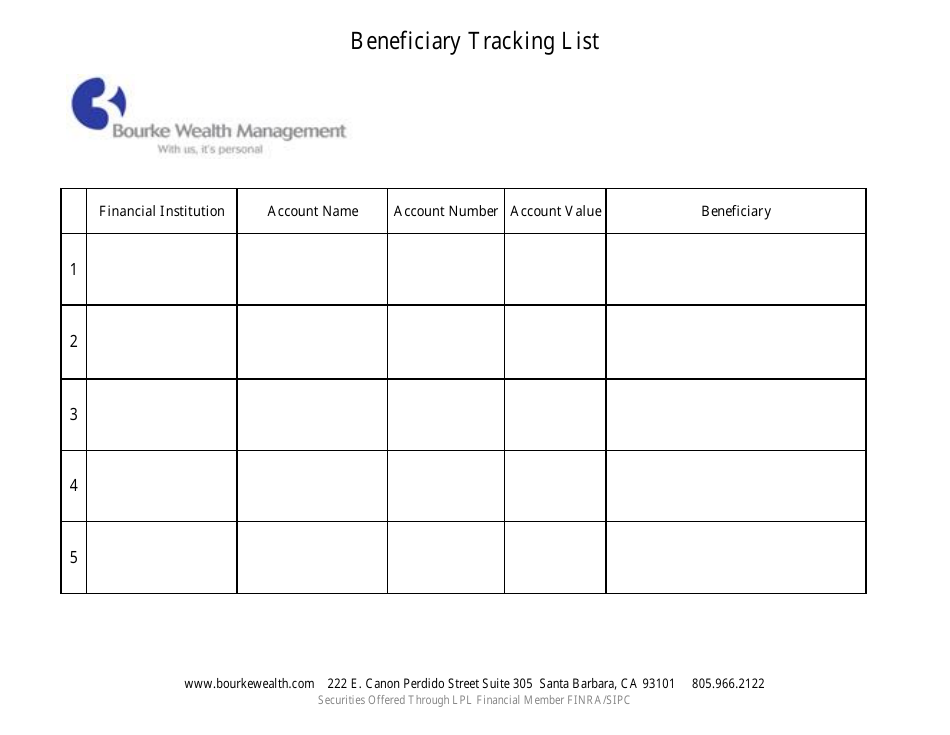

Beneficiary Tracking List Template - Bourke Wealth Management

The Beneficiary Tracking List Template - Bourke Wealth Management is used to keep track of individuals who are named as beneficiaries in financial documents such as wills, trusts, and insurance policies. It helps ensure that the correct beneficiaries are identified and keeps a record of their contact information and relationship to the account holder.

FAQ

Q: What is a Beneficiary Tracking List?

A: A Beneficiary Tracking List is a document used by Bourke Wealth Management to keep track of the beneficiaries for their clients' financial accounts.

Q: Why is a Beneficiary Tracking List important?

A: A Beneficiary Tracking List is important because it ensures that the correct beneficiaries are designated for each financial account, so that assets can be distributed according to the client's wishes after their passing.

Q: What information is typically included in a Beneficiary Tracking List?

A: A Beneficiary Tracking List typically includes the client's name, account number, type of account, and the names and contact information of their designated beneficiaries.

Q: How can I update my beneficiary information?

A: To update your beneficiary information, you should contact Bourke Wealth Management and provide them with the necessary details and documentation. They will then update your beneficiary information on the Beneficiary Tracking List.

Q: Is the Beneficiary Tracking List accessible to clients?

A: The Beneficiary Tracking List is typically an internal document used by Bourke Wealth Management, and may not be directly accessible to clients. However, clients can request information regarding their designated beneficiaries from their financial advisor.

Q: Can I make changes to my beneficiary designations without contacting Bourke Wealth Management?

A: No, it is important to contact Bourke Wealth Management to make changes to your beneficiary designations. They will guide you through the process and ensure that your changes are properly recorded.

Q: What happens if I do not update my beneficiary information?

A: If you do not update your beneficiary information, your assets may be distributed according to the previous beneficiary designations or default rules set by the financial institution, which may not align with your wishes.

Q: Can I have multiple beneficiaries for a single account?

A: Yes, it is possible to have multiple beneficiaries for a single account. You can specify the percentage or division of assets that each beneficiary should receive.

Q: How often should I review my beneficiary information?

A: It is recommended to review your beneficiary information periodically, especially after major life events such as marriage, divorce, birth of children, or the passing of a loved one.

Q: What should I do if I have questions about my beneficiary information?

A: If you have questions about your beneficiary information, you should contact Bourke Wealth Management and speak to your financial advisor. They will be able to provide you with guidance and clarification.