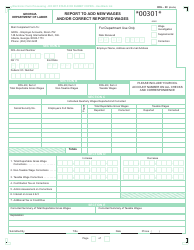

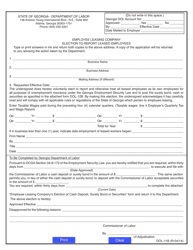

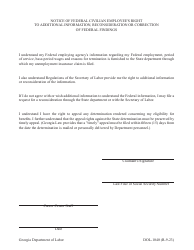

Form DOL-4N Employer's Quarterly Tax and Wage Report - Georgia (United States)

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form DOL-4N?

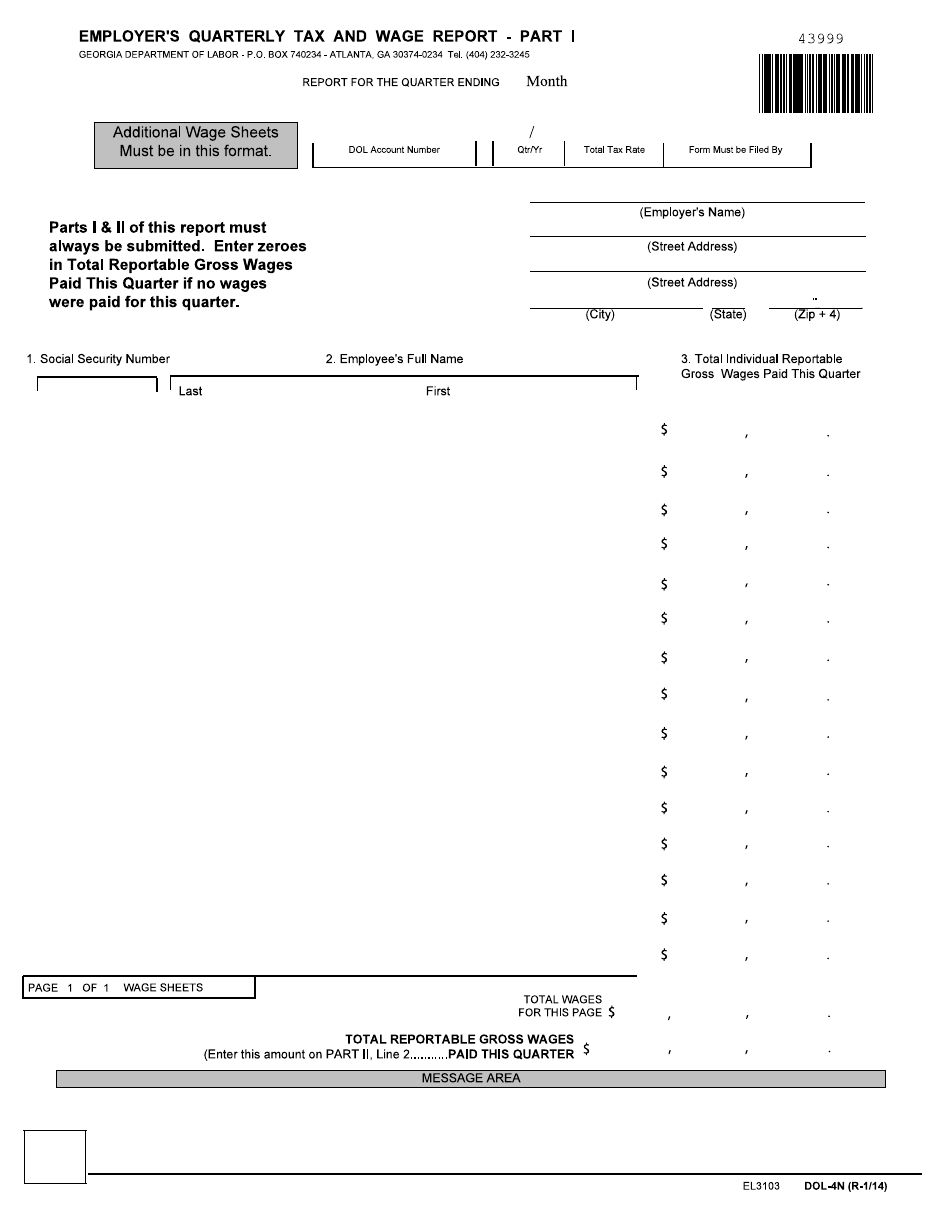

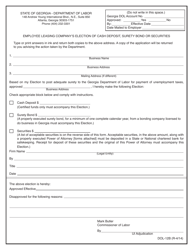

Form DOL-4N, Employer's Quarterly Tax, and Wage Report , is a formal document that all employers must file each quarter if their business is active to inform the authorities about the wages they have paid to their employees. Before April 30, July 31, October 31, and January 31 of each year, the employers collect information on all wages paid and calculate the tax they owe to the government to comply with the unemployment insurance requirements.

Alternate Name:

- Georgia Employer Quarterly Tax and Wage Report.

This form was released by the Georgia Department of Labor (GDOL) on December 1, 2016 , with all previous editions obsolete. A fillable DOL-4N Form is available for download below.

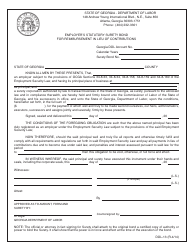

Form DOL-4N Instructions

Form DOL-4N instructions are as follows:

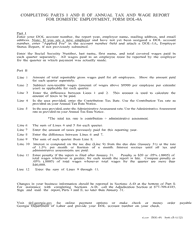

- Write down the number of the account your business has with the GDOL, the quarter and year you are providing information for, and the total tax rate.

- Enter the employer's name and address.

- List all employees' full names and social security numbers. Indicate wages you have paid this quarter to each of these people and calculate the total amount of wages and total reportable gross wages. If you have not paid any wages for three months, enter zeroes in every column.

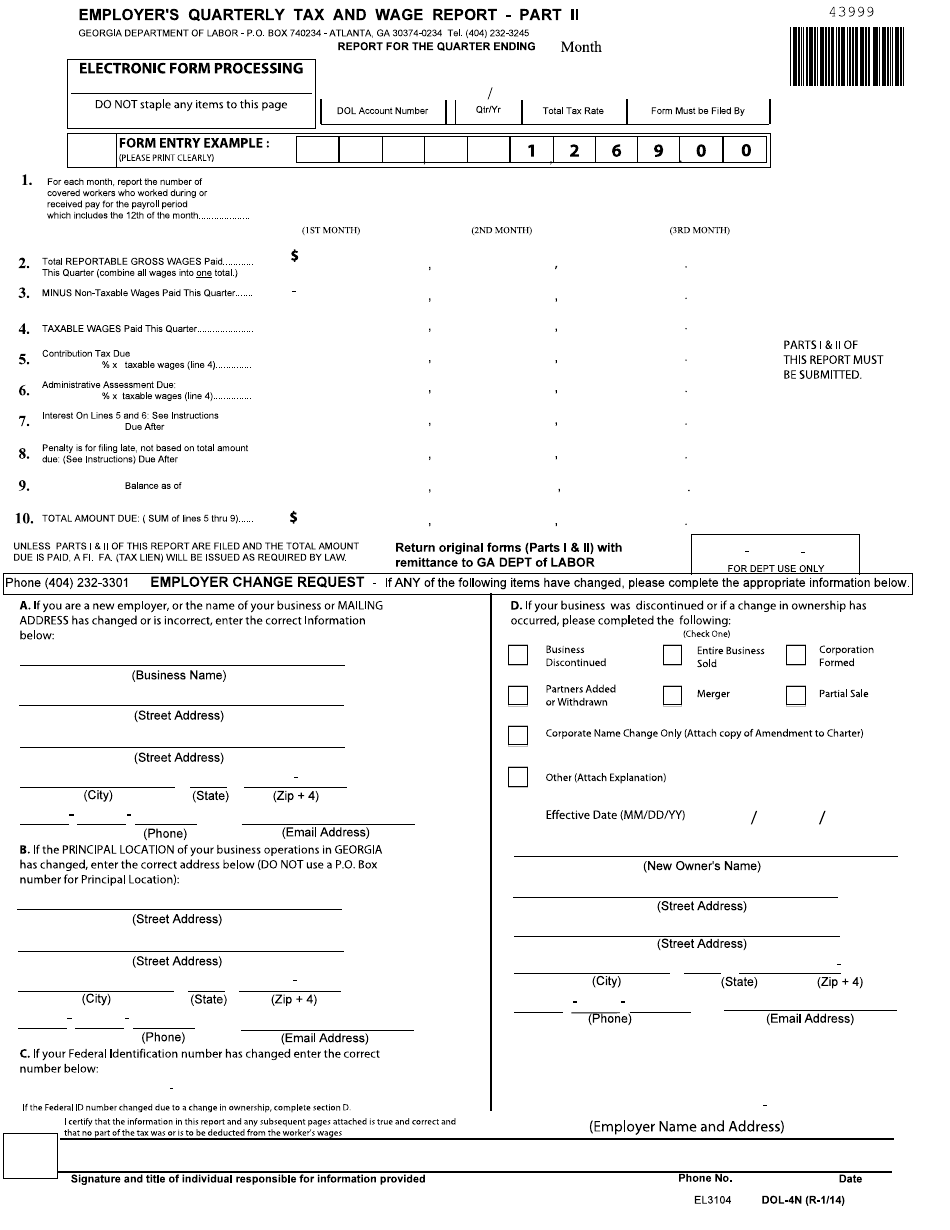

- State the number of employees who worked for you or received wages for the reporting period.

- Enter total reportable wages for all employees for the quarter.

- Subtract non-taxable wages and record the result.

- Calculate contribution tax and administrative assessment - they apply to all employees, new and old.

- If your payment is late, compute interest at 1.5% rate per month and calculate the penalty for late filing.

- Enter the total amount you owe by adding amounts from lines 5 through 8.

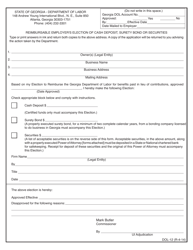

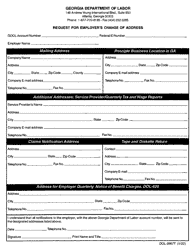

- If you need to report any changes that occurred, you may use the bottom of the last page of the form to tell the DOL your business name and address, principal location, and federal identification number. It is also required to notify the authorities about the business discontinuance or a change in ownership.

- Date the form, write down your name, address, and telephone number. Confirm all the statements in the document are true and correct and sign the report.

Once the document is completed, there are two ways to submit it:

- Access the employer portal on the GDOL official website. Using your account, you may file the information online which is mandatory if you have more than one hundred employees;

- File the report along with the check or money order using traditional mail - send all documentation to the GDOL, PO Box 740234, Atlanta, Georgia 30374-0234 .