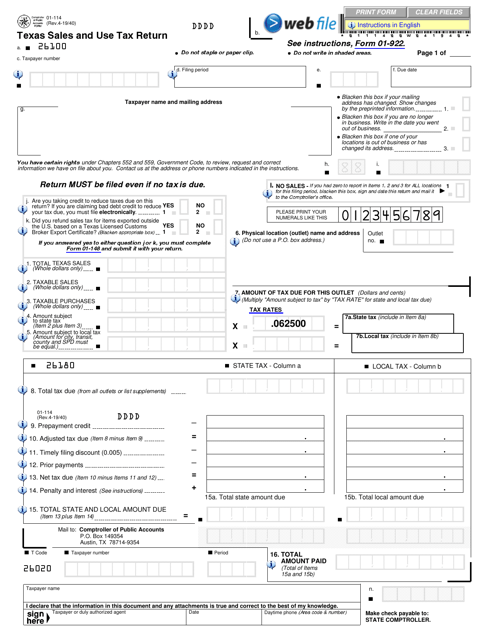

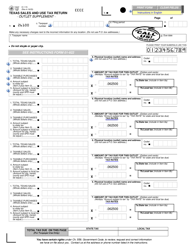

Form 01-114 Texas Sales and Use Tax Return - Texas

What Is Form 01-114?

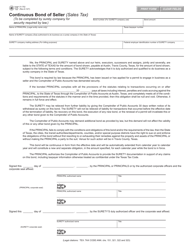

Form 01-114, Texas Sales and Use Tax Return , is a document that can be used by taxpayers when they want to report information related to the Texas Sales and Use Tax they are supposed to pay. The purpose of the form is to collect and systematize the financial data of the taxpayer in order to figure out how much tax is due.

This form was issued by the Texas Comptroller of Public Accounts and was last revised on April 1, 2019 . A fillable Texas Sales and Use Tax Return Form is available for download below.

If taxpayers are not sure whether they are supposed to file this type of tax return, they can check with the criteria presented in Form 01-922, Instructions for Completing Texas Sales and Use Tax Return. Here they can also find guidelines on how to complete each section of Form 01-114, where to file it, when to pay the tax, and other details.

How to Fill Out the Texas Sales and Use Tax Return?

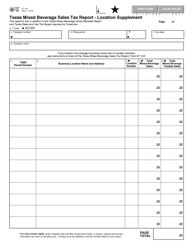

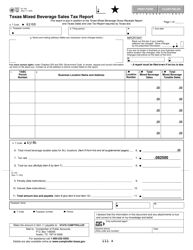

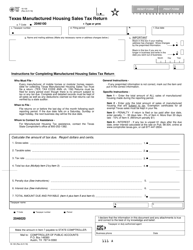

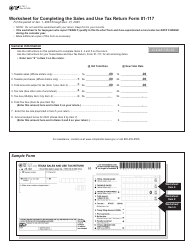

The 01-114 Form consists of several parts, where they are supposed to designate different kinds of information. These parts are:

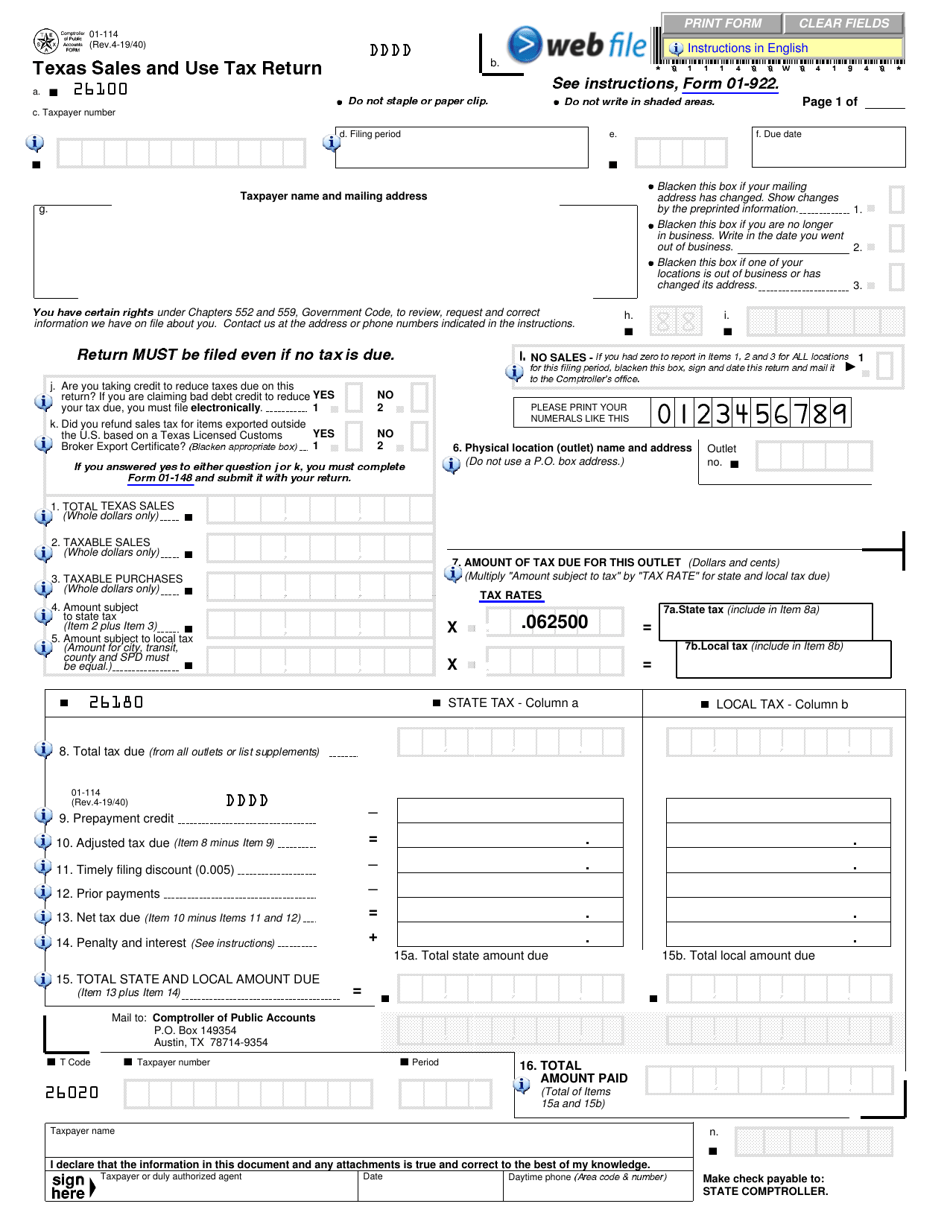

- Introduction . In the first part of the document, the taxpayer is required to provide their taxpayer number, filing period, and the tax due date. In addition to this, taxpayers must designate their name and address.

- Tax Information . This section of the tax return must be used by the taxpayer to state particular tax details. Here, they must report the total amount of sales they made during the reported period, the total amount of the taxable sales that took palace during the same period, the total amount of taxable purchases that were made, and so on. If there were no sales or purchases to report, the taxpayer must enter "0" in the form.

- State and Local Tax Details . This part is of the tax return is presented in the form of a timetable with two columns. In column A the taxpayer is supposed to designate numbers related to the state tax that is due, while in column B they are supposed to report numbers related to the local tax that is due.

- Conclusion . The taxpayer must state that the information presented in the form is correct and valid. Under this statement, they must put their signature and date. Additionally, they must provide their telephone number in case the receiver of the document will have any questions.

If taxpayers are experiencing difficulties while filling out the form, they can visit the closest Comptroller's field office and ask for assistance, or call their helpline. After taxpayers have filled in Form 01-114, they are supposed to mail it to the Texas Comptroller of Public Accounts.

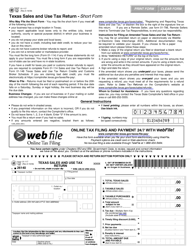

In some cases, taxpayers can file Form 01-117, Texas Sales and Use Tax Return - Short Form, instead of 01-114 Form. To find out whether it is applicable to their situations, taxpayers can read the instructions attached to the short form, where they can find requirements for filing it.