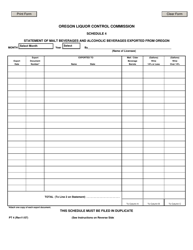

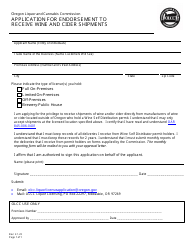

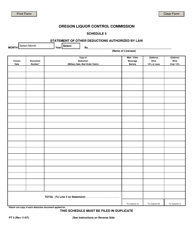

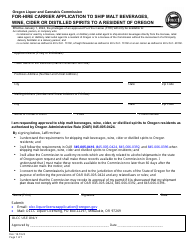

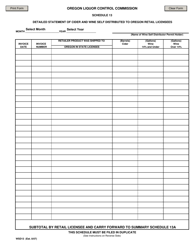

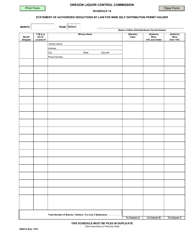

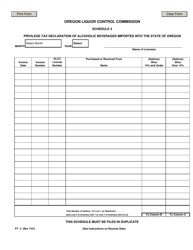

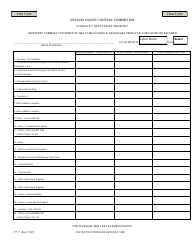

Form PT6 Schedule 6 Statement of Small Winery Deductions Allowed by Law - Oregon

What Is Form PT6 Schedule 6?

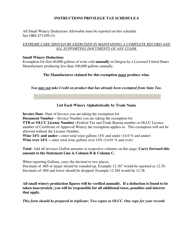

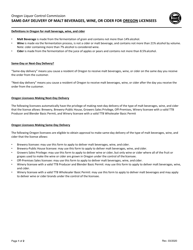

This is a legal form that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT6 Schedule 6?

A: Form PT6 Schedule 6 is a statement of small winery deductions allowed by law in Oregon.

Q: Who needs to file Form PT6 Schedule 6?

A: Small wineries in Oregon need to file Form PT6 Schedule 6.

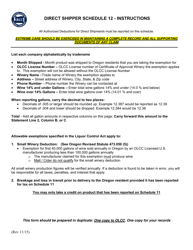

Q: What deductions are allowed by law for small wineries in Oregon?

A: Form PT6 Schedule 6 provides information on the deductions allowed by law for small wineries in Oregon.

Q: What is the purpose of Form PT6 Schedule 6?

A: The purpose of Form PT6 Schedule 6 is to calculate and report the small winery deductions allowed by law in Oregon.

Q: When is Form PT6 Schedule 6 due?

A: Form PT6 Schedule 6 is typically due on the same date as the annual Oregon income tax return, which is generally April 15th.

Q: Are there any penalties for not filing Form PT6 Schedule 6?

A: Penalties may apply for failing to file Form PT6 Schedule 6 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Can I e-file Form PT6 Schedule 6?

A: Yes, Form PT6 Schedule 6 can be e-filed along with the annual Oregon income tax return.

Q: Is Form PT6 Schedule 6 specific to small wineries in Oregon only?

A: Yes, Form PT6 Schedule 6 is specific to small wineries in the state of Oregon.

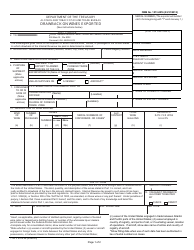

Form Details:

- Released on November 1, 2007;

- The latest edition provided by the Oregon Liquor and Cannabis Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT6 Schedule 6 by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.