This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1024

for the current year.

Instructions for IRS Form 1024 Application for Recognition of Exemption Under Section 501(A)

This document contains official instructions for IRS Form 1024 , Application for Recognition of Exemption Under Section 501(A) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1024 is available for download through this link.

FAQ

Q: What is IRS Form 1024?

A: IRS Form 1024 is an application for recognition of exemption under Section 501(a) of the IRS tax code.

Q: Who should file IRS Form 1024?

A: Any organization seeking recognition of exemption from federal income tax under Section 501(a) should file IRS Form 1024.

Q: What is the purpose of IRS Form 1024?

A: The purpose of IRS Form 1024 is to apply for recognition of exemption from federal income tax.

Q: What documents should be included with IRS Form 1024?

A: You should include all required attachments and supporting documents as specified in the instructions for IRS Form 1024.

Q: How long does it take to process IRS Form 1024?

A: Processing times for IRS Form 1024 can vary, but it generally takes several months.

Q: Can I file IRS Form 1024 electronically?

A: No, you cannot file IRS Form 1024 electronically. It must be filed by mail.

Q: Can I receive a refund for the user fee if my application is denied?

A: No, the user fee for IRS Form 1024 is non-refundable, even if your application is denied.

Q: What happens after I file IRS Form 1024?

A: After you file IRS Form 1024, the IRS will review your application and may request additional information or clarification. Once a decision is reached, you will be notified of the outcome.

Q: Can I appeal a denial of exemption under IRS Form 1024?

A: Yes, if your application for exemption under IRS Form 1024 is denied, you have the right to appeal the decision. The appeals process is outlined in the IRS instructions for Form 1024.

Instruction Details:

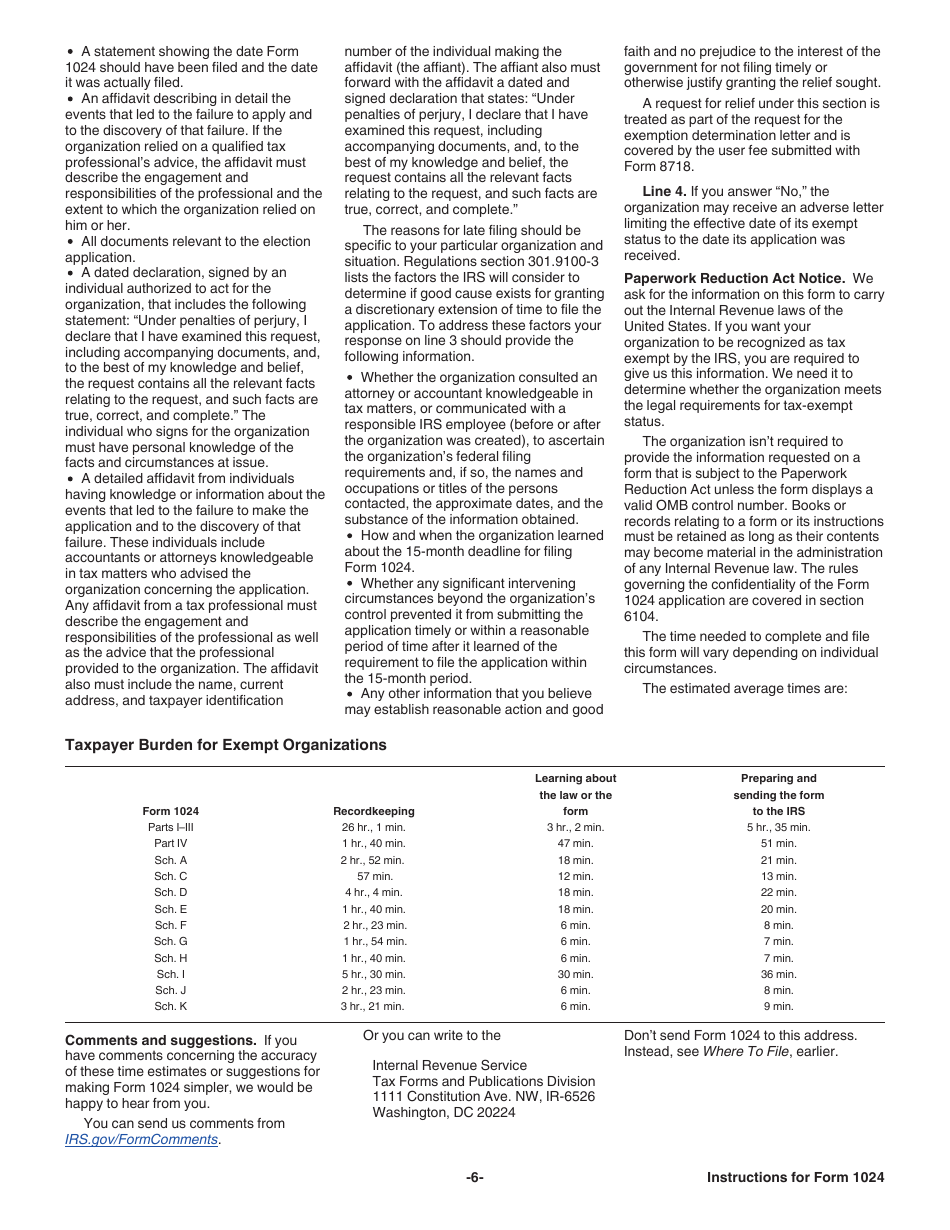

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.