This version of the form is not currently in use and is provided for reference only. Download this version of

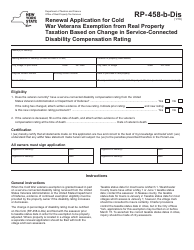

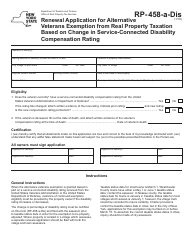

Instructions for Form RP-458-B

for the current year.

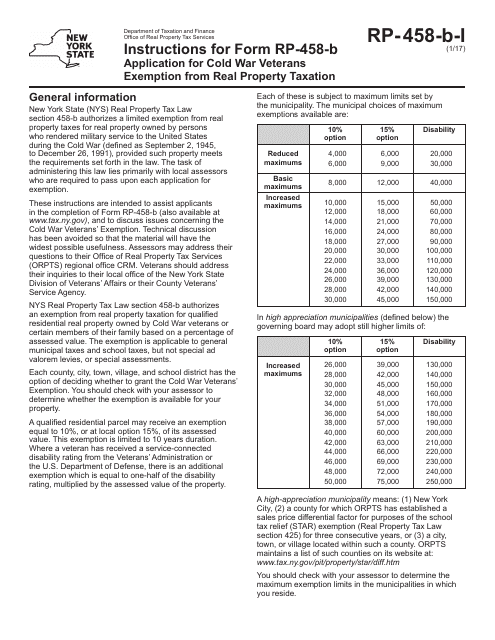

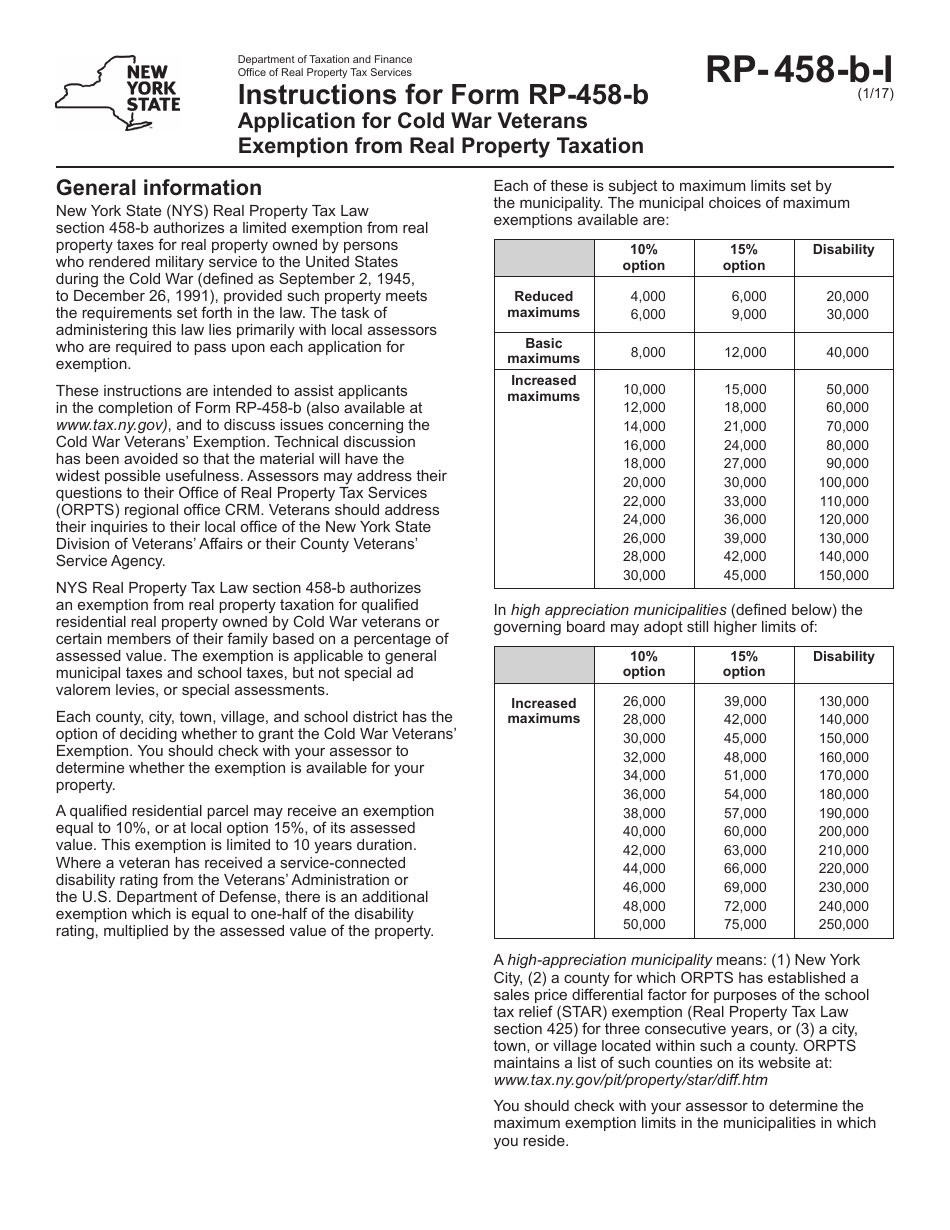

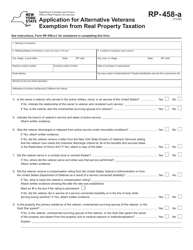

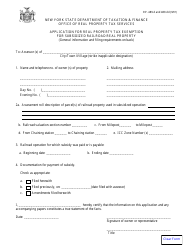

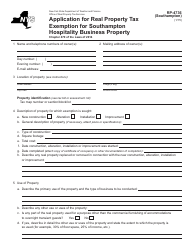

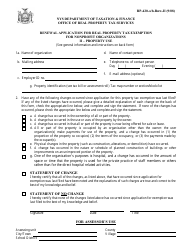

Instructions for Form RP-458-B Application for Cold War Veterans Exemption From Real Property Taxation - New York

This document contains official instructions for Form RP-458-B , Application for Cold War Real Property Taxation - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-458-B is available for download through this link.

FAQ

Q: What is Form RP-458-B?

A: Form RP-458-B is an application for Cold War Veterans Exemption from real property taxation in New York.

Q: Who is eligible for the Cold War Veterans Exemption?

A: Cold War Veterans who served on active duty in the United States Armed Forces between September 2, 1945 and December 26, 1991 are eligible for the exemption.

Q: What is the purpose of the Cold War Veterans Exemption?

A: The purpose of the exemption is to provide property tax relief to qualifying Cold War Veterans.

Q: What documents are required to apply for the exemption?

A: Applicants must provide proof of eligibility, such as military discharge papers or separation documents, along with the completed Form RP-458-B.

Q: When is the deadline to file Form RP-458-B?

A: The deadline to file Form RP-458-B is March 1st of each year. However, if you miss the deadline, you may still file the form up until the taxable status date for the current year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.