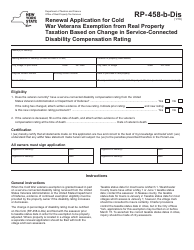

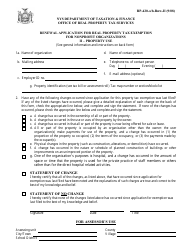

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-458-B

for the current year.

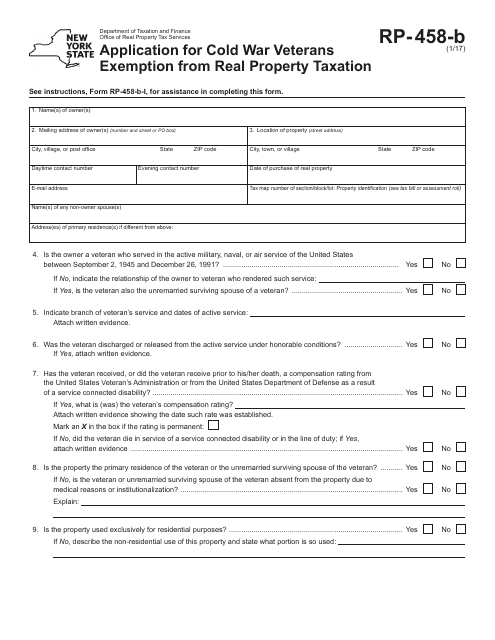

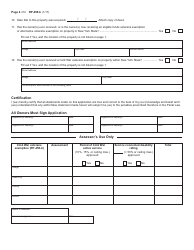

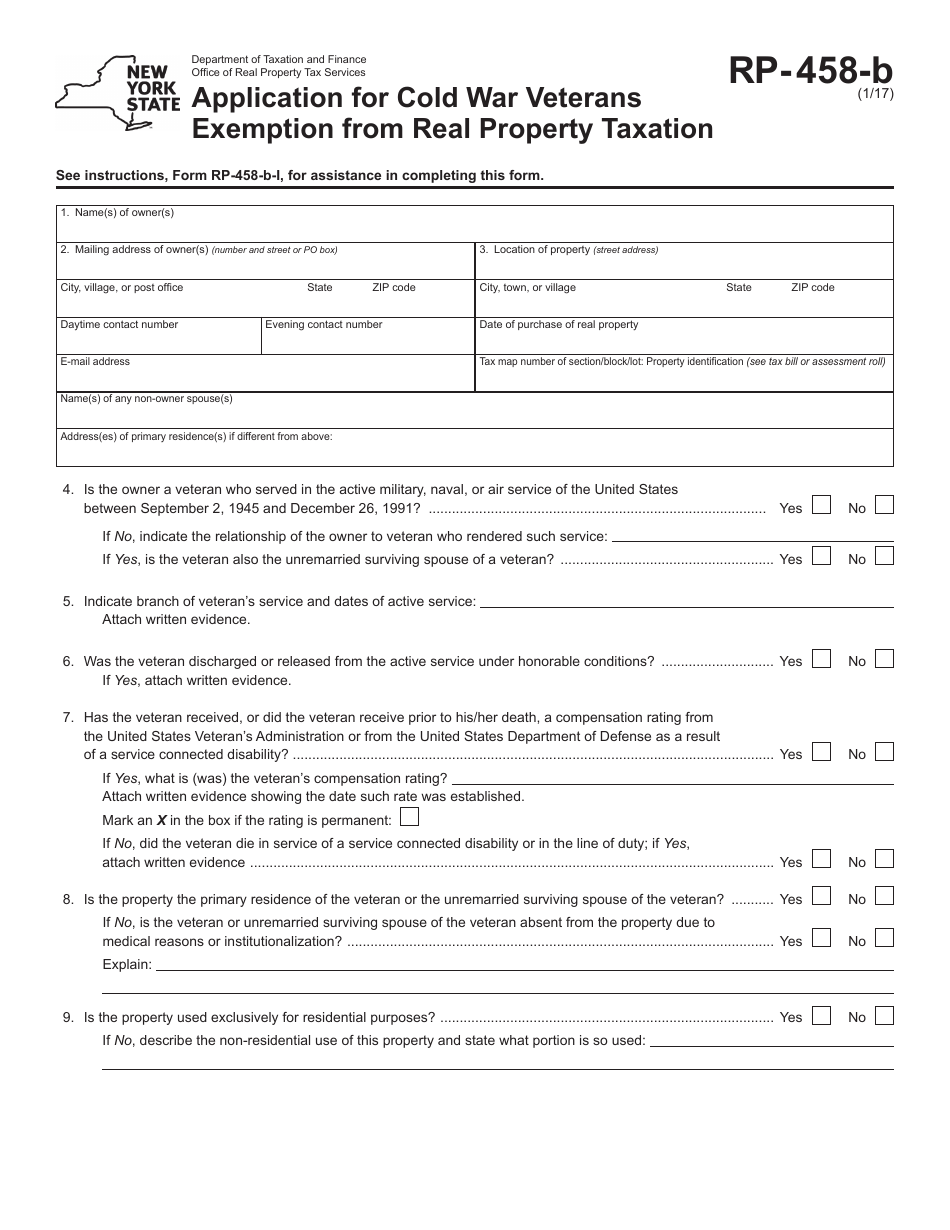

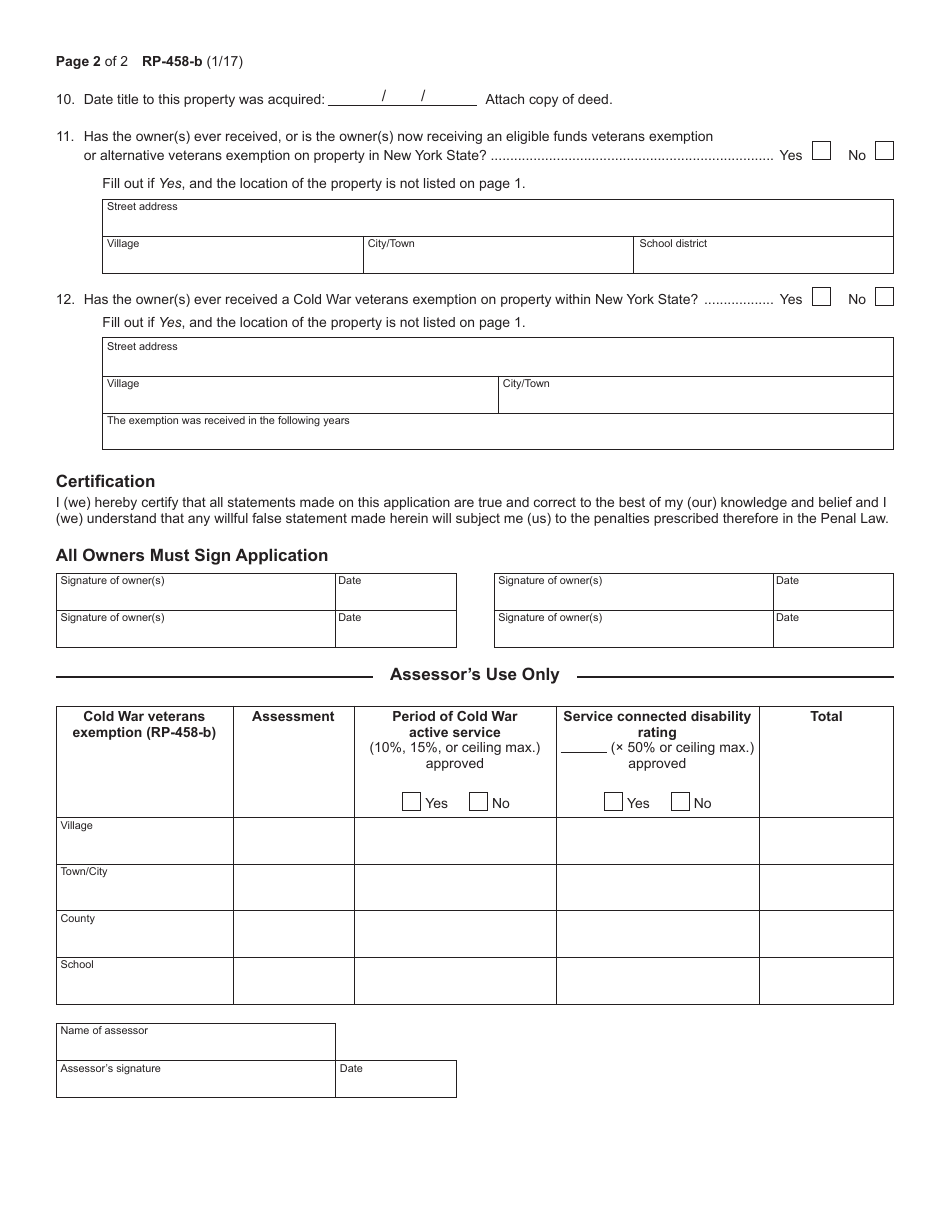

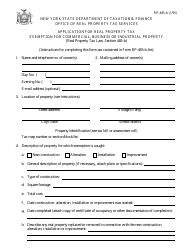

Form RP-458-B Application for Cold War Veterans Exemption From Real Property Taxation - New York

What Is Form RP-458-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

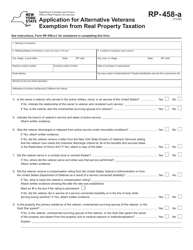

Q: What is Form RP-458-B?

A: Form RP-458-B is an application for Cold War Veterans Exemption from real property taxation in New York.

Q: Who can apply for the Cold War Veterans Exemption?

A: Cold War veterans who served on active duty between September 2, 1945, and December 26, 1991, and were discharged under honorable conditions are eligible to apply for the exemption.

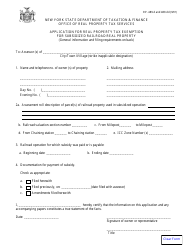

Q: What is the purpose of the Cold War Veterans Exemption?

A: The exemption aims to provide property tax relief for eligible Cold War veterans in recognition of their service.

Q: What documents do I need to include with the application?

A: You will need to include your discharge papers (DD-214 or equivalent), as well as any other documentation requested on the application form.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-458-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.