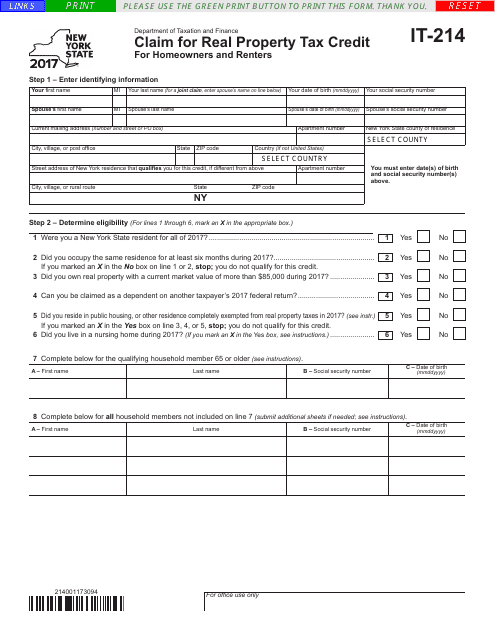

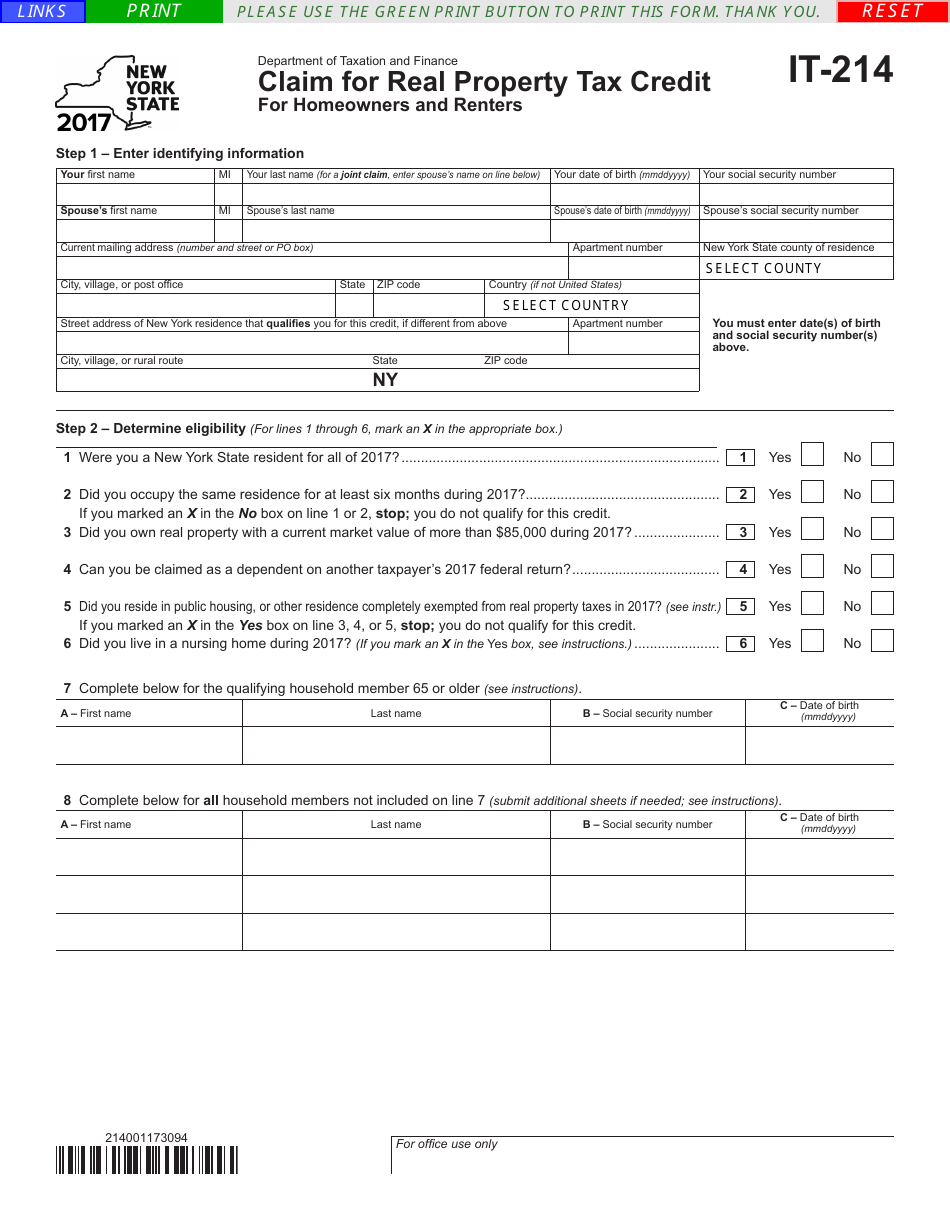

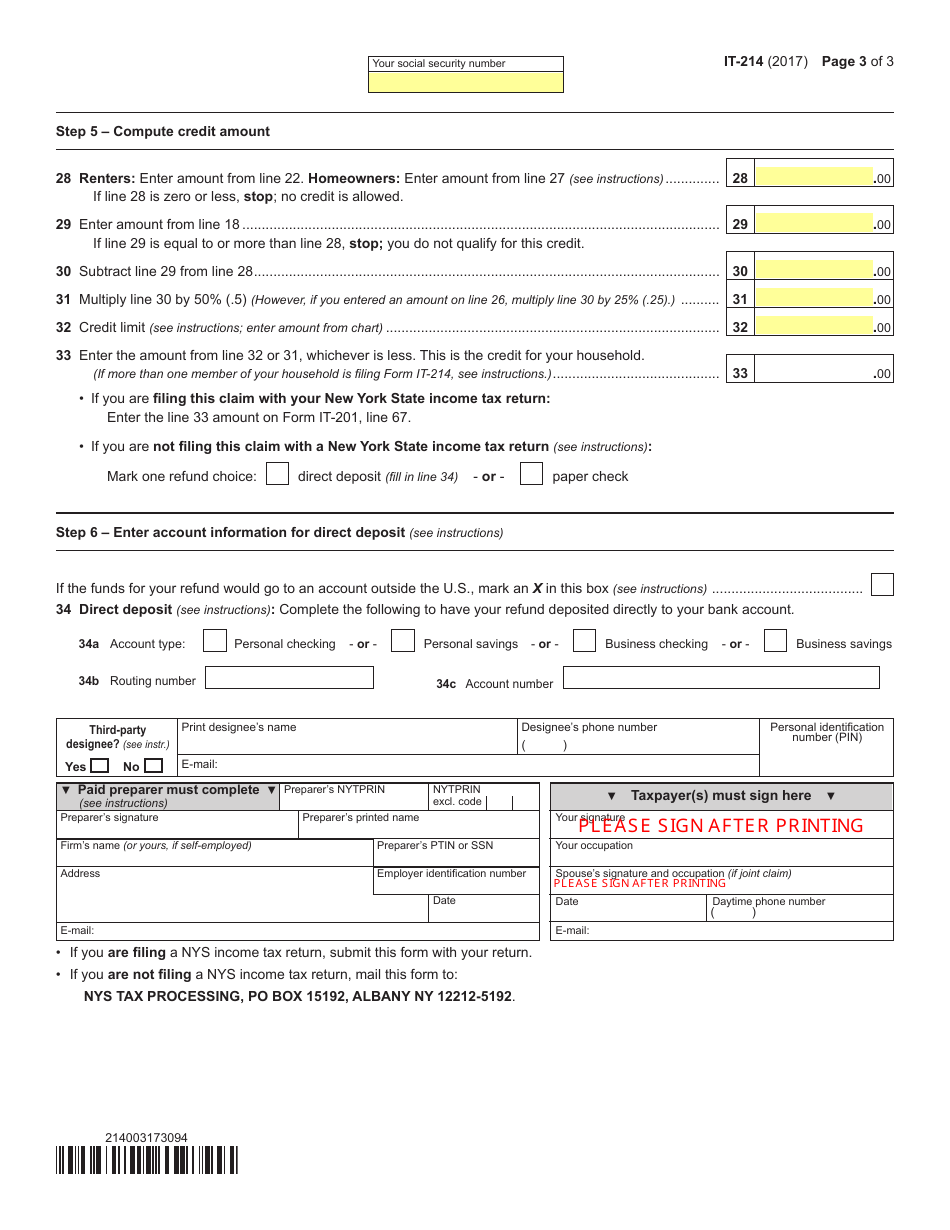

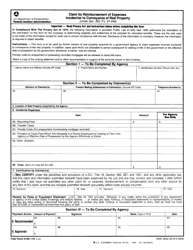

Form IT-214 Claim for Real Property Tax Credit - New York

What Is Form IT-214?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-214?

A: Form IT-214 is a claim for Real Property Tax Credit in New York.

Q: Who can use Form IT-214?

A: Any New York resident who owns property and pays real property taxes may use Form IT-214.

Q: What is the purpose of Form IT-214?

A: The purpose of Form IT-214 is to claim a credit for real property taxes paid on a primary residence in New York.

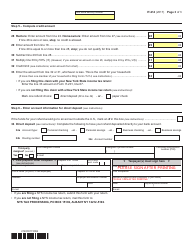

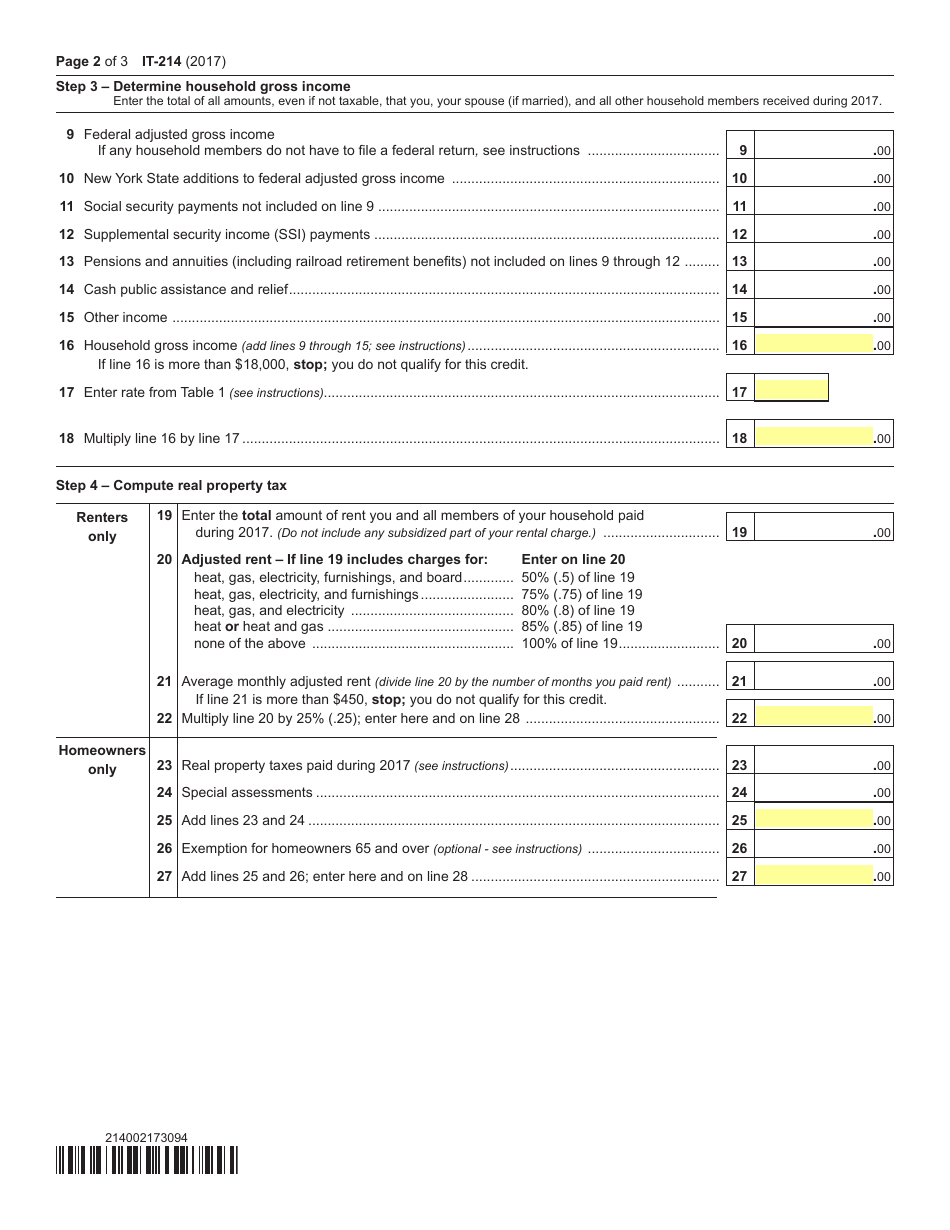

Q: What information is required on Form IT-214?

A: Form IT-214 requires information such as the amount of real property taxes paid, the property's location, and the taxpayer's income.

Q: When is Form IT-214 due?

A: Form IT-214 is generally due on the same day as your New York State tax return, which is usually April 15th.

Q: Can I e-file Form IT-214?

A: Yes, you can e-file Form IT-214 if you are also e-filing your New York State tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-214 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.