This version of the form is not currently in use and is provided for reference only. Download this version of

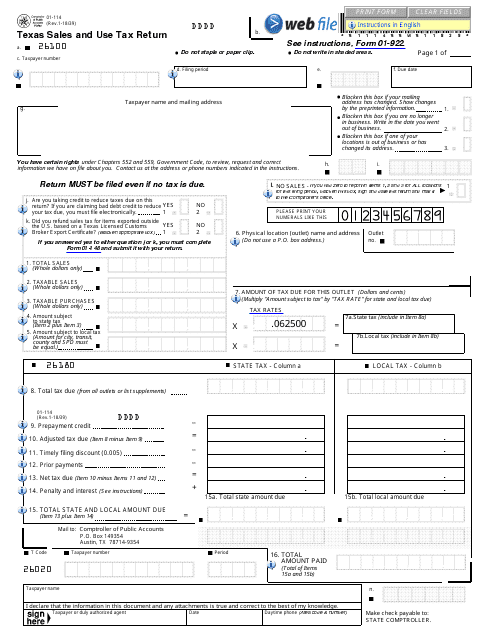

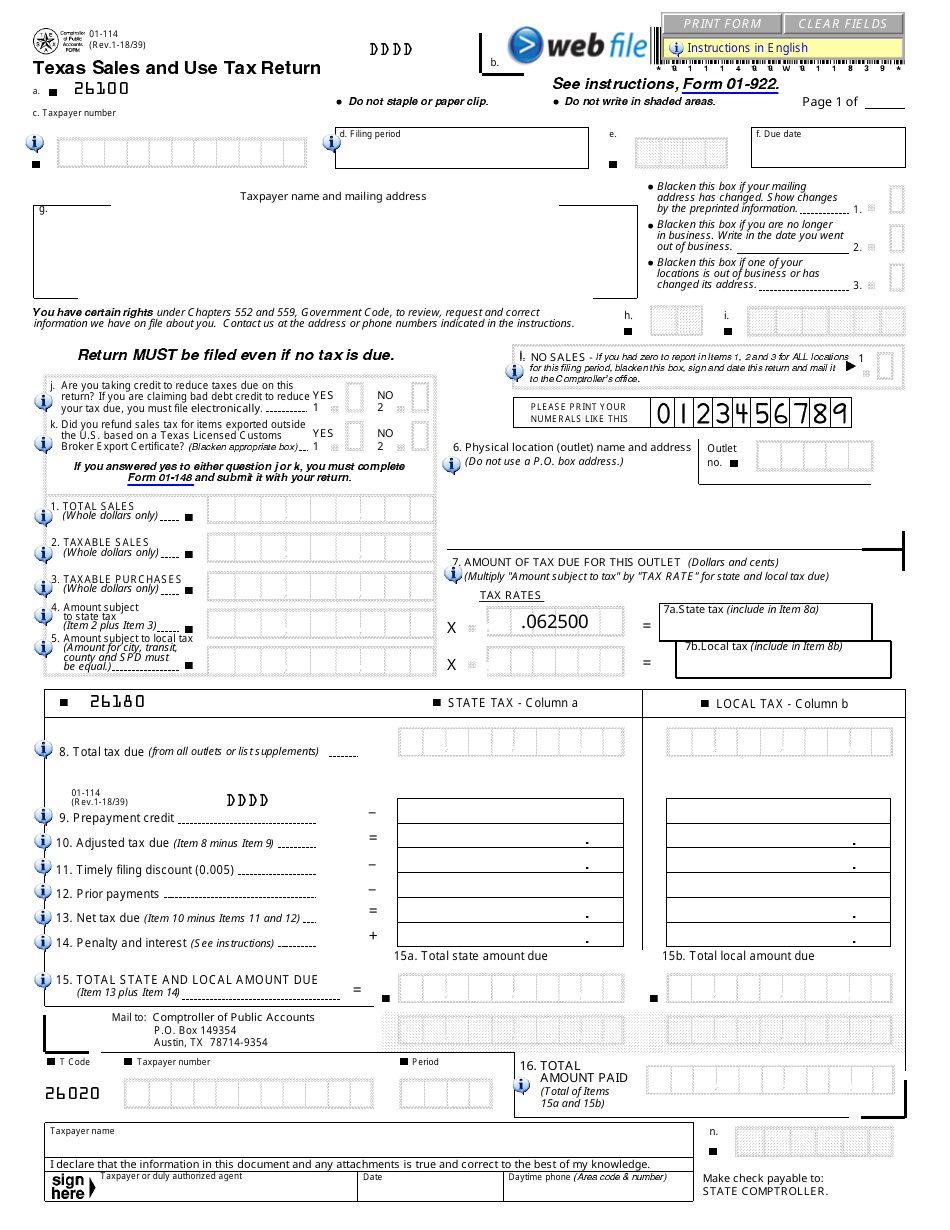

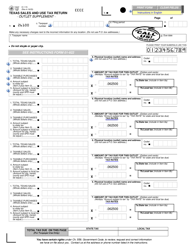

Form 01-114

for the current year.

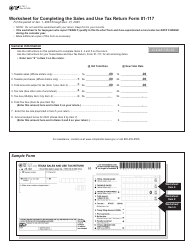

Form 01-114 Texas Sales and Use Tax Return - Texas

What Is Form 01-114?

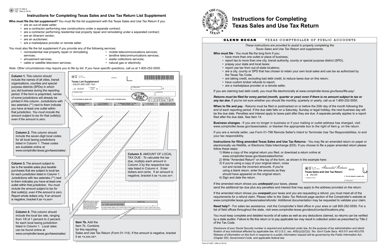

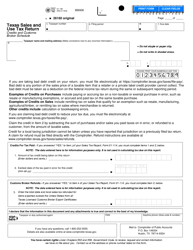

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 01-114?

A: Form 01-114 is the Texas Sales and Use Tax Return form.

Q: What is the purpose of Form 01-114?

A: Form 01-114 is used to report and pay sales and use taxes in the state of Texas.

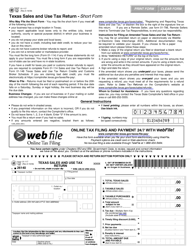

Q: Who needs to file Form 01-114?

A: Businesses that sell taxable goods or services in Texas need to file Form 01-114.

Q: What is the deadline for filing Form 01-114?

A: Form 01-114 is generally due on the 20th day of the month following the reporting period.

Q: What should I do if I made a mistake on Form 01-114?

A: If you made a mistake on Form 01-114, you should file an amended return to correct the error.

Q: Are there any penalties for late filing of Form 01-114?

A: Yes, there may be penalties for late filing or underpayment of sales and use taxes.

Q: Do I need to attach any documents with Form 01-114?

A: In most cases, you do not need to attach any supporting documents with Form 01-114.

Q: Is Form 01-114 applicable only to businesses in Texas?

A: Yes, Form 01-114 is specifically for businesses operating in the state of Texas.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-114 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.